World Acceptance Corporation (NASDAQ: WRLD) today reported

financial results for its second quarter of fiscal 2025.

Second fiscal quarter highlights

During its second fiscal quarter, World Acceptance Corporation

achieved improved loan growth while continuing to focus on credit

quality. Management believes that continuing to carefully invest in

our best customers and closely monitoring performance has

strengthened the Company's financial position and positioned us

well for the remainder of the fiscal year.

Highlights from the second quarter include:

- Net income of $22.1 million

- Diluted net income per share of $3.99

- Recency delinquency on accounts 90+ days past due improved to

3.4% at September 30, 2024, from 3.7% at September 30, 2023

- Total revenues of $131.4 million, including a 113 basis point

yield increase compared to the same quarter in the prior year

Portfolio results

Gross loans outstanding were $1.30 billion as of September 30,

2024, a 6.1% decrease from the $1.38 billion of gross loans

outstanding as of September 30, 2023. During the most recent

quarter, gross loans outstanding increased sequentially 1.7%, or

$21.1 million, from $1.28 billion as of June 30, 2024, compared to

a decrease of 1.3%, or $18.5 million, in the comparable quarter of

the prior year.

During the most recent quarter, we saw improvement in borrowing

from new, former and existing customers compared to the same

quarter of fiscal year 2024. Specifically, new, former and

refinance loan customer volume during the quarter increased 20.8%,

11.5% and 2.9%, respectively, compared to the same quarter of

fiscal year 2024. Our customer base decreased by 0.1% during the

twelve-month period ended September 30, 2024, compared to a

decrease of 9.4% for the comparable period ended September 30,

2023. During the quarter ended September 30, 2024, the number of

unique borrowers in the portfolio increased by 3.6% compared to an

increase of 1.0% during the quarter ended September 30, 2023. We

continued to improve the gross yield to expected loss ratio for all

new, former and refinance customer originations and will continue

to monitor performance indicators and intend to adjust underwriting

accordingly.

The following table includes the volume of gross loan

origination balances by customer type for the following comparative

quarterly periods:

Q2 FY 2025

Q2 FY 2024

Q2 FY 2023

New Customers

$44,479,349

$36,822,744

$36,638,094

Former Customers

$100,630,514

$90,227,607

$98,701,899

Refinance Customers

$557,020,707

$541,181,690

$621,138,738

As of September 30, 2024, the Company had 1,045 open branches.

For branches open at least twelve months, same store gross loans

decreased 5.6% in the twelve-month period ended September 30, 2024,

compared to a decrease of 10.9% for the twelve-month period ended

September 30, 2023. For branches open throughout both periods, the

customer base over the twelve-month period ended September 30,

2024, increased 0.3% compared to a decrease of 6.7% for the

twelve-month period ended September 30, 2023.

Three-month financial results

Net income for the second quarter of fiscal 2025 increased to

$22.1 million compared to $16.1 million for the same quarter of the

prior year. Net income per diluted share increased to $3.99 per

share in the second quarter of fiscal 2025 compared to $2.71 per

share for the same quarter of the prior year. Net income in the

current and prior year quarter benefited from lower incentive

expense as a result of the reversal of the expense associated with

our performance-based share plan.

Total revenues for the second quarter of fiscal 2025 decreased

to $131.4 million, a 4.0% decrease from $136.9 million for the same

quarter of the prior year. Interest and fee income declined 2.6%,

from $117.0 million in the second quarter of fiscal 2024 to $113.9

million in the second quarter of fiscal 2025. Insurance income

decreased by 20.5% to $12.3 million in the second quarter of fiscal

2025 compared to $15.5 million in the second quarter of fiscal

2024. The large loan portfolio decreased from 56.7% of the overall

portfolio as of September 30, 2023, to 52.1% as of September 30,

2024. Interest and insurance yields for the quarter ended September

30, 2024 increased 191 and 113 basis points compared to the

quarters ended March 31, 2024 and September 30, 2023, respectively.

Other income increased by 17.5% to $5.2 million in the second

quarter of fiscal 2025 compared to $4.4 million in the second

quarter of fiscal 2024.

