00001035957/272024Q1false00001035952023-07-302023-10-280000103595us-gaap:CommonClassAMember2023-12-05xbrli:shares0000103595us-gaap:CommonClassBMember2023-12-0500001035952023-10-28iso4217:USD00001035952023-07-290000103595us-gaap:RelatedPartyMember2023-10-280000103595us-gaap:RelatedPartyMember2023-07-290000103595us-gaap:CommonClassAMember2023-07-290000103595us-gaap:CommonClassAMember2023-10-280000103595us-gaap:CommonClassBMember2023-07-290000103595us-gaap:CommonClassBMember2023-10-2800001035952022-07-312022-10-290000103595us-gaap:CommonClassAMember2023-07-302023-10-28iso4217:USDxbrli:shares0000103595us-gaap:CommonClassAMember2022-07-312022-10-290000103595us-gaap:CommonClassBMember2023-07-302023-10-280000103595us-gaap:CommonClassBMember2022-07-312022-10-290000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-290000103595us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-07-290000103595us-gaap:RetainedEarningsMember2023-07-290000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-290000103595us-gaap:TreasuryStockCommonMember2023-07-290000103595us-gaap:RetainedEarningsMember2023-07-302023-10-280000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-302023-10-280000103595us-gaap:TreasuryStockCommonMember2023-07-302023-10-280000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-302023-10-280000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-10-280000103595us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-10-280000103595us-gaap:RetainedEarningsMember2023-10-280000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-280000103595us-gaap:TreasuryStockCommonMember2023-10-280000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-300000103595us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-300000103595us-gaap:RetainedEarningsMember2022-07-300000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-300000103595us-gaap:TreasuryStockCommonMember2022-07-3000001035952022-07-300000103595us-gaap:RetainedEarningsMember2022-07-312022-10-290000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-312022-10-290000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-312022-10-290000103595us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-10-290000103595us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-10-290000103595us-gaap:RetainedEarningsMember2022-10-290000103595us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-290000103595us-gaap:TreasuryStockCommonMember2022-10-2900001035952022-10-290000103595vlgea:CenterStoreMember2023-07-302023-10-28xbrli:pure0000103595vlgea:CenterStoreMember2022-07-312022-10-290000103595vlgea:FreshMember2023-07-302023-10-280000103595vlgea:FreshMember2022-07-312022-10-290000103595vlgea:PharmacyMember2023-07-302023-10-280000103595vlgea:PharmacyMember2022-07-312022-10-290000103595vlgea:OtherProductMember2023-07-302023-10-280000103595vlgea:OtherProductMember2022-07-312022-10-29vlgea:class0000103595us-gaap:RestrictedStockMember2023-07-302023-10-280000103595us-gaap:RestrictedStockMember2022-07-312022-10-290000103595us-gaap:InvesteeMembervlgea:RelatedPartyNoteReceivableMaturingSeptember2027Member2022-08-150000103595vlgea:RelatedPartyNoteReceivableMaturingAugust2022Memberus-gaap:InvesteeMember2022-08-152022-08-150000103595vlgea:RelatedPartyNoteReceivableMaturingAugust2022Memberus-gaap:InvesteeMember2023-07-302023-10-280000103595us-gaap:InvesteeMembervlgea:RelatedPartyNoteReceivableMaturingSeptember2027Member2022-09-282022-09-280000103595vlgea:RelatedPartyNoteReceivableMaturingAugust2027Memberus-gaap:InvesteeMember2022-09-282022-09-280000103595us-gaap:InvesteeMembervlgea:RelatedPartyNoteReceivableMaturingFebruary2024Member2022-09-280000103595us-gaap:InvesteeMembervlgea:RelatedPartyNoteReceivableMaturingFebruary2024Member2023-07-302023-10-280000103595vlgea:RelatedPartyNoteReceivableMaturingAugust2022Memberus-gaap:InvesteeMember2023-10-280000103595vlgea:RelatedPartyNoteReceivableMaturingAugust2027Memberus-gaap:InvesteeMember2023-10-280000103595us-gaap:InvesteeMember2023-10-280000103595us-gaap:InvesteeMember2023-07-290000103595us-gaap:LimitedPartnerMember2022-04-282022-04-280000103595us-gaap:LimitedPartnerMember2023-10-280000103595srt:MinimumMemberus-gaap:LimitedPartnerMember2022-04-282022-04-280000103595srt:MaximumMemberus-gaap:LimitedPartnerMember2022-04-282022-04-280000103595us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-10-280000103595us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-07-290000103595us-gaap:LineOfCreditMemberus-gaap:MediumTermNotesMember2023-10-280000103595us-gaap:LineOfCreditMemberus-gaap:MediumTermNotesMember2023-07-290000103595us-gaap:NotesPayableToBanksMember2023-10-280000103595us-gaap:NotesPayableToBanksMember2023-07-290000103595us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-280000103595us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-282022-01-280000103595us-gaap:LineOfCreditMemberus-gaap:MediumTermNotesMembervlgea:AmendedAndRestatedCreditAgreementMember2020-05-120000103595us-gaap:LineOfCreditMemberus-gaap:MediumTermNotesMembervlgea:AmendedAndRestatedCreditAgreementMember2020-05-122020-05-120000103595us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:MediumTermNotesMembersrt:ScenarioForecastMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-282027-05-040000103595us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:MediumTermNotesMembervlgea:AmendedAndRestatedCreditAgreementMember2022-02-280000103595us-gaap:LineOfCreditMemberus-gaap:MediumTermNotesMembervlgea:AmendedAndRestatedCreditAgreementMember2022-02-280000103595us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembervlgea:AmendedAndRestatedCreditAgreementMember2020-09-010000103595us-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2020-09-012020-09-010000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMembersrt:ScenarioForecastMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-282035-09-010000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:InterestRateSwapMemberus-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2022-02-280000103595us-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2022-02-2800001035952020-09-01vlgea:store0000103595us-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-280000103595us-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-282022-01-280000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMembersrt:ScenarioForecastMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-282037-01-280000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:InterestRateSwapMemberus-gaap:SecuredDebtMembervlgea:AmendedAndRestatedCreditAgreementMember2022-01-280000103595us-gaap:UnsecuredDebtMember2022-09-010000103595us-gaap:UnsecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-09-012022-09-010000103595us-gaap:UnsecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-09-010000103595us-gaap:SecuredDebtMember2023-01-272023-01-270000103595us-gaap:SecuredDebtMember2023-01-270000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2023-01-272023-01-270000103595us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2023-01-270000103595us-gaap:LineOfCreditMembervlgea:AmendedAndRestatedCreditAgreementMemberus-gaap:LetterOfCreditMember2020-05-060000103595us-gaap:LineOfCreditMembervlgea:AmendedAndRestatedCreditAgreementMemberus-gaap:LetterOfCreditMember2023-10-2800001035952017-12-2900001035952017-12-292017-12-290000103595srt:ScenarioForecastMember2017-12-292024-12-29vlgea:swap0000103595us-gaap:InterestRateSwapMember2022-07-300000103595us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-07-302023-10-280000103595us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-07-312022-10-290000103595us-gaap:InterestRateSwapMember2023-10-28

