Meritor Remains Neutral - Analyst Blog

May 14 2013 - 1:10PM

Zacks

On May 13, we maintained our Neutral recommendation on

Meritor Inc. (MTOR), based on its expansion of

global manufacturing footprint by outsourcing to low-cost

countries. These outsourcing efforts allow the company to adjust

its production levels.

However, we are concerned about the high customer concentration,

recent turmoil in the global economy and the year-over-year decline

in the company’s profits in the second quarter of fiscal 2013.

Why Maintained?

On Apr 30, Meritor Inc. reported a significant fall in the adjusted

income to $6.0 million or 6 cents per share in the second quarter

of fiscal 2013 compared with $32.0 million or 33 cents in the

year-ago quarter. However, earnings per share surpassed the Zacks

Consensus Estimate by 5 cents.

Revenues went down 21.7% to $908.0 million, missing the Zacks

Consensus Estimate of $934.0 million. The decline in revenues was

due to lower sales volumes in global markets, excluding South

America.

Following the release of the second-quarter results, the Zacks

Consensus Estimate for fiscal 2013 increased 19.2% to 31 cents per

share, but the same for fiscal 2014 dropped 2.9% to 66 cents.

Currently, shares of Meritor maintain a Zacks Rank #3 (Hold).

Meritor will benefit from its focus on OEMs based in Asia and South

America. The company plans to extend its footprint in the low-cost

countries with new plants, especially in China and India.

The company also plans to develop several significant business

projects in South America. In addition to this, Meritor aims to

boost revenues and earnings by focusing on improving its research,

development, engineering and product design capabilities.

However, Meritor faces challenges from its high customer

concentration. About 71% of its revenues are generated from the top

ten customers, with AB Volvo, Navistar

International (NAV) and Daimler AG contributing about 22%,

15% and 11%, respectively.

Other Stocks to Look For

A few stocks that are performing well in the broader industry

include Visteon Corp. (VC) and Tower

International, Inc. (TOWR). Both the companies carry a

Zacks Rank #1 (Strong Buy).

MERITOR INC (MTOR): Free Stock Analysis Report

NAVISTAR INTL (NAV): Free Stock Analysis Report

TOWER INTL INC (TOWR): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

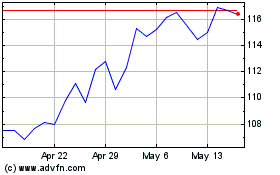

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

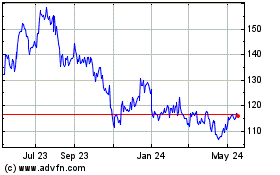

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024