| | | | | | | | | | | | | | |

| Prospectus Supplement No. 19 | | | | Filed pursuant to Rule 424(b)(3) |

| (To Prospectus dated July 9, 2024) | | | | Registration No. 333-280643 |

Wheeler Real Estate Investment Trust, Inc.

This is Prospectus Supplement No. 19 (this “Prospectus Supplement”) to our Prospectus, dated July 9, 2024 (the “Prospectus”), relating to the issuance from time to time by Wheeler Real Estate Investment Trust, Inc. of up to 20,704,217 shares of our common stock, par value $0.01 (“Common Stock”). Terms used but not defined in this Prospectus Supplement have the meanings ascribed to them in the Prospectus.

We have attached to this Prospectus Supplement our Current Report on Form 8-K filed on March 4, 2025. The attached information updates and supplements, and should be read together with, the Prospectus, as supplemented from time to time.

Investing in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 6 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is March 4, 2025.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): March 4, 2025

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 2.02 Results of Operations and Financial Condition.

On March 4, 2025, Wheeler Real Estate Investment Trust, Inc. (the “Company”), issued a press release announcing that it had reported its financial and operating results for the three and twelve months ended December 31, 2024. A copy of the press release is hereby furnished as Exhibit 99.1 to this report on Form 8-K.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" with the Securities and Exchange Commission ("SEC") nor incorporated by reference in any registration statement filed by the Company under the Securities Act of 1933, as amended (the "Securities Act"), unless specified otherwise.

Item 7.01 Regulation FD Disclosure

On March 4, 2025, the Company made publicly available certain supplemental financial information for the three and twelve months ended December 31, 2024 on its investor relations website, https://ir.whlr.us/.

This supplemental financial information is hereby furnished as Exhibit 99.2 to this Current Report on Form 8-K. The information contained in this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed "filed" with the SEC nor incorporated by reference in any registration statement filed by the Company under the Securities Act unless specified otherwise. The information found on, or otherwise accessible through, the Company's website is not incorporated into, and does not form a part of, this Current Report on Form 8-K or any other report or document the Company files with or furnishes to the SEC.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are included with this Report:

Exhibit No.

| | | | | | | | | | | | | | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: March 4, 2025

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

ANNOUNCES THE RELEASE OF ITS

FOURTH QUARTER AND YEAR-END 2024 FINANCIAL AND OPERATING RESULTS

VIRGINIA BEACH, VA – March 4, 2025 – Wheeler Real Estate Investment Trust, Inc. (NASDAQ: WHLR) (the "Company") announced today that it has reported its financial and operating results for the year ended December 31, 2024 with the filing of its Annual Report on Form 10-K (the "Form 10-K") with the Securities and Exchange Commission. In addition, the Company has posted supplemental information to its website regarding it's financial and operating results for the three and twelve months ended December 31, 2024. Both the Form 10-K and the supplemental information can be accessed by visiting the Company's investor relations website at https://ir.whlr.us/.

Contact

Investor Relations: (757) 627-9088

ABOUT WHEELER REAL ESTATE INVESTMENT TRUST, INC.

Headquartered in Virginia Beach, Virginia, Wheeler Real Estate Investment Trust, Inc. is a fully integrated, self-managed commercial real estate investment trust (REIT) that owns, leases and operates income-producing retail properties with a primary focus on grocery-anchored centers. For more information on the Company, please visit www.whlr.us.

| | | | | |

| Table of Contents | |

| Page |

| Glossary of Terms | |

| Company Overview | |

| Financial and Portfolio Overview | |

| Financial and Operating Results | |

| Financial Summary | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Reconciliation of Non-GAAP Measures | |

| Debt Summary | |

| Portfolio Summary | |

| Property Summary | |

| Top Ten Tenants by Annualized Base Rent and Lease Expiration Schedules | |

| Leasing Summary | |

Cautionary Note on Forward-Looking Statements

This document contains forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor. When used in this presentation, the words "continue," "may," "approximately," "potentially," or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks include, without limitation: The use of and demand for retail space; general and economic business conditions, including the rate and other terms on which we are able to lease our properties; the loss or bankruptcy of the Company's tenants; the geographic concentration of our properties in the Mid-Atlantic, Southeast and Northeast; consumer spending and confidence trends, including those affecting the ability of individuals to spend in retail shopping centers; availability, terms and deployment of capital; substantial dilution of our common stock, par value $0.01 ("Common Stock") and steep decline in its market value resulting from the exercise by the holders of our Series D Cumulative Convertible Preferred Stock (the "Series D Preferred Stock") of their redemption rights and downward adjustment of the Conversion Price (as defined below) on our outstanding 7.00% Subordinated Convertible Notes due 2031 (the "Convertible Notes"), each of which has already occurred and is anticipated to continue; given the volatility in the trading of our Common Stock, whether we have registered and, as necessary, can continue to register sufficient shares of our Common Stock to settle redemptions of all Series D Preferred Stock tendered to us by the holders thereof; the degree and nature of our competition; changes in governmental regulations, accounting rules, tax rates and similar matters; the ability and willingness of the Company’s tenants and other third parties to satisfy their obligations under their respective contractual arrangements with the Company; the ability and willingness of the Company’s tenants to renew their leases with the Company upon expiration; the Company’s ability to re-lease its properties on the same or better terms in the event of non-renewal or in the event the Company exercises its right to replace an existing tenant, and obligations the Company may incur in connection with the replacement of an existing tenant; litigation risks generally; the risk that shareholder litigation filed by the Company's former CEO, Daniel Khoshaba, may result in significant costs of defense, indemnification and liability, and divert management's attention away from running the Company; the Company's ability to maintain compliance with the financial and other covenants in its debt agreements and under the terms of its Series D Preferred Stock; financing risks, such as the Company’s inability to obtain new financing or

| | | | | |

WHLR | Financial & Operating Data | 2 |

refinancing on favorable terms as the result of market volatility or instability and increases in the Company’s borrowing costs as a result of changes in interest rates and other factors; the impact of the Company’s leverage on operating performance; our ability to successfully execute strategic or necessary asset acquisitions and divestitures; risks related to the market for retail space generally, including reductions in consumer spending, variability in retailer demand for leased space, adverse impact of e-commerce, ongoing consolidation in the retail sector and changes in economic conditions and consumer confidence; risks endemic to real estate and the real estate industry generally; the adverse effect of any future pandemic, endemic or outbreak of infectious diseases, and mitigation efforts, including government-imposed lockdowns, to control their spread; risks to our information systems - or those of our tenants or vendors - from service interruption, misappropriation of data, breaches of security or information technology, or other cyber-related attacks; competitive risks; the Company’s ability to maintain compliance with the listing standards of the Nasdaq Capital Market ("Nasdaq"); the effects on the trading market of our Common Stock of the one-for-10 reverse stock split effected on August 17, 2023 (the "August 2023 Reverse Stock Split"), the one-for-24 reverse stock split effected on May 16, 2024 (the "May 2024 Reverse Stock Split"), the one-for-five reverse stock split effected on June 27, 2024 (the "June 2024 Reverse Stock Split"), the one-for-three reverse stock split effected on September 19, 2024 (the "September 2024 Reverse Stock Split", the one-for-two reverse stock split effected on November 18, 2024 (the "November 2024 Reverse Stock Split" and collectively with the May 2024 Reverse Stock Split, June 2024 Reverse Stock Split, September 2024 Reverse Stock Split and November 2024 Reverse Stock Split, the “2024 Reverse Stock Splits”), the one-for-four reverse stock split effected on January 27, 2025 (the "January 2025 Reverse Stock Split" and, together with the August 2023 Reverse Stock Split and the 2024 Reverse Stock Splits, the "Reverse Stock Splits") and any reverse stock splits the Company may effect in the future; damage to the Company’s properties from catastrophic weather and other natural events, and the physical effects of climate change; the risk that an uninsured loss on the Company’s properties or a loss that exceeds the limits of the Company’s insurance policies could subject the Company to lost capital or revenue on those properties; the risk that continued increases in the cost of necessary insurance could negatively impact the Company's profitability; the Company’s ability and willingness to maintain its qualification as a real estate investment trust ("REIT") in light of economic, market, legal, tax and other considerations; the ability of our operating partnership, Wheeler REIT, L.P. (the "Operating Partnership"), and each of our other partnerships and limited liability companies to be classified as partnerships or disregarded entities for federal income tax purposes; the impact of e-commerce on our tenants’ business; and the inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws.

