Filed Pursuant to Rule 424(b)(5)

Registration No. 333-269644

Prospectus Supplement

(to Prospectus dated March 21, 2023)

Up to $100,000,000 of Shares of Common Stock

On October 18, 2024, we entered into a certain

Sales Agreement, or sales agreement, with Aegis Capital Corp. (“Aegis”) relating to shares of our common stock offered by

this prospectus supplement. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having

an aggregate offering price of up to $100,000,000 from time to time through Aegis, acting as our sales agent or principal.

We are an “emerging growth company”

and “smaller reporting company” as defined under U.S. federal securities laws and are subject to reduced public company reporting

requirements. Our shares of common stock are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “VLCN”.

The last sale price of our shares of common stock on October 16, 2024 was $0.982 per share.

Sales of our common stock, if any, under this

prospectus supplement may be made in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated under

the Securities Act of 1933, as amended, or the Securities Act. If authorized by us in writing, Aegis may also sell shares of our common

stock in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices

and/or in any other method permitted by law. If we and Aegis agree on any method of distribution other than sales of shares of our common

stock on or through the Nasdaq Capital Market or another existing trading market in the United States at market prices, we will file a

further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. Aegis

is not required to sell any specific number or dollar amount of securities but will act as a sales agent using commercially reasonable

efforts consistent with its normal trading and sales practices, on mutually agreed terms between Aegis and us. There is no arrangement

for funds to be received in any escrow, trust or similar arrangement.

The compensation to Aegis for sales of common

stock sold pursuant to the sales agreement will be equal to 3.5% of the gross proceeds of any shares of common stock sold under the sales

agreement, in addition to reimbursement of certain expenses, see “Plan of Distribution.” In connection with the sale of the

common stock on our behalf, Aegis will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of Aegis will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to

Aegis with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended,

or the Exchange Act.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement

and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Aegis Capital Corp.

The date of this prospectus supplement is October

18, 2024.

Table of Contents

About This Prospectus Supplement

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing

a “shelf” registration process. Each time we conduct an offering to sell securities under the accompanying prospectus we will

provide a prospectus supplement that will contain specific information about the terms of that offering, including the price, the amount

of securities being offered and the plan of distribution. The shelf registration statement was initially filed with the SEC on February

8, 2023, and was declared effective by the SEC on March 21, 2023. This prospectus supplement describes the specific details regarding

this offering and may add, update or change information contained in the accompanying prospectus. The accompanying prospectus provides

general information about us and our securities, some of which, may not apply to this offering. This prospectus supplement and the accompanying

prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful

to do so. We are not making offers to sell or solicitations to buy our common stock in any jurisdiction in which an offer or solicitation

is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful

to make an offer or solicitation.

If information in this prospectus supplement is

inconsistent with the accompanying prospectus or the information incorporated by reference with an earlier date, you should rely on this

prospectus supplement. This prospectus supplement, together with the base prospectus, the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for use in connection with this

offering include all material information relating to this offering. We have not authorized anyone to provide you with different or additional

information and you must not rely on any unauthorized information or representations. You should assume that the information appearing

in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and

the accompanying prospectus and any free writing prospectus we have authorized for use in connection with this offering is accurate only

as of the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed

since those dates. You should carefully read this prospectus supplement, the accompanying prospectus and the information and documents

incorporated herein by reference herein and therein, as well as any free writing prospectus we have authorized for use in connection with

this offering, before making an investment decision. See “Incorporation by Reference” and “Where You Can Find More Information”

in this prospectus supplement and in the accompanying prospectus.

This prospectus supplement relates only to an offering of up to $100.0

million of shares of our common stock through Aegis. These sales, if any, will be made pursuant to the terms of the sales agreement entered

into between us and Aegis on October 18, 2024, a copy of which is incorporated by reference into this prospectus supplement.

No action is being taken in any jurisdiction outside

the United States to permit a public offering of these securities or possession or distribution of this prospectus supplement or the accompanying

prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement and the accompanying prospectus in jurisdictions

outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution

of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

This prospectus supplement and the accompanying

prospectus contain summaries of certain provisions contained in some of the documents described herein which are summaries only and are

not intended to be complete. Reference is made to the actual documents for complete information. All of the summaries are qualified in

their entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated by reference

herein. See “Where You Can Find More Information” in this prospectus supplement. We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into

this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement and the accompanying

prospectus contain and incorporate by reference certain market data and industry statistics and forecasts that are based on Company estimates,

independent industry publications and other publicly available information. Although we believe these sources are reliable, estimates

as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on

various factors, including those discussed under “Risk Factors” in this prospectus supplement and the accompanying prospectus

and under similar headings in the documents incorporated by reference herein and therein. Accordingly, investors should not place undue

reliance on this information.

Unless otherwise stated or the context requires

otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our”

and “Volcon” refer to Volcon, Inc., a Delaware corporation, and its wholly-owned subsidiaries.

Prospectus Supplement Summary

This summary highlights information

contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and

therein. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You

should read this entire prospectus supplement and the accompanying prospectus carefully, including the section entitled “Risk Factors”

beginning on page S-4 and our consolidated financial statements and the related notes and the other information incorporated by reference

into this prospectus supplement and the accompanying prospectus, before making an investment decision.

Our Company

We are an all-electric, off-road powersports

vehicle company developing electric two and four-wheel motorcycles and utility terrain vehicles, or UTVs, also known as side-by-sides,

along with a complete line of upgrades and accessories. In October 2020, we began building and testing prototypes for our future offerings

with two off-road motorcycles – the Grunt and the Runt. Our motorcycles feature unique frame designs protected by design patents.

Additional utility and design patents have been filed for other aspects of Volcon’s vehicles.

Recent Developments

On September 9, 2024,

Christian Okonsky resigned as a member of our Board of Directors, Mr. Okonsky informed the board that his resignation was for personal

reasons and not because of any disagreement between Mr. Okonsky and the Company on any matter relating to the Company’s operations,

accounting policies, or practices.

