Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 17 2024 - 11:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number 001-39564

Mingzhu Logistics Holdings Limited

(Translation of registrant’s name into English)

27F, Yantian Modern Industry Service Center

No. 3018 Shayan Road, Yantian District

Shenzhen, Guangdong, China 518081

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes ☐

No ☒

If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

MINGZHU LOGISTICS HOLDINGS LIMITED |

| Date: July 17, 2024 |

|

|

| |

By: |

/s/ Jinlong Yang |

| |

|

Name: |

Jinlong Yang |

| |

|

Title: |

Chief Executive Officer |

EXHIBIT INDEX

2

Exhibit 99.1

MingZhu Logistics Regains Compliance with Nasdaq

Minimum Bid Price Requirement

SHENZHEN, China, July 17, 2024 /PRNewswire/

-- MingZhu Logistics Holdings Limited (“MingZhu” or the “Company”) (Nasdaq: YGMZ), an elite provider of

logistics and transportation services to businesses, today announced that on July 16, 2024, it received notification from The Nasdaq

Stock Market LLC (“Nasdaq”) confirming the Company has cured the bid price deficiency, and that the Company has regained compliance

with Listing Rule 5550(a)(2). Accordingly, this matter is now closed and the Company’s ordinary shares will continue to trade uninterrupted

on Nasdaq under the ticker “YGMZ”.

About MingZhu Logistics Holdings Limited (Nasdaq: YGMZ)

Established in 2002 and headquartered in Shenzhen,

China, MingZhu Logistics Holdings Limited is a 4A-rated professional trucking service provider. Based on the Company’s regional logistics

terminals in Guangdong Province, MingZhu Logistics Holdings offers tailored solutions to our clients to deliver their goods through

our network density and broad geographic coverage across the country by a combination of self-owned fleets tractors and trailers and subcontractors’

fleets. For more information, please visit https://ir.szygmz.com/.

Forward-Looking Statements

The statements in this press release regarding

the Company’s future expectations, plans and prospects constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include statements regarding plans, goals, objectives, strategies, future events,

expected performance, assumptions and any other statements of fact that have not occurred. Any statements that contain the words “may”,

“will”, “want”, “should”, “believe”, “expect”, “anticipate”, “estimate”,

“calculate” or similar statements that are not factual in nature are to be considered forward-looking statements. Actual results

may differ materially from historical results or from those expressed in these forward-looking statements as a result of a variety of

factors. These factors include, but are not limited to, the Company’s strategic objectives, the Company’s future plans, market demand

and user acceptance of the Company’s products or services, technological advances, economic trends, the growth of the trucking services

market in China, the Company’s reputation and brand, the impact of industry competition and bidding, relevant policies and regulations,

fluctuations in China’s macroeconomic conditions, and the risks and assumptions disclosed in the Company’s reports provided

to the CSRC (China Security Regulatory Commission). The potential acquisition involves substantial risks and uncertainties that could

cause actual results to differ materially from those expressed or implied by such statements including but not limited to statements about

the potential benefits of the potential acquisition; the anticipated timing of closing of the potential acquisition (including failure

to obtain necessary regulatory approvals) and the possibility that the potential acquisition does not close; risks related to the ability

to realize the anticipated benefits of the potential acquisition, including the possibility that the expected benefits from the proposed

transaction will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated

successfully; disruption from the potential acquisition making it more difficult to maintain business and operational relationships; negative

effects of announcing the potential acquisition or the consummation of the potential acquisition on the market price of our common stock

or operating results; costs associated with the potential acquisition; unknown liabilities; and the risk of litigation and/or regulatory

actions related to the potential acquisition. For these and other related reasons, we advise investors not to place any reliance on these

forward-looking statements, and we urge investors to review the Company’s relevant SEC filings for additional factors that may affect

the Company’s future results of operations. The Company undertakes no obligation to publicly revise these forward-looking statements subsequent

to the filing of these documents as a result of changes in particular events or circumstances.

SOURCE MingZhu Logistics Holdings Limited

MingZhu Logistics (NASDAQ:YGMZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

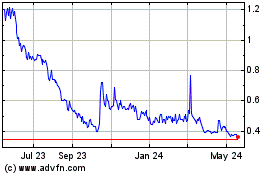

MingZhu Logistics (NASDAQ:YGMZ)

Historical Stock Chart

From Nov 2023 to Nov 2024