| | | | | |

WHLR | Financial & Operating Data | 3 |

Glossary of Terms

| | | | | | | | |

| Term | | Definition |

| | |

| Adjusted FFO ("AFFO") | | We believe the computation of funds from operations ("FFO") in accordance with the National Association of Real Estate Investment Trusts' ("Nareit") definition includes certain items that are not indicative of the results provided by our operating portfolio and affect the comparability of our period-over-period performance. These items include, but are not limited to, legal settlements, non-cash share-based compensation expense, non-cash amortization on loans and acquisition costs. Therefore, in addition to FFO, management uses Adjusted FFO ("AFFO"), a non-GAAP measure, for REITs, which we define to exclude such items. Management believes that these adjustments are appropriate in determining AFFO as they are not indicative of the operating performance of our assets. In addition, we believe that AFFO is a useful supplemental measure for the investing community to use in comparing us to other REITs as many REITs provide some form of adjusted or modified FFO. However, there can be no assurance that AFFO presented by us is comparable to the adjusted or modified FFO of other REITs. |

| | |

| Anchor | | Lease occupying 20,000 square feet or more. |

| | |

| Annualized Base Rent ("ABR") | | Monthly base rent on occupied space as of the end of the current reporting period multiplied by twelve months, excluding the impact of tenant concessions and rent abatements. |

| | |

| Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") | | A widely-recognized non-GAAP financial measure that the Company believes, when considered with financial statements prepared in accordance with GAAP, is useful to investors and lenders in understanding financial performance and providing a relevant basis for comparison against other companies, including other REITs. While EBITDA should not be considered as a substitute for net income attributable to the Company’s common stockholders, net operating income, cash flow from operating activities, or other income or cash flow data prepared in accordance with GAAP, the Company believes that EBITDA may provide additional information with respect to the Company’s performance or ability to meet its future debt service requirements, capital expenditures and working capital requirements. The Company computes EBITDA by excluding interest expense, net loss attributable to noncontrolling interests, depreciation and amortization, and impairment of long-lived assets and notes receivable from income from continuing operations. The Company also presents Adjusted EBITDA, which excludes items affecting the comparability of the periods presented, including but not limited to, costs associated with acquisitions and capital related activities. |

| | |

| Funds from Operations ("FFO") | | We use FFO, a non-GAAP measure, as an alternative measure of our operating performance, specifically as it relates to results of operations and liquidity. We compute FFO in accordance with standards established by the Board of Governors of Nareit in its March 1995 White Paper (as amended in November 1999, April 2002 and December 2018). As defined by Nareit, FFO represents net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus real estate-related depreciation and amortization (excluding amortization of loan origination costs), plus impairment of real estate related long-lived assets and after adjustments for unconsolidated partnerships and joint ventures. Most industry analysts and equity REITs, including us, consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions and excluding depreciation, FFO is a helpful tool that can assist in the comparison of the operating performance of a company’s real estate between periods, or as compared to different companies. Management uses FFO as a supplemental measure to conduct and evaluate our business because there are certain limitations associated with using GAAP net income alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time, while historically real estate values have risen or fallen with market conditions. Accordingly, we believe FFO provides a valuable alternative measurement tool to GAAP when presenting our operating results. |

| | |

| Gross Leasable Area ("GLA") | | The total amount of leasable space in an investment property. |

| | |

| Ground Lease | | A lease in which the tenant owns the building but not the land it is built on. |

| | |

| | | | | |

WHLR | Financial & Operating Data | 4 |

| | | | | | | | |

| Term | | Definition |

| | |

Leased Rate /

% Leased | | The space committed to lessee under a signed lease agreement as a percentage of gross leasable area executed through December 31, 2024. |

| | |

Local Tenant

| | Tenant with presence in one state with 10 or less locations. |

| | |

| National / Regional Tenant | | Tenant with presence in multiple states or single state presence with more than 10 locations. |

| | |

| Occupancy Rate / % Occupied | | The space delivered to a tenant under a signed lease agreement as a percentage of gross leasable area through December 31, 2024. |

| | |

| Rent Spread: | | |

| | |

| New Rent Spread | | Weighted average change over the gross value of the new lease, annualized per square foot, compared to the annualized base rent per square foot of the prior tenant. |

| | |

Renewal Rent Spread | | Weighted average change over the gross value of the renewed lease, annualized per square foot, compared to the annualized base rent per square foot of the prior rate. |

| | |

| Same-Property | | Properties owned during all periods presented herein. |

| | |

Same-Property Net Operating Income ("Same-Property NOI") | | Same-Property net operating income ("Same-Property NOI") is a widely-used non-GAAP financial measure for REITs. The Company believes that Same-Property NOI is a useful measure of the Company's property operating performance. The Company defines Same-Property NOI as property revenues (rental and other revenues) less property and related expenses (property operation and maintenance and real estate taxes). Because Same-Property NOI excludes general and administrative expenses, depreciation and amortization, gain or loss on sale or capital expenditures and leasing costs and impairment charges, it provides a performance measure, that when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from operating income. The Company uses Same-Property NOI to evaluate its operating performance since Same-Property NOI allows the Company to evaluate the impact of factors, such as occupancy levels, lease structure, lease rates and tenant base, have on the Company's results, margins and returns. Properties are included in Same-Property NOI if they are owned and operated for the entirety of both periods being compared. Consistent with the capital treatment of such costs under GAAP, tenant improvements, leasing commissions and other direct leasing costs are excluded from Same-Property NOI.

The most directly comparable GAAP financial measure is consolidated operating income. Same-Property NOI should not be considered as an alternative to consolidated operating income prepared in accordance with GAAP or as a measure of liquidity. Further, Same-Property NOI is a measure for which there is no standard industry definition and, as such, it is not consistently defined or reported on among the Company's peers, and thus may not provide an adequate basis for comparison among REITs. |

| | |

| SOFR | | Secured Overnight Financing Rate |

| | |

| Undeveloped Property | | Vacant land without GLA. |

| | | | | |

WHLR | Financial & Operating Data | 5 |

Company Overview

Headquartered in Virginia Beach, Virginia, Wheeler Real Estate Investment Trust, Inc. (Nasdaq: WHLR) is a fully-integrated, self-managed commercial real estate investment company focused on owning, leasing and operating income-producing retail properties with a primary focus on grocery-anchored centers. WHLR’s portfolio contains well-located, potentially dominant retail properties in secondary and tertiary markets that generate attractive, risk-adjusted returns. WHLR’s common stock, Series B convertible preferred stock ("Series B Preferred Stock" and, together with the Series D Preferred Stock, the "Preferred Stock"), Series D Preferred Stock, and Convertible Notes trade publicly on Nasdaq under the symbols "WHLR", "WHLRP", "WHLRD", and "WHLRL", respectively.

Cedar Realty Trust, Inc. ("CDR" or "Cedar") is a subsidiary of WHLR. CDR's 7-1/4% Series B cumulative redeemable preferred stock ("Cedar Series B Preferred Stock") and 6-1/2% Series C cumulative redeemable preferred stock ("Cedar Series C Preferred Stock") trade publicly on the New York Stock Exchange ("NYSE") under the symbols "CDRpB" and "CDRpC", respectively and represent a noncontrolling interest to WHLR.

Accordingly, the use of the word "Company" refers to WHLR and its consolidated subsidiaries, which includes Cedar, except where the context otherwise requires.

| | | | | | | | |

| Corporate Headquarters | | |

| Wheeler Real Estate Investment Trust, Inc. | | |

2529 Virginia Beach Boulevard

Virginia Beach, VA 23452 | | |

Phone: (757) 627-9088

Toll Free: (866) 203-4864 | | |

| Website: www.whlr.us | | |

| | |

| Executive Management | | |

| M. Andrew Franklin - CEO and President | | |

| Crystal Plum - CFO | | |

| | |

| | |

| Board of Directors | | Board of Directors |

| Stefani D. Carter (Chair) | | Kerry G. Campbell (Chair) |

| E.J. Borrack | | E.J. Borrack |

| Robert Brady | | M. Andrew Franklin |

| Kerry D. Campbell | | Crystal Plum |

| Rebecca Musser | | Paula Poskon |

| Megan Parisi | | Gary Skoien |

| Dennis Pollack | | |

| Joseph D. Stilwell | | |

| | |

| Stock Transfer Agent and Registrar | | |

Computershare Trust Company, N.A.

150 Royall Street, Suite 101

Canton, MA 02021

www.computershare.com | | |

| | |

| Investor Relations Representative | | |

investorrelations@whlr.us

Office: (757) 627-9088 | | |

| | | | | |

WHLR | Financial & Operating Data | 6 |

Financial and Portfolio Overview

All share and share-related information for all periods presented reflect the Reverse Stock Splits unless otherwise noted.