Corporate Information

Our principal executive offices are

located at 3121 Eagles Nest, Suite 120, Round Rock, TX 78665. Our website address is www.volcon.com. Information contained in, or accessible

through, our website does not constitute part of this prospectus supplement and inclusions of our website address in this prospectus supplement

are inactive textual references only.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted

and intend to rely on certain exemptions from various public company reporting requirements, including not being required to have our

internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the

Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements,

and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments

not previously approved.

Risks Affecting Our Company

In evaluating an investment in our

securities, you should carefully read this prospectus supplement and especially consider the factors incorporated by reference in the

sections titled “Risk Factors” commencing on page S-4 of this prospectus supplement, in our accompanying prospectus and in

our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, all of which are incorporated by reference herein

The Offering

| Common Stock Offered |

|

Shares of our common stock having an aggregate offering price of up to $100.0 million pursuant to the sales agreement. |

| |

|

|

| Manner of the Offering |

|

“At the market offering” that may be made from time to time through or to Aegis as sales agent or principal. See “Plan of Distribution”. |

| |

|

|

| Common Stock Currently Outstanding |

|

4,487,213 |

| |

|

|

| Common Stock to Be Outstanding Immediately Following This Offering |

|

Up to 101,832,993 shares of our common stock, assuming sales at a price

of $0.982 per share, which was the closing price on Nasdaq on October 16, 2024. The actual number of shares issued will vary depending

on the price at which shares may be sold from time to time under this offering. Issuances will not exceed our total authorized amount

of shares of common stock, which is 250,000,000 as of the date of this prospectus supplement. |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering for working capital and for general corporate purposes. See “Use of Proceeds” on page S-7 of the prospectus supplement for a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Risk Factors |

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

VLCN. |

The number of shares of our common stock expected

to be outstanding after this offering is based on 4,487,213 shares of common stock outstanding as of October 16, 2024, and excludes, as

of that date, the following:

| |

· |

50,164 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average exercise price of $160.49 per share; |

| |

· |

1,540,687 shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $9.03 per share (includes 656,836 pre-funded warrants with an exercise price of $0.00001); and |

| |

· |

up to an aggregate of 136 shares of common stock reserved for future issuance under our stock plan, as amended. |

Except as otherwise indicated herein, all information

in this prospectus supplement assumes no exercise of the warrants and options listed above.

Risk Factors

An investment in our securities

involves risks. We urge you to consider carefully the risks described below, and in the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus, before making an investment decision, including those risks identified under “Item IA.

Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference in this

prospectus supplement and which may be amended, supplemented or superseded from time to time by other reports that we subsequently file

with the SEC. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously

harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please

also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to this Offering

We have in the past

failed to maintain compliance with all applicable continued listing requirements of the Nasdaq Capital Market, and if we fail to maintain

compliance with all applicable continued listing requirements of the Nasdaq Capital Market in the future, we will not be afforded traditional

cure periods under Nasdaq rules and our common stock will be delisted from Nasdaq, which could have an adverse impact on the liquidity

and market price of our common stock.

On December 19, 2023,

we were notified by the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market (“Nasdaq”)

that we were not in compliance with Nasdaq’s Listing Rule 5550(a)(2), as the minimum bid price of our common stock had been below

$1.00 per share for 30 consecutive business days. On January 4, 2024, the Staff notified us that the market value of our listed securities

had been below the minimum $35,000,000 required for continued listing as set forth in Nasdaq’s Listing Rule 5550(b)(2) for the previous

180 calendar days and served as an additional basis for delisting.

We submitted a hearing

request to Nasdaq’s Hearings Department, which stayed the suspension of our common stock. The hearing was held on March 26, 2024.

On April 2, 2024, we received notification from the Nasdaq Hearings Panel (“Panel”) that it had granted an extension until

June 24, 2024, to demonstrate compliance with Listing Rules 5550(a)(2) and 5550(b)(1) (which requires at least $2.5 million in shareholders’

equity), subject to certain conditions.

On July 17, 2024, we

received a letter from the Nasdaq Office of General Counsel confirming the decision of the Panel that we had demonstrated compliance with

the requirements for continued listing on The Nasdaq Capital Market, but that we will be subject to a Discretionary Panel Monitor for

a period of one year. As such, in the event that we have another deficiency or deficiencies, we will immediately go back into Nasdaq’s

hearings process.

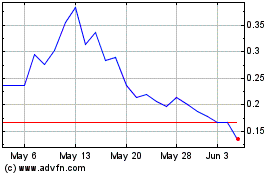

On October 1, 2024, the Company’s stock

price fell below $1.00 per share and remained below $1.00 as of the date of this prospectus. As noted in the paragraph above, if the share

price remains below $1.00 for 30 consecutive business days, we expect to receive another deficiency and will immediately go back into

the Nasdaq’s hearings process.

In the event that the

Nasdaq Hearings Department does not grant us an extension to demonstrate compliance, our common stock would be delisted from Nasdaq and

trading of our common stock could be conducted only in the over-the-counter market or on an electronic bulletin board established for

unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such an event, it could become more difficult to dispose of,

or obtain accurate price quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts

and the news media, which could cause the price of our common stock to decline further. Also, it may be difficult for us to raise additional

capital if we are not listed on a major exchange.

You may experience immediate and substantial

dilution in the book value per share of the common stock you purchase in the offering.

The shares sold in this offering, if any, will

be sold from time to time at various prices. The offering price per share in this offering may exceed the net tangible book value per

share of our common stock outstanding prior to this offering. The future exercise of warrants for shares of our common stock and the exercise

of outstanding stock options following the date of this prospectus supplement may result in dilution of your investment depending upon

the actual price per share when shares are sold under this offering.