2023.10.28UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| |

| For the quarterly period ended October 28, 2023 |

| |

| OR |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| |

Commission File No. 0-2633 |

VILLAGE SUPER MARKET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | |

| New Jersey | | 22-1576170 | | | | |

| (State or other jurisdiction of incorporation or organization) | | (I. R. S. Employer Identification No.) | | | | |

| | | | | | | |

733 Mountain Avenue, Springfield, New Jersey, 07081 | | | | |

| (Address of principal executive offices) (Zip Code) | | | | |

| | | | | | | |

| Registrant's telephone number, including area code: | (973) 467-2200 | | | | |

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | |

| | | | | | |

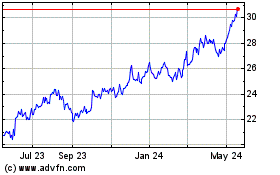

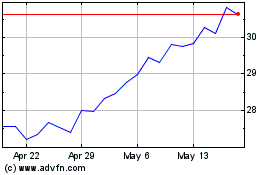

| Class A common stock, no par value | VLGEA | The NASDAQ Stock Market | | | | |

| (Title of Class) | (Trading Symbol) | (Name of exchange on which registered) | | | | |

| | | | | | |

| Securities registered pursuant to Section 12(g) of the Act: None | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12-b2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☐ | Accelerated filer ☒ |

Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒. |

| | | | | | | | |

| Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: |

| | |

| | December 6, 2023 |

| | |

| Class A Common Stock, No Par Value | 10,603,764 Shares |

| Class B Common Stock, No Par Value | 4,203,748 Shares |

VILLAGE SUPER MARKET, INC.

INDEX

| | | | | |

| PART I | PAGE NO. |

| | |

| FINANCIAL INFORMATION | |

| | |

| Item 1. Financial Statements (Unaudited) | |

| | |

| Consolidated Balance Sheets | |

| | |

| Consolidated Statements of Operations | |

| | |

| Consolidated Statements of Comprehensive Income | |

| |

| Consolidated Statements of Shareholders' Equity | |

| | |

| Consolidated Statements of Cash Flows | |

| | |

| Notes to Consolidated Financial Statements | |

| | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

| Item 3. Quantitative & Qualitative Disclosures about Market Risk | |

| | |

| Item 4. Controls and Procedures | |

| | |

| PART II | |

| | |

| OTHER INFORMATION | |

| |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| | |

| Item 6. Exhibits | |

| | |

| Signatures | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| | | | | | | | | | | |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands) (Unaudited) |

| | October 28,

2023 | | July 29,

2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 134,773 | | | $ | 140,910 | |

| Merchandise inventories | 47,492 | | | 44,515 | |

| Patronage dividend receivable | 17,315 | | | 12,466 | |

| Notes receivable from Wakefern | 32,211 | | | 31,483 | |

| | | |

| | | |

| Other current assets | 17,683 | | | 17,313 | |

| Total current assets | 249,474 | | | 246,687 | |

| | | |

| Property, equipment and fixtures, net | 281,611 | | | 277,310 | |

| Operating lease assets | 268,790 | | | 274,100 | |

| Notes receivable from Wakefern | 64,137 | | | 62,726 | |

| Investment in Wakefern | 33,145 | | | 33,107 | |

| Investments in Real Estate Partnerships | 14,968 | | | 13,155 | |

| Goodwill | 24,190 | | | 24,190 | |

| Other assets | 40,408 | | | 36,431 | |

| | | |

| Total assets | $ | 976,723 | | | $ | 967,706 | |

| LIABILITIES and SHAREHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Operating lease obligations | $ | 20,937 | | | $ | 20,389 | |

| Finance lease obligations | 686 | | | 667 | |

| Notes payable to Wakefern | 754 | | | 737 | |

| Current portion of debt | 9,370 | | | 9,370 | |

| Accounts payable to Wakefern | 81,178 | | | 77,033 | |

| Accounts payable and accrued expenses | 34,960 | | | 31,441 | |

| Accrued wages and benefits | 28,433 | | | 29,853 | |

| Income taxes payable | 6,881 | | | 9,483 | |

| Total current liabilities | 183,199 | | | 178,973 | |

| Long-term debt | | | |

| Operating lease obligations | 262,220 | | | 266,683 | |

| Finance lease obligations | 20,390 | | | 20,623 | |

| Notes payable to Wakefern | 1,566 | | | 1,686 | |

| Long-term debt | 70,039 | | | 72,426 | |

| Total long-term debt | 354,215 | | | 361,418 | |

| Pension liabilities | 5,005 | | | 4,893 | |

| Other liabilities | 15,059 | | | 12,256 | |

Commitments and contingencies (Note 5) | | | |

| Shareholders' equity | | | |

Preferred stock, no par value: Authorized 10,000 shares, none issued | — | | | — | |

Class A common stock, no par value: Authorized 20,000 shares; issued 11,568 shares at October 28, 2023 and 11,563 shares at July 29, 2023 | 77,103 | | | 76,179 | |

Class B common stock, no par value: Authorized 20,000 shares; issued and outstanding 4,204 shares at October 28, 2023 and July 29, 2023 | 683 | | | 683 | |

| Retained earnings | 351,732 | | | 343,497 | |

| Accumulated other comprehensive income | 8,836 | | | 8,134 | |

Less treasury stock, Class A, at cost: 944 shares at October 28, 2023 and 912 shares at July 29, 2023 | (19,109) | | | (18,327) | |

| Total shareholders’ equity | 419,245 | | | 410,166 | |

| | | |

| Total liabilities and shareholders’ equity | $ | 976,723 | | | $ | 967,706 | |

See notes to consolidated financial statements.

| | | | | | | | | | | | | | | |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) (Unaudited) |

| | | | 13 Weeks Ended |

| | | | | | October 28,

2023 | | October 29,

2022 |

| Sales | | | | | $ | 536,354 | | | $ | 519,689 | |

| | | | | | | |

| Cost of sales | | | | | 383,406 | | | 370,404 | |

| | | | | | | |

| Gross profit | | | | | 152,948 | | | 149,285 | |

| | | | | | | |

| Operating and administrative expense | | | | | 130,292 | | | 125,562 | |

| | | | | | | |

| Depreciation and amortization | | | | | 8,506 | | | 8,547 | |

| | | | | | | |

| Operating income | | | | | 14,150 | | | 15,176 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest expense | | | | | (1,064) | | | (1,087) | |

| | | | | | | |

| Interest income | | | | | 3,825 | | | 1,968 | |

| | | | | | | |

| Income before income taxes | | | | | 16,911 | | | 16,057 | |

| | | | | | | |

| Income taxes | | | | | 5,326 | | | 4,976 | |

| | | | | | | |

| Net income | | | | | $ | 11,585 | | | $ | 11,081 | |

| | | | | | | |

Net income per share: | | | | | | | |

| Class A common stock: | | | | | | |

| Basic | | | | | $ | 0.87 | | | $ | 0.85 | |

| Diluted | | | | | $ | 0.78 | | | $ | 0.76 | |

| | | | | | | |

| Class B common stock: | | | | | | | |

| Basic | | | | | $ | 0.56 | | | $ | 0.55 | |

| Diluted | | | | | $ | 0.56 | | | $ | 0.55 | |

See notes to consolidated financial statements.

| | | | | | | | | | | | | | | |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) (Unaudited) |

| | | | 13 Weeks Ended |

| | | | | | October 28,

2023 | | October 29,

2022 |

| Net income | | | | | $ | 11,585 | | | $ | 11,081 | |

| | | | | | | |

| Other comprehensive income: | | | | | | | |

| Unrealized gains on interest rate swaps, net of tax (1) | | | | | 777 | | | 2,765 | |

| Amortization of pension actuarial gain, net of tax (2) | | | | | (75) | | | (96) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Comprehensive income | | | | | $ | 12,287 | | | $ | 13,750 | |

(1)Amount is net of tax of $357 and $1,242 for the 13 weeks ended October 28, 2023 and October 29, 2022, respectively.

