- Patent protected acoustic and data valuation,

visualization and monetization technologies successfully acquired

include Web 3.0 Sumerian® crypto anchors, ADIO® advertising

network, industry first blockchain and AI enabled Information Data

Exchange® - - WiSA Will Change Name to Datavault Inc. in

Mid-January 2025 -

WiSA Technologies, Inc. (“WiSA Technologies”, the “Company”, or

“WiSA”) (Nasdaq: WISA), closed its purchase of Datavault®

intellectual property and information technology assets of

privately held Data Vault Holdings Inc.® (“Data Vault Holdings”) on

December 31, 2024. In conjunction with the closing, WiSA issued 40

million shares of restricted common stock, par value $0.0001 per

share (the “Common Stock”), to Data Vault Holdings (the “Closing

Stock Consideration”); Nathaniel T. Bradley (Nate) was named CEO

and Director; and Brett Moyer assumed a new role as CFO while

remaining a director. WiSA Technologies plans to change its name to

Datavault Inc. (“Datavault”) in mid-January 2025, concurrent with a

planned change of its Nasdaq ticker symbol to ADIO. The Company

will continue to trade under the Nasdaq ticker symbol WISA until

such time as the new ticker symbol is announced.

On December 31, 2024, in connection with Nate Bradley’s

appointment as the Company’s CEO, Mr. Bradley was granted 1,200,000

units of restricted stock of WiSA (the “Units”) as an inducement

material to Mr. Bradley’s entering into employment with WiSA. The

Units were approved by the board of directors of the Company and

granted outside of the Company’s 2020 Stock Incentive Plan and 2018

Long-Term Stock Incentive Plan in accordance with Nasdaq Listing

Rule 5635(c)(4). In connection with the award of Units, Mr. Bradley

and the Company have entered into an Inducement Award Agreement for

the Units, which agreement contemplates half of the Units vesting

in equal 3-month installments over a 36-month period beginning

March 20, 2025, and the other half of the Units vesting upon the

Company’s aggregate revenue equaling or exceeding $40 million over

any trailing 12 calendar month period ending on or prior to the

date that is 5 years from the grant date.

Nate Bradley, CEO of WiSA Technologies, said, “Successfully

integrating Datavault and WiSA creates a much larger and more

robust company with significant synergies. As a public company, we

are positioned to grow by acquiring complementary niche

technologies, to raise our investment profile and to further

leverage our core technologies. The strategic opportunities are

abundant, and I am thrilled to be leading our transformation.”

Brett Moyer, CFO of WiSA Technologies, said, “Nate is a

technology visionary with the experience of successfully launching

multiple publicly traded companies. I resoundingly welcome him as

incoming CEO and director to create value for our shareholders.

Datavault has been advancing its technology and strategic

relationships since its founding six years ago, building value in

the process. Now, we have a more diversified portfolio of assets

and broad reach into multiple markets that are expected to exceed

$4 billion in annual sales. Our offerings are gaining traction and

now we can accelerate our growth plan.”

Datavault is a data technology and licensing company that

enables clients and strategic partners to monetize their Blockchain

Data and AI Web 3.0 assets via tokenization, data ownership and

digital twins offering two primary solutions:

- Data Sciences will license High Performance Computing

(HPC) software applications and Web 3.0 data management serving the

biotech research, energy, education, fintech, real estate, and

healthcare industries, among others.

- Acoustic Sciences will license spatial and multichannel

HD sound transmission, including proprietary brands ADIO®, WiSA®

and Sumerian®, to customers in sports & entertainment, events

& venues, restaurants, automotive, finance, and other

industries.

The Datavault Platform

Datavault’s software and encryption enables a comprehensive

solution for managing and monetizing data in the Web 3.0

environment. It allows risk-free licensing of name, image, and

likeness (NIL) by securely attaching physical real-world objects to

immutable metadata or blockchain objects, fostering responsible AI

with integrity. Datavault's solutions ensure privacy and credential

protection. They are completely customizable and offer AI and ML

automation, third-party integration, detailed analytics and data,

marketing automation and advertising monitoring.

The platform creates value through scarcity, utility, and

encrypted data protection and generates revenue through licensing

partnerships that provide detailed analytics, sophisticated HPC

modeling, digital ownership, tokenization, and advertising, among

other means.

Summary of the Asset Purchase

- Consideration paid to Data Vault Holdings in exchange for

Datavault and ADIO intellectual property and information technology

assets by WiSA Technologies.

- Closing Stock Consideration issued at closing of the

transaction

- $10 million in an unsecured promissory note due 3 years from

closing, with 10% of the proceeds of any financings used to pay

down or pay off the promissory note in the interim

- 3% royalty on future net revenues from Datavault and ADIO

product lines

Restricted Common Stock Distribution to Data Vault Holdings’

Stockholders

In connection with the closing of the asset purchase, Data Vault

Holdings distributed the Closing Stock Consideration pro rata to

its stockholders, excluding 3,999,911 shares of Common Stock that

are held by Data Vault Holdings.