Our management will have broad discretion over

the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion in the

application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their investment decision

to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine

our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure

by our management to apply these funds effectively could harm our business. See “Use of Proceeds” on page S-7 of this prospectus

supplement for a description of our proposed use of proceeds from this offering.

We do not intend to pay dividends in the foreseeable

future.

We have never paid cash dividends on our common

stock and currently do not plan to pay any cash dividends in the foreseeable future.

The common stock offered hereby will be sold

in “at the market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales

price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices

they paid.

The actual number of shares we will issue under

the sales agreement with Aegis, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement

with Aegis and compliance with applicable law, we have the discretion to deliver placement notices to Aegis at any time throughout the

term of the sales agreement. The number of shares that are sold by Aegis after delivering a placement notice will fluctuate based on the

market price of the common stock during the sales period and limits we set with Aegis.

If our shares become subject to the penny stock

rules, it may be more difficult to sell our shares.

The SEC has adopted rules that regulate broker-dealer

practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00

(other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation

systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange

or system). The OTC Bulletin Board does not meet such requirements and if the price of our shares is less than $5.00 and our shares are

no longer listed on a national securities exchange such as Nasdaq, our shares may be deemed a penny stock. The penny stock rules require

a broker-dealer, at least two business days prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver

to the customer a standardized risk disclosure document containing specified information and to obtain from the customer a signed and

date acknowledgment of receipt of that document. In addition, the penny stock rules require that prior to effecting any transaction in

a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is

a suitable investment for the purchaser and receive: (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure

statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability

statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our shares,

and therefore shareholders may have difficulty selling their shares.

Sales of a significant number of shares of

our common stock in the public markets or significant short sales of our common stock, or the perception that such sales could occur,

could depress the market price of our common stock and impair our ability to raise capital.

Sales of a substantial number of shares of our

common stock or other equity-related securities in the public markets, could depress the market price of our common stock. This offering

may contribute to a depressed market price of our common stock. If there are significant short sales of our common stock, the price decline

that could result from this activity may cause the share price to decline more so, which, in turn, may cause long holders of the common

stock to sell their shares, thereby contributing to sales of common stock in the market. Such sales also may impair our ability to raise

capital through the sale of additional equity securities in the future at a time and price that our management deems acceptable, if at

all.

.

Cautionary Note Regarding Forward-Looking Statements

This prospectus supplement, the accompanying prospectus

and the documents we have filed with the SEC that are incorporated by reference herein and therein contain forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Forward-looking statements concern our current plans, intentions, beliefs, expectations and statements of future economic

performance. Statements containing terms such as “will,” “may,” “believe,” “do not believe,”

“plan,” “expect,” “intend,” “estimate,” “anticipate” and other phrases of

similar meaning are considered to be forward-looking statements.

Forward-looking statements include, but are not limited to, statements

about:

| |

· |

our ability to maintain the listing of our common stock on the Nasdaq Stock Market; |

| |

· |

our ability to generate revenues from sales, generate cash from operations, or obtain additional funding to market our vehicles and develop new products; |

| |

· |

our ability to successfully implement and effectively manage our outsourced manufacturing, design and development model and achieve any anticipated benefits; |

| |

· |

the ability of third party manufacturers to produce our vehicles in accordance with our design and quality specifications, with sufficient scale to satisfy customers and within a reasonable cost; |

| |

· |

anticipated timing for the manufacture, design, production, shipping and launch of our vehicles; |

| |

· |

the inability of our suppliers to deliver the necessary components for our vehicles at prices and volumes acceptable to our third party manufacturers; |

| |

· |

our ability to establish a network of dealers and international distributors to sell and service our vehicles on the timeline we expect; |

| |

· |

whether our vehicles will perform as expected; |

| |

· |

our facing product warranty claims or product recalls; |

| |

· |

our facing adverse determinations in significant product liability claims; |

| |

· |

customer adoption of electric vehicles; |

| |

· |

the development of alternative technology that adversely affects our business; |

| |

· |

increased government regulation of our industry; |

| |

· |

tariffs and currency exchange rates; and |

| |

· |

the conflict with Russia and Ukraine and the potential adverse effect it may have on the availability of materials used in the manufacturing of batteries for our vehicles. |

Forward-looking statements are based on our assumptions

and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those reflected

in or implied by these forward-looking statements. Factors that might cause actual results to differ include, among others, those set

forth under “Risk Factors” in this prospectus supplement and those discussed in “Management’s Discussion and Analysis

of Financial Condition and Results of Operation” in our most recent Annual Report on Form 10-K and in our future reports filed with

the SEC, all of which are incorporated by reference herein. Readers are cautioned not to place undue reliance on any forward-looking statements

contained in this prospectus supplement, the accompanying prospectus or the documents we have filed with the SEC that are incorporated

by reference herein and therein, which reflect management’s views and opinions only as of their respective dates. We assume no obligation

to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking

statements, except to the extent required by applicable securities laws.

You should carefully read this prospectus supplement,

the accompanying prospectus and the information incorporated herein by reference as described under the heading “Incorporation of Documents by Reference,” and the documents that we reference in this prospectus supplement and the accompanying prospectus and have

filed as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are a part with the

understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we

expect. We qualify all of our forward-looking statements by these cautionary statements.

Use of Proceeds

We may issue and sell shares of common stock having

aggregate sales proceeds of up to $100.0 million from time to time, before deducting sales agent commissions and expenses. The amount

of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold.

There can be no assurance that we will be able to sell any shares under, or fully utilize, the sales agreement with Aegis.

We intend to use the net proceeds from this offering

for working capital and for general corporate purposes. This represents our best estimate of the manner in which we will use the net proceeds

we receive from this offering based upon the current status of our business, but we have not reserved or allocated amounts for specific

purposes and we cannot specify with certainty how or when we will use any of the net proceeds. Amounts and timing of our actual expenditures

will depend on numerous factors. Our management will have broad discretion in applying the net proceeds from this offering.