(2)Amounts are net of tax of $34 and $43 for the 13 weeks ended October 28, 2023 and October 29, 2022, respectively. All amounts are reclassified from accumulated other comprehensive income to operating and administrative expense.

See notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands) (Unaudited) |

| 13 Weeks Ended October 28, 2023 and October 29, 2022 |

| | Class A

Common Stock | | Class B

Common Stock | | | | Accumulated

Other

Comprehensive

Income (Loss) | | Treasury Stock

Class A | | Total

Shareholders'

Equity |

| | Shares Issued | | Amount | | Shares Issued | | Amount | | Retained Earnings | | Shares | | Amount |

Balance, July 29, 2023 | 11,563 | | | $ | 76,179 | | | 4,204 | | | $ | 683 | | | $ | 343,497 | | | $ | 8,134 | | | 912 | | | $ | (18,327) | | | $ | 410,166 | |

| Net income | — | | | — | | | — | | | — | | | 11,585 | | | — | | | — | | | — | | | 11,585 | |

Other comprehensive loss, net of tax of $323 | — | | | — | | | — | | | — | | | — | | | 702 | | | — | | | — | | | 702 | |

| Dividends | — | | | — | | | — | | | — | | | (3,350) | | | — | | | — | | | — | | | (3,350) | |

| | | | | | | | | | | | | | | | | |

| Treasury stock purchases | — | | | — | | | — | | | — | | | — | | | — | | | 32 | | | (782) | | | (782) | |

| Restricted shares forfeited | (9) | | | (28) | | | — | | | — | | | — | | | — | | | — | | | — | | | (28) | |

| Share-based compensation expense | 14 | | | 952 | | | — | | | — | | | — | | | — | | | — | | | — | | | 952 | |

| | | | | | | | | | | | | | | | | |

Balance, October 28, 2023 | 11,568 | | | $ | 77,103 | | | 4,204 | | | $ | 683 | | | $ | 351,732 | | | $ | 8,836 | | | 944 | | | $ | (19,109) | | | $ | 419,245 | |

| | | | | | | | | | | | | | | | | |

Balance, July 30, 2022 | 10,971 | | | $ | 72,891 | | | 4,294 | | | $ | 697 | | | $ | 306,974 | | | $ | 6,135 | | | 752 | | | $ | (14,588) | | | $ | 372,109 | |

| Net income | — | | | — | | | — | | | — | | | 11,081 | | | — | | | — | | | — | | | 11,081 | |

Other comprehensive income, net of tax of $1,199 | — | | | — | | | — | | | — | | | — | | | 2,669 | | | — | | | — | | | 2,669 | |

| Dividends | — | | | — | | | — | | | — | | | (3,252) | | | — | | | — | | | — | | | (3,252) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Share-based compensation expense | — | | | 608 | | | — | | | — | | | — | | | — | | | — | | | — | | | 608 | |

| | | | | | | | | | | | | | | | | |

Balance, October 29, 2022 | 10,971 | | | $ | 73,499 | | | 4,294 | | | $ | 697 | | | $ | 314,803 | | | $ | 8,804 | | | 752 | | | $ | (14,588) | | | $ | 383,215 | |

| | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See notes to consolidated financial statements.

| | | | | | | | | | | | |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) | |

| | 13 Weeks Ended | |

| | October 28,

2023 | | October 29,

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net income | $ | 11,585 | | | $ | 11,081 | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | 8,967 | | | 8,950 | | |

| Non-cash share-based compensation | 924 | | | 608 | | |

| | | | |

| Deferred taxes | (207) | | | 103 | | |

| Provision to value inventories at LIFO | 466 | | | 538 | | |

| | | | |

| Gain on sale of property, equipment and fixtures | (39) | | | (17) | | |

| Changes in assets and liabilities: | | | | |

| Merchandise inventories | (3,443) | | | (4,893) | | |

| Patronage dividend receivable | (4,849) | | | (4,745) | | |

| Accounts payable to Wakefern | 4,216 | | | 3,760 | | |

| Accounts payable and accrued expenses | 3,954 | | | 3,389 | | |

| Accrued wages and benefits | (1,420) | | | (697) | | |

| Income taxes receivable / payable | (2,602) | | | 4,492 | | |

| Other assets and liabilities | 827 | | | (550) | | |

| Net cash provided by operating activities | 18,379 | | | 22,019 | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Capital expenditures | (13,773) | | | (9,813) | | |

| Proceeds from the sale of assets | 39 | | | 17 | | |

| Investment in notes receivable from Wakefern | (2,139) | | | (59,767) | | |

| Maturity of notes receivable from Wakefern | — | | | 28,850 | | |

| | | | |

| | | | |

| Investment in real estate partnership | (1,813) | | | (1,276) | | |

| | | | |

| Net cash used in investing activities | (17,686) | | | (41,989) | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| | | | |

| | | | |

| Proceeds from issuance of long-term debt | — | | | 10,000 | | |

| Principal payments of long-term debt | (2,698) | | | (2,352) | | |

| | | | |

| | | | |

| Debt issuance costs | — | | | (11) | | |

| Dividends | (3,350) | | | (3,252) | | |

| Treasury stock purchases | (782) | | | — | | |

| Net cash (used in) provided by financing activities | (6,830) | | | 4,385 | | |

| | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | (6,137) | | | (15,585) | | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | 140,910 | | | 134,832 | | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | $ | 134,773 | | | $ | 119,247 | | |

| | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH PAYMENTS MADE FOR: | | | | |

| Interest | $ | 1,064 | | | $ | 1,087 | | |

| Income taxes | $ | 8,135 | | | $ | 380 | | |

| | | | |

| NONCASH SUPPLEMENTAL DISCLOSURES: | | | | |

| Investment in Wakefern and increase in notes payable to Wakefern | $ | 38 | | | $ | — | | |

| Capital expenditures included in accounts payable and accrued expenses | $ | 5,086 | | | $ | 5,427 | | |

| Lease obligations obtained in exchange for right-of-use assets | $ | 908 | | | $ | — | | |

See notes to consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands) (Unaudited)

1. BASIS OF PRESENTATION and ACCOUNTING POLICIES

In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments (consisting of normal and recurring accruals) necessary to present fairly the consolidated financial position as of October 28, 2023 and the consolidated statements of operations, comprehensive income and cash flows for the 13 weeks ended October 28, 2023 and October 29, 2022 of Village Super Market, Inc. (“Village” or the “Company”).

The significant accounting policies followed by the Company are set forth in Note 1 to the Company's consolidated financial statements in the July 29, 2023 Village Super Market, Inc. Annual Report on Form 10-K, which should be read in conjunction with these financial statements. The results of operations for the period ended October 28, 2023 are not necessarily indicative of the results to be expected for the full year.

Disaggregated Revenues

The following table presents the Company's sales by product categories during each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | |

| | October 28, 2023 | | October 29, 2022 | | | | |

| Amount | | % | | Amount | | % | | | | | | | | |

| Center Store (1) | $ | 320,924 | | | 59.8 | % | | $ | 311,824 | | | 60.0 | % | | | | | | | | |

| Fresh (2) | 193,520 | | | 36.1 | | | 189,008 | | | 36.4 | | | | | | | | | |

| Pharmacy | 20,211 | | | 3.8 | | | 17,169 | | | 3.3 | | | | | | | | | |

| Other (3) | 1,699 | | | 0.3 | | | 1,688 | | | 0.3 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total Sales | $ | 536,354 | | | 100.0 | % | | $ | 519,689 | | | 100.0 | % | | | | | | | | |

(1) Consists primarily of grocery, dairy, frozen, health and beauty care, general merchandise and liquor.