For the Three Months Ended December 31, 2024 (consolidated amounts unless otherwise noted) | | | | | |

Financial Results | |

| Net income attributable to Wheeler REIT common stockholders (in 000s) | $ | 32,037 | |

| Net income per basic shares | $ | 173.35 | |

| Net loss per diluted shares | $ | (3.79) | |

| FFO available to common stockholders and Operating Partnership (OP) unitholders (in 000s) | $ | 45,927 | |

| FFO per common share and OP unit | $ | 248.50 | |

| AFFO (in 000s) | $ | 3,411 | |

| AFFO per common share and OP unit | $ | 18.46 | |

| |

Assets and Leverage | |

Investment Properties, net of $112.2 million accumulated depreciation (in 000s) | $ | 534,925 | |

| Cash and Cash Equivalents (in 000s) | $ | 42,964 | |

| Total Assets (in 000s) | $ | 653,702 | |

| Total Debt (in 000s) | $ | 499,531 | |

| Debt to Total Assets | 76.42 | % |

| Debt to Gross Asset Value | 64.26 | % |

| |

Market Capitalization | |

| Common shares outstanding | 328,112 | |

| |

| |

| | | | | | | | | | | | | | | | | |

| Ticker | Shares Outstanding at December 31, 2024 | | Fourth Quarter stock price range | | Stock price as of December 31, 2024 |

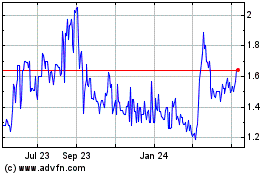

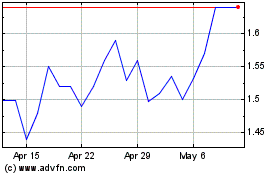

| WHLR | 328,112 | | $13.20-$150.48 | | $ | 13.48 | |

| WHLRP | 3,357,142 | | $2.25-$3.74 | | $ | 3.05 | |

| WHLRD | 2,236,046 | | $21.00-$27.48 | | $ | 27.14 | |

| CDRpB | 1,449,609 | | $14.00-$16.74 | | $ | 15.00 | |

| CDRpC | 4,208,694 | | $11.14-$14.99 | | $ | 14.49 | |

| | | | | |

| Common Stock market capitalization (in 000s) | $ | 4,423 | |

| | | | | | | | | | | |

Portfolio Summary | | | |

| GLA in sq. ft. | 5,308,451 | | | 2,352,528 | |

| Occupancy Rate | 94.8 | % | | 86.7 | % |

| Leased Rate | 94.9 | % | | 88.9 | % |

| Annualized Base Rent (in 000s) | $ | 51,411 | | | $ | 22,037 | |

| Total number of leases signed or renewed | 35 | | | 14 | |

| Total sq. ft. leases signed or renewed | 163,867 | | | 56,606 | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 7 |

Financial and Operating Results

For the three months ended December 31, 2024 and 2023, WHLR's net income (loss) attributable to WHLR's common stockholders for basic earnings per share was $173.35 per share and $1,585.37 per share, respectively, and for dilutive earnings per share was $(3.79) per share and $80.60 per share, respectively. For the years ended December 31, 2024 and 2023, WHLR's net loss attributable to WHLR's common stockholders was $(317.02) per share and $(13,157.97) per share, respectively.

2024 FOURTH QUARTER HIGHLIGHTS

(All comparisons are to the same prior year period unless otherwise noted)

LEASING

•The Company's real estate portfolio:

•was 92.3% occupied, a 120 basis point increase from 91.1%;

•was 93.1% leased, a 60 basis point decrease from 93.7%; and

•includes 34 properties that are 100% leased.

•WHLR Quarter-To-Date Leasing Activity

•Executed 28 lease renewals totaling 139,842 square feet at a weighted-average increase of $1.36 per square foot, representing an increase of 11.39% over in-place rental rates.

•Signed 7 new leases totaling 24,025 square feet with a weighted-average rental rate of $14.91 per square foot, representing a new rent spread of 37.76%.

•The WHLR portfolio, excluding Cedar, was:

◦94.8% occupied, a 120 basis point increase from 93.6%; and

◦94.9% leased, a 100 basis point decrease from 95.9%.

•CDR Quarter-To-Date Leasing Activity

•Executed 9 lease renewals totaling 46,630 square feet at a weighted-average increase of $3.15 per square foot, representing an increase of 22.33% over in-place rental rates.

•Signed 5 new leases totaling 9,976 square feet with a weighted-average rental rate of $31.31 per square foot, representing a new rent spread of 79.72%.

•The Cedar portfolio was:

◦86.7% occupied, a 30 basis point increase from 86.4%; and

◦88.9% leased, a 70 basis point decrease from 89.6%.

•The Company’s gross leasable area ("GLA"), which is subject to leases that expire over the next twelve months and includes month-to-month leases, decreased to approximately 7.5%, compared to 7.9%. At December 31, 2024, 47.5% of this expiring GLA is subject to renewal options (a lease expiration schedule can be found on page 23 and provides additional details on the Company's leases).

SAME-PROPERTY NET OPERATING INCOME

•Same-Property NOI increased by 4.8% or $0.7 million. Same-Property NOI was impacted by:

•$1.2 million increase in property revenue; partially offset by

•$0.4 million increase in property operating expense.

OPERATIONS

•Total revenue of $27.6 million increased by 5.3% or $1.4 million, primarily a result of:

•$1.0 million increase in tenant reimbursements;

•$0.5 million increase in other revenue; partially offset by

•$0.2 million decrease in market lease amortization.

•Total operating expenses of $18.5 million decreased by 2.7% or $0.5 million, primarily a result of:

•$0.8 million decrease in depreciation and amortization;

•$0.3 million decrease in salaries;

•$0.2 million decrease in utilities; partially offset by

•$0.4 million increase in legal fees;

•$0.2 million increase in repairs; and

•$0.2 million increase in real estate taxes.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 8 |

FINANCIAL

•FFO was $45.9 million, or $248.50 per share of the Company's Common Stock and OP Units in our Operating Partnership, as compared to FFO of $21.0 million, or $2,691.84 per share.

•AFFO was $18.46 per share of the Company's Common Stock and OP Units in our Operating Partnership, as compared to $182.82 per share.

CAPITAL MARKETS

•Effected a one-for-two reverse stock split on November 18, 2024.

•Recognized a non-operating gain of $41.4 million in net changes in fair value of derivative liabilities, primarily related to the conversion rate on the Convertible Notes relative to market trade prices of the Convertible Notes and Common Stock.

•Issued 11,000 shares of its Common Stock to an unaffiliated holder in exchange for 22,000 shares of the Company's Series D Preferred Stock and 22,000 shares of the Company's Series B Preferred Stock.

•As of December 31, 2024, the conversion price for the Convertible Notes was approximately $16.88 per share of the Company’s Common Stock (approximately 1.48 shares of Common Stock for each $25.00 of principal amount of the Convertible Notes being converted).

CEDAR CAPITAL MARKETS

•Cedar repurchased and retired 714,231 shares of Cedar Series C Preferred Stock in a series of repurchase transactions, including through a "modified Dutch auction" tender offer that commenced in September 2024 (the "September 2024 Cedar Tender Offer") and expired the fourth quarter. The repurchase of the noncontrolling interests caused the recognition of $3.5 million deemed distributions.

•On December 27, 2024, the Company announced and commenced a second "modified Dutch auction" tender offer to purchase up to an aggregate amount paid of $12.5 million of shares of Cedar Series C Preferred Stock at a price of not less than $13.75 nor greater than $15.75 per share of Cedar Series C Preferred Stock, to the sellers in cash, less any applicable withholding taxes and without interest (the "December 2024 Cedar Tender Offer"). Following the expiration of the December 2024 Cedar Tender Offer on January 28, 2025, the Company accepted for purchase 645,276 shares of its Cedar Series C Preferred Stock at $15.75 per share for approximately $10.2 million. The December 2024 Cedar Tender Offer will provide future annual dividend savings of $1.0 million.

2024 YEAR-TO-DATE HIGHLIGHTS

(All comparisons to the same prior year period unless otherwise noted)

LEASING

•WHLR Year-To-Date Leasing Activity

•Executed 138 lease renewals totaling 755,437 square feet at a weighted-average increase of $0.91 per square foot, representing an increase of 8.83% over in-place rental rates.

•Signed 36 new leases totaling 162,206 square feet with a weighted-average rental rate of $13.84 per square foot, representing a new rent spread of 31.51%.

•CDR Year-To-Date Leasing Activity

•Executed 32 lease renewals totaling 213,713 square feet at a weighted-average increase of $1.50 per square foot, representing an increase of 11.28% over in-place rental rates.

•Signed 19 new leases totaling 68,747 square feet with a weighted-average rental rate of $15.92 per square foot, representing a new rent spread of 3.93%.

SAME-PROPERTY NET OPERATING INCOME

•Same-Property NOI increased by 4.9% or $2.9 million. Same-Property NOI was impacted by:

•$3.1 million increase in property revenue; partially offset by

•$0.2 million increase in property operating expense.

OPERATIONS

•Total revenue of $104.6 million increased by 2.2% or $2.2 million, primarily a result of:

•$2.7 million increase in tenant reimbursements;

•$0.7 million increase in base rent;

•$0.2 million increase in other income; partially offset by

•$1.4 million decrease in market lease amortization.

•Total operating expenses of $72.6 million decreased by 3.4% or $2.5 million, primarily a result of:

•$3.2 million decrease in depreciation and amortization;

•$0.5 million decrease in salaries;

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 9 |

•$0.4 million decrease in legal fees;

•$0.2 million decrease in ground rent expense due to the 2023 acquisition of a land parcel located on the Company's property; partially offset by

•$1.2 million increase in impairment charges on Oregon Avenue;

•$0.3 million increase in insurance; and

•$0.2 million increase in corporate administration.

FINANCIAL

•FFO of $3.3 million, or $46.50 per share of the Company's Common Stock and OP Units in our Operating Partnership, as compared to FFO of $12.8 million, or $5,762.35 per share.

•AFFO of $102.80 per share of the Company's Common Stock and OP Units in our Operating Partnership, as compared to $(110.96) per share.

CAPITAL MARKETS

•The Company effected one-for-24, one-for-five, one-for-three and one-for-two reverse stock splits on May 16, 2024, June 27, 2024, September 19, 2024 and November 18, 2024, respectively.