Pending application of the net proceeds as described

above, we intend to invest the proceeds to us in investment-grade, interest-bearing securities such as money market funds, certificates

of deposit, or direct or guaranteed obligations of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested

will yield a favorable, or any, return.

Dividend Policy

We have never declared or paid any cash dividends

on our capital stock, and we do not currently intend to pay any cash dividends on our common stock for the foreseeable future. We expect

to retain future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends on our

common stock will be at the discretion of our board of directors and will depend upon, among other factors, our results of operations,

financial condition, capital requirements and any contractual restrictions.

Dilution

If you invest in our common stock in this offering,

your interest will be diluted immediately to the extent of the difference between the public offering price per share of our common stock

and the as adjusted net tangible book value per share of our common stock immediately after this offering.

As of June 30, 2024, our as reported net tangible

book value was $3.8 million, or $2.31 per share of common stock. Net tangible book value per share represents our total tangible assets,

less our total liabilities, divided by the number of outstanding shares of our common stock. After giving effect to: (i) the sale on July

12, 2024 of 820,836 shares common stock and pre-funded warrants to purchase 2,466,836 shares of common stock in lieu thereof (and shares

of common stock issued for the exercise of 1,810,000 of these pre-funded warrants as of October 16, 2024) in a registered direct offering

at a purchase price of $3.65 per share or pre-funded warrant; (ii) the repayment in July 2024 of outstanding notes in principal amount

of $2.9 million; and (iii) the issuance of 192 shares of common stock upon the cashless exercise of certain warrants (iv) the exchange

of 774,569 shares of our common stock for the issuance of 774,569 pre-funded warrants to an institutional shareholder on October 16, 2024,

our as adjusted net tangible book value as of June 30, 2024 would have been $18.7 million, or $4.16 per share of common stock.

After giving effect to the sale of 101,832,993

shares of our common stock, representing a net amount of $96.4 million after deducting sales agent commissions and estimated offering

expenses payable by us, at an assumed offering price of $0.982 per share, the last reported sale price of our common stock on Nasdaq on

October 16, 2024, our as adjusted net tangible book value as of June 30, 2024 would have been approximately $115.04 million, or approximately

$1.082 per share. This represents an immediate dilution in net tangible book value of approximately $3.08 per share to our existing stockholders

on an as adjusted basis and an immediate increase of approximately $0.10 per share to new investors purchasing securities at the assumed

purchase price.

The following table illustrates the dilution in

net tangible book value per share to new investors as of June 30, 2024 on an as adjusted basis after consideration for the effects of

the items noted above. The following table illustrates this calculation on a per share basis. The as adjusted information is illustrative

only and will adjust based on the actual price to the public, the actual number of shares sold and other terms of the offering determined

at the time shares of our common stock are sold pursuant to this prospectus supplement. The shares sold in this offering, if any, will

be sold from time to time at various prices. We will not offer and sell shares in excess of any amount that would cause the number of

our outstanding shares to exceed the number of shares then authorized to be issued under our articles of incorporation, which is 250,000,000

shares as of the date of this prospectus supplement.

| Assumed public offering price per share |

|

|

|

|

$ 0.982 |

|

| Net tangible book value per share as of June 30, 2024 on an as adjusted basis |

|

$ |

4.16 |

|

|

|

|

|

| Decrease in the as adjusted net tangible book value per share attributable to this offering |

|

$ |

(3.08) |

|

|

|

|

|

| As adjusted net tangible book value per share after giving effect to this offering |

|

|

|

|

|

$ |

1.082 |

|

| Increase per share to new investors participating in this offering at the assumed public offering price |

|

|

|

|

|

$ |

0.10 |

|

The number of shares of common stock to be outstanding

after this offering is based on 1,642,685 shares outstanding as of June 30, 2024 plus (i) the issuance subsequent to June 30, 2024 of

988,069 shares of common stock upon the conversion of our Series A preferred stock; (ii) the issuance of 820,836 shares of our common

stock from a public offering in July 2024; (iii) the issuance subsequent to June 30, 2024 of 1,810,192 shares of our common stock upon

the exercise outstanding warrants, (iv) the exchange of 774,569 shares of our common stock for pre-funded warrants and (v) excludes:

| |

· |

50,164 shares of common stock issuable upon the exercise of outstanding stock options, vested and

unvested, with a weighted-average exercise price of $160.49 per share; |

| |

· |

1,540,687 shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $9.03 per share (includes 1,431,405 pre-funded warrants with an exercise price of $0.00001); and |

| |

· |

up to an aggregate of 136 shares of common stock reserved for future issuance under our stock plan, as amended. |

The above illustration of dilution per share to

investors participating in this offering assumes no exercise of outstanding options or warrants to purchase our common stock, and no conversion

of convertible notes. The exercise of outstanding options or warrants or the conversion of convertible notes having an exercise or conversion

price less than the offering price would increase dilution to investors participating in this offering. In addition, we may choose to

raise additional capital depending on market conditions, our capital requirements and strategic considerations, even if we believe we

have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through our sale of equity

or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

Plan of Distribution

We have entered into the sales agreement with

Aegis under which we may issue and sell shares of our common stock from time to time up to $100.0 million to or through Aegis, acting

as our sales agent or principal. The sales of our common stock, if any, under this prospectus supplement will be made at market prices

by any method deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act,

including sales made directly on Nasdaq, on any other existing trading market for our common stock or to or through a market maker. If

we and Aegis agree on any method of distribution other than sales of shares of our common stock on or through the Nasdaq Capital Market

or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information

about such offering as required by Rule 424(b) under the Securities Act.

