false

0001641631

0001641631

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): August 6, 2024

Beyond

Air, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-38892 |

|

47-3812456 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

900

Stewart Avenue, Suite 301

Garden

City, NY 11530

(Address

of Principal Executive Offices and Zip Code)

(516)

665-8200

Registrant’s

Telephone Number, Including Area Code

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$.0001 per share |

|

XAIR |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 6, 2024, Beyond Air, Inc. (the “Company”) issued a press release announcing financial results for its first quarter

ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

This

information, including the exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by specific reference in such filing.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

August 8, 2024, the Company received a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock

Market LLC (“Nasdaq”) notifying the Company that for the last 30 consecutive business days, the bid price of the Company’s

common stock had been below the minimum closing bid price of $1.00 per share, required by the continued listing requirements of Nasdaq

Listing Rule 5550(a)(2).

The

notification received has no immediate effect on the listing of the Company’s common stock on the Nasdaq Capital Market.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has 180 calendar days, or until February 4, 2025 (the “Compliance

Date”), to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of the Company’s

common stock must be at least $1.00 per share for a minimum of ten consecutive business days prior to the Compliance Date.

In

the event the Company does not regain compliance by the Compliance Date, the Company may be eligible for additional time. To qualify,

the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial

listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice

of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If the

Company meets these requirements, Nasdaq will inform the Company that it has been granted an additional 180 calendar days. However, if

it appears to Staff that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, the Staff

will provide notice that its securities will be subject to delisting. At that time, the Company may appeal the delisting determination

to a Hearings Panel.

The

Company intends to actively monitor the closing bid price of its common stock between now and the Compliance Date and will evaluate available

options to resolve the deficiency and regain compliance with the minimum bid price rule. There can be no assurance that the Company will

be able to regain compliance with the minimum bid price requirement or will otherwise be in compliance with other Nasdaq listing criteria.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

August 6, 2024, Amir Avniel was appointed Chief Executive Officer of NeuroNOS Israel Limited overseeing the Company’s autism

spectrum disorder program and tendered his resignation from the board of directors of the Company and as the Chief Business

Officer of the Company. The appointments and resignations will be effective on August 15, 2024. Mr. Avniel will remain President

of the Company’s Beyond Air Ltd. subsidiary. Mr. Avniel’s resignations were voluntary and are not due to any disagreement

with the Company on any matters related to the Company’s operations, policies, or practices.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BEYOND AIR,

Inc. |

| |

|

|

| Date: August 9, 2024 |

By: |

/s/ Steven

A. Lisi |

| |

Name: |

Steven A. Lisi |

| |

Title |

Chief Executive Officer |

Exhibit

99.1

Beyond

Air® Reports Fiscal First Quarter 2025 Financial Results and Provides Corporate Update

Revenues

increased 45% compared to the previous quarter ended March 31, 2024

Optimized

LungFit PH device continues to expand footprint and strengthen customer base

Amir

Avniel, Beyond Air Board member and Chief Business Officer, appointed Chief Executive Officer of NeuroNOS, Beyond Air’s wholly

owned subsidiary focused on neurological disorders with a lead indication of Autism Spectrum Disorder

Reiterates

revenue guidance of at least $10 million for FY 2025

Garden

City, NY, August 6, 2024 – Beyond Air, Inc. (NASDAQ: XAIR) (“Beyond Air” or the “Company”),

a commercial stage medical device and biopharmaceutical company focused on harnessing the power of nitric oxide (NO) to improve the lives

of patients, today announced its financial results for the fiscal first quarter ended June 30, 2024, and provided a corporate update.