•On January 17, 2024, the Company paid down $0.6 million of the Convertible Notes through an open market purchase of 23,280 units at a total purchase price of $1.3 million. As a result of this transaction, the Company recognized a $0.7 million loss included in non-operating expenses.

•On June 28, 2024, the Company entered into a term loan agreement (the "Term Loan Agreement, 5 Properties") with Guggenheim Real Estate, LLC, for $25.5 million at a fixed rate of 6.80% with interest-only payments due monthly. Commencing on August 10, 2029, until the maturity date of July 10, 2034, monthly principal and interest payments will be made based on a 30-year amortization schedule calculated based on the principal amount as of that time. The Term Loan Agreement, 5 Properties' proceeds were used to refinance four loans, including paying $0.4 million in defeasance. The Term Loan Agreement, 5 Properties is collateralized by Cypress Shopping Center, Conyers Crossing, Chesapeake Square, Sangaree Plaza and Tri-County Plaza. As a result of the four loans refinanced, the Company was refunded $3.5 million from restricted cash.

•Recognized a non-operating loss of $8.3 million in net changes in fair value of derivative liabilities, primarily related to the conversion rate on the Convertible Notes which can only be adjusted downward based on the redemption price(s) of the Series D Preferred Stock relative to market trade prices of the Convertible Notes and Common Stock.

CEDAR CAPITAL MARKETS

•On February 29, 2024, Cedar entered into a revolving credit agreement with KeyBank National Association to draw up to $9.5 million (the "Cedar Revolving Credit Agreement"). The interest rate under the Cedar Revolving Credit Agreement was the daily SOFR, plus applicable margins of 0.10% plus 2.75%. Interest payments were due monthly, and any outstanding principal was due at maturity on February 28, 2025. The Cedar Revolving Credit Agreement was collateralized by 6 properties, consisting of Carll's Corner, Fieldstone Marketplace, Oakland Commons, Kings Plaza, Oregon Avenue and South Philadelphia, and proceeds were used for capital expenditures and tenant improvements for such properties. Upon the disposition of Kings Plaza the Cedar Revolving Credit Agreement was closed on September 12, 2024.

•In 2024, Cedar repurchased and retired 791,306 shares of Cedar Series C Preferred Stock in a series of repurchase transactions, including the September 2024 Cedar Tender Offer. The shares of Cedar Series C Preferred Stock were repurchased for an aggregate of $11.5 million at a weighted average price of $13.93 per share, representing a premium to the book value of $9.75 per share. The repurchase of the noncontrolling interests caused the recognition of $3.8 million deemed distributions and will produce future annual dividend savings of $1.3 million.

DISPOSITIONS

•On June 18, 2024, the Company entered into a settlement agreement with the City of Grove, Oklahoma, which, among other things, provided for the transfer of the Harbor Point land parcel and a one-time payment of $160 thousand to the City of Grove in exchange for a release of the Company from all increment taxes and other obligations under the Economic Development Agreement the Company had entered into with the City of Grove and the dismissal of the litigation commenced by the City of Grove against the Company.

•On June 26, 2024, the Company sold Oakland Commons, located in Bristol, Connecticut, for $6.0 million, generating a gain of $3.4 million and net proceeds of $5.7 million.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 10 |

•On September 11, 2024, the Company sold Edenton Commons land parcel, located in Edenton, North Carolina, for $1.4 million, generating a gain of $0.6 million and net proceeds of $1.3 million.

•On September 12, 2024, the Company sold Kings Plaza, located in New Bedford, Massachusetts, for $14.2 million, generating a gain of $6.5 million and net proceeds of $13.7 million.

•On November 27, 2024, the Company sold Brickyard Plaza land parcel, located in Berlin, Connecticut, for $1.2 million, generating a gain of $1.0 million and net proceeds of $1.1 million.

•On December 26, 2024, the Company sold South Philadelphia retail center, located in Philadelphia, Pennsylvania, for $21 million, generating a loss of $5.4 million and net proceeds of $16.7 million.

OTHER

•The Company recognized non-operating expenses of $1.5 million, which primarily consisted of capital structure costs, including a repurchase of Convertible Notes and legal and other expenses incurred in connection with the 2024 Reverse Stock Splits, the registration of our Common Stock to issue in settlement of Series D Preferred Stock redemptions and redemptions by holders of the Series D Preferred Stock.

•On June 1, 2024, the Company subscribed for an additional investment in the amount of $0.5 million for limited partnership interests in Stilwell Activist Investments, L.P., a Delaware limited partnership ("SAI").

BALANCE SHEET

•Cash and cash equivalents totaled $43.0 million, compared to $18.4 million at December 31, 2023.

•Restricted cash totaled $17.8 million, compared to $21.4 million at December 31, 2023. The funds are held in lender reserves primarily for the purpose of tenant improvements, lease commissions, real estate taxes and insurance expenses.

•Debt totaled $499.5 million, compared to $495.6 million at December 31, 2023, the increase is a result of a

•$3.9 million increase from 2024 loan refinancing activities;

•$5.2 million draw on Cedar Revolving Credit Agreement;

•$2.5 million increase from the Timpany Plaza loan agreement draw; partially offset by

•$5.2 million payment on Cedar Revolving Credit Agreement;

•$0.7 million repurchase and conversions of Convertible Notes;

•$0.4 million payment on Cedar term loan, 10 properties related to the sale of Brickyard Plaza land parcel; and

•$1.4 million scheduled loan principal payments on debt.

•The Company's weighted average interest rate on property level debt was 5.44% with a term of 7.6 years, compared to 5.32% with a term of 8.2 years at December 31, 2023. The weighted average interest rate on all debt was 5.53% with a term of 7.5 years, compared to 5.42% with a term of 8.2 years at December 31, 2023. The increase in property debt interest was $1.6 million a result of (1) an increase of $1.1 million due to an increase in the overall average interest rate and (2) an increase of $0.5 million in the average principal debt balance. See page 19 for further details on interest expense.

•Real estate totaled $534.9 million compared to $565.1 million as of December 31, 2023.

•The Company invested $22.5 million in tenant improvements and capital expenditures into the properties.

DIVIDENDS

•Total cumulative dividends in arrears for WHLR's Series D Preferred Stock were $32.8 million or $14.67 per share as of December 31, 2024.

•During the year ended December 31, 2024, Cedar paid dividends of $10.4 million.

•On January 30, 2025, Cedar announced that Cedar's Board of Directors declared a dividend of $0.453125 and $0.406250 per share with respect to the Cedar Series B Preferred Stock and Cedar Series C Preferred Stock, respectively. The dividends were paid on February 20, 2025 to shareholders of record on February 10, 2025.

SERIES D PREFERRED STOCK - REDEMPTIONS

•At December 31, 2024 and December 31, 2023, the Company had 2,236,046 and 2,590,458 issued shares, respectively and 6,000,000 authorized shares of Series D Preferred Stock, without par value with a $25.00 liquidation preference per share, or $88.7 million and $97.1 million in aggregate liquidation value, respectively, of which $4.1 million and $0.4 million, respectively, are classified as a liability due to redemption requests received before period end.

•During the year ended December 31, 2024, the Company processed redemptions for an aggregate of 519,822 shares of Series D Preferred Stock from the holders thereof. Accordingly, the Company issued

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 11 |

294,083 shares of Common Stock in settlement of an aggregate redemption price of approximately $20.4 million.

•The gain on Preferred Stock retirements is a result of the fair market value of the Common Stock issued on redemptions and exchanges of the Company's Preferred Stock, in comparison to the Preferred Stock's book value. During the year ended December 31, 2024, the Company has realized a gain of $4.8 million in the aggregate, as a result of the fair market value of the Common Stock issued in these transactions being less than the book value of the Preferred Stock retired..

RELATED PARTY

•The Company performs property management and leasing services for Cedar, a subsidiary of the Company. During the year ended December 31, 2024, Cedar paid the Company $1.4 million for these services.

•Related party amounts due to WHLR from Cedar for financing and real estate taxes, management fees, leasing commissions and Cost Sharing Agreement allocations were $9.5 million and $8.1 million as of December 31, 2024 and December 31, 2023, respectively, and have been eliminated for consolidation purposes.

•As of December 31, 2024, the fair value of the Company’s SAI investment was $12.0 million, which includes $10.5 million of subscriptions. For the year ended December 31, 2024, the gain on investment securities, net was $0.8 million, net of $0.3 million in fees. This investment is presented on the line "investment securities - related party”, on the consolidated balance sheets, for more information see Note 4 in our Annual Report on Form 10-K for the period ended December 31, 2024.

SUBSEQUENT EVENTS

•The Company effected a one-for-four reverse stock split on January 27, 2025.

•The Company processed 154,578 shares of Series D Preferred Stock. Accordingly, the Company issued 568,527 shares of Common Stock in settlement of an aggregate redemption price of approximately $6.2 million.

•On January 7, 2025, the Company agreed to issue 2,000 shares of its Common Stock to one unaffiliated holder of its securities in exchange for 1,000 shares of the Company’s Series D Preferred Stock and 1,000 shares of the Company's Series B Preferred Stock.