Each time that we wish to issue and sell shares

of our common stock under the sales agreement, we will provide Aegis with a placement notice describing the amount of shares to be sold,

the time period during which sales are requested to be made, any limitation on the amount of shares of common stock that may be sold in

any single day, any minimum price below which sales may not be made or any minimum price requested for sales in a given time period and

any other instructions relevant to such requested sales. Upon receipt of a placement notice, Aegis, acting as our sales agent, will

use commercially reasonable efforts, consistent with its normal trading and sales practices and applicable state and federal laws, rules

and regulations and the rules of Nasdaq, to sell shares of our common stock under the terms and subject to the conditions of the placement

notice and the sales agreement. We or Aegis may suspend the offering of common stock pursuant to a placement notice upon notice and subject

to other conditions.

Settlement for sales of common stock, unless the

parties agree otherwise, will occur on the first trading day following the date on which any sales are made in return for payment of the

net proceeds to us. There are no arrangements to place any of the proceeds of this offering in an escrow, trust or similar account. Sales

of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company

or by such other means as we and Aegis may agree upon.

Because there are no minimum sale requirements

as a condition to this offering, the actual total public offering price, commissions and net proceeds to us, if any, are not determinable

at this time. The actual dollar amount and number of shares of common stock we sell through this prospectus supplement will be dependent,

among other things, on market conditions and our capital raising requirements.

We will report at least quarterly the number of

shares of common stock sold through Aegis under the sales agreement, the net proceeds to us and the compensation paid by us to Aegis in

connection with the sales of common stock under the sales agreement.

The offering pursuant to the sales agreement will

terminate upon the earlier of (i) the sale of all shares of common stock subject to the sales agreement and (ii) termination of the sales

agreement as permitted therein. We may terminate the sales agreement in our sole discretion at any time by giving three days’ prior

notice to Aegis. Aegis may terminate the sales agreement under the circumstances specified in the sales agreement and in its sole discretion

at any time by giving three days’ prior notice to us.

This prospectus supplement in electronic format

may be made available on a website maintained by Aegis, and Aegis may distribute this prospectus supplement electronically.

Fees and Expenses

We will pay Aegis commissions for its services

in acting as our sales agent in the sale of our common stock pursuant to the sales agreement. Aegis will be entitled to compensation at

a fixed commission rate of 3.5% of the gross proceeds from the sale of our common stock on our behalf pursuant to the sales agreement.

We have also agreed to reimburse Aegis for its reasonable and documented out-of-pocket expenses (including but not limited to the

reasonable and documented fees and expenses of its legal counsel) in an amount equal to $75,000.

We estimate that the total expenses for this offering,

excluding compensation payable to Aegis and certain expenses reimbursable to Aegis under the terms of the sales agreement, will be approximately

$75,000. The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental,

regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common stock.

Regulation M

In connection with the sale of the common stock

on our behalf, Aegis will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation

of Aegis will be deemed to be underwriting commissions or discounts.

Aegis will not engage in any market making activities

involving our common stock while the offering is ongoing under this prospectus supplement if such activity would be prohibited under Regulation

M or other anti-manipulation rules under the Securities Act. As our sales agent, Aegis will not engage in any transactions

that stabilizes our common stock.

Indemnification

We have agreed to indemnify Aegis against certain

civil liabilities, including liabilities under the Securities Act and the Exchange Act, and to contribute to payments that

the Aegis may be required to make in respect of such liabilities.

Listing

Our common stock is listed on The Nasdaq Capital

Market under the symbol “VLCN.”

Other Relationships

Aegis and/or its affiliates have in the past engaged,

and may in the future engage, in transactions with, and may perform, from time to time, investment banking and advisory services for us

in the ordinary course of their business and for which it would receive customary fees and expenses. In addition, in the ordinary course

of its business activities, Aegis and its affiliates may make or hold a broad array of investments and actively trade debt and equity

securities (or related derivative securities) and financial instruments (including bank loans) for its own account and for the accounts

of its customers. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates.

Legal Matters

The validity of the common stock offered hereby

will be passed upon for us by ArentFox Schiff LLP, Washington, DC. Kaufman & Canoles, P.C., Richmond, Virginia, is acting as counsel

for the sales agent in connection with this offering.

Experts

The audited financial statements incorporated

by reference in this prospectus and elsewhere in the registration statement have been incorporated by reference in reliance upon the report

of MaloneBailey LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

Incorporation by Reference

The SEC allows us to “incorporate by reference”

into this prospectus supplement the information in other documents that we file with it. This means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement,

and information in documents that we file later with the SEC will automatically update and supersede information contained in documents

filed earlier with the SEC or contained in this prospectus supplement. We incorporate by reference in this prospectus supplement the documents

listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act prior

to the termination of the offering under this prospectus supplement; provided, however, that we are not incorporating, in each case, any

documents or information deemed to have been furnished and not filed in accordance with SEC rules:

| |

· |

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 28, 2024. |

| |

|

|

| |

· |

Our Quarterly

Report on Form 10-Q filed with the SEC on May 7, 2024 and August 6, 2024. |

| |

|

|

| |

· |

Our Definitive Proxy Statement on Schedule 14A filed on April 25, 2024; |

| |

|

|

| |

· |

Our Definitive Proxy Statement on Schedule 14A filed on October 11, 2024; |

| |

|

|

| |

· |

Our Current Report on Form 8-K filed with the SEC on January

4, 2024; January 5, 2024; January

12, 2024; January 19, 2024; February

5, 2024; February 23, 2024; March

1, 2024; March 4, 2024; March

25, 2024; April 4, 2024; April

5, 2024; May 17, 2024; May

20, 2024; May 30, 2024; June

7, 2024; June 14, 2024; July

12, 2024; July 18, 2024; July

29, 2024; August 2, 2024; September

13, 2024; and October 16, 2024. |

| |

|

|

| |

· |

The description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on October 1, 2021, and any other amendment or report filed for the purpose of updating such description, including any exhibits to our Annual Report on Form 10-K. |

All reports and other documents we

subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering,

including all such documents we may file with the SEC after the date of this prospectus supplement and accompanying prospectus, but

excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus

supplement and deemed to be part of this prospectus supplement from the date of the filing of such reports and documents.

