false

0001450704

0001450704

2024-09-20

2024-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2024

VIVAKOR, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41286 |

|

26-2178141 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5220 Spring Valley Road, Suite 500

Dallas, TX 75254

(Address of principal executive offices)

(949) 281-2606

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

VIVK |

|

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K or this Report contains forward-looking statements. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding the plans and objectives of management for future operations.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances, including the closing of the Membership Interest Purchase Agreement disclosed below, and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

|

ITEM 7.01 |

REGULATION FD DISCLOSURE |

On September 24, 2024, the Company issued a press release announcing the Company’s Board of Directors approval and authorization to close the transactions contemplated by the MIPA, with such closing set for October 1, 2024. A copy of the press release is furnished with this Current Report as Exhibit 99.1.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under such section, nor shall it be deemed incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

At a meeting held on September 20, 2024, Vivakor, Inc’s (the “Company”) Board of Directors authorized and approved the closing of the transactions contemplated by the previously-disclosed Membership Interest Purchase Agreement dated March 21, 2024 (the “MIPA”) by and between the Company, Jorgan Development, LLC, a Louisiana limited liability company (“Jorgan”) and JBAH Holdings, LLC, a Texas limited liability company (“JBAH” and, together with Jorgan, the “Sellers”), as the equity holders of Endeavor Crude, LLC, a Texas limited liability company, Equipment Transport, LLC, a Pennsylvania limited liability company, Meridian Equipment Leasing, LLC, a Texas limited liability company, and Silver Fuels Processing, LLC, a Texas limited liability company (collectively, the “Endeavor Entities”), with the closing to be effective on October 1, 2024 (the “Closing”).

On September 24, 2024, the Company issued a

press release providing an update on the on the closing of its previously announced acquisition of Endeavor Entities. A copy of the press

release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

|

ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS. |

Financial Statements of Business Acquired.

In reviewing the agreements included or incorporated by reference as exhibits to this Current Report on Form 8-K, please remember that they are included to provide investors with information regarding their terms and are not intended to provide any other factual or disclosure information about the Company or the other parties to the agreements. The agreements may contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties have been made solely for the benefit of the parties to the applicable agreement and:

|

● |

should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate; |

|

● |

have been qualified by disclosures that were made to the other party in connection with the negotiation of the applicable agreement, which disclosures are not necessarily reflected in the agreement; |

|

● |

may apply standards of materiality in a way that is different from what may be viewed as material to other investors; and |

|

● |

were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more recent developments. |

Accordingly, these representations and warranties may not describe the actual state of affairs as of the date they were made or at any other time. Additional information about the Company may be found elsewhere in this Current Report on Form 8-K and in the Company’s periodic and other filings which are available without charge through the SEC’s website at http://www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VIVAKOR, INC. |

| |

|

|

| Dated: September 24, 2024 |

By: |

/s/ James H. Ballengee |

| |

|

Name: |

James H. Ballengee |

| |

|

Title: |

Chairman, President & CEO |

Exhibit 99.1

Vivakor

Board Approves Closing of $120 Million Acquisition of Endeavor Entities

For the Six Months Ended June 30, 2024, the Endeavor Entities Realized Revenues of $47.3 Million, with $9.3 Million EBITDA

DALLAS, TX / ACCESSWIRE / September 24, 2024 / Vivakor, Inc. (NASDAQ:VIVK) (“Vivakor” or the “Company”), an integrated provider of energy transportation, storage, reuse, and remediation services, announced today that its Board of Directors approved the closing of its planned acquisition of Endeavor Crude, LLC, Meridian Equipment Leasing, LLC, Equipment Transport, LLC, and

Silver Fuels Processing, LLC, and their subsidiaries (collectively, the “Endeavor Entities”) as previously announced. The closing will be effective on October 1, 2024.

The Endeavor Entities comprise a fully-integrated, flexible and scalable midstream logistics business that transports, stores, treats, remediates, and sells

crude oil, produced water, and associated hydrocarbons. They own and operate one of the largest combined oilfield trucking fleets in the continental United States transporting crude oil,

petroleum products, and produced water, which is fully integrated with a network of

station, terminal, and pipeline facilities for blending, processing, reuse and remediation. In addition, the Endeavor Entities have a series of long-term strategic partnerships with customers in the Permian Basin, Eagle Ford Basin, and STACK play of Oklahoma.

For the six months ended June 30, 2024, the Endeavor Entities realized revenues of $47.3 million and $9.3 million of earnings before interest, taxes, depreciation, and amortization

(“EBITDA”), yielding an annualized projection of $94.6 million in revenue and $18.6 million of EBITDA for the Endeavor Entities.