“Our

team continues to enhance the commercial execution for LungFit PH, which includes strengthening our sales pipeline in targeted markets

across the U.S. We are confident in the long-term growth of our optimized LungFit PH system and have received positive feedback from

new and existing customers as they realize the clinical benefits the system provides by offering on-demand, ambient air-generated NO

compared to legacy cylinder NO systems. Through our consistent efforts and customer engagement, we are seeing an increasing number of

customer engagements for multi-year contracts in the sales pipeline and existing hospital relationships are expanding across affiliate

locations,” said Steve Lisi, Chairman and Chief Executive Officer of Beyond Air. “This continued positive momentum is supported

by our capital conservation strategy, which has strengthened our cash runway to focus on LungFit PH’s launch, and our new Chief

Commercial Officer, David Webster, who brings a results-driven mentality that is already energizing our commercial operations.”

Recent

Portfolio Highlights and Upcoming Milestones

LungFit®

PH

| |

|

○ |

Increased

commercial demand for LungFit PH, as evidenced by: |

| |

|

■ |

A

45% increase in quarterly revenue compared to the previous quarter ending March 31, 2024 |

| |

|

■ |

More

than $5 million in contracted revenue through fiscal year 2027 |

| |

|

■ |

LungFit

PH devices have been used in more than 55 hospitals |

| |

|

■ |

Customer

base extending across 10 states in the U.S. |

| |

|

○ |

Cardiac

surgery PMA supplement FDA decision expected before year-end 2024 |

| |

|

■ |

Currently

no FDA approved NO system is labeled for cardiac surgery |

| |

|

■ |

Approval

would increase LungFit PH’s rate of market penetration and support long-term revenue growth |

| |

|

○ |

A

decision on CE Mark for LungFit PH in Europe expected before year-end 2024 |

| |

|

○ |

Transport

ready LungFit PH PMA submission to FDA anticipated by year-end 2024/early 2025 |

Beyond

Cancer - Solid Tumor Program

| |

● |

Clinical

Development Execution |

| |

|

○ |

Ultra-high

concentration Nitric Oxide (UNO) therapy is in an ongoing Phase 1a trial evaluating advanced, relapsed or refractory unresectable,

primary or metastatic cutaneous and subcutaneous solid tumors. |

| |

|

■ |

Ongoing

Phase 1a trial reported encouraging first-in-class clinical data demonstrating evidence of immune system activation via biomarker

response in a heavily pretreated population, which were presented at the American Society of Clinical Oncology Key Opinion Leader

Event at the 2024 Annual Meeting |

| |

|

■ |

Upon

regulatory clearance, a Phase 1b trial is planned to enroll up to 20 subjects with prior exposure to anti-PD-1 antibody that have

either progressed, not achieved a response, or have prolonged stable disease (≥ 12 weeks) on single agent anti-PD-1 without radiographic

evidence of continued tumor reduction. Subjects enrolled in the Phase 1b trial will be treated with UNO + anti-PD-1 combination |

Recent

Corporate Updates

Beyond

Air - Enhanced Management Team with New Chief Commercial Officer

| |

● |

Appointed

David Webster as Chief Commercial Officer in July 2024 |

| |

|

○ |

Mr.

Webster has made strong progress on strengthening the commercial strategy and execution since joining Beyond Air. |

| |

|

○ |

Mr.

Webster brings decades of experience leading innovative programs through clinical development and regulatory submissions and spearheading

global commercialization strategies, having previously served in executive roles at Body Vision Medical and Samsung NeuroLogica. |

Capital

Conservation

| |

● |

Continue to

implement previously announced capital conservation strategy |

| |

● |

Reduced the Company’s

headcount by over 25% since January 1, 2024 |

| |

● |

Extends the Company’s

cash runway and focus resources on the commercial program for LungFit PH and maintain the timeline for the second generation LungFit