You may obtain a copy of any or all of the documents

referred to above, which may have been or may be incorporated by reference into this prospectus supplement, including exhibits, at no

cost to you by writing or telephoning us at the following address:

Volcon, Inc.

Attn: Chief Financial Officer

3121 Eagles Nest, Suite 120

Round Rock

TX 78665

Tel: (512) 400-4271

Email: greg@volcon.com.

Where You Can Find More Information

This prospectus supplement and the accompanying

prospectus are part of a registration statement on Form S-3 we filed with the SEC under the Securities Act and do not contain all the

information set forth or incorporated by reference in the registration statement. Whenever a reference is made in this prospectus supplement

or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should

refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by

reference into this prospectus supplement or the accompanying prospectus for a copy of such contract, agreement or other document. Because

we are subject to the information and reporting requirements of the Exchange A, we file annual, quarterly and current reports, proxy statements

and other information with the SEC. You may read and copy information filed by us with the SEC at the SEC’s public reference section,

100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the public reference section can be obtained by calling

1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that contains reports, statements and other information

about issuers, such as us, who file electronically with the SEC.

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated

March 15, 2023

PROSPECTUS

$200,000,000

Volcon, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

____________________

We may from time to time issue

up to $200,000,000 aggregate dollar amount of common stock, preferred stock, debt securities, warrants or units of securities consisting

of some or all of these securities, in any combination, together or separately, in one or more offerings, in amounts, at prices and on

the terms determined at the time of the offering. We will specify in the accompanying prospectus supplement the terms of the securities

to be offered and sold. We may sell these securities directly to you, through underwriters, dealers or agents we select, or through a

combination of these methods. We will describe the plan of distribution for any particular offering of these securities in the applicable

prospectus supplement.

This prospectus may not

be used to consummate a sale of any securities unless it is accompanied by a prospectus supplement.

Our common stock is listed

on The NASDAQ Capital Market and is traded under the symbol “VLCN”. On March 13, 2023, the closing price of the common stock,

as reported on NASDAQ, was $1.44 per share.

As of February 6, 2023, the

aggregate market value of our outstanding common stock held by non-affiliates was approximately $29.1 million, based on 24,426,260 shares

of outstanding common stock, of which approximately 17,299,970 shares were held by non-affiliates, and a per share price of $1.68 based

on the closing sale price of our common stock on February 6, 2023.

Investing in our securities

is highly speculative and involves a high degree of risk. You should purchase these securities only if you can afford a complete loss

of your investment. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning

on page 6 of this prospectus before making a decision to purchase our securities.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is March 21,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration

process. Under this shelf registration process, we may sell the securities described in this prospectus in one or more offerings up to

a total dollar amount of $200,000,000.

We have provided to you in

this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration process,

we will provide a prospectus supplement that will contain specific information about the terms of that offering. That prospectus supplement

may include additional risk factors or other special considerations applicable to the securities being offered. We may also add, update

or change in the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between

the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement,

provided that if a statement in any document is inconsistent with a statement in another document having a later date - for example, a

document incorporated by reference in this prospectus or any prospectus supplement - the statement in the document having the later date

modifies or supersedes the earlier statement. You should read both this prospectus and the prospectus supplement together with the additional

information described under “Where You Can Find More Information.”

THIS PROSPECTUS MAY NOT

BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

The registration statement

containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities

offered under this prospectus. The registration statement, including the exhibits, can be read at the SEC website or at the SEC offices

mentioned under the heading “Where You Can Find More Information.”

You should rely only on the

information incorporated by reference or provided in this prospectus and the accompanying prospectus supplement. We have not authorized

anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to buy these securities in

any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified

to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should not assume that the information in this prospectus

or the accompanying prospectus supplement is accurate as of any date other than the date on the front of the document.

Unless the context requires

otherwise, references to the “Company,” “we,” “our,” and “us,” refer to Volcon, Inc. and

its subsidiaries, except that such terms refer to only Volcon, Inc. and not its subsidiaries in the sections entitled “Description

of Common Stock,” “Description of Preferred Stock,” “Description of Warrants,” “Description of the

Debt Securities,” and “Description of the Stock Purchase Contracts and Stock Purchase Units.”

PROSPECTUS SUMMARY

This summary provides an overview of selected

information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should

consider before investing in our securities. You should carefully read the prospectus, the information incorporated by reference and the

registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information

discussed under “Risk Factors” in this prospectus and the documents incorporated by reference and our financial statements

and notes thereto that are incorporated by reference in this prospectus. As used in this prospectus, unless the context otherwise indicates,

the terms “we,” “our,” “us,” the “Company,” or “Volcon” refer to Volcon, Inc.,

a Delaware corporation.

OUR COMPANY

We are an all-electric, off-road

powersports vehicle company developing and building electric two and four-wheel motorcycles and utility terrain vehicles (UTVs), also

known as side-by-sides, along with a complete line of upgrades and accessories. In October 2020, we began building and testing prototypes

for our future offerings with two off-road motorcycles – the Grunt and the Runt. Our motorcycles feature unique frame designs protected

by design patents. Additional utility and design patents have been filed for other aspects of Volcon’s vehicles.

We initially began to sell

and distribute the Grunt and related accessories in the U.S. on a direct-to-consumer sales platform. We terminated our direct-to-consumer

sales platform in November 2021. Prior to the termination of our direct-to-consumer sales platform, U.S. customers made deposits for 360

Grunts (net of cancellations) and five Runts, plus accessories and a delivery fee representing total deposits of $2.2 million. These orders

were cancelable by the customer until the vehicle was delivered and after a 14-day acceptance period, therefore the deposits were recorded

as deferred revenue. As of June 30, 2022, we had completed shipping of all Grunts sold through our direct-to-consumer sales platform.