(2) Consists primarily of produce, meat, deli, seafood, bakery, prepared foods and floral.

(3) Consists primarily of sales related to other income streams, including service fees related to digital sales, gift card and lottery commissions and wholesale sales.

2. MERCHANDISE INVENTORIES

At October 28, 2023 and July 29, 2023, approximately 63% and 64%, respectively, of merchandise inventories are valued by the LIFO method while the balance is valued by FIFO. If the FIFO method had been used for the entire inventory, inventories would have been $21,704 and $21,238 higher than reported at October 28, 2023 and July 29, 2023, respectively.

3. NET INCOME PER SHARE

The Company has two classes of common stock. Class A common stock is entitled to cash dividends as declared 54% greater than those paid on Class B common stock. Shares of Class B common stock are convertible on a share-for-share basis for Class A common stock at any time.

The Company utilizes the two-class method of computing and presenting net income per share. The two-class method is an earnings allocation formula that calculates basic and diluted net income per share for each class of common stock separately based on dividends declared and participation rights in undistributed earnings. Under the two-class method, Class A common stock is assumed to receive a 54% greater participation in undistributed earnings than Class B common stock, in accordance with the classes' respective dividend rights. Unvested share-based payment awards that contain nonforfeitable rights to dividends are treated as participating securities and therefore included in computing net income per share using the two-class method.

Diluted net income per share for Class A common stock is calculated utilizing the if-converted method, which assumes the conversion of all shares of Class B common stock to Class A common stock on a share-for-share basis, as this method is more dilutive than the two-class method. Diluted net income per share for Class B common stock does not assume conversion of Class B common stock to shares of Class A common stock.

The table below reconciles Net income to Net income available to Class A and Class B shareholders:

| | | | | | | | | | | | | | | |

| | | 13 Weeks Ended |

| | | | | | October 28,

2023 | | October 29,

2022 |

| Net income | | | | | $ | 11,585 | | | $ | 11,081 | |

Distributed and allocated undistributed Net income to unvested restricted shareholders | | | | | 440 | | | 304 | |

| Net income available to Class A and Class B shareholders | | | | | $ | 11,145 | | | $ | 10,777 | |

The tables below reconcile the numerators and denominators of basic and diluted Net income per share for all periods presented.

| | | | | | | | | | | | | | | |

| | | 13 Weeks Ended |

| | | | October 28, 2023 |

| | | | | | Class A | | Class B |

| Numerator: | | | | | | | |

Net income allocated, basic | | | | | $ | 8,782 | | | $ | 2,363 | |

| Conversion of Class B to Class A shares | | | | | 2,363 | | | — | |

| | | | | | | |

Net income allocated, diluted | | | | | $ | 11,145 | | | $ | 2,363 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted average shares outstanding, basic | | | | | 10,146 | | | 4,204 | |

| Conversion of Class B to Class A shares | | | | | 4,204 | | | — | |

| | | | | | | |

| Weighted average shares outstanding, diluted | | | | | 14,350 | | | 4,204 | |

| | | | | | | |

| | | 13 Weeks Ended |

| | | | October 29, 2022 |

| | | | | | Class A | | Class B |

| Numerator: | | | | | | | |

| Net income allocated, basic | | | | | $ | 8,402 | | | $ | 2,376 | |

| Conversion of Class B to Class A shares | | | | | 2,376 | | | — | |

| | | | | | | |

| Net income allocated, diluted | | | | | $ | 10,778 | | | $ | 2,376 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted average shares outstanding, basic | | | | | 9,863 | | | 4,294 | |

| Conversion of Class B to Class A shares | | | | | 4,294 | | | — | |

| | | | | | | |

| Weighted average shares outstanding, diluted | | | | | 14,157 | | | 4,294 | |

Outstanding stock options to purchase Class A shares of 86 and 93 were excluded from the calculation of diluted net income per share at October 28, 2023 and October 29, 2022, respectively, as a result of their anti-dilutive effect. In addition, 507 and 363 non-vested restricted Class A shares, which are considered participating securities, and their allocated net income were excluded from the diluted net income per share calculation at October 28, 2023 and October 29, 2022, respectively, due to their anti-dilutive effect.

4. RELATED PARTY INFORMATION

A description of the Company’s transactions with Wakefern, its principal supplier, and with other related parties is included in the Company’s Annual Report on Form 10-K for the year ended July 29, 2023.

On August 15, 2022, notes receivable due from Wakefern of $28,850 that earned interest at the prime rate plus 1.25% matured. The Company invested all of the proceeds received in variable rate notes receivable from Wakefern that earn interest at the prime rate plus .50% and mature on August 15, 2027. On September 28, 2022, the Company invested an additional $30,000 in variable rate notes receivable from Wakefern that earn interest at the prime rate plus .50% and mature on September 28, 2027. At October 28, 2023, the Company held variable rate notes receivable due from Wakefern of $32,211 that earn interest at the prime rate plus .75% and mature on February 15, 2024, $31,559 that earn interest at the prime rate plus .50% and mature on August 15, 2027 and $32,578 that earn interest at the prime rate plus .50% and mature on September 28, 2027. Wakefern has the right to prepay these notes at any time. Under certain conditions, the Company can require Wakefern to prepay the notes, although interest earned since inception would be reduced as if it was earned based on overnight money market rates as paid by Wakefern on demand deposits.

Included in cash and cash equivalents at October 28, 2023 and July 29, 2023 are $116,520 and $122,028, respectively, of demand deposits invested at Wakefern at overnight money market rates.

On April 28, 2022, the Company entered into a partnership agreement for 30% interest in the development of a retail center in Old Bridge, New Jersey, which includes a Village replacement store with an operating lease obligation of $4,304 as of October 28, 2023.Village will fund its share of project costs estimated to be $15,000 to $20,000 over the two to three year life of the project. As of October 28, 2023, Village has invested $12,688 into the real estate partnership, which is accounted for as an equity method investment included in Investments in Real Estate Partnerships on the Consolidated Balance Sheet.

There have been no other significant changes in the Company’s relationships or nature of transactions with related parties during the 13 weeks ended October 28, 2023.

5. COMMITMENTS and CONTINGENCIES

The Company is involved in litigation incidental to the normal course of business. Company management is of the opinion that the ultimate resolution of these legal proceedings should not have a material adverse effect on the consolidated financial position, results of operations or liquidity of the Company.

6. DEBT

Long-term debt consists of:

| | | | | | | | | | | | | | |

| | October 28,

2023 | | July 29,

2023 |

| | | | |

| Secured term loans | | $ | 52,846 | | | $ | 53,912 | |

| Unsecured term loan | | 21,443 | | | 22,702 | |

| New Market Tax Credit Financing | | 5,120 | | | 5,182 | |

| | | | |

| Total debt, excluding obligations under leases | | 79,409 | | | 81,796 | |

| Less current portion | | 9,370 | | | 9,370 | |

| | | | |

| Total long-term debt, excluding obligations under leases | | $ | 70,039 | | | $ | 72,426 | |

Credit Facility

The Company has a credit facility (the “Credit Facility”) with Wells Fargo National Bank, National Association (“Wells Fargo”). The principal purpose of the Credit Facility is to finance general corporate and working capital requirements, Village’s fiscal 2020 acquisition of certain Fairway assets and certain capital expenditures. Among other things, the Credit Facility provides for:

•An unsecured revolving line of credit providing a maximum amount available for borrowing of $75,000. Indebtedness under this agreement bears interest at the applicable Secured Overnight Financing Rate ("SOFR") plus 1.10% and expires on May 6, 2025.