PH |

NeuroNos

– Appointed CEO of Wholly Owned Subsidiary to Oversee Autism Program

| |

|

○ |

IND-enabling

studies are underway for the treatment of autism spectrum disorder (“ASD”) |

| |

|

○ |

Successfully completed

genotoxicity studies for the lead nNOS inhibitor under development |

| |

|

○ |

Nonclinical

pharmacokinetic studies indicate multiple routes of administration for the lead nNOS inhibitor are feasible, including oral delivery

and subcutaneous injection |

| |

|

○ |

Mr. Avniel is resigning

as of August 15, 2024 from the Board of Directors and as Chief Business Officer to focus wholly on his added responsibilities. |

Financial

Results for the Fiscal First Quarter Ended June 30, 2024

Revenues

for the fiscal quarter ended June 30, 2024 were $0.7 million compared to $0.1 million for the fiscal quarter ended June 30, 2023 and

$0.5 million for the previous quarter ended March 31, 2024. Cost of revenue of $1.0 million was recognized for the three months ended

June 30, 2024, compared to $0.3 million for the three months ended June 30, 2023. Cost of revenue exceeded revenue primarily driven by

investments in supply chain infrastructure required to grow revenue in future periods and depreciation of LungFit devices built to be

able to capture future revenue.

Research

and development expenses for the three months ended June 30, 2024, were $6.0 million as compared to $4.7 million for the three months

ended June 30, 2023. The increase of $1.3 million was primarily attributed to an increase in development costs in Beyond Air ($1.1 million)

and NeuroNOS ($0.1 million), an increase in salaries of $0.9 million ($0.3 million for Beyond Air and $0.6 million for Beyond Cancer),

offset by a decrease in stock compensation costs $0.6 million ($0.4 million in Beyond Air and $0.2 million in Beyond Cancer) and a decrease

in development costs in Beyond Cancer research ($0.3 million).

Selling,

general and administrative expenses for the three months ended June 30, 2024 and June 30, 2023 were $7.2 million and $10.9 million, respectively.

The decrease of $3.7 million was primarily attributed to a decrease in stock-based compensation of $2.2 million ($1.2 million in Beyond

Air and $1.0 million in Beyond Cancer), decreasing salaries of $0.4 million (Beyond Air $0.8 million partially offset by an increase

in Beyond Cancer of $0.4 million), professional fees ($0.7 million), rent ($0.2 million) and travel expenses ($0.1 million).

Net

loss attributed to common stockholders for the three months ended June 30, 2024, was ($12.2) million or a loss of ($0.27) per share,

basic and diluted. The Company’s net loss attributed to common stockholders for the three months ended June 30, 2023 was ($14.1)

million or a loss of ($0.45) per share, basic and diluted.

Cash

burn in the fiscal quarter ended June 30, 2024 was $13.1 million.

As

of June 30, 2024, the Company reported cash, cash equivalents, and marketable securities of $21.4 million.

Financial

Guidance for Fiscal Year 2025

| ● |

Revenue is

expected to be greater than $10 million for FY 2025 |

| ● |

With the previously

announced capital conservation strategy, net cash burn rate is expected to be less than $30 million

in FY 2025. Net cash burn is expected to continue to decline in FY 2026 with an expectation that the Company will achieve cash flow

breakeven in the fourth fiscal quarter of 2026. |

Conference

Call

As

announced during the Company’s corporate update on June 24th, due to the short period of time between today’s

quarterly report and the Fiscal Year 2024 report, the Beyond Air management team will forgo hosting a conference call.

About

Beyond Air®, Inc.

Beyond

Air is a commercial stage medical device and biopharmaceutical company dedicated to harnessing the power of endogenous and exogenous

nitric oxide (NO) to improve the lives of patients suffering from respiratory illnesses, neurological disorders, and solid tumors. The

Company has received FDA approval for its first system, LungFit® PH, for the treatment of term and near-term neonates with hypoxic

respiratory failure. Beyond Air is currently advancing its other revolutionary LungFit systems in clinical trials for the treatment of

severe lung infections such as viral community-acquired pneumonia (including COVID-19), and nontuberculous mycobacteria (NTM) among others.

