0001607678false00016076782025-03-102025-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 10, 2025 |

Viking Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37355 |

46-1073877 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9920 Pacific Heights Blvd, Suite 350 |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 858 704-4660 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.00001 per share |

|

VKTX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Definitive Material Agreement.

Strategic Manufacturing and Supply Agreement

On March 10, 2025, Viking Therapeutics Ireland Limited (“Viking Ireland”), a wholly owned subsidiary of Viking Therapeutics, Inc. (the “Company”), entered into a Strategic Manufacturing and Supply Agreement (the “Supply Agreement”) with Corden Pharma Schweizerhalle GmbH, Corden Pharma GmbH and Corden Pharma Colorado, Inc. (collectively, “CordenPharma”), pursuant to which CordenPharma shall timely manufacture, supply and deliver quantities of VK2735 and/or other pharmaceutical materials (collectively, the “API”), and Viking Ireland shall order at least a minimum quantity of API over a period of approximately four years after commercial launch of the API and a minimum percentage of Viking Ireland’s commercial requirements for API for a period of three years after commercial launch of the API, all of the foregoing as discussed in more detail below. CordenPharma also shall timely manufacture, supply and deliver the API for use by Viking Ireland to conduct clinical trials at Viking Ireland’s request. The price for the API manufactured and supplied pursuant to the Supply Agreement will be determined through good-faith negotiations between Viking Ireland and CordenPharma, subject to a maximum price that will be reduced as Viking Ireland orders certain minimum quantities of the API. Pursuant to the Supply Agreement, Viking Ireland will provide CordenPharma with a rolling forecast for its orders of the API for commercial use, a certain portion of which will be binding, and CordenPharma shall timely manufacture, supply and deliver such orders to the extent that the amounts ordered do not exceed the forecast plus an additional upside percentage of the forecast. CordenPharma also shall use best efforts to timely manufacture and supply and deliver by the applicable specified delivery dates any amounts of API ordered by Viking Ireland that are greater than the amounts of the forecast plus upside.

Pursuant to the Supply Agreement, CordenPharma agreed to dedicate an entire manufacturing line to Viking Ireland and to provide additional manufacturing capacity if required by Corden to meet its obligations to timely supply Viking Ireland. In addition, Viking Ireland may elect for Corden to install an additional manufacturing line in the facility at least until June 30, 2028 and thereafter subject to space being available.

The Supply Agreement also includes customary acceptance, warranty, quality, testing and inspection, audit, access to information, and confidentiality terms and conditions.

The Supply Agreement has an initial term of eight years unless terminated earlier in accordance with its terms and conditions and automatically extends for successive three-year renewal periods unless terminated by Viking Ireland or Corden with certain advance notice and upon certain conditions or by either party upon an uncured material breach by the other party.

Prepayment Agreement

In connection with and pursuant to the Supply Agreement, Viking Ireland and CordenPharma entered into a Prepayment Agreement, effective as of March 10, 2025 (the “Prepayment Agreement”), pursuant to which Viking Ireland agreed to make prepayments to CordenPharma, as payment in advance for the purchase of the API, in the amount of $90.0 million in the aggregate during the period from 2025-2028 and an additional amount in 2028 for the procurement and receipt of key starting and other raw materials and ingredients used in manufacturing the API (collectively, the “API Prepayments”). Each API Prepayment is contingent upon CordenPharma having satisfied certain milestones applicable to such prepayment.

In order to secure CordenPharma’s obligations under the Prepayment Agreement, CordenPharma shall grant to Viking Ireland before any API Prepayment a security interest in its Plankstadt facility, and may be required to provide additional collateral to Viking Ireland as specified in the Prepayment Agreement.

Under the Prepayment Agreement, CordenPharma shall provide a credit to Viking Ireland of a certain percentage against each invoice for API until such credits in the aggregate equal the API Prepayments in the aggregate.