•An unsecured $25,500 term loan issued on May 12, 2020, repayable in equal monthly installments based on a seven-year amortization schedule through May 4, 2027 and bearing interest at the applicable SOFR plus 1.46%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at .26% per annum through May 4, 2027, resulting in a fixed effective interest rate of 1.72% on the term loan.

•A secured $50,000 term loan issued on September 1, 2020 repayable in equal monthly installments based on a fifteen-year amortization schedule through September 1, 2035 and bearing interest at the applicable SOFR plus 1.61%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at .57% per annum through September 1, 2035, resulting in a fixed effective interest rate of 2.18% on the term loan. The term loan is secured by real properties of Village Super Market, Inc. and its subsidiaries, including the sites of three Village stores.

•A secured $7,350 term loan issued on January 28, 2022 repayable in equal monthly installments based on a fifteen-year amortization schedule through January 28, 2037 and bearing interest at the applicable SOFR plus 1.50%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at 1.41% per annum through January 28, 2037, resulting in a fixed effective interest rate of 2.91% on the term loan. The term loan is secured by the Galloway store shopping center acquired in the first quarter of fiscal 2022.

On September 1, 2022, the Company amended the Credit Facility due to the execution of a seven year $10,000 unsecured term loan. The unsecured term loan is repayable in equal monthly installments based on a seven year amortization schedule through September 4, 2029 and bears interest at the applicable SOFR plus 1.35%. Village also executed an interest rate swap for a notional amount equal to the term loan amount that fixes the base SOFR at 2.95%, resulting in a fixed effective rate of 4.30%. This loan qualified for an interest rate subsidy program with Wakefern on financing related to certain capital expenditure projects. Net of the subsidy, the Company will pay interest at a fixed effective rate of 2.30%.

On January 27, 2023, the Company purchased the Vineland store shopping center for $9,500. As part of the purchase, the Company amended the Credit Facility due to the execution of a fifteen year $7,125 term loan secured by the Vineland store shopping center. The secured term loan is repayable in equal monthly installments based on a fifteen year amortization schedule through January 27, 2038 and bears interest at the applicable SOFR plus 1.75%. Village also executed an interest rate swap for a notional amount equal to the term loan amount that fixes the base SOFR at 3.59%, resulting in a fixed effective rate of 5.34%.

The Credit Facility also provides for up to $25,000 of letters of credit ($7,336 outstanding at October 28, 2023), which secure obligations for store leases and construction performance guarantees to municipalities. The Credit Facility contains covenants that, among other conditions, require a minimum tangible net worth, a minimum fixed charge coverage ratio and a maximum adjusted debt to EBITDAR ratio. The Company was in compliance with all covenants of the credit agreement at October 28, 2023. As of October 28, 2023, $67,664 remained available under the unsecured revolving line of credit.

New Markets Tax Credit Financing

On December 29, 2017, the Company entered into a financing transaction with Wells Fargo Community Investment Holdings, LLC (“Wells Fargo”) under a qualified New Markets Tax Credit (“NMTC”) program related to the construction of a new store in the Bronx, New York. The NMTC program was provided for in the Community Renewal Tax Relief Act of 2000 (the “Act”) and is intended to induce capital investment in qualified lower income communities. The Act permits taxpayers to claim credits against their Federal income taxes for up to 39% of qualified investments in the equity of community development entities (“CDEs”). CDEs are privately managed investment institutions that are certified to make qualified low-income community investments.

In connection with the financing, the Company loaned $4,835 to VSM Investment Fund, LLC (the "Investment Fund") at an interest rate of 1.403% per year and with a maturity date of December 31, 2044. Repayments on the loan commence in March 2025. Wells Fargo contributed $2,375 to the Investment Fund and, by virtue of such contribution, is entitled to substantially all of the tax benefits derived from the NMTC. The Investment Fund is a wholly owned subsidiary of Wells Fargo. The loan to the Investment Fund is recorded in Other assets in the consolidated balance sheets.

The Investment Fund then contributed the proceeds to a CDE, which, in turn, loaned combined funds of $6,563, net of debt issuance costs, to Village Super Market of NY, LLC, a wholly-owned subsidiary of the Company, at an interest rate

of 1.000% per year with a maturity date of December 31, 2051. These loans are secured by the leasehold improvements and equipment related to the construction of the Bronx store. Repayment of the loans commences in March 2025. The proceeds of the loans from the CDE were used to partially fund the construction of the Bronx store. The Notes payable related to New Markets Tax Credit, net of debt issuance costs, are recorded in long-term debt in the consolidated balance sheets.

The NMTC is subject to 100% recapture for a period of seven years. The Company is required to be in compliance with various regulations and contractual provisions that apply to the New Markets Tax Credit arrangement. Noncompliance could result in Wells Fargo's projected tax benefits not being realized and, therefore, require the Company to indemnify Wells Fargo for any loss or recapture of NMTCs. The Company does not anticipate any credit recapture will be required in connection with this financing arrangement. The transaction includes a put/call provision whereby the Company may be obligated or entitled to repurchase Wells Fargo's interest in the Investment Fund. The value attributed to the put/call is de minimis. We believe that Wells Fargo will exercise the put option in December 2024, at the end of the recapture period, that will result in a net benefit to the Company of $1,728. The Company is recognizing the net benefit over the seven-year compliance period in operating and administrative expense.

7. DERIVATIVES AND HEDGING ACTIVITIES

The Company is exposed to interest rate risk arising from fluctuations in SOFR related to the Company’s Credit Facility. The Company manages exposure to this risk and the variability of related cash flows primarily by the use of derivative financial instruments, specifically, interest rate swaps.

The Company’s objectives in using interest rate swaps are to add stability to interest expense and to manage its exposure to interest rate movements. Interest rate swaps designated as cash flow hedges involve the receipt of variable amounts from a counterparty in exchange for the Company making fixed-rate payments over the life of the agreements without exchange of the underlying notional amount.

As of October 28, 2023, the Company had five interest rate swaps with an aggregate initial notional value of $99,975 to hedge the variable cash flows associated with variable-rate loans under the Company's Credit Facility. The interest rate swaps were executed for risk management and are not held for trading purposes. The objective of the interest rate swaps is to hedge the variability of cash flows resulting from fluctuations in the reference rate. The swaps replaced the applicable reference rate with fixed interest rates and payments are settled monthly when payments are made on the variable-rate loans. The Company's derivatives qualify and have been designated as cash flow hedges of interest rate risk. The gain or loss on the derivative is recorded in Accumulated other comprehensive income and subsequently reclassified into interest expense in the same period during which the hedged transaction affects earnings. Amounts reported in Accumulated other comprehensive income related to derivatives will be reclassified to interest expense as interest payments are made on the variable-rate loans. The Company reclassified $781 and $243 during the 13 weeks ended October 28, 2023 and October 29, 2022, respectively, from Accumulated other comprehensive income to Interest expense.

The notional value of the interest rate swaps were $74,570 as of October 28, 2023. The fair value of interest rate swaps recorded in Other assets in the consolidated balance sheets is $10,269 as of October 28, 2023.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Dollars in Thousands)

OVERVIEW

Village Super Market, Inc. (the “Company” or “Village”) was founded in 1937. Village operates a chain of 34 supermarkets in New Jersey (26), New York (6), Maryland (1) and Pennsylvania (1) under the ShopRite and Fairway banners and three Gourmet Garage specialty markets in New York City. Village is the second largest member of Wakefern Food Corporation (“Wakefern”), the nation’s largest retailer-owned food cooperative and owner of the ShopRite, Fairway and Gourmet Garage names. As further described in the Company’s Form 10-K, this ownership interest in Wakefern provides Village with many of the economies of scale in purchasing, distribution, advanced retail technology, marketing and advertising associated with chains of greater size and geographic coverage.