Also, the Company has also partnered with The Hebrew University of Jerusalem to advance a pre-clinical program dedicated to the treatment

of autism spectrum disorder (ASD) and other neurological disorders. Additionally, Beyond Cancer, Ltd., an affiliate of Beyond Air, is

investigating ultra-high concentrations of NO with a proprietary delivery system to target certain solid tumors in the pre-clinical setting.

For more information, visit www.beyondair.net.

About

Nitric Oxide

Nitric

Oxide is a powerful molecule, naturally synthesized in the human body, proven to play a critical role in a broad array of biological

functions. In the airways, NO targets the vascular smooth muscle cells that surround the small resistance arteries in the lungs. Currently,

exogenous inhaled NO is used in adult respiratory distress syndrome, post certain cardiac surgeries and persistent pulmonary hypertension

of the newborn to treat hypoxemia. Additionally, NO is believed to play a key role in the innate immune system and in vitro studies

suggest that NO possesses anti-microbial activity not only against common bacteria, including both gram-positive and gram-negative, but

also against other diverse pathogens, including mycobacteria, viruses, fungi, yeast and parasites, and has the potential to eliminate

multi-drug resistant strains.

About

LungFit®*

Beyond

Air’s LungFit is a cylinder-free, phasic flow generator and delivery system and has been designated as a medical device by the

U.S. Food and Drug Administration (FDA). The ventilator compatible version of the device can generate NO from ambient air on demand for

delivery to the lungs at concentrations ranging from 1 ppm to 80 ppm. The LungFit system could potentially replace large, high-pressure

NO cylinders providing significant advantages in the hospital setting, including greatly reducing inventory and storage requirements,

improving overall safety with the elimination of NO2 purging steps, and other benefits. LungFit can also deliver NO at concentrations

at or above 80 ppm for potentially treating severe acute lung infections in the hospital setting (e.g. COVID-19, bronchiolitis)

and chronic, refractory lung infections in the home setting (e.g. NTM). With the elimination of cylinders, Beyond Air intends

to offer NO treatment in the home setting.

*

Beyond Air’s LungFit PH is approved for commercial use only in the United States of America to treat term and near-term neonates

with hypoxic respiratory failure. Beyond Air’s other LungFit systems are not approved for commercial use and are for investigational

use only. Beyond Air is not suggesting NO use over 80 ppm or use at home.

About

PPHN

Persistent

pulmonary hypertension of the newborn (PPHN) is a lethal condition and secondary to failure of normal circulatory transition at birth.

It is a syndrome characterized by elevated pulmonary vascular resistance (PVR) that causes labile hypoxemia due to decreased pulmonary

blood flow and right-to-left shunting of blood. Its incidence has been reported as 1.9 per 1000 live births (0.4–6.8/1000 live

births) with mortality rate ranging between 4–33%. This syndrome complicates the course of about 10% of infants with respiratory

failure and remains a source of considerable morbidity and mortality. NO gas is a vasodilator, is approved in dozens of countries to

improve oxygenation and reduces the need for extracorporeal membrane oxygenation (ECMO) in term and near-term (>34 weeks gestation)

neonates with hypoxic respiratory failure associated with clinical or echocardiographic evidence of pulmonary hypertension in conjunction

with ventilator support and other appropriate agents.

About

Viral Community-Acquired Pneumonia (VCAP)

In

adults, viruses have been identified as the causative agents in approximately 100 million cases of community-acquired pneumonia per year.

While viral pneumonia in adults is most commonly caused by rhinovirus, respiratory syncytial virus (RSV) and influenza virus, newly emerging

viruses (including SARS-CoV-1, SARS-CoV-2, avian influenza A, and H1N1 viruses) have been identified as pathogens contributing to the

overall burden of adult viral pneumonia. Patients aged 65 years or older are at particular risk for death from the disease, as are patients

with other underlying health conditions or weakened immune systems. There is no consensus regarding the use of antiviral drugs to treat

viral pneumonia, and specific preventative measures are currently limited to the influenza vaccine. Given that current treatment recommendations

are largely limited to supportive care, there is an unmet medical need for effective treatment options. NO may prove to be a treatment

as the impact on the lung should result in bronchodilation, reduction in inflammation and inhibition of the viral replication process.

