American Axle's 1Q Earnings Plunge - Analyst Blog

May 03 2013 - 7:56AM

Zacks

American Axle and Manufacturing Inc. (AXL)

reported earnings of $18.6 million or 23 cents per share before

debt refinancing and redemption costs in the first quarter of the

year that plunged 62.3% from 61 cents per share in the comparable

quarter of 2012 (excluding special items). Nevertheless, earnings

surpassed the Zacks Consensus Estimate of 15 cents during the

quarter.

On a reported basis, net earnings were $7.3 million or 10 cents per

share in the quarter versus $51.2 million 68 cents in the first

quarter of 2012.

Revenues were almost flat at $755.6 million compared with $751.5

million in the first quarter of 2012 and missed the Zacks Consensus

Estimate of $757 million. The company’s revenues reflect the

adverse impact of roughly $12.5 million related to the labor strike

at General Motors’ (GM) Rayong plant in

Thailand.

American Axle’s content-per-vehicle – dollar value of its product

sales supporting GM’s North American light truck and SUV programs

and Chrysler's heavy duty Dodge Ram pickup trucks – increased 2.0%

to $1,504 from $ $1,475 in the first quarter of 2012.

However, the company witnessed a reverse trend in diversification

of its customer base during the quarter. The company’s non-GM sales

decreased 2.8% to $188.1 million from $193.6 million in the

year-ago quarter.

Gross profit dipped 25.1% to $104.3 million or 13.8% of sales from

$139.2 million or 18.5% in the first quarter in 2012. Meanwhile,

operating income slashed 42.2% to $44.7 million or 5.9% of sales

from $77.4 million or 10.3% a year ago.

American Axle had cash and cash equivalents of $100.8 million as of

Mar 31, 2013, up from $62.4 million as of Dec 31, 2012. Long-term

debt increased to $1.6 million as of Mar 31, 2013 compared with

$1.5 billion as of Dec 31, 2012.

The company had lower operating net cash flow use of $26.8 million

compared with $71.5 million in the first quarter of 2012. Net

capital spending of the company was $47.8 million compared with

$43.6 million in the same period of 2012. Therefore, American Axle

had narrower free cash flow use of $70.7 million in the quarter

compared to the use of $115.1 million in the corresponding period

in 2012.

American Axle is a leading supplier of driveline systems, modules

and components for the light vehicle market. The company makes

axles, driveshaft and chassis components for light trucks, sport

utility vehicles and passenger cars.

The company with its numerous new global product and process

launches featuring advanced driveline technology, and customer

diversification expects to grow in the future. Currently, it

retains a Zacks Rank #3 (Hold).

Other stocks that are performing well in the industry include

Visteon Corp. (VC) and STRATTEC Security

Corp. (STRT). They carry a Zacks Rank #1 (Strong Buy).

AMER AXLE & MFG (AXL): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

STRATTEC SEC CP (STRT): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

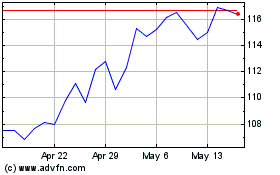

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

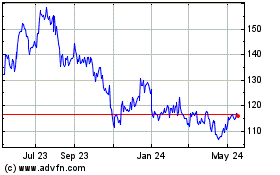

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024