The supermarket industry is highly competitive and characterized by narrow profit margins. The Company competes directly with multiple retail formats, both in-store and online, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, restaurants, dollar stores and convenience stores. The Company competes by providing a superior customer service experience, competitive pricing and a broad range of consistently available quality products. The ShopRite Price Plus and Fairway Insider customer loyalty programs enable Village to offer continuity programs, focus on target marketing initiatives and to offer discounts and attach digital coupons directly to a customer's loyalty card.

Online grocery ordering for in-store pick up or home delivery is available in all of our ShopRite stores through shoprite.com, the ShopRite app or through third party service providers. Additionally, the ShopRite Order Express app enables customers to pre-order deli, catering, specialty occasion cakes and other items. Online ordering for home delivery is available in all Fairway stores through fairwaymarket.com, the Fairway app or through third party service providers. Online ordering for home delivery is available in all Gourmet Garage stores through gourmetgarage.com, the Gourmet Garage app or through third party service providers.

To promote production efficiency, product quality and consistency, the Company operates a centralized commissary supplying certain products in deli, bakery, prepared foods and other perishable product categories to all stores. The Company also owns and operates an automated micro-fulfillment center to facilitate online order fulfillment for the south New Jersey stores.

The Company’s stores, eight of which are owned, average 54,000 total square feet. These larger store sizes enable the Company to offer a wide variety of national branded and locally sourced food products, including grocery, meat, produce, dairy, deli, seafood, prepared foods, bakery and frozen foods as well as non-food product offerings, including health and beauty care, general merchandise, liquor and 21 in-store pharmacies. Most product departments include high-quality, competitively priced own-brand offerings under the Wholesome Pantry, Bowl & Basket, Paperbird and Fairway brands. Our Fairway Markets offer a one-stop destination shopping experience with an emphasis on fresh, unique, and high quality offerings paired with an expansive variety of natural, organic, specialty and gourmet products. Our Gourmet Garage specialty markets offer organic produce, signature soups and prepared foods, high-quality meat and seafood, charcuterie and gourmet cheeses, artisan baked bread and pastries, chef-prepared meals to go and pantry staples.

The Company has an ongoing program to evaluate, upgrade and expand its supermarket chain. This program has included store remodels as well as the opening or acquisition of additional stores. When remodeling, Village has sought, whenever possible, to increase the amount of selling space in its stores. On August 14, 2022, we converted the Pelham, NY store from the Fairway banner to the ShopRite banner and a major remodel of the store was completed in late October 2022.

On November 1, 2023, Village closed an 8,400 sq. ft. Gourmet Garage store located in New York City. The impact associated with the closure and ongoing results of operating were not material to Village’s consolidated financial statements.

We consider a variety of indicators to evaluate our performance, such as same store sales; percentage of total sales by department (mix); shrink; departmental gross profit percentage; sales per labor hour; units per labor hour; and hourly labor rates.

RESULTS OF OPERATIONS

The following table sets forth the major components of the Consolidated Statements of Operations as a percentage of sales:

| | | | | | | | | | | | | | | |

| | | | 13 Weeks Ended |

| | | | | | October 28, 2023 | | October 29, 2022 |

| Sales | | | | | 100.00 | % | | 100.00 | % |

| Cost of sales | | | | | 71.48 | | | 71.27 | |

| Gross profit | | | | | 28.52 | | | 28.73 | |

| Operating and administrative expense | | | | | 24.29 | | | 24.16 | |

| Depreciation and amortization | | | | | 1.59 | | | 1.65 | |

| Operating income | | | | | 2.64 | | | 2.92 | |

| | | | | | | |

| Interest expense | | | | | (0.20) | | | (0.21) | |

| Interest income | | | | | 0.71 | | | 0.38 | |

| Income before income taxes | | | | | 3.15 | | | 3.09 | |

| Income taxes | | | | | 0.99 | | | 0.96 | |

| Net income | | | | | 2.16 | % | | 2.13 | % |

Sales. Sales were $536,354 in the 13 weeks ended October 28, 2023, an increase of 3.2% compared to the 13 weeks ended October 29, 2022. Sales increased due to an increase in same store sales of 2.0% and increased sales due to the remodel and conversion of the Pelham, NY Fairway to the ShopRite banner on August 15, 2022. Same store sales increased due primarily to retail price inflation. New stores, replacement stores and stores with banner changes are included in same store sales in the quarter after the store has been in operation for four full quarters. Store renovations and expansions are included in same store sales immediately.

Gross Profit. Gross profit as a percentage of sales decreased .21% in the 13 weeks ended October 28, 2023 compared to the 13 weeks ended October 29, 2022 due primarily to higher promotional spending (.22%), increased warehouse assessment charges from Wakefern (.20%) and an unfavorable change in product mix (.14%) partially offset by increased departmental gross margin percentages (.36%). Department gross margins increased due primarily to improvements in commissary operations.

Operating and Administrative Expense. Operating and administrative expense as a percentage of sales increased .13% in the 13 weeks ended October 28, 2023 compared to the 13 weeks ended October 29, 2022 due primarily to increased facility repair and maintenance costs (.10%), security costs (.07%) and external fees associated with digital sales (.05%) partially offset by lower labor costs and fringe benefits (.10%).

Depreciation and Amortization. Depreciation and amortization expense in the 13 weeks ended October 28, 2023 was flat compared to the 13 weeks ended October 29, 2022.

Interest Expense. Interest expense in the 13 weeks ended October 28, 2023 was flat compared to the 13 weeks ended October 29, 2022.

Interest Income. Interest income increased in the 13 weeks ended October 28, 2023 compared to the 13 weeks ended October 29, 2022 due primarily to higher interest rates and larger amounts invested in variable rate notes receivable from Wakefern and demand deposits at Wakefern.

Income Taxes. The effective income tax rate was 31.5% in the 13 weeks ended October 28, 2023 compared to 31.0% in the 13 weeks ended October 29, 2022.

Net Income. Net Income was $11,585 in the 13 weeks ended October 28, 2023 compared to $11,081 in the 13 weeks ended October 29, 2022. Net income increased 5% compared to the prior year due primarily to the increase in sales of 3.2% and higher interest income.

CRITICAL ACCOUNTING POLICIES

Critical accounting policies are those accounting policies that management believes are important to the portrayal of the Company’s financial condition and results of operations. These policies require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. The Company’s critical accounting policies relating to the impairment of long-lived assets, goodwill and indefinite-lived intangible assets and accounting for patronage dividends earned as a stockholder of Wakefern, are described in the Company’s Annual Report on Form 10-K for the year ended July 29, 2023. As of October 28, 2023, there have been no changes to the critical accounting policies contained therein.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

LIQUIDITY AND CAPITAL RESOURCES

Net cash provided by operating activities was $18,379 in the 13 weeks ended October 28, 2023 compared to $22,019 in the corresponding period of the prior year. The change in cash flows from operating activities in fiscal 2024 was primarily due to changes in working capital. Working capital changes, including Other assets and liabilities, decreased cash flows from operating activities by $3,317 in fiscal 2024 compared to an increase of $756 in fiscal 2023. The change in impact of working capital is due primarily to the timing of tax payments.