About

NTM

NTM

infection is a rare and serious bacterial infection in the lungs causing debilitating pulmonary disease associated with high morbidity

and mortality. NTM infection is acquired by inhaling aerosolized bacteria from the environment, and can lead to NTM lung disease, a progressive

and chronic condition. According to the Cystic Fibrosis Foundation, 13% of U.S. cystic fibrosis patients had a positive culture for a

NTM species in 2017. NTM is considered an emerging public health concern worldwide because of its multi-drug antibiotic resistance. Current

treatment guidelines suggest a combination of multiple antibiotics dosed chronically for as long as two years. These complex, expensive

and invasive regimens have a poor record in the treatment of Mycobacterium abscessus complex (MABSC) and refractory Mycobacterium avium

complex (MAC) and have the potential to cause severe adverse events. Beyond Air’s system is designed to deliver 150 – 400

ppm NO to the lungs, and early data, including from the pilot study of the LungFit GO, indicate that this range of NO concentrations

could have a positive effect on patients infected with NTM.

About

Beyond Cancer, Ltd.

Beyond

Cancer, Ltd., an affiliate of Beyond Air, Inc., is a development-stage biopharmaceutical and medical device company utilizing (UNO via

a proprietary delivery platform to treat primary tumors and prevent metastatic disease. Nitric oxide at ultra-high concentrations has

been reported to show anticancer properties and to potentially serve as a chemosensitizer and radiotherapy enhancer. A first-in-human

study is underway in patients with solid tumors. The Company is conducting preclinical studies of UNO in multiple solid tumor models

to inform additional treatment protocols.

For

more information, visit www.beyondcancer.com.

About

UNO Therapy for Solid Tumors

Cancer

is the second leading cause of death globally, with tumor metastases responsible for approximately 90% of all cancer-related deaths.

Current cancer treatment modalities generally include chemotherapy, immunotherapy, radiation, and/or surgery. UNO therapy is a completely

new approach to preventing relapse or metastatic disease. In vitro murine data show that local tumor ablation with UNO stimulates an

anti-tumor immune response in solid tumor cancer models. The Company believes that UNO has the potential to prevent relapse or metastatic

disease with as little as a single 5-minute treatment and with limited toxicity or off-target effects.

About

ASD

ASD

is a serious neurodevelopmental and behavioral disorder, and one of the most disabling conditions and chronic illnesses in children.

ASDs include a wide range of developmental disorders that share a core of neurobehavioral deficits manifested by abnormalities in social

interactions, deficits in communication, restricted interests, and repetitive behaviors. In 2023, the CDC reported that approximately

1 in 36 children in the U.S. is diagnosed with an ASD. On average, ASD costs an estimated $60,000 a year through childhood, with the

bulk of the costs in special services and lost wages related to increased demands on one or both parents. Mothers of children with ASD,

who tend to serve as the child’s case manager and advocate, are less likely to work outside the home. On average, they work fewer

hours per week and earn 56 percent less than mothers of children with no health limitations and 35 percent less than mothers of children

with other disabilities or disorders. The cost of caring for Americans with autism reached $268 billion in 2015 and is expected to rise

to $461 billion by 2025 in the absence of more-effective interventions and support across the life span.