•On January 16, 2025, the Company agreed to issue 267,800 shares of its Common Stock in the aggregate to six unaffiliated holders of the Company’s securities in exchange for a total of 82,400 shares of the Company’s Series D Preferred Stock and a total of 82,400 shares of the Company's Series B Preferred Stock.

•Subsequent to December 31, 2024, the Company moved 7 properties to held for sale and as of March 4, 2025, 6 properties were classified as held for sale and 1 property, Webster Commons, was disposed.

•On February 11, 2025, the Company sold Webster Commons, a 98,984 square foot retail center located in Webster, Massachusetts, for $14.5 million, resulting in $13.9 million in net proceeds, which includes a $9.1 million pay down of the Ceder term loan, 10 properties to release the property from collateral.

•For the February 2025 Series D Preferred Stock redemptions, the lowest price at which any Series D Preferred Stock was converted by a holder into Common Stock was approximately $7.05. Accordingly, pursuant to Section 14.02 (Optional Conversion) of the indenture governing the Convertible Notes, the conversion price for the Convertible Notes was further adjusted to approximately $3.88 per share of Common Stock (approximately 6.44 shares of Common Stock for each $25.00 of principal amount of the Convertible Notes being converted), representing a 45% discount to $7.05.

•On February 21, 2025, Cedar announced and commenced concurrent but separate offers to purchase up to an aggregate amount paid of $9.5 million of (i) up to 584,615 shares of Cedar Series C Preferred Stock for a purchase price of $16.25 per share, in cash, and (ii) up to 535,211 shares of Cedar Series B Preferred Stock for a purchase price of $17.75 per share, in cash, each less any applicable withholding taxes and without interest (the "February 2025 Cedar Tender Offers"). The February 2025 Cedar Tender Offers are intended to expire at 5:00 p.m., New York City time, on March 21, 2025, unless either offer is earlier extended or terminated.

ADDITIONAL INFORMATION

The enclosed information should be read in conjunction with the Company's filings with the Securities and Exchange Commission (the "SEC"), including, but not limited to, its quarterly and annual filings on Forms 10-Q and 10-K. These documents are or will be available upon filing via the SEC website (www.sec.gov) or through WHLR’s website at www.whlr.us.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 12 |

Consolidated Balance Sheets

$ in 000s, except par value and share data

| | | | | | | | | | | |

| | December 31, |

| | 2024 | | 2023 |

| ASSETS: | | | |

| Real estate: | | | |

| Land and land improvements | $ | 138,177 | | | $ | 149,908 | |

| Buildings and improvements | 508,957 | | | 510,812 | |

| 647,134 | | | 660,720 | |

| Less accumulated depreciation | (112,209) | | | (95,598) | |

| Real estate, net | 534,925 | | | 565,122 | |

| | | |

| Cash and cash equivalents | 42,964 | | | 18,404 | |

| Restricted cash | 17,752 | | | 21,403 | |

| Receivables, net | 14,692 | | | 13,126 | |

| Investment securities - related party | 12,025 | | | 10,685 | |

| | | |

| Above market lease intangibles, net | 1,285 | | | 2,114 | |

| Operating lease right-of-use assets | 9,235 | | | 9,450 | |

| Deferred costs and other assets, net | 20,824 | | | 28,028 | |

| Total Assets | $ | 653,702 | | | $ | 668,332 | |

| | | |

| LIABILITIES: | | | |

| Loans payable, net | $ | 482,609 | | | $ | 477,574 | |

| | | |

| Below market lease intangible, net | 11,121 | | | 17,814 | |

| Derivative liabilities | 11,985 | | | 3,653 | |

| Operating lease liabilities | 10,128 | | | 10,329 | |

| Series D Preferred Stock redemptions | 4,074 | | | 369 | |

| Accounts payable, accrued expenses and other liabilities | 17,131 | | | 17,065 | |

| Total Liabilities | 537,048 | | | 526,804 | |

| Commitments and contingencies | | | |

| Series D Cumulative Convertible Preferred Stock | 84,625 | | | 96,705 | |

| EQUITY: | | | |

Series A Preferred Stock (no par value, 4,500 shares authorized, 562 shares issued and outstanding; $0.6 million in aggregate liquidation value) | 453 | | | 453 | |

Series B Convertible Preferred Stock (no par value, 5,000,000 authorized, 3,357,142 and 3,379,142 shares issued and outstanding, respectively; $83.9 million and $84.5 million aggregate liquidation preference, respectively) | 44,791 | | | 44,998 | |

Common Stock ($0.01 par value, 200,000,000 shares authorized, 328,112 and 18,670 shares issued and outstanding, respectively) | 3 | | | — | |

| Additional paid-in capital | 276,413 | | | 258,110 | |

| Accumulated deficit | (347,029) | | | (324,854) | |

| Total Stockholders’ Deficit | (25,369) | | | (21,293) | |

| Noncontrolling interests | 57,398 | | | 66,116 | |

| Total Equity | 32,029 | | | 44,823 | |

| Total Liabilities and Equity | $ | 653,702 | | | $ | 668,332 | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 13 |

Consolidated Statements of Operations

$ in 000s, except share and per share data

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| REVENUE: | | | | | | | |

| Rental revenues | $ | 26,483 | | | $ | 25,594 | | | $ | 102,408 | | | $ | 100,332 | |

| Other revenues | 1,110 | | | 621 | | | 2,166 | | | 1,993 | |

| Total Revenue | 27,593 | | | 26,215 | | | 104,574 | | | 102,325 | |

| OPERATING EXPENSES: | | | | | | | |

| Property operations | 8,942 | | | 8,802 | | | 35,100 | | | 34,870 | |

| Depreciation and amortization | 6,104 | | | 6,860 | | | 25,316 | | | 28,502 | |

| Impairment charges | — | | | — | | | 1,195 | | | — | |

| Corporate general & administrative | 3,494 | | | 3,386 | | | 10,982 | | | 11,750 | |

| Total Operating Expenses | 18,540 | | | 19,048 | | | 72,593 | | | 75,122 | |

| (Loss) gain on disposal of properties, net | (4,416) | | | — | | | 5,550 | | | 2,204 | |

| Operating Income | 4,637 | | | 7,167 | | | 37,531 | | | 29,407 | |

| Interest income | 204 | | | 148 | | | 460 | | | 484 | |

| Gain on investment securities, net | 61 | | | 605 | | | 840 | | | 685 | |

| Interest expense | (8,568) | | | (8,189) | | | (32,602) | | | (32,314) | |

| Net changes in fair value of derivative liabilities | 41,442 | | | 9,739 | | | (8,332) | | | 3,458 | |

| Loss on conversion of Convertible Notes | (44) | | | — | | | (412) | | | — | |

| Gain on Preferred Stock retirements | 2,033 | | | 9,893 | | | 4,772 | | | 9,893 | |

| Other expense | (3) | | | (209) | | | (1,489) | | | (5,482) | |

| Net Income Before Income Taxes | 39,762 | | | 19,154 | | | 768 | | | 6,131 | |

| Income tax expense | — | | | — | | | (1) | | | (48) | |

| Net Income | 39,762 | | | 19,154 | | | 767 | | | 6,083 | |

| Less: Net income attributable to noncontrolling interests | 2,255 | | | 2,709 | | | 10,343 | | | 10,770 | |

| Net Income (Loss) Attributable to Wheeler REIT | 37,507 | | | 16,445 | | | (9,576) | | | (4,687) | |

| Preferred Stock dividends - undeclared | (2,132) | | | (2,322) | | | (8,267) | | | (9,262) | |

| Deemed contribution (distribution) related to preferred stock redemption value | 158 | | | (1,746) | | | (552) | | | (15,288) | |

| Deemed distribution related to repurchase of noncontrolling interests | (3,496) | | | — | | | (3,780) | | | — | |

| Net Income (Loss) Attributable to Wheeler REIT Common Stockholders | $ | 32,037 | | | $ | 12,377 | | | $ | (22,175) | | | $ | (29,237) | |

| | | | | | | |

| Per common share: | | | | | | | |

| Net Income (Loss) Attributable to Wheeler REIT Common Stockholders | | | | | | | |

| Basic | $ | 173.35 | | | $ | 1,585.37 | | | $ | (317.02) | | | $ | (13,157.97) | |

| Diluted | $ | (3.79) | | | $ | 80.60 | | | $ | (317.02) | | | $ | (13,157.97) | |

| | | | | | | |

| Weighted average number of shares: | | | | | | | |

| Basic | 184,815 | | | 7,807 | | | 69,948 | | | 2,222 | |

| Diluted | 2,014,001 | | | 153,565 | | | 69,948 | | | 2,222 | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 14 |