“The acquisition of the Endeavor Entities is a significant milestone for Vivakor,” said James Ballengee, Chairman, President, & CEO. “They strategically integrate with our existing Colorado City, Texas and Delhi, Louisiana,

facilities, provide an immediate platform for our company to expand, and unlock additional opportunities and revenues for the Company.”

The purchase price for the Endeavor Entities is $120 million, subject to standard

post-closing adjustments, including assumed debt, and an earn-out adjustment, payable

by the Company in a combination of Company common stock and Series A Convertible Preferred Stock.

Ballengee continued, “Vivakor now owns and operates one of the largest combined fleets of oilfield trucking services in the continental United States. Our focus on flexible and scaleable crude oil and produced water logistics solutions

that are fully integrated with our network of station, terminal, and pipeline facilities providing blending, reuse, and remediation services will provide us with a key competitive advantage.”

About Vivakor, Inc.

Vivakor, Inc. (NASDAQ:VIVK), is is an integrated provider of energy transportation, storage, reuse, and remediation services. Vivakor’s corporate mission is to develop, acquire, accumulate, and operate assets, properties, and technologies in the energy sector. Its Delhi, Louisiana, and Colorado City, Texas facilities provide crude oil gathering, storage, transportation, reuse, and remediation services under long-term contracts.

Vivakor’s oilfield waste remediation facilities, currently under construction, will facilitate the recovery, reuse, and disposal of petroleum byproducts and oilfield waste products.

For more information, please visit our website: http://vivakor.com

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements within the meaning of the

“safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based upon the current beliefs and expectations of our management and

are inherently subject to significant business, economic and competitive uncertainties

and contingencies, many of which are difficult to predict and generally beyond our

control. Actual results and the timing of events may differ materially from the results

anticipated in these forward-looking statements. Forward-looking statements may be

identified but not limited by the use of the words “anticipates,” “expects,” “intends,” “plans,” “should,” “could,” “would,” “may,” “will,” “believes,” “estimates,” “potential,” or “continue” and variations or similar expressions. Our actual results may differ materially and

adversely from those expressed in any forward-looking statements as a result of various

factors and uncertainties, including, but not limited to, the expected transaction

and ownership structure, the valuation of the transaction, the likelihood and ability

of the parties to successfully and timely consummate planned acquisitions, the risk that any required regulatory approvals are not obtained, are delayed or are

subject to unanticipated conditions that could adversely affect Vivakor or the expected

benefits of the such transaction, our ability to maintain the listing of our securities on The Nasdaq Capital Market, the parties failure to realize the anticipated benefits of pending transactions, disruption and volatility in the global currency, capital, and credit markets, changes

in federal, local and foreign governmental regulation, changes in tax laws and liabilities,

tariffs, legal, regulatory, political and economic risks, our ability to successfully

develop products, rapid change in our markets, changes in demand for our future products,

and general economic conditions.

These risks and uncertainties include, but are not limited to, risks and uncertainties

discussed in Vivakor’s filings with the U.S. Securities and Exchange Commission, which factors may be incorporated

herein by reference. Actual results, performance or achievements may differ materially,

and potentially adversely, from any projections and forward-looking statements and

the assumptions on which those forward-looking statements are based. There can be

no assurance that the data contained herein is reflective of future performance to

any degree. You are cautioned not to place undue reliance on forward-looking statements

as a predictor of future performance as projected financial information and other

information are based on estimates and assumptions that are inherently subject to various significant

risks, uncertainties and other factors, many of which are beyond our control. All

information set forth herein speaks only as of the date hereof in the case of information

about Vivakor and the Endeavor Entities or the date of such information in the case

of information from persons other than Vivakor and the Endeavor Entities, and we disclaim any intention or obligation to update any forward-looking statements

as a result of developments occurring after the date of this communication. Forecasts

and estimates regarding the Endeavor Entities industries and markets are based on

sources we believe to be reliable; however, there can be no assurance these forecasts

and estimates will prove accurate in whole or in part.

Investor Contact:

Phone: (949) 281-2606

info@vivakor.com

ClearThink

nyc@clearthink.capital

SOURCE: Vivakor, Inc.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

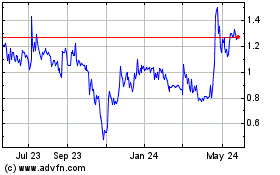

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Dec 2024 to Jan 2025

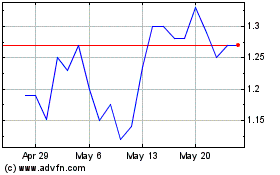

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Jan 2024 to Jan 2025