During the 13 weeks ended October 28, 2023, Village used cash to fund capital expenditures of $13,773, dividends of $3,350, principal payments of long-term debt of $2,698, share repurchases of $782, an investment in a real estate partnership for the development of a retail center in Old Bridge, New Jersey of $1,813 and additional net investments of $2,139 in notes receivable from Wakefern. Capital expenditures primarily include costs associated with the construction of the Old Bridge replacement store scheduled to open in fiscal 2024, the minor remodel of the Millburn, NJ ShopRite and various technology, equipment and facility upgrades.

We have budgeted $85,000 for capital expenditures in fiscal 2024. Planned expenditures include costs for construction of the Old Bridge replacement store scheduled to open in fiscal 2024 and two other replacement stores scheduled to open in fiscal 2025, potential real estate purchases, several smaller store remodels and merchandising initiatives and various technology, equipment and facility upgrades. The Company’s primary sources of liquidity in fiscal 2024 are expected to be cash and cash equivalents on hand at October 28, 2023 and operating cash flow generated in fiscal 2024.

On April 28, 2022 the Company entered into a partnership agreement for a 30% interest in the development of a retail center in Old Bridge, New Jersey, which includes a Village replacement store with an operating lease obligation of $4,304 as of October 28, 2023. Village will fund its share of project costs estimated to be $15,000 to $20,000 over the two to three year life of the project. As of October 28, 2023, Village has invested $12,688 into the real estate partnership, which is accounted for as an equity method investment included in Investments in Real Estate Partnerships on the consolidated balance sheet.

On August 15, 2022, notes receivable due from Wakefern of $28,850 that earned interest at the prime rate plus 1.25% matured. The Company invested all of the proceeds received in variable rate notes receivable from Wakefern that earn interest at the prime rate plus .50% and mature on August 15, 2027. On September 28, 2022, the Company invested an additional $30,000 in variable rate notes receivable from Wakefern that earn interest at the prime rate plus .50% and mature on September 28, 2027.

At October 28, 2023, the Company held variable rate notes receivable due from Wakefern of $32,211 that earn interest at the prime rate plus .75% and mature on February 15, 2024, $31,559 that earn interest at the prime rate plus .50% and mature on August 15, 2027 and $32,578 that earn interest at the prime rate plus .50% and mature on September 28, 2027. Wakefern has the right to prepay these notes at any time. Under certain conditions, the Company can require Wakefern to prepay the notes, although interest earned since inception would be reduced as if it was earned based on overnight money market rates as paid by Wakefern on demand deposits.

Working capital was $66,275 at October 28, 2023 compared to $67,714 at July 29, 2023. Working capital ratios at the same dates were 1.36 and 1.38 to one, respectively. The Company’s working capital needs are reduced, since inventories are generally sold by the time payments to Wakefern and other suppliers are due.

Credit Facility

The Company has a credit facility (the “Credit Facility”) with Wells Fargo National Bank, National Association (“Wells Fargo”). The principal purpose of the Credit Facility is to finance general corporate and working capital requirements, Village’s fiscal 2020 acquisition of certain Fairway assets and certain capital expenditures. Among other things, the Credit Facility provides for:

•An unsecured revolving line of credit providing a maximum amount available for borrowing of $75,000. Indebtedness under this agreement bears interest at the applicable Secured Overnight Financing Rate ("SOFR") plus 1.10% and expires on May 6, 2025.

•An unsecured $25,500 term loan issued on May 12, 2020, repayable in equal monthly installments based on a seven-year amortization schedule through May 4, 2027 and bearing interest at the applicable SOFR plus 1.46%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at .26% per annum through May 4, 2027, resulting in a fixed effective interest rate of 1.72% on the term loan.

•A secured $50,000 term loan issued on September 1, 2020 repayable in equal monthly installments based on a fifteen-year amortization schedule through September 1, 2035 and bearing interest at the applicable SOFR plus 1.61%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at .57% per annum through September 1, 2035, resulting in a fixed effective interest rate of 2.18% on the term loan. The term loan is secured by real properties of Village Super Market, Inc. and its subsidiaries, including the sites of three Village stores.

•A secured $7,350 term loan issued on January 28, 2022 repayable in equal monthly installments based on a fifteen-year amortization schedule through January 28, 2037 and bearing interest at the applicable SOFR plus 1.50%. An interest rate swap with notional amounts equal to the term loan fixes the base SOFR at 1.41% per annum through January 28, 2037, resulting in a fixed effective interest rate of 2.91% on the term loan. The term loan is secured by the Galloway store shopping center acquired for $9,800 in the first quarter of fiscal 2022.

On September 1, 2022, the Company amended the Credit Facility due to the execution of a seven year $10,000 unsecured term loan. The unsecured term loan is repayable in equal monthly installments based on a seven year amortization schedule through September 4, 2029 and bears interest at the applicable SOFR plus 1.35%. Village also executed an interest rate swap for a notional amount equal to the term loan amount that fixes the base SOFR at 2.95%, resulting in a fixed effective rate of 4.30%. This loan qualified for an interest rate subsidy program with Wakefern on financing related to certain capital expenditure projects. Net of the subsidy, the Company will pay interest at a fixed effective rate of 2.30%.

On January 27, 2023, the Company purchased the Vineland store shopping center for $9,500. As part of the purchase, the Company amended the Credit Facility due to the execution of a fifteen year $7,125 term loan secured by the Vineland store shopping center. The secured term loan is repayable in equal monthly installments based on a fifteen year amortization schedule through January 27, 2038 and bears interest at the applicable SOFR plus 1.75%. Village also executed an interest rate swap for a notional amount equal to the term loan amount that fixes the base SOFR at 3.59%, resulting in a fixed effective rate of 5.34%.

Based on current trends, the Company believes cash and cash equivalents on hand at October 28, 2023, operating cash flow and availability under our Credit Facility are sufficient to meet our liquidity needs for the next twelve months and for the foreseeable future beyond the next twelve months.

There have been no other substantial changes as of October 28, 2023 to the contractual obligations and commitments discussed in the Company’s Annual Report on Form 10-K for the year ended July 29, 2023.

OUTLOOK

This Form 10-Q contains certain forward-looking statements about Village’s future performance. These statements are based on management’s assumptions and beliefs in light of information currently available. Such statements relate to, for example: same store sales; economic conditions; expected pension plan contributions; projected capital expenditures; cash flow requirements; inflation expectations; and legal matters; and are indicated by words such as “will,” “expect,” “should,” “intend,” “anticipates,” “believes” and similar words or phrases. The Company cautions the reader that there is no assurance that actual results or business conditions will not differ materially from the results expressed, suggested or implied by such forward-

looking statements. The Company undertakes no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof.

•We expect the increase in same store sales to range from 1.0% to 3.0% in fiscal 2024.

•We have budgeted $85,000 for capital expenditures in fiscal 2024. Planned expenditures include costs for construction of the Old Bridge replacement store scheduled to open in fiscal 2024 and two other replacement stores scheduled to open in fiscal 2025, potential real estate purchases, several smaller store remodels and merchandising initiatives and various technology, equipment and facility upgrades.

•The Board’s current intention is to continue to pay quarterly dividends in 2024 at the most recent rate of $.25 per Class A and $.1625 per Class B share.

•We believe cash and cash equivalents on hand, operating cash flow and the Company's Credit Facility will be adequate to meet anticipated requirements for working capital, capital expenditures and debt payments for the foreseeable future.

•We expect our effective income tax rate in fiscal 2024 to be in the range of 31.0% - 32.0%.