Reconciliation of Non-GAAP Measures

Same-Property Net Operating Income

$ in 000s

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Operating Income | $ | 4,637 | | | $ | 7,167 | | | $ | 37,531 | | | $ | 29,407 | |

| Adjustments: | | | | | | | |

| Loss (Gain) on disposal of properties | 4,416 | | | — | | | (5,550) | | | (2,204) | |

| Corporate general & administrative | 3,494 | | | 3,386 | | | 10,982 | | | 11,750 | |

| Impairment charges | — | | | — | | | 1,195 | | | — | |

| Depreciation and amortization | 6,104 | | | 6,860 | | | 25,316 | | | 28,502 | |

| Straight-line rents | (449) | | | (366) | | | (1,334) | | | (1,370) | |

| Above (below) market lease amortization, net | (827) | | | (984) | | | (3,434) | | | (4,849) | |

| Other non-property revenue | (912) | | | (7) | | | (1,043) | | | (137) | |

| NOI related to non-same store property | (354) | | | (685) | | | (1,957) | | | (2,285) | |

| Same-Property Net Operating Income | $ | 16,109 | | | $ | 15,371 | | | $ | 61,706 | | | $ | 58,814 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 15 |

Reconciliation of Non-GAAP Measures (continued)

FFO and AFFO

$ in 000s, except share, unit and per share data

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net Income | | $ | 39,762 | | | $ | 19,154 | | | $ | 767 | | | $ | 6,083 | |

| Depreciation and amortization of real estate assets | | 6,104 | | | 6,860 | | | 25,316 | | | 28,502 | |

| Impairment charges | | — | | | — | | | 1,195 | | | — | |

| Loss (Gain) on disposal of properties, net | | 4,416 | | | — | | | (5,550) | | | (2,204) | |

| FFO | | 50,282 | | | 26,014 | | | 21,728 | | | 32,381 | |

| Preferred stock dividends - undeclared | | (2,132) | | | (2,322) | | | (8,267) | | | (9,262) | |

| Dividends on noncontrolling interests preferred stock | | (2,245) | | | (2,688) | | | (10,295) | | | (10,752) | |

| | | | | | | | |

| Preferred stock accretion adjustments | | 22 | | | 22 | | | 87 | | | 460 | |

| FFO available to common stockholders and common unitholders | | 45,927 | | | 21,026 | | | 3,253 | | | 12,827 | |

Other non-recurring and non-cash expenses (1) | | — | | | 8 | | | 368 | | | 2,051 | |

| Gain on investment securities, net | | (61) | | | (605) | | | (840) | | | (685) | |

| Net changes in fair value of derivative liabilities | | (41,442) | | | (9,739) | | | 8,332 | | | (3,458) | |

| Loss on conversion of Convertible Notes | | 44 | | | — | | | 412 | | | — | |

| Gain on Preferred Stock retirements | | (2,033) | | | (9,893) | | | (4,772) | | | (9,893) | |

| Straight-line rental revenue, net straight-line expense | | (466) | | | (383) | | | (1,402) | | | (1,380) | |

| Deferred financing cost amortization | | 516 | | | 503 | | | 2,673 | | | 2,860 | |

| Paid-in-kind interest | | 2,102 | | | 1,902 | | | 4,133 | | | 3,908 | |

| Above (below) market lease amortization, net | | (827) | | | (984) | | | (3,434) | | | (4,849) | |

| Recurring capital expenditures tenant improvement reserves | | (349) | | | (407) | | | (1,532) | | | (1,628) | |

| AFFO | | $ | 3,411 | | | $ | 1,428 | | | $ | 7,191 | | | $ | (247) | |

| | | | | | | | |

| Weighted Average Common Shares | | 184,815 | | | 7,807 | | | 69,948 | | | 2,222 | |

| Weighted Average OP Units | | 2 | | | 4 | | | 3 | | | 4 | |

| Total Common Shares and OP Units | | 184,817 | | | 7,811 | | | 69,951 | | | 2,226 | |

| FFO per Common Share and OP Common Units | | $ | 248.50 | | | $ | 2,691.84 | | | $ | 46.50 | | | $ | 5,762.35 | |

| AFFO per Common Share and OP Common Units | | $ | 18.46 | | | $ | 182.82 | | | $ | 102.80 | | | $ | (110.96) | |

(1) Other non-recurring expenses are described in "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our Annual Report on Form 10-K for the year ended December 31, 2024.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 16 |

Reconciliation of Non-GAAP Measures (continued)

EBITDA

$ in 000s

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net Income | $ | 39,762 | | | $ | 19,154 | | | $ | 767 | | | $ | 6,083 | |

Add back: | | | | | | | |

| Depreciation and amortization (1) | 5,277 | | | 5,876 | | | 21,882 | | | 23,653 | |

| Interest Expense (2) | 8,568 | | | 8,189 | | | 32,603 | | | 32,314 | |

| Income tax expense | — | | | — | | | 1 | | | 48 | |

EBITDA | 53,607 | | | 33,219 | | | 55,253 | | | 62,098 | |

| Adjustments for items affecting comparability: | | | | | | | |

| Net change in FMV of derivative liabilities | (41,442) | | | (9,739) | | | 8,332 | | | (3,458) | |

| Other non-recurring and non-cash expenses (3) | — | | | — | | | — | | | 259 | |

| Impairment charges | — | | | — | | | 1,195 | | | — | |

| Loss on conversion of Convertible Notes | 44 | | | — | | | 412 | | | — | |

| Gain on preferred stock redemptions | (2,033) | | | (9,893) | | | (4,772) | | | (9,893) | |

| Gain on investment securities, net | (61) | | | (605) | | | (840) | | | (685) | |

| Loss (Gain) on disposal of properties, net | 4,416 | | | — | | | (5,550) | | | (2,204) | |

Adjusted EBITDA | $ | 14,531 | | | $ | 12,982 | | | $ | 54,030 | | | $ | 46,117 | |

(1) Includes above (below) market lease amortization.

(2) Includes loan cost amortization.

(3) Other non-recurring expenses are described in "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our Annual Report on Form 10-K for the period ended December 31, 2024.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 17 |

Debt Summary

$ in 000s

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property/Description | | Monthly Payment | | Interest

Rate | | Maturity | | December 31, 2024 | | December 31, 2023 |

| Cypress Shopping Center | | $ | 34,360 | | | 4.70% | | July 2024 | | $ | — | | | $ | 5,769 | |

| Conyers Crossing | | Interest only | | 4.67% | | October 2025 | | — | | | 5,960 | |

| Winslow Plaza | | $ | 24,295 | | | 4.82% | | December 2025 | | 4,250 | | | 4,331 | |

| Tuckernuck | | $ | 32,202 | | | 5.00% | | March 2026 | | 4,619 | | | 4,771 | |

| Chesapeake Square | | $ | 23,857 | | | 4.70% | | August 2026 | | — | | | 4,014 | |

| Sangaree/Tri-County | | $ | 32,329 | | | 4.78% | | December 2026 | | — | | | 5,990 | |

| Timpany Plaza | | $ | 79,858 | | | 7.27% | | September 2028 | | 11,527 | | | 9,060 | |

| Village of Martinsville | | $ | 89,664 | | | 4.28% | | July 2029 | | 14,313 | | | 14,755 | |

| Laburnum Square | | $ | 37,842 | | | 4.28% | | September 2029 | | 7,625 | | | 7,665 | |

Rivergate (1) | | $ | 100,222 | | | 4.25% | | September 2031 | | 17,091 | | | 17,557 | |

| Convertible Notes | | Interest only | | 7.00% | | December 2031 | | 30,865 | | | 31,530 | |

| Term loan, 22 properties | | Interest only | | 4.25% | | July 2032 | | 75,000 | | | 75,000 | |

JANAF (2) | | Interest only | | 5.31% | | July 2032 | | 60,000 | | | 60,000 | |

| Cedar term loan, 10 properties | | Interest only | | 5.25% | | November 2032 | | 109,571 | | | 110,000 | |

| Patuxent Crossing/Coliseum Marketplace | | Interest only | | 6.35% | | January 2033 | | 25,000 | | | 25,000 | |

| Term loan, 12 properties | | Interest only | | 6.19% | | June 2033 | | 61,100 | | | 61,100 | |

| Term loan, 8 properties | | Interest only | | 6.24% | | June 2033 | | 53,070 | | | 53,070 | |

| Term loan, 5 properties | | Interest only | | 6.80% | | July 2034 | | 25,500 | | | — | |

| Total Principal Balance | | | | | | | | 499,531 | | | 495,572 | |

| Unamortized deferred financing cost | | | | | | | | (16,922) | | | (17,998) | |

| Total Loans Payable, net | | | | | | | | $ | 482,609 | | | $ | 477,574 | |

(1) In October 2026, the interest rate under this loan changes to a variable interest rate equal to the 5-year U.S. Treasury Rate plus 2.70%, with a floor of 4.25%.

(2) Collateralized by JANAF properties.