The Company accrues for expected losses with a current expected

credit loss ("CECL") methodology, which requires us to create a

provision for credit losses on the day we originate the loan. The

provision for credit losses increased $6.2 million to $46.7 million

from $40.5 million when comparing the second quarter of fiscal 2025

to the second quarter of fiscal 2024. The table below itemizes the

key components of the CECL allowance and provision impact during

the quarter.

CECL Allowance and Provision (Dollars

in millions)

Q2 FY 2025

Q2 FY 2024

Difference

Reconciliation

Beginning Allowance - June 30

$109.7

$129.3

$(19.6)

Change due to Growth

$1.8

$(1.6)

$3.4

$3.4

Change due to Expected Loss Rate on

Performing Loans

$0.8

$(1.2)

$2.0

$2.0

Change due to 90 day past due

$2.2

$2.4

$(0.2)

$(0.2)

Ending Allowance - September 30

$114.5

$128.9

$(14.4)

$5.2

Net Charge-offs

$41.9

$40.9

$1.0

$1.0

Provision

$46.7

$40.5

$6.2

$6.2

Note: The change in allowance for the

quarter plus net charge-offs for the quarter equals the provision

for the quarter (see above reconciliation).

The provision was negatively impacted by growth and an increase

in expected loss rates during the quarter. Specifically, expected

loss rates were negatively impacted by an increase in our 0-5 month

customers, our riskiest customers, during the current quarter.

Net charge-offs for the quarter increased $1.0 million, from

$40.9 million in the second quarter of fiscal 2024 to $41.9 million

in the second quarter of fiscal 2025. Net charge-offs as a

percentage of average net loan receivables on an annualized basis

increased to 17.6% in the second quarter of fiscal 2025 from 16.1%

in the second quarter of fiscal 2024. The prior year quarter's net

charge-offs benefited from a $4.9 million bulk sale of charge-offs

from prior periods.

Accounts 61 days or more past due decreased to 5.6% on a recency

basis at September 30, 2024, compared to 5.9% at September 30,

2023. Our allowance for credit losses as a percent of net loans

receivable was 12.0% at September 30, 2024, compared to 12.8% at

September 30, 2023. We also experienced improvement in recency

delinquency on accounts at least 90 days past due, improving from

3.7% at September 30, 2023, to 3.4% at September 30, 2024.

The table below is updated to use the customer tenure-based

methodology that aligns with our CECL methodology. After

experiencing rapid portfolio growth during fiscal years 2019 and

2020, primarily in new customers, our gross loan balance

experienced pandemic related declines in fiscal 2021 before

rebounding during fiscal 2022. Over the last two and a half years

we have tightened our lending to new customers substantially. The

tables below illustrate the changes in the portfolio weighting.

Gross Loan Balance By Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

Total

09/30/2019

$457,720,143

$816,488,354

$1,274,208,497

09/30/2020

$365,242,591

$744,182,305

$1,109,424,896

09/30/2021

$455,201,848

$939,669,804

$1,394,871,652

09/30/2022

$481,374,232

$1,117,025,275

$1,598,399,507

09/30/2023

$324,731,250

$1,054,823,272

$1,379,554,522

09/30/2024

$259,160,389

$1,036,732,429

$1,295,892,818

Year-Over-Year Growth

(Decline) in Gross Loan Balance by Customer Tenure at

Origination

12 Month Period Ended

Less Than 2 Years

More Than 2 Years

Total

09/30/2019

$97,211,268

$50,207,090

$147,418,358

09/30/2020

$(92,477,552)

$(72,306,049)

$(164,783,601)

09/30/2021

$89,959,257

$195,487,499

$285,446,756

09/30/2022

$26,172,384

$177,355,471

$203,527,855

09/30/2023

$(156,642,982)

$(62,202,003)

$(218,844,985)

09/30/2024

$(65,570,861)

$(18,090,843)

$(83,661,704)

Portfolio Mix by Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

09/30/2019

35.9%

64.1%

09/30/2020

32.9%

67.1%

09/30/2021

32.6%

67.4%

09/30/2022

30.1%

69.9%

09/30/2023

23.5%

76.5%

09/30/2024

20.0%

80.0%

General and administrative (“G&A”) expenses decreased $16.6

million, or 26.4%, to $46.4 million in the second quarter of fiscal

2025 compared to $62.9 million in the same quarter of the prior

fiscal year. As a percentage of revenues, G&A expenses

decreased from 46.0% during the second quarter of fiscal 2024 to

35.3% during the second quarter of fiscal 2025. G&A expenses

per average open branch decreased by 25.9% when comparing the

second quarter of fiscal 2025 to the second quarter of fiscal

2024.