Fill and Finish Agreement

In connection with the Supply Agreement, Viking Ireland, on the one hand, and Corden Pharma GmbH, Corden Pharma Lisbon S.A. and Corden Pharma S.p.A., on the other hand (collectively, the “CordenPharma Parties”) entered into a Manufacturing and Supply (Drug Product) Agreement, effective as of March 10, 2025 (the “Fill and Finish Agreement,” and together with the Supply Agreement and the Prepayment Agreement, the “CordenPharma Agreements”), pursuant to which the CordenPharma Parties shall timely manufacture, supply and deliver, and Viking Ireland shall order at least a designated minimum percentage for a period of three years following receipt of marketing approval from the FDA or comparable foreign authority of a Viking Ireland product candidate containing the API (such product and any other Viking Ireland product candidate containing the API, collectively, the “Product”) of, Viking Ireland’s commercial requirements for Product for commercial use, all of the foregoing as discussed in more detail below. The price for the Product manufactured and supplied pursuant to the Fill and Finish Agreement will be determined through good-faith negotiations between Viking Ireland and the CordenPharma Parties, subject to a maximum price that will be reduced based on the quantities ordered by Viking Ireland. The CordenPharma Parties also shall timely manufacture, supply and deliver Product for use by Viking Ireland to conduct clinical trials at Viking Ireland’s request. Pursuant to the Fill and Finish Agreement, Viking Ireland will provide the CordenPharma Parties with a rolling forecast for its orders of Product for commercial use, a certain portion of which will

be binding, and the CordenPharma Parties shall timely manufacture, supply and deliver such orders to the extent that the amounts ordered do not exceed the forecast (which forecast for injectable Products may be up to the sum in the aggregate of any reserved capacity, the capacity of any Dedicated Line(s), and any other available capacity of the CordenPharma Parties for the applicable injectable Products (as discussed in more detail below)) plus an additional upside percentage. The CordenPharma Parties also shall use best efforts to timely manufacture and supply and deliver by the applicable specified delivery dates any amounts of Product ordered by Viking Ireland that are greater than the amounts of the forecast plus upside.

Pursuant to the Fill and Finish Agreement, Viking Ireland may elect in writing to make prepayments (the “Product Prepayments”) to the CordenPharma Parties to reserve manufacturing capacity for the supply of Product formulated for subcutaneous injection of API (the “Injectable Product”) ordered by Viking Ireland in any calendar year during the term of the Fill and Finish Agreement (the “Prepaid Injectable Period”), which prepayment amount will depend on the volume of units of the Injectable Product ordered by Viking Ireland. Additionally, Viking Ireland may elect in writing that the CordenPharma Parties install one or more manufacturing lines (each, a “Dedicated Line”) for the Injectable Product in the applicable manufacturing facility owned or controlled by the CordenPharma Parties or their affiliates, for which Viking Ireland shall make Product Prepayments in installments contingent upon the CordenPharma Parties having satisfied certain milestones, including milestones related to obtaining regulatory approval for the Dedicated Line(s) and the CordenPharma Parties’ supply and delivery of the Injectable Product manufactured using the Dedicated Line(s). The CordenPharma Parties shall provide a credit to Viking Ireland of a certain percentage against each invoice for Product up to an amount that equals the Product Prepayments in the aggregate.

The Fill and Finish Agreement also includes customary acceptance, warranty, quality, testing and inspection, audit, access to information, and confidentiality terms and conditions.

The Fill and Finish Agreement has an initial term of eight years unless terminated earlier in accordance with its terms and conditions and automatically extends for successive three-year renewal periods unless terminated by Viking Ireland or Corden with certain advance notice and upon certain conditions or by either party upon an uncured material breach by the other party.

The foregoing descriptions of the CordenPharma Agreements do not purport to be complete and are qualified in their entirety by reference to the full text of the CordenPharma Agreements, which will be filed with the Company’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2025 and are incorporated by reference herein. The CordenPharma Agreements are incorporated herein by reference only to provide investors with information regarding their terms. They are not intended to provide any other factual information on the Company or any of its subsidiaries.

In each CordenPharma Agreement, each party made customary representations and warranties and agreed to customary covenants, including, without limitation, with respect to indemnification, for transactions of this type. The representations, warranties and covenants contained in the CordenPharma Agreements were made only for purposes of the CordenPharma Agreements and in some cases only as of specific dates, were solely for the benefit of the parties thereto and may be subject to limitations agreed upon by the contracting parties. Investors are not third-party beneficiaries under the CordenPharma Agreements and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. The CordenPharma Agreements should be read in conjunction with the disclosures in the Company’s periodic reports and other filings with the Securities and Exchange Commission. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the CordenPharma Agreements, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 regarding the CordenPharma Agreements is hereby incorporated by reference.