Total Debt

$ in 000s

| | | | | | | | | | | | | | |

| Scheduled principal repayments and maturities by year | | Amount | | % Total Principal Payments and Maturities |

| December 31, 2025 | | $ | 5,953 | | | 1.19 | % |

| December 31, 2026 | | 6,450 | | | 1.29 | % |

| December 31, 2027 | | 2,826 | | | 0.57 | % |

| December 31, 2028 | | 16,115 | | | 3.23 | % |

| December 31, 2029 | | 24,459 | | | 4.90 | % |

| Thereafter | | 443,728 | | | 88.82 | % |

| Total principal repayments and debt maturities | | $ | 499,531 | | | 100.00 | % |

| | | | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 18 |

Debt Summary (continued)

Interest Expense

$ in 000s

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, | | Three Months Ended Changes | | Years Ended Changes |

| 2024 | | 2023 | | 2024 | | 2023 | | Change | | % Change | | Change | | % Change |

| Property debt interest - excluding Cedar debt | $ | 4,403 | | | $ | 4,303 | | | $ | 17,118 | | | $ | 16,153 | | | $ | 100 | | | 2.3 | % | | $ | 965 | | | 6.0 | % |

Convertible Notes interest (1) | 1,561 | | | 1,339 | | | 4,133 | | | 3,908 | | | 222 | | | 16.6 | % | | 225 | | | 5.8 | % |

| Defeasance paid | — | | | — | | | 368 | | | 1,758 | | | — | | | — | % | | (1,390) | | | (79.1) | % |

| Amortization of deferred financing costs | 516 | | | 503 | | | 2,673 | | | 2,860 | | | 13 | | | 2.6 | % | | (187) | | | (6.5) | % |

| Property debt interest - Cedar | 2,088 | | | 2,044 | | | 8,310 | | | 7,635 | | | 44 | | | 2.2 | % | | 675 | | | 8.8 | % |

| Total Interest Expense | $ | 8,568 | | | $ | 8,189 | | | $ | 32,602 | | | $ | 32,314 | | | $ | 379 | | | 4.6 | % | | $ | 288 | | | 0.9 | % |

(1) Includes the fair value adjustment for the paid-in-kind interest.

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 19 |

Property Summary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property | | Location | | Number of

Tenants | Total Leasable

Square Feet | Percentage

Leased | Percentage Occupied | Total SF Occupied | Annualized

Base Rent (in 000's) | Annualized Base Rent per Occupied Sq. Foot |

| WHLR | | | | | | | | | | |

| Alex City Marketplace | | Alexander City, AL | | 20 | | 151,843 | | 100.0 | % | 100.0 | % | 151,843 | | $ | 1,330 | | $ | 8.76 | |

| Amscot Building | | Tampa, FL | | 1 | | 2,500 | | 100.0 | % | 100.0 | % | 2,500 | | 83 | | 33.00 | |

| Beaver Ruin Village | | Lilburn, GA | | 28 | | 74,038 | | 92.5 | % | 92.5 | % | 68,448 | | 1,287 | | 18.80 | |

| Beaver Ruin Village II | | Lilburn, GA | | 4 | | 34,925 | | 100.0 | % | 100.0 | % | 34,925 | | 497 | | 14.22 | |

| Brook Run Shopping Center | | Richmond, VA | | 17 | | 147,738 | | 91.5 | % | 91.5 | % | 135,110 | | 1,187 | | 8.79 | |

| Bryan Station | | Lexington, KY | | 9 | | 54,277 | | 94.5 | % | 94.5 | % | 51,275 | | 612 | | 11.94 | |

| Cardinal Plaza | | Henderson, NC | | 10 | | 50,000 | | 100.0 | % | 100.0 | % | 50,000 | | 519 | | 10.39 | |

| Chesapeake Square | | Onley, VA | | 13 | | 108,982 | | 90.9 | % | 90.9 | % | 99,006 | | 768 | | 7.75 | |

| Clover Plaza | | Clover, SC | | 10 | | 45,575 | | 100.0 | % | 100.0 | % | 45,575 | | 386 | | 8.47 | |

| Conyers Crossing | | Conyers, GA | | 14 | | 170,475 | | 100.0 | % | 100.0 | % | 170,475 | | 1,023 | | 6.00 | |

| Crockett Square | | Morristown, TN | | 4 | | 107,122 | | 100.0 | % | 100.0 | % | 107,122 | | 978 | | 9.13 | |

| Cypress Shopping Center | | Boiling Springs, SC | | 19 | | 80,435 | | 100.0 | % | 100.0 | % | 80,435 | | 807 | | 10.04 | |

| Darien Shopping Center | | Darien, GA | | 1 | | 26,001 | | 100.0 | % | 100.0 | % | 26,001 | | 140 | | 5.38 | |

| Devine Street | | Columbia, SC | | 1 | | 38,464 | | 89.1 | % | 89.1 | % | 34,264 | | 180 | | 5.25 | |

| Folly Road | | Charleston, SC | | 5 | | 47,794 | | 100.0 | % | 100.0 | % | 47,794 | | 737 | | 15.43 | |

| Forrest Gallery | | Tullahoma, TN | | 28 | | 214,451 | | 91.2 | % | 91.2 | % | 195,642 | | 1,499 | | 7.66 | |

| Fort Howard Shopping Center | | Rincon, GA | | 20 | | 113,652 | | 100.0 | % | 100.0 | % | 113,652 | | 1,312 | | 11.55 | |

| Freeway Junction | | Stockbridge, GA | | 17 | | 156,834 | | 97.6 | % | 97.6 | % | 152,984 | | 1,356 | | 8.86 | |

| Franklin Village | | Kittanning, PA | | 24 | | 151,821 | | 93.9 | % | 93.9 | % | 142,493 | | 1,383 | | 9.70 | |

| Franklinton Square | | Franklinton, NC | | 13 | | 65,366 | | 93.0 | % | 93.0 | % | 60,800 | | 589 | | 9.69 | |

| Georgetown | | Georgetown, SC | | 2 | | 29,572 | | 100.0 | % | 100.0 | % | 29,572 | | 267 | | 9.04 | |

| Grove Park Shopping Center | | Orangeburg, SC | | 13 | | 93,265 | | 94.2 | % | 94.2 | % | 87,851 | | 722 | | 8.22 | |

| Harrodsburg Marketplace | | Harrodsburg, KY | | 8 | | 60,048 | | 91.0 | % | 91.0 | % | 54,648 | | 466 | | 8.53 | |

| JANAF | | Norfolk, VA | | 111 | | 796,624 | | 86.4 | % | 86.4 | % | 688,033 | | 9,042 | | 13.14 | |

| Laburnum Square | | Richmond, VA | | 20 | | 109,405 | | 98.2 | % | 98.2 | % | 107,405 | | 1,031 | | 9.60 | |

| Ladson Crossing | | Ladson, SC | | 15 | | 52,607 | | 97.7 | % | 97.7 | % | 51,407 | | 563 | | 10.95 | |

| LaGrange Marketplace | | LaGrange, GA | | 13 | | 76,594 | | 92.2 | % | 92.2 | % | 70,600 | | 463 | | 6.56 | |

| Lake Greenwood Crossing | | Greenwood, SC | | 8 | | 43,618 | | 100.0 | % | 100.0 | % | 43,618 | | 414 | | 9.50 | |

| Lake Murray | | Lexington, SC | | 5 | | 39,218 | | 100.0 | % | 100.0 | % | 39,218 | | 364 | | 9.28 | |

| Litchfield Market Village | | Pawleys Island, SC | | 25 | | 86,717 | | 100.0 | % | 98.6 | % | 85,517 | | 1,124 | | 13.15 | |

| Lumber River Village | | Lumberton, NC | | 11 | | 66,781 | | 100.0 | % | 100.0 | % | 66,781 | | 519 | | 7.77 | |

| Moncks Corner | | Moncks Corner, SC | | 1 | | 26,800 | | 100.0 | % | 100.0 | % | 26,800 | | 330 | | 12.31 | |

| Nashville Commons | | Nashville, NC | | 12 | | 56,100 | | 100.0 | % | 100.0 | % | 56,100 | | 675 | | 12.03 | |

| New Market Crossing | | Mt. Airy, NC | | 13 | | 117,076 | | 100.0 | % | 100.0 | % | 117,076 | | 1,052 | | 8.99 | |

| Parkway Plaza | | Brunswick, GA | | 5 | | 52,365 | | 84.8 | % | 84.8 | % | 44,385 | | 483 | | 10.88 | |

| Pierpont Centre | | Morgantown, WV | | 15 | | 111,162 | | 98.5 | % | 98.5 | % | 109,437 | | 1,099 | | 10.05 | |

| Port Crossing | | Harrisonburg, VA | | 8 | | 65,365 | | 100.0 | % | 100.0 | % | 65,365 | | 866 | | 13.25 | |

| Ridgeland | | Ridgeland, SC | | 1 | | 20,029 | | 100.0 | % | 100.0 | % | 20,029 | | 140 | | 7.00 | |

| Riverbridge Shopping Center | | Carrollton, GA | | 11 | | 91,188 | | 96.9 | % | 96.9 | % | 88,375 | | 756 | | 8.56 | |

| Rivergate Shopping Center | | Macon, GA | | 24 | | 193,960 | | 87.5 | % | 86.5 | % | 167,816 | | 2,602 | | 15.50 | |

| Sangaree Plaza | | Summerville, SC | | 10 | | 66,948 | | 100.0 | % | 100.0 | % | 66,948 | | 739 | | 11.05 | |

| Shoppes at Myrtle Park | | Bluffton, SC | | 13 | | 56,609 | | 97.5 | % | 97.5 | % | 55,185 | | 674 | | 12.20 | |

| South Lake | | Lexington, SC | | 11 | | 44,318 | | 100.0 | % | 100.0 | % | 44,318 | | 275 | | 6.21 | |

| South Park | | Mullins, SC | | 4 | | 60,734 | | 96.9 | % | 96.9 | % | 58,834 | | 401 | | 6.82 | |

| South Square | | Lancaster, SC | | 6 | | 44,350 | | 81.0 | % | 81.0 | % | 35,900 | | 311 | | 8.65 | |

| St. George Plaza | | St. George, SC | | 9 | | 59,174 | | 100.0 | % | 100.0 | % | 59,174 | | 470 | | 7.95 | |

| Sunshine Plaza | | Lehigh Acres, FL | | 22 | | 111,189 | | 100.0 | % | 98.7 | % | 109,689 | | 1,127 | | 10.27 | |

| Surrey Plaza | | Hawkinsville, GA | | 3 | | 42,680 | | 82.0 | % | 82.0 | % | 35,000 | | 222 | | 6.35 | |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 20 |