Forward

Looking Statements

This

press release contains “forward-looking statements” concerning the potential safety and efficacy of inhaled nitric oxide

and the ultra-high concentration nitric oxide product candidate, as well as its therapeutic potential in a number of indications; and

the potential impact on patients and anticipated benefits associated with inhaled nitric oxide and the ultra-high concentration nitric

oxide product candidate. Forward-looking statements include statements about expectations, beliefs, or intentions regarding product offerings,

business, results of operations, strategies or prospects. You can identify such forward-looking statements by the words “appears,”

“expects,” “plans,” “anticipates,” “believes” “expects,” “intends,”

“looks,” “projects,” “goal,” “assumes,” “targets” and similar expressions

and/or the use of future tense or conditional constructions (such as “will,” “may,” “could,” “should”

and the like) and by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking

statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking

statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could

cause actual results to differ materially from any future results expressed or implied by the forward-looking statements. These forward-looking

statements are only predictions and reflect views as of the date they are made with respect to future events and financial performance.

Many factors could cause actual activities or results to differ materially from the activities and results anticipated in forward-looking

statements, including risks related to the ability to raise additional capital; the timing and results of future pre-clinical studies

and clinical trials; the potential that regulatory authorities, including the FDA and comparable non-U.S. regulatory authorities, may

not grant or may delay approval for our product candidates; the approach to discover and develop novel drugs, which is unproven and may

never lead to efficacious or marketable products; the ability to fund and the results of further pre-clinical studies and clinical trials

of our product candidates; obtaining, maintaining and protecting intellectual property utilized by products; obtaining regulatory approval

for products; competition from others using similar technology and others developing products for similar uses; dependence on collaborators;

and other risks, which may, in part, be identified and described in the “Risk Factors” section of Beyond Air’s most

recent Annual Report on Form 10-K and other of its filings with the Securities and Exchange Commission, all of which are available on

Beyond Air’s website. Beyond Air and Beyond Cancer undertake no obligation to update, and have no policy of updating or revising,

these forward-looking statements, except as required by applicable law.

CONTACTS:

Investor

Relations contacts

Corey

Davis, Ph.D.

LifeSci

Advisors, LLC

Cdavis@lifesciadvisors.com

(212)

915-2577

++++++

BEYOND

AIR, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(amounts

in thousands, except share and per share data)

| | |

June 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,161 | | |

$ | 11,378 | |

| Marketable securities | |

| 17,213 | | |

| 23,090 | |

| Restricted cash | |

| 229 | | |

| 230 | |

| Accounts receivable | |

| 475 | | |

| 319 | |

| Inventory | |

| 2,391 | | |

| 2,127 | |

| Other current assets and prepaid expenses | |

| 6,405 | | |

| 6,792 | |

| Total current assets | |

| 30,874 | | |

| 43,936 | |

| Licensed right to use technology | |

| 1,376 | | |

| 1,427 | |

| Right-of-use lease assets | |

| 2,021 | | |

| 2,121 | |

| Property and equipment, net | |

| 12,117 | | |

| 9,364 | |

| Other assets | |

| 112 | | |

| 113 | |

| TOTAL ASSETS | |

$ | 46,500 | | |

$ | 56,961 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 3,114 | | |

$ | 1,948 | |

| Accrued expenses and other current liabilities | |

| 7,674 | | |

| 8,402 | |

| Operating lease liability, current portion | |

| 429 | | |

| 418 | |

| Loans payable, current portion | |

| 536 | | |

| 800 | |

| Total current liabilities | |

| 11,753 | | |

| 11,567 | |

| | |

| | | |

| | |

| Operating lease liability, net | |

| 1,790 | | |

| 1,898 | |

| Long-term debt, net | |

| 14,946 | | |

| 14,721 | |

| Warrant liability | |

| 56 | | |

| 275 | |

| Derivative liability | |

| 256 | | |

| 1,314 | |

| Total liabilities | |

| 28,801 | | |

| 29,775 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred Stock, $0.0001 par value per share: 10,000,000 shares authorized, 0 shares issued and outstanding | |

| - | | |

| - | |

| Common Stock, $0.0001 par value per share: 100,000,000 shares authorized, 45,900,821 shares issued and outstanding as of June 30, 2024 and March 31, 2024, respectively | |