Personnel expense decreased $16.7 million, or 43.4%, during the

second quarter of fiscal 2025 as compared to the second quarter of

fiscal 2024. Salary expense decreased approximately $0.5 million,

or 1.7%, during the quarter ended September 30, 2024, compared to

the quarter ended September 30, 2023. Our headcount as of September

30, 2024, decreased 6.7% compared to September 30, 2023. Benefit

expense decreased approximately $1.1 million, or 12.2%, when

comparing the quarterly periods ended September 30, 2024 and 2023.

Incentive expense decreased $14.6 million, in the second quarter of

fiscal 2025 compared to the second quarter of fiscal 2024. The

decrease in incentive expense is mostly due to a decrease in

share-based compensation as a result of an $18.5 million reversal

of the expense associated with the second tranche of our

performance-based share plan since the Company is no longer

expected to achieve the target required for the second tranche to

vest. The target was set at earnings per share of $20.45 over four

consecutive quarters, and the final measurement date for this

target is March 31, 2025.

Occupancy and equipment expense decreased $0.1 million, or 0.7%,

when comparing the quarterly periods ended September 30, 2024 and

2023.

Advertising expense increased $0.6 million, or 25.9%, in the

second quarter of fiscal 2025 compared to the second quarter of

fiscal 2024 due to increased spending on customer acquisition

programs.

Interest expense for the quarter ended September 30, 2024,

decreased by $2.1 million, or 16.6%, from the corresponding quarter

of the previous year. Interest expense decreased due to a 14.5%

decrease in average debt outstanding for the quarter and a 0.6%

decrease in the effective interest rate from 8.71% to 8.66%. The

average debt outstanding decreased from $580.4 million to $496.0

million when comparing the quarters ended September 30, 2024 and

2023. The Company’s debt to equity ratio decreased to 1.2:1 at

September 30, 2024, compared to 1.4:1 at September 30, 2023. As of

September 30, 2024, the Company had $504.9 million of debt

outstanding, net of unamortized debt issuance costs related to the

unsecured senior notes payable. The Company repurchased and

canceled $12.0 million of its previously issued bonds for a

purchase price of $11.5 million during the second quarter of fiscal

2025.

Other key return ratios for the second quarter of fiscal 2025

included a 7.8% return on average assets and a return on average

equity of 20.1% (both on a trailing twelve-month basis).

The Company repurchased 85,843 shares of its common stock on the

open market at an aggregate purchase price of approximately $10.0

million during the second quarter of fiscal 2025. This is in

addition to repurchases of 79,324 shares during the first quarter

of fiscal 2025 at an aggregate purchase price of approximately

$11.1 million. As of September 30, 2024, the Company had $10.0

million in aggregate remaining repurchase capacity under its

current share repurchase program and approximately $24.7 million

under the terms of our debt facilities. The Company repurchased

295,201 shares during fiscal 2024 at an aggregate purchase price of

approximately $36.2 million. The Company had approximately 5.4

million common shares outstanding, excluding approximately 367,500

unvested restricted shares, as of September 30, 2024.

Six-Month Results

Net income for the six-months ended September 30, 2024,

increased $6.5 million to $32.1 million compared to $25.6 million

for the same period of the prior year. This resulted in a net

income of $5.77 per diluted share for the six months ended

September 30, 2024, compared to $4.33 per diluted share in the

prior-year period. Total revenues for the first six-months of

fiscal 2025 decreased 5.5% to $260.9 million, compared to $276.2

million during the corresponding period of the previous year due to

a decrease in loans outstanding. Annualized net charge-offs as a

percent of average net loans increased from 16.5% during the first

six-months of fiscal 2024 to 17.0% for the first six-months of

fiscal 2025.

About World Acceptance Corporation (World Finance)

Founded in 1962, World Acceptance Corporation (NASDAQ: WRLD), is

a people-focused finance company that provides personal installment

loan solutions and personal tax preparation and filing services to

over one million customers each year. Headquartered in Greenville,

South Carolina, the Company operates more than 1,000

community-based World Finance branches across 16 states. The

Company primarily serves a segment of the population that does not

have ready access to credit; however, unlike many other lenders in

this segment, we strive to work with our customers to understand

their broader financial pictures, ensure they have the ability and

stability to make payments, and help them achieve their financial

goals. For more information, visit www.loansbyworld.com.