Property Summary (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property | | Location | | Number of Tenants | Total Leasable Square Feet | Percentage Leased | Percentage Occupied | Total SF Occupied | Annualized Base Rent (in 000's) | Annualized Base Rent per Occupied Sq. Foot |

| Tampa Festival | | Tampa, FL | | 22 | | 141,580 | | 100.0 | % | 100.0 | % | 141,580 | | $ | 1,334 | | $ | 9.42 | |

| Tri-County Plaza | | Royston, GA | | 8 | | 67,577 | | 96.0 | % | 96.0 | % | 64,877 | | 464 | | 7.16 | |

| Tuckernuck | | Richmond, VA | | 18 | | 93,391 | | 100.0 | % | 100.0 | % | 93,391 | | 1,129 | | 12.09 | |

| Twin City Commons | | Batesburg-Leesville, SC | | 5 | | 47,680 | | 100.0 | % | 100.0 | % | 47,680 | | 491 | | 10.30 | |

| Village of Martinsville | | Martinsville, VA | | 22 | | 288,254 | | 100.0 | % | 100.0 | % | 288,254 | | 2,449 | | 8.50 | |

| Waterway Plaza | | Little River, SC | | 10 | | 49,750 | | 100.0 | % | 100.0 | % | 49,750 | | 498 | | 10.02 | |

| Westland Square | | West Columbia, SC | | 11 | | 62,735 | | 85.1 | % | 85.1 | % | 53,360 | | 483 | | 9.05 | |

| Winslow Plaza | | Sicklerville, NJ | | 18 | | 40,695 | | 100.0 | % | 100.0 | % | 40,695 | | 693 | | 17.03 | |

| | WHLR TOTAL | | 771 | | 5,308,451 | | 94.9 | % | 94.8 | % | 5,035,012 | | $ | 51,411 | | $ | 10.21 | |

| CDR | | | | | | | | | | |

| Brickyard Plaza | | Berlin, CT | | 11 | | 227,598 | | 100.0 | % | 100.0 | % | 227,598 | | $ | 2,100 | | $ | 9.23 | |

| Carll's Corner | | Bridgeton, NJ | | 7 | | 116,532 | | 36.9 | % | 36.9 | % | 43,012 | | 450 | | 10.46 | |

| Coliseum Marketplace | | Hampton, VA | | 9 | | 106,648 | | 94.9 | % | 94.9 | % | 101,198 | | 833 | | 8.24 | |

| Fairview Commons | | New Cumberland, PA | | 11 | | 50,485 | | 87.8 | % | 87.8 | % | 44,335 | | 511 | | 11.53 | |

| Fieldstone Marketplace | | New Bedford, MA | | 12 | | 193,836 | | 79.4 | % | 53.5 | % | 103,664 | | 1,053 | | 10.15 | |

| Gold Star Plaza | | Shenandoah, PA | | 6 | | 71,720 | | 97.8 | % | 97.8 | % | 70,120 | | 643 | | 9.17 | |

| Golden Triangle | | Lancaster, PA | | 18 | | 202,790 | | 89.2 | % | 89.2 | % | 180,940 | | 2,706 | | 14.96 | |

| Hamburg Square | | Hamburg, PA | | 7 | | 102,058 | | 100.0 | % | 100.0 | % | 102,058 | | 703 | | 6.89 | |

| Oregon Avenue (1) | | Philadelphia, PA | | — | | — | | — | % | — | % | — | | — | | — | |

| Patuxent Crossing | | California, MD | | 26 | | 264,068 | | 82.3 | % | 82.0 | % | 216,467 | | 2,542 | | 11.74 | |

| Pine Grove Plaza | | Brown Mills, NJ | | 16 | | 79,306 | | 86.4 | % | 86.4 | % | 68,506 | | 839 | | 12.25 | |

| Southington Center | | Southington, CT | | 8 | | 155,842 | | 92.1 | % | 91.0 | % | 141,870 | | 1,031 | | 7.27 | |

| Timpany Plaza | | Gardner, MA | | 18 | | 182,820 | | 82.8 | % | 82.8 | % | 151,460 | | 1,600 | | 10.56 | |

| Trexler Mall | | Trexlertown, PA | | 23 | | 342,541 | | 98.7 | % | 98.7 | % | 337,944 | | 3,820 | | 11.31 | |

| Washington Center Shoppes | | Sewell, NJ | | 29 | | 157,300 | | 96.1 | % | 96.1 | % | 151,150 | | 1,921 | | 12.71 | |

| Webster Commons | | Webster, MA | | 9 | | 98,984 | | 100.0 | % | 100.0 | % | 98,984 | | 1,285 | | 12.98 | |

| | CDR TOTAL | | 210 | | 2,352,528 | | 88.9 | % | 86.7 | % | 2,039,306 | | $ | 22,037 | | $ | 10.81 | |

| | | | | | | | | | |

| | COMBINED TOTAL | | 981 | | 7,660,979 | | 93.1 | % | 92.3 | % | 7,074,318 | | $ | 73,448 | | $ | 10.38 | |

| | | | | | | | | | |

(1) Includes property where a redevelopment opportunity exists.

| | | | | | | | | | | | | | | | | | | | |

| Undeveloped Land | | Company | | Location | | Parcel Size (in acres) |

| Brook Run Properties | | WHLR | | Richmond, VA | | 2.00 |

| Courtland Commons | | WHLR | | Courtland, VA | | 1.04 |

| St. George Land | | WHLR | | St. George, SC | | 2.51 |

| South Philadelphia parcels | | CDR | | Philadelphia, PA | | 4.47 |

| Webster Commons | | CDR | | Webster, MA | | 0.55 |

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 21 |

Property Summary (continued)

| | | | | |

WHLR | Financial & Operating Data | as of 12/31/2024 unless otherwise stated | 22 |

Top Ten Tenants by Annualized Base Rent

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenants | | Category | | Annualized Base Rent

($ in 000s) | | % of Total Annualized Base Rent | | Total Occupied Square Feet | | Percent Total Leasable Square Feet | | Annualized Base Rent Per Occupied Square Foot |

| Food Lion | | Grocery | | $ | 4,280 | | | 5.86 | % | | 520,000 | | | 6.79 | % | | $ | 8.23 | |

| Kroger Co (1) | | Grocery | | 2,097 | | | 2.87 | % | | 239,000 | | | 3.12 | % | | 8.77 | |

| Dollar Tree (2) | | Discount Retailer | | 2,070 | | | 2.83 | % | | 255,000 | | | 3.33 | % | | 8.12 | |

| Planet Fitness | | Gym | | 1,949 | | | 2.67 | % | | 205,000 | | | 2.68 | % | | 9.51 | |

| TJX Companies (3) | | Discount Retailer | | 1,721 | | | 2.35 | % | | 195,000 | | | 2.55 | % | | 8.83 | |

| Piggly Wiggly | | Grocery | | 1,363 | | | 1.87 | % | | 170,000 | | | 2.22 | % | | 8.02 | |

| Lowes Foods (4) | | Grocery | | 1,223 | | | 1.67 | % | | 130,000 | | | 1.70 | % | | 9.41 | |

| Aldi (5) | | Grocery | | 1,072 | | | 1.47 | % | | 106,000 | | | 1.38 | % | | 10.11 | |

| Kohl's | | Discount Retailer | | 1,049 | | | 1.44 | % | | 147,000 | | | 1.92 | % | | 7.14 | |

| Lehigh Valley Health | | Medical | | 803 | | | 1.10 | % | | 43,000 | | | 0.56 | % | | 18.67 | |

| | | | | $ | 17,627 | | | 24.13 | % | | 2,010,000 | | | 26.25 | % | | $ | 8.77 | |

(1) Kroger 4 / Harris Teeter 1 / 3 fuel stations

(2) Dollar Tree 18 / Family Dollar 7

(3) Marshall's 4 / HomeGoods 2 / TJ Maxx 1

(4) Lowes Foods 1 / KJ's Market 2

(5) Aldi 3 / Winn Dixie 1

Lease Expiration Schedule | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lease Expiration Period | | Number of Expiring Leases | | Total Expiring Square Footage | | % of Total Expiring Square Footage | | % of Total Occupied Square Footage Expiring | | Expiring Annualized Base Rent (in 000s) | | % of Total Annualized Base Rent | | Expiring Base Rent Per Occupied

Square Foot |

| Available | | — | | | 586,661 | | | 7.66 | % | | — | % | | $ | — | | | — | % | | $ | — | |