Item 8.01. Other Information.

On March 11, 2025, the Company issued a press release announcing its entry into the CordenPharma Agreements. A copy of the press release is filed as Exhibit 99.1 to the Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VIKING THERAPEUTICS, INC. |

|

|

|

|

Date: |

March 11, 2025 |

By: |

/s/ Brian Lian, Ph.D. |

|

|

|

Brian Lian, Ph.D.

President and Chief Executive Officer

(Principal Executive Officer) |

Viking Therapeutics Signs Broad Manufacturing Agreement With CordenPharma to Support Commercialization of VK2735

Long-Term Agreement Secures Dedicated Capacity for Multi-Ton Annual Supply of VK2735 Active Pharmaceutical Ingredient

Secures Dedicated Fill/Finish Capacity for 100 Million Annual Autoinjector Supply and Additional 100 Million Annual Vial/Syringe Supply

Provides Annual Capacity of Over 1 Billion Oral Tablets

Viking to Make Prepayments Totaling $150 Million Between 2025-2028

SAN DIEGO, CA – March 11, 2025 – Viking Therapeutics, Inc. ("Viking") (NASDAQ: VKTX), a clinical-stage biopharmaceutical company focused on the development of novel therapies for metabolic and endocrine disorders, today announced that it has signed a broad, multi-year manufacturing agreement with CordenPharma, an industry-leading contract development and manufacturing organization (CDMO), covering both the active pharmaceutical ingredient (API) and final finished product supply for its VK2735 program for obesity. The agreement provides Viking with sufficient long-term supply of both subcutaneous and oral VK2735 product forms to support a potential multi-billion-dollar annual product opportunity.

Under the terms of the agreement, Viking has secured dedicated capacity for the manufacture of, and a commitment to supply annually, multiple metric tons of VK2735 API. In addition, CordenPharma will provide fill/finish capacity for both the injectable and oral formulations of VK2735. This includes dedicated manufacturing lines and an annual commitment to supply 100 million autoinjectors and an additional 100 million vial and syringe products for the subcutaneous formulation, as well as an annual capacity of over one billion oral VK2735 tablets. These API and final finished product capacities are further expandable at Viking’s option.

“We are excited to enter into this agreement with one of the world’s leading CDMOs in the peptide space,” said Brian Lian, Ph.D., chief executive officer of Viking Therapeutics. “We have a long history of working with CordenPharma and are happy to extend and strengthen our relationship with this agreement. CordenPharma’s established presence in commercial peptide manufacturing gives us confidence in their ability to deliver supply commensurate with what we anticipate will be significant commercial demand. In addition, CordenPharma’s ability to provide dedicated capacity across the supply chain,

from API through finished commercial products, makes them a uniquely qualified partner to work with in bringing this important therapy to the market.”

In exchange for dedicated API and fill/finish capacity, Viking will make prepayments totaling $150 million, to be paid over the period from 2025 to 2028. Prepayments will be credited against future orders. Viking retains ownership of all global rights to VK2735 under the agreement and expects to maintain standard pharmaceutical product margins.

VK2735, the company’s dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors, is being developed in both oral and subcutaneous formulations for the potential treatment of various metabolic disorders such as obesity. Viking is currently conducting the Phase 2 VENTURE-Oral Dosing Trial of VK2735 dosed as an oral tablet once daily for 13 weeks. Additionally, the company plans to initiate Phase 3 development with the subcutaneous formulation of VK2735 in the second quarter of 2025.

About GLP-1 and Dual GLP-1/GIP Agonists

Activation of the glucagon-like peptide 1 (GLP-1) receptor has been shown to decrease glucose, reduce appetite, lower body weight, and improve insulin sensitivity in patients with type 2 diabetes, obesity, or both. Semaglutide is a GLP-1 receptor agonist that has been approved by the U.S. Food and Drug Administration and is currently marketed in various dosage strengths and forms as Ozempic®, Rybelsus®, and Wegovy®. More recently, research efforts have explored the potential co-activation of the glucose-dependent insulinotropic peptide (GIP) receptor as a means of enhancing the therapeutic benefits of GLP-1 receptor activation. Tirzepatide is a dual GLP-1/GIP receptor agonist that has been approved by the U.S. Food and Drug Administration and is currently marketed in various dosage strengths and forms as Mounjaro® and Zepbound®.