Nathaniel (Nate) Bradley

Nathaniel (Nate) Bradley, CEO and Co-founder of Data Vault

Holdings, a highly accomplished inventor with over 70 international

and U.S. patents across diverse fields such as Internet

broadcasting, mobile advertising, behavioral healthcare,

blockchain, cybersecurity, AI, and data science. As CEO and

co-founder of Data Vault Holdings Inc., which operates Datavault

Inc., Adio LLC, True Luck Inc., and Data Donate Technologies,

Bradley has developed patented technologies that establish

Datavault as a leader in Web 3.0 data monetization. He has also

lobbied Congress for a Digital Bill of Rights and founded the

Intellectual Property Network Inc., offering IP and IT development

services globally. Previously, Bradley was the inventor and founder

of AudioEye (Nasdaq: AEYE), where he pioneered cloud-based

assistive technologies, earning recognition for his contributions

to internet accessibility. His extensive experience includes roles

as Chief Technology Officer for Marathon Patent Group (currently

named Marathon Digital Holdings, Nasdaq: MARA) and involvement in

significant acquisitions within the Internet Radio industry.

Legal Advisors

Sullivan & Worcester LLP served as legal counsel for WiSA

Technologies, and Mitchell Silberberg & Knupp LLP served as

legal counsel for Data Vault Holdings Inc.

About Data Vault Holdings Inc.

Data Vault Holdings Inc. is a technology holding company that

provides a proprietary, cloud-based platform for the delivery of

blockchain objects. Data Vault Holdings Inc. provides businesses

with the tools to monetize data assets securely over its

Information Data Exchange® (IDE). The company is in the process of

finalizing the consolidation of its affiliates Data Donate

Technologies, Inc., ADIO LLC, and Datavault Inc. as wholly owned

subsidiaries under one corporate structure. Learn more about Data

Vault Holdings Inc. Datavault Inc. and True Luck, Inc. as wholly

owned subsidiaries under one corporate structure. Learn more about

Data Vault Holdings Inc. at www.datavaultsite.com.

About WiSA Technologies, Inc.

WiSA is a leading provider of immersive, wireless sound

technology for intelligent devices and next-generation home

entertainment systems. Working with leading CE brands and

manufacturers such as Harman International, a division of Samsung;

LG; Hisense; TCL; Bang & Olufsen; Platin Audio; and others, the

company delivers immersive wireless sound experiences for

high-definition content, including movies and video, music, sports,

gaming/esports, and more. WiSA Technologies, Inc. is a founding

member of WiSA™ (the Wireless Speaker and Audio Association) whose

mission is to define wireless audio interoperability standards as

well as work with leading consumer electronics companies,

technology providers, retailers, and ecosystem partners to

evangelize and market spatial audio technologies driven by WiSA

Technologies, Inc. The company is headquartered in Beaverton, OR

with sales teams in Taiwan, China, Japan, Korea, and

California.

Cautionary Note Regarding Forward-Looking Statements

This press release of WiSA Technologies contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements, include, among others, the Company’s expectations with

respect to the completed asset purchase (the “Asset Purchase”),

including statements regarding the benefits of the Asset Purchase,

the implied valuation of the Company, the products offered by the

Company and the markets in which it operates, and the Company’s

projected future results and market opportunities, as well as

information with respect to WiSA’s future operating results and

business strategy. Readers are cautioned not to place undue

reliance on these forward-looking statements. Actual results may

differ materially from those indicated by these forward-looking

statements as a result of a variety of factors, including, but not

limited to: (i) risks and uncertainties impacting WiSA’s business

including, risks related to its current liquidity position and the

need to obtain additional financing to support ongoing operations,

WiSA’s ability to continue as a going concern, WiSA’s ability to

maintain the listing of its common stock on Nasdaq, WiSA’s ability

to predict the timing of design wins entering production and the

potential future revenue associated with design wins, WiSA’s

ability to predict its rate of growth, WiSA’s ability to predict

customer demand for existing and future products and to secure

adequate manufacturing capacity, consumer demand conditions

affecting WiSA’s customers’ end markets, WiSA’s ability to hire,

retain and motivate employees, the effects of competition on WiSA’s

business, including price competition, technological, regulatory

and legal developments, developments in the economy and financial

markets, and potential harm caused by software defects, computer

viruses and development delays, (ii) risks related to WiSA’s

ability to realize some or all of the anticipated benefits from the

Asset Purchase, any risks that may adversely affect the business,

financial condition and results of operations of WiSA after the

completion of the Asset Purchase, including but not limited to

cybersecurity risks, the potential for AI design and usage errors,

risks related to regulatory compliance and costs, potential harm

caused by data privacy breaches, digital business interruption and

geopolitical risks, and (iii) other risks as set forth from time to

time in WiSA’s filings with the U.S. Securities and Exchange

Commission. The information in this press release is as of the date

hereof and neither the Company nor Datavault undertakes any

obligation to update such information unless required to do so by

law. The reader is cautioned not to place under reliance on forward

looking statements. The Company does not give any assurance that

the Company will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107730995/en/

Investors Contact: David Barnard, Alliance Advisors

Investor Relations, 415-433-3777, dbarnard@allianceadvisors.com

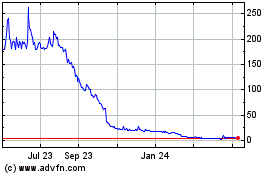

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Dec 2024 to Jan 2025

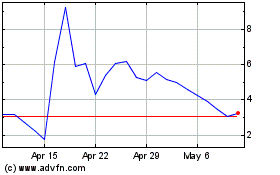

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Jan 2024 to Jan 2025