Various uncertainties and other factors could cause actual results to differ from the forward-looking statements contained in this report. These include:

•The supermarket business is highly competitive and characterized by narrow profit margins. Results of operations may be materially adversely impacted by competitive pricing and promotional programs, industry consolidation and competitor store openings. Village competes directly with multiple retail formats both in-store and online, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, restaurants, dollar stores and convenience stores. Some of these competitors have greater financial resources, lower merchandise acquisition costs and lower operating expenses than we do.

•The Company’s stores are concentrated in New Jersey, New York, Pennsylvania and Maryland. We are vulnerable to economic downturns in these states in addition to those that may affect the country as a whole. Economic conditions such as inflation, deflation, interest rate fluctuations, movements in energy costs, social programs, minimum wage legislation, unemployment rates, disturbances due to social unrest and changing demographics may adversely affect our sales and profits.

•Village purchases substantially all of its merchandise from Wakefern. In addition, Wakefern provides the Company with support services in numerous areas including advertising, workers' compensation, liability and property insurance, supplies, certain equipment purchasing, coupon processing, certain financial accounting applications, retail technology support, and other store services. Further, Village receives patronage dividends and other product incentives from Wakefern and also has demand deposits and notes receivable due from Wakefern.

Any material change in Wakefern’s method of operation or a termination or material modification of Village’s relationship with Wakefern could have an adverse impact on the conduct of the Company’s business and could involve additional expense for Village. The failure of any Wakefern member to fulfill its obligations to Wakefern or a member’s insolvency or withdrawal from Wakefern could result in increased costs to the Company. Additionally, an adverse change in Wakefern’s results of operations could have an adverse effect on Village’s results of operations.

•Approximately 92% of our employees are covered by collective bargaining agreements. Any work stoppages could have an adverse impact on our financial results. If we are unable to control health care and pension costs provided for in the collective bargaining agreements, we may experience increased operating costs.

•The Company could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations.

•Certain of the multi-employer plans to which we contribute are underfunded. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of our collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur a withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under very complex actuarial and allocation rules. The failure of a withdrawing employer to fund these obligations can impact remaining employers. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations, withdrawals by other participating employers and the actual return on assets held in the plans, among other factors.

•The Company uses a combination of insurance and self-insurance to provide for potential liability for workers’ compensation, automobile, general liability, property, director and officers’ liability, and certain employee health care benefits. Any projection of losses is subject to a high degree of variability. Changes in legal claims, trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, and insolvency of insurance carriers could all affect our financial condition, results of operations, or cash flows.

•Our long-lived assets, primarily store property, equipment and fixtures, are subject to periodic testing for impairment. Failure of our asset groups to achieve sufficient levels of cash flow could result in impairment charges on long-lived assets.

•Our goodwill and indefinite-lived intangible assets are tested at the end of each fiscal year, or more frequently if circumstances dictate, for impairment. Failure of acquired businesses to achieve their forecasted expectations could result in impairment charges to goodwill and indefinite-lived intangible assets.

•Our effective tax rate may be impacted by the results of tax examinations and changes in tax laws.

•Wakefern provides all members of the cooperative with information system support that enables us to effectively manage our business data, customer transactions, ordering, communications and other business processes. These information systems are subject to damage or interruption from power outages, computer or telecommunications failures, computer viruses and related malicious software, catastrophic weather events, or human error. Any material interruption of our or Wakefern’s information systems could have a material adverse impact on our results of operations.

Due to the nature of our business, personal information about our customers, vendors and associates is received and stored in these information systems. In addition, confidential information is transmitted through our online business at shoprite.com and through the ShopRite app. Unauthorized parties may attempt to access information stored in or to sabotage or disrupt these systems. Wakefern and the Company maintain substantial security measures to prevent and detect unauthorized access to such information, including utilizing third-party service providers for monitoring our networks, security reviews, and other functions. It is possible that computer hackers, cyber terrorists and others may be able to defeat the security measures in place at the Company, Wakefern or those of third-party service providers.

Any breach of these security measures and loss of confidential information, which could be undetected for a period of time, could damage our reputation with customers, vendors and associates, cause Wakefern and Village to incur significant costs to protect any customers, vendors and associates whose personal data was compromised, cause us to make changes to our information systems and could result in government enforcement actions and litigation against Wakefern and/or Village from outside parties. Any such breach could have a material adverse impact on our operations, consolidated financial condition, results of operations, and liquidity if the related costs to Wakefern and Village are not covered or are in excess of carried insurance policies. In addition, a security breach could require Wakefern and Village to devote significant management resources to address problems created by the security breach and restore our reputation.

RELATED PARTY TRANSACTIONS

See note 4 to the unaudited consolidated financial statements for information on related party transactions.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

As required by Rule 13a-15 under the Exchange Act, the Company carried out an evaluation of the effectiveness of the design and operation of the Company’s disclosure controls and procedures at the end of the period. This evaluation was carried out under the supervision, and with the participation, of the Company’s management, including the Company’s Chief Executive Officer along with the Company’s Chief Financial Officer. Based upon that evaluation, the Company’s Chief Executive Officer, along with the Company’s Chief Financial Officer, concluded that the Company’s disclosure controls and procedures are effective.

Disclosure controls and procedures are designed to ensure that information required to be disclosed in Company reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in Company reports filed under the Exchange Act is accumulated and communicated to management, including the Company’s Chief Executive Officer and Chief Financial Officer as appropriate, to allow timely decisions regarding required disclosure.

There have been no changes in the Company’s internal control over financial reporting during the quarter ended October 28, 2023 that have materially affected, or are reasonably likely to materially affect, the Company’s internal controls over financial reporting.

PART II - OTHER INFORMATION

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

ITEM 2C. ISSUER PURCHASES OF EQUITY SECURITIES

The number and average price of shares purchased in each fiscal month of the first quarter of fiscal 2024 are set forth in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period(1) | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (2) | |

| July 30, 2023 to August 26, 2023 | | — | | $— | | — | | $3,202,713 | |

| August 27, 2023 to September 23, 2023 | | — | | $— | | — | | $3,202,713 | |

| September 24, 2023 to October 28, 2023 | | 32,174 | | $24.32 | | 32,174 | | $2,420,089 | |

| Total | | 32,174 | | $24.32 | | 32,174 | | $2,420,089 | |

(1) The reported periods conform to our fiscal calendar.

(2) Includes amount remaining under the $5.0 million repurchase program of the Company's Class A Common Stock authorized by the Board of Directors and announced on September 13, 2019 . Repurchases may be made from time-to-time through a variety of methods, including open market purchases and other negotiated transactions, including through plans designed to comply with Rule 10b5-1 under the Securities Exchange Act of 1934.

| | | | | | |

| ITEM 6. EXHIBITS | |

| | |

| Exhibit 31.1 | | |

| Exhibit 31.2 | | |

| Exhibit 32.1 | | |

| Exhibit 32.2 | | |

| Exhibit 99.1 | | |

| 101 INS | XBRL Instance | |

| 101 SCH | XBRL Schema | |

| 101 CAL | XBRL Calculation | |

| 101 DEF | XBRL Definition | |

| 101 LAB | XBRL Label | |

| 101 PRE | XBRL Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| | Village Super Market, Inc. |

| | Registrant |

| | |

| Dated: December 6, 2023 | /s/ Robert P. Sumas |

| | Robert P. Sumas |

| | (Chief Executive Officer) |

| | |

| Dated: December 6, 2023 | /s/ John Van Orden |

| | John Van Orden |

| | (Chief Financial Officer) |

I, Robert P. Sumas, certify that:

| | | | | | | | |

| 1. | I have reviewed this quarterly report on Form 10-Q of Village Super Market, Inc.; |

| | |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| | |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report. |

| | |

| 4. | The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| | |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| | |

| c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| | |