About Viking Therapeutics, Inc.

Viking Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the development of novel first-in-class or best-in-class therapies for the treatment of metabolic and endocrine disorders, with three compounds currently in clinical trials. Viking's research and development activities leverage its expertise in metabolism to develop innovative therapeutics designed to improve patients' lives. Viking's clinical programs include VK2735, a novel dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors for the potential treatment of various metabolic disorders. Data from a Phase 1 and a Phase 2 trial evaluating VK2735 (dosed subcutaneously) for metabolic disorders demonstrated an encouraging safety and tolerability profile as well as positive signs of clinical benefit. Concurrently, the company is evaluating an oral formulation of VK2735 in a Phase 2 trial. Viking is also developing VK2809, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the treatment of lipid and metabolic disorders. The compound successfully achieved both the primary and secondary endpoints in a recently completed Phase 2b study for the treatment of biopsy-confirmed non-alcoholic steatohepatitis (NASH) and fibrosis.

In a Phase 2a trial for the treatment of non-alcoholic fatty liver disease (NAFLD) and elevated LDL-C, patients who received VK2809 demonstrated statistically significant reductions in LDL-C and liver fat content compared with patients who received placebo. The company’s newest program is evaluating a series of internally developed dual amylin and calcitonin receptor agonists (or DACRAs) for the treatment of obesity and other metabolic disorders. In the rare disease space, Viking is developing VK0214, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the potential treatment of X-linked adrenoleukodystrophy (X-ALD). In a Phase 1b clinical trial in patients with the adrenomyeloneuropathy (AMN) form of X-ALD, VK0214 was shown to be safe and well-tolerated, while driving significant reductions in plasma levels of very long-chain fatty acids (VLCFAs) and other lipids, as compared to placebo.

For more information about Viking Therapeutics, please visit www.vikingtherapeutics.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding Viking Therapeutics, Inc., under the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements about Viking's expectations regarding its clinical and preclinical development programs; its agreement with CordenPharma, including the expected sufficiency of the supply of subcutaneous and oral VK2735 product forms under the agreement; the potential annual product opportunity for subcutaneous and oral VK2735; the anticipated timing for reporting clinical data and cash resources. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and adversely and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: risks associated with the success, cost and timing of Viking's product candidate development activities and clinical trials, including those for VK2735, VK0214, VK2809, and the company's other incretin receptor agonists; risks that prior clinical and preclinical results may not be replicated; risks regarding regulatory requirements; risks relating to the manufacturing of API and product supply for VK2735; and other risks that are described in Viking's most recent periodic reports filed with the Securities and Exchange Commission, including Viking's Annual Report on Form 10-K for the year ended December 31, 2024, including the risk factors set forth in those filings. These forward-looking statements speak only as of the date hereof. Viking disclaims any obligation to update these forward-looking statements except as required by law.

Contacts:

Viking Therapeutics, Inc.

Greg Zante

Chief Financial Officer

858-704-4672

gzante@vikingtherapeutics.com

Vida Strategic Partners

Stephanie Diaz (Investors)

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

415-675-7402

tbrons@vidasp.com

v3.25.0.1

Document And Entity Information

|

Mar. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 10, 2025

|

| Entity Registrant Name |

Viking Therapeutics, Inc.

|

| Entity Central Index Key |

0001607678

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37355

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-1073877

|

| Entity Address, Address Line One |

9920 Pacific Heights Blvd, Suite 350

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

704-4660

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

VKTX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

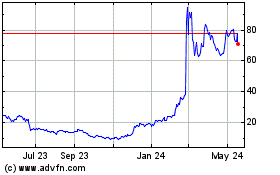

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Feb 2025 to Mar 2025

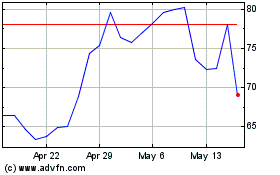

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Mar 2024 to Mar 2025