Second quarter conference call

The senior management of World Acceptance Corporation will be

discussing these results in its quarterly conference call to be

held at 10:00 a.m. Eastern Time today. A simulcast of the

conference call will be available on the Internet at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=Lh4m14ro.

The call will be available for replay on the Internet for

approximately 30 days.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

Cautionary Note Regarding Forward-looking Information

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, that represent the Company’s current

expectations or beliefs concerning future events. Statements other

than those of historical fact, as well as those identified by words

such as “anticipate,” “estimate,” intend,” “plan,” “expect,”

“project,” “believe,” “may,” “will,” “should,” “would,” “could,”

“probable” and any variation of the foregoing and similar

expressions are forward-looking statements. Such forward-looking

statements are inherently subject to risks and uncertainties. The

Company’s actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause actual results or

performance to differ from the expectations expressed or implied in

such forward-looking statements include the following: recently

enacted, proposed or future legislation and the manner in which it

is implemented; changes in the U.S. tax code; the nature and scope

of regulatory authority, particularly discretionary authority, that

is or may be exercised by regulators, including, but not limited

to, U.S. Consumer Financial Protection Bureau, and individual state

regulators having jurisdiction over the Company; the unpredictable

nature of regulatory examinations, proceedings and litigation;

employee misconduct or misconduct by third parties; uncertainties

associated with management turnover and the effective succession of

senior management; media and public characterization of consumer

installment loans; labor unrest; the impact of changes in

accounting rules and regulations, or their interpretation or

application, which could materially and adversely affect the

Company’s reported consolidated financial statements or necessitate

material delays or changes in the issuance of the Company’s audited

consolidated financial statements; the Company's assessment of its

internal control over financial reporting; changes in interest

rates; the impact of inflation; risks relating to the acquisition

or sale of assets or businesses or other strategic initiatives,

including increased loan delinquencies or net charge-offs, the loss

of key personnel, integration or migration issues, the failure to

achieve anticipated synergies, increased costs of servicing,

incomplete records, and retention of customers; risks inherent in

making loans, including repayment risks and value of collateral;

cybersecurity threats or incidents, including the potential or

actual misappropriation of assets or sensitive information,

corruption of data or operational disruption and the cost of the

associated response thereto; our dependence on debt and the

potential impact of limitations in the Company’s amended revolving

credit facility or other impacts on the Company's ability to borrow

money on favorable terms, or at all; the timing and amount of

revenues that may be recognized by the Company; changes in current

revenue and expense trends (including trends affecting delinquency

and charge-offs); the impact of extreme weather events and natural

disasters; changes in the Company’s markets and general changes in

the economy (particularly in the markets served by the

Company).

These and other factors are discussed in greater detail in Part

I, Item 1A,“Risk Factors” in the Company’s most recent annual

report on Form 10-K for the fiscal year ended March 31, 2024, as

filed with the SEC and the Company’s other reports filed with, or

furnished to, the SEC from time to time. World Acceptance

Corporation does not undertake any obligation to update any

forward-looking statements it makes. The Company is also not

responsible for updating the information contained in this press

release beyond the publication date, or for changes made to this

document by wire services or Internet services.

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited and in thousands,

except per share amounts)

Three months ended September

30,

Six months ended September

30,

2024

2023

2024

2023

Revenues:

Interest and fee income

$

113,905

$

116,953

$

225,066

$

233,572

Insurance and other income, net

17,504

19,922

35,870

42,627

Total revenues

131,409

136,875

260,936

276,199

Expenses:

Provision for credit losses

46,669

40,463

92,088

87,065

General and administrative expenses:

Personnel

21,754

38,437

58,730

80,229

Occupancy and equipment

12,337

12,429

24,500

25,048

Advertising

2,821

2,242

4,478

4,991

Amortization of intangible assets

959

1,063

1,965

2,132

Other

8,484

8,776

18,093

18,672

Total general and administrative

expenses

46,355

62,947

107,766

131,072

Interest expense

10,457

12,543

20,226

24,785

Total expenses

103,481

115,953

220,080

242,922

Income before income taxes

27,928

20,922

40,856

33,277

Income tax expense

5,800

4,839

8,780

7,655

Net income

$

22,128

$

16,083

$

32,076

$

25,622

Net income per common share, diluted

$

3.99

$

2.71

$

5.77

$

4.33

Weighted average diluted shares

outstanding

5,549

5,939

5,558

5,915

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(unaudited and in thousands)