| 5 | | |

| 5 | |

| Treasury stock | |

| (25 | ) | |

| (25 | ) |

| Additional paid-in capital | |

| 267,960 | | |

| 264,780 | |

| Accumulated deficit | |

| (251,898 | ) | |

| (239,697 | ) |

| Accumulated other comprehensive income (loss) | |

| 88 | | |

| (15 | ) |

| Total stockholders’ equity attributable to Beyond Air, Inc. | |

| 16,130 | | |

| 25,048 | |

| Non-controlling interest | |

| 1,570 | | |

| 2,138 | |

| Total equity | |

| 17,699 | | |

| 27,186 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 46,500 | | |

$ | 56,961 | |

BEYOND

AIR, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(amounts

in thousands, except share and per share data)

| | |

For the Three Months Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 683 | | |

$ | 59 | |

| | |

| | | |

| | |

| Cost of revenues | |

| (1,016 | ) | |

| (303 | ) |

| | |

| | | |

| | |

| Gross loss | |

| (332 | ) | |

| (244 | ) |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| | |

| | | |

| | |

| Research and development | |

| (6,009 | ) | |

| (4,695 | ) |

| Selling, general and administrative | |

| (7,239 | ) | |

| (10,936 | ) |

| Total operating expenses | |

| (13,247 | ) | |

| (15,631 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (13,580 | ) | |

| (15,875 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Dividend and interest income | |

| 361 | | |

| 409 | |

| Interest and finance expense | |

| (964 | ) | |

| (158 | ) |

| Change in fair value of warrant liability | |

| 219 | | |

| 324 | |

| Change in fair value of derivative liability | |

| 1,058 | | |

| 512 | |

| Foreign exchange gain / (loss) | |

| (146 | ) | |

| 8 | |

| Estimated liability for contingent loss | |

| - | | |

| (198 | ) |

| Other income / (expense) | |

| (2 | ) | |

| (77 | ) |

| Total other income/(expense) | |

| 525 | | |

| 820 | |

| | |

| | | |

| | |

| Net loss before income taxes | |

| (13,055 | ) | |

| (15,055 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net loss | |

$ | (13,055 | ) | |

$ | (15,055 | ) |

| | |

| | | |

| | |

| Less : net loss attributable to non-controlling interest | |

| (854 | ) | |

| (960 | ) |

| | |

| | | |

| | |

| Net loss attributable to Beyond Air, Inc. | |

$ | (12,201 | ) | |

$ | (14,095 | ) |

| | |

| | | |

| | |

| Foreign currency translation gain | |

| 103 | | |

| 25 | |

| | |

| | | |

| | |

| Comprehensive loss attributable to Beyond Air, Inc. | |

$ | (12,098 | ) | |

$ | (14,070 | ) |

| | |

| | | |

| | |

| Net basic and diluted loss per share attributable to Beyond Air, Inc. | |

$ | (0.27 | ) | |

$ | (0.45 | ) |

| | |

| | | |

| | |

| Weighted average number of shares, outstanding basic and diluted | |

| 45,900,821 | | |

| 31,382,986 | |

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity File Number |

001-38892

|

| Entity Registrant Name |

Beyond

Air, Inc.

|

| Entity Central Index Key |

0001641631

|

| Entity Tax Identification Number |

47-3812456

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

900

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 301

|

| Entity Address, City or Town |

Garden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(516)

|

| Local Phone Number |

665-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$.0001 per share

|

| Trading Symbol |

XAIR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

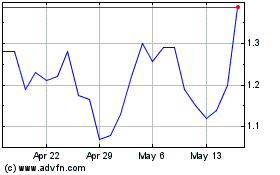

Beyond Air (NASDAQ:XAIR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Beyond Air (NASDAQ:XAIR)

Historical Stock Chart

From Mar 2024 to Mar 2025