Due to delays in developing the Runt, we refunded the deposits made for all Runts.

Beginning in November 2021,

we began negotiating dealership agreements with powersports dealers to display and sell our vehicles and accessories. Customers can now,

or will soon be able to, buy our vehicles and accessories directly from a local dealership. Some of these dealers will also provide warranty

and repair services to customers. Through December 31, 2022, we have entered into 151 dealership agreements. Upon sale of a Grunt the

dealer may order an additional Grunt. We also expect to be able to offer the dealers a financing option, or “floor plan” to

make larger purchases of our vehicles but we do not currently have this financing option available. We have agreements with third-party

financing companies to provide financing to qualified customers of each dealer. There is no recourse to the Company or the dealer if the

dealer’s customer defaults on the financing agreement with this third-party.

As of December 31, 2022, we

have signed agreements with five importers in Latin America and one importer for the Caribbean Region, collectively referred to herein

as the LATAM importers to sell our vehicles and accessories in their assigned countries/markets. In June 2022 we signed an exclusive distribution

agreement with Torrot Electric Europa S.A., referred to herein as Torrot, to distribute their electric motorcycles for youth riders in

Latin America. We will use our LATAM importers to sell Torrot’s products in Latin America.

In October 2022, we signed

an expanded agreement with Torrot to also be the exclusive distributor of Torrot and Volcon co-branded youth electric motorcycles in the

United States as well as Latin America. This agreement supersedes the original Torrot agreement and once all Torrot branded inventory

is sold, we will no longer distribute Torrot branded motorcycles. Finally, in December 2022 we signed an expanded agreement with

Torrot to be the exclusive distributor of Volcon co-branded youth electric motorcycles in Canada.

We expect to expand our global

sales of our vehicles and accessories beyond our current LATAM importer base. We expect to sign more LATAM importers in 2023 and expect

to begin selling in Canada, Europe and Australia in 2023. We expect export sales to be executed with individual importers in each country

that buy vehicles by the container. Each importer will sell vehicles and accessories to local dealers or directly to customers. Local

dealers will provide warranty and repair services for vehicles purchased in their country.

In July 2022, we expanded

our offerings with the introduction of the first of our Volcon Stag UTV models, the Stag, which we anticipate will be available for delivery

in the first half of 2023, followed by additional models of the Stag expected in 2024 and 2025 and the introduction of a higher performance,

longer range UTV (to be named) which we expect to begin delivering in 2025. The Stag will be manufactured by a third-party and incorporate

electrification units, which include batteries, drive units and control modules provided by General Motors. Beginning in June 2022 we

have taken non-binding pre-production orders which are cancelable prior to delivery.

Through August 2022 we assembled

the Grunt in a leased production facility in Round Rock, Texas. In August 2022 we announced that we will outsource the manufacturing of

the Grunt to a third-party manufacturer, which we anticipate will reduce costs and improve profitability on the Grunt and began receiving

Grunts from this manufacturer in January 2023. We also outsourced the manufacturing of the 2023 Grunt EVO to the same third-party manufacturer.

The 2023 Grunt EVO will replace the Grunt and has a belt drive rather than a chain drive as well as an updated rear suspension.

In September 2022, we reduced

our headcount in our product development and administration departments as we outsourced the design and development of certain components

of our vehicle development. We also hired our Chief Marketing Officer and expect to hire additional sales and marketing employees and

increase marketing activities to further support our brand and products.

We began taking pre-orders

for an E-Bike, the Brat, in September 2022 and shipments to customers began in the fourth quarter of 2022. In February 2023, we

began selling the Brat directly to consumers through our website. Consumers who order the Brat from our website will have the option

to have the Brat shipped to their specified destination or to have it shipped to a dealer where they can pick it up. The Brat is being

manufactured by a third-party.

In November 2022 we finalized

an agreement for a third-party to manufacture the Runt. We expect to receive prototypes of the Runt in the first quarter of 2023

and to begin sales in the second quarter of 2023.

The estimated fulfillment

of all orders we have received to date assumes that our third-party manufacturers can successfully meet our order quantities and deadlines.

If they are unable to satisfy orders on a timely basis, our customers may cancel their orders.

Implications of Being an Emerging Growth Company

We qualify as an “emerging

growth company” as the term is used in The Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and therefore,

we may take advantage of certain exemptions from various public company reporting requirements, including:

| · |

a requirement to only have two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis; |

| · |

exemption from the auditor attestation requirement on the effectiveness of our internal controls over financial reporting; |

| · |

reduced disclosure obligations regarding executive compensation; and |

| · |

exemptions from the requirements of holding a non-binding advisory stockholder vote on executive compensation and any golden parachute payments. |

We may take advantage of these

provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging

growth company if we have more than $1.235 billion in annual revenues, have more than $700.0 million in market value of our capital stock

held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage

of some, but not all, of the available benefits of the JOBS Act. We have taken advantage of some of the reduced reporting requirements

in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public

companies in which you hold stock. In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised

accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption

from new or revised accounting standards and, therefore, we will not be subject to the same new or revised accounting standards as other

public companies that are not emerging growth companies.

COMPANY

INFORMATION

We are a Delaware corporation

and were incorporated in February 2020. The Company completed its initial public offering in October 2021. Our principal executive offices

are located at 3121 Eagles Nest, Suite 120, Round Rock, TX 78665. Our website address is www.volcon.com. We make our periodic reports

and other information filed with, or furnished to, the SEC available free of charge through our website. The information on or accessible

through our website is not part of and is not incorporated by reference into this prospectus.

SECURITIES WE MAY OFFER

With this prospectus, we may

offer common stock, preferred stock, debt securities, warrants, and/or units consisting of some or all of these securities in any combination.

The aggregate offering price of securities that we offer with this prospectus will not exceed $200,000,000. Each time we offer securities

with this prospectus, we will provide offerees with a prospectus supplement that will contain the specific terms of the securities being

offered. The following is a summary of the securities we may offer with this prospectus.