September 30, 2024

March 31, 2024

September 30, 2023

ASSETS

Cash and cash equivalents

$

9,746

$

11,839

$

18,786

Gross loans receivable

1,295,870

1,277,149

1,379,514

Less:

Unearned interest, insurance and fees

(338,708

)

(326,746

)

(370,312

)

Allowance for credit losses

(114,455

)

(102,963

)

(128,892

)

Loans receivable, net

842,707

847,440

880,310

Income taxes receivable

4,769

3,091

—

Operating lease right-of-use assets,

net

80,604

79,501

80,397

Property and equipment, net

21,445

22,897

23,696

Deferred income taxes, net

32,231

30,943

41,858

Other assets, net

41,183

42,199

40,124

Goodwill

7,371

7,371

7,371

Intangible assets, net

9,107

11,070

13,158

Total assets

$

1,049,163

$

1,056,351

$

1,105,700

LIABILITIES &

SHAREHOLDERS' EQUITY

Liabilities:

Senior notes payable

$

265,630

$

223,419

$

276,556

Senior unsecured notes payable, net

239,311

272,610

284,379

Income taxes payable

—

—

1,947

Operating lease liability

82,860

81,921

82,948

Accounts payable and accrued expenses

43,898

53,974

49,847

Total liabilities

631,699

631,924

695,677

Shareholders' equity

417,464

424,427

410,023

Total liabilities and shareholders'

equity

$

1,049,163

$

1,056,351

$

1,105,700

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

SELECTED CONSOLIDATED

STATISTICS

(unaudited and in thousands,

except percentages and branches)

Three months ended September

30,

Six months ended September

30,

2024

2023

2024

2023

Gross loans receivable

$

1,295,870

$

1,379,514

$

1,295,870

$

1,379,514

Average gross loans receivable (1)

1,284,326

1,394,395

1,277,911

1,390,609

Net loans receivable (2)

957,162

1,009,202

957,162

1,009,202

Average net loans receivable (3)

949,302

1,017,773

946,188

1,015,017

Expenses as a percentage of total

revenue:

Provision for credit losses

35.5

%

29.6

%

35.3

%

31.5

%

General and administrative

35.3

%

46.0

%

41.3

%

47.5

%

Interest expense

8.0

%

9.2

%

7.8

%

9.0

%

Operating income as a % of total revenue

(4)

29.2

%

24.4

%

23.4

%

21.0

%

Loan volume (5)

702,238

668,215

1,384,435

1,389,449

Net charge-offs as percent of average net

loans receivable on an annualized basis

17.6

%

16.1

%

17.0

%

16.5

%

Return on average assets (trailing 12

months)

7.8

%

5.0

%

7.8

%

5.0

%

Return on average equity (trailing 12

months)

20.1

%

15.2

%

20.1

%

15.2

%

Branches opened or acquired (merged or

closed), net

(2

)

(2

)

(3

)

(20

)

Branches open (at period end)

1,045

1,053

1,045

1,053

_______________________________________________________

(1) Average gross loans receivable is

determined by averaging month-end gross loans receivable over the

indicated period, excluding tax advances.

(2) Net loans receivable is defined as

gross loans receivable less unearned interest and deferred

fees.

(3) Average net loans receivable is

determined by averaging month-end gross loans receivable less

unearned interest and deferred fees over the indicated period,

excluding tax advances.

(4) Operating income is computed as total

revenues less provision for credit losses and general and

administrative expenses.

(5) Loan volume includes all loan balances

originated by the Company. It does not include loans purchased

through acquisitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025905980/en/

John L. Calmes, Jr. Executive VP, Chief Financial & Strategy

Officer, and Treasurer (864) 298-9800

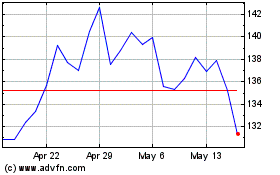

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Dec 2024 to Jan 2025

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Jan 2024 to Jan 2025