Common Stock

We may offer shares of our

common stock, par value $0.00001 per share.

Preferred Stock

We may offer shares of our

preferred stock, par value $0.00001 per share, in one or more series. Our board of directors or a committee designated by the board will

determine the dividend, voting, conversion and other rights of the series of shares of preferred stock being offered. Each series of preferred

stock will be more fully described in the particular prospectus supplement that will accompany this prospectus, including redemption provisions,

rights in the event of our liquidation, dissolution or the winding up, voting rights and rights to convert into common stock.

Debt Securities

We may offer general obligations,

which may be secured or unsecured, senior or subordinated and convertible into shares of our common stock or preferred stock. In this

prospectus, we refer to the senior debt securities and the subordinated debt securities together as the “debt securities.”

Our board of directors will determine the terms of each series of debt securities being offered. We will issue the debt securities under

an indenture between us and a trustee. In this document, we have summarized general features of the debt securities from the indenture.

We encourage you to read the indenture, which is an exhibit to the registration statement of which this prospectus is a part.

Warrants

We may offer warrants for

the purchase of debt securities, shares of preferred stock or shares of common stock. We may issue warrants independently or together

with other securities. Our board of directors will determine the terms of the warrants.

Units

We may offer units consisting

of some or all of the securities described above, in any combination, including common stock, preferred stock, warrants and/or debt securities.

The terms of these units will be set forth in a prospectus supplement. The description of the terms of these units in the related prospectus

supplement will not be complete. You should refer to the applicable form of unit and unit agreement for complete information with respect

to these units.

RISK FACTORS

Before making an investment

decision, you should consider the “Risk Factors” included under Item 1A of our most recent Annual Report on Form 10-K and

in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q, all of which are incorporated by reference in this prospectus,

as updated by our future filings with the SEC. The market or trading price of our common stock could decline due to any of these risks.

In addition, please read “Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated

with our business and the forward-looking statements included or incorporated by reference in this prospectus. Please note that additional

risks not currently known to us or that we currently deem immaterial may also impair our business and operations. The accompanying prospectus

supplement may contain a discussion of additional risks applicable to an investment in us and the particular type of securities we are

offering under that prospectus supplement.

FORWARD-LOOKING STATEMENTS

Some of the information in

this prospectus, and the documents we incorporate by reference, contain forward-looking statements within the meaning of the federal securities

laws. You should not rely on forward-looking statements in this prospectus, and the documents we incorporate by reference. Forward-looking

statements typically are identified by use of terms such as “anticipate,” “believe,” “plan,” “expect,”

“future,” “intend,” “may,” “will,” “should,” “estimate,” “predict,”

“potential,” “continue,” and similar words, although some forward-looking statements are expressed differently.

This prospectus, and the documents we incorporate by reference, may also contain forward-looking statements attributed to third parties

relating to their estimates regarding the markets we may enter in the future. All forward-looking statements address matters that involve

risk and uncertainties, and there are many important risks, uncertainties and other factors that could cause our actual results to differ

materially from the forward-looking statements contained in this prospectus, and the documents we incorporate by reference.

You should also consider carefully

the statements under “Risk Factors” and other sections of this prospectus, and the documents we incorporate by reference,

which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We

caution investors not to place significant reliance on the forward-looking statements contained in this prospectus, and the documents

we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result

of new information, future developments or otherwise.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act with respect to the securities offered in this offering. We file annual,

quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may read and copy

the registration statement and any other documents we have filed at the Securities and Exchange Commission’s Public Reference Room

100 F Street, N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information

on the Public Reference Room. Our Securities and Exchange Commission filings are also available to the public at the Securities and Exchange

Commission’s Internet site at www.sec.gov.

This prospectus is part of

the registration statement and does not contain all of the information included in the registration statement. Whenever a reference is

made in this prospectus to any of our contracts or other documents, the reference may not be complete and, for a copy of the contract

or document, you should refer to the exhibits that are a part of the registration statement.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information we file with it, which means that we can disclose important information to you

by referring you to those documents. Later information filed with the SEC will update and supersede this information.

The following documents are

incorporated by reference into this document:

| |

|

| • |

Our Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, filed with the SEC on March 7, 2023 as amended by Form 10-K/A

filed with the SEC on March 14, 2023. |

| |

|

| • |

Our Current Report on Form 8-K filed with the SEC on February

10, 2023. |

| |

|

| • |

The description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on October 1, 2021, and any other amendment or report filed for the purpose of updating such description. |

An updated description of

our capital stock is included in this prospectus under “Description of Common Stock” and “Description of Preferred Stock”.

We also incorporate by reference

into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d)

of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus forms a part

and prior to effectiveness of the registration statement, or (ii) after the date of this prospectus but prior to the termination

of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, as well as proxy statements.

We will provide to each person,

including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy

of any and all of the information that is incorporated by reference in this prospectus, including exhibits which are specifically incorporated

by reference into such documents. You may request a copy of these filings, at no cost, by contacting us at:

Volcon, Inc.

Attn: Chief Financial Officer

3121 Eagles Nest, Suite 120

Round Rock

TX 78665

Tel: (512) 400-4271

Email: greg@volcon.com.

Any statement contained herein

or in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded

for purposes of the document to the extent that a statement contained in this document or any other subsequently filed document that is

deemed to be incorporated by reference into this document modifies or supersedes the statement.

USE OF PROCEEDS

We will retain broad discretion

over the use of the net proceeds from the sale of the securities offered hereby. Except as described in any prospectus supplement or

any related free writing prospectus that we may authorize to be provided to you, we currently intend to use the net proceeds from the

sale of the securities offered hereby for general corporate purposes, including working capital, operating expenses and capital expenditures.

We may also use a portion of the net proceeds to acquire or invest in businesses and products that are complementary to our own, although