ZoomInfo, (NASDAQ: ZI) the Go-To-Market Intelligence platform,

today announced its financial results for the fourth quarter and

full-year ended December 31, 2024.

“Our Go-To-Market Intelligence Platform provides the best GTM

data, AI-powered applications, and agents for the world’s most

innovative and high-performing companies,” said Henry Schuck,

ZoomInfo founder and CEO. “Our AI innovation and commitment to

customer success helped us improve financial performance faster

than expected, with strength continuing into 2025. With our

operational improvements taking hold, we are delivering

better-than-expected revenue, profitability, and free cash

flow.”

Fourth Quarter 2024 Financial Highlights:

- GAAP Revenue of $309.1 million, a decrease of 2%

year-over-year.

- GAAP Operating Income of $30.9 million and Adjusted Operating

Income of $115.9 million.

- GAAP Operating Income Margin of 10% and Adjusted Operating

Income Margin of 37%.

- GAAP Cash Flow from Operations of $109.0 million and Unlevered

Free Cash Flow of $93.6 million.

Full-Year 2024 Financial Highlights:

- GAAP Revenue of $1,214.3 million, a decrease of 2%

year-over-year.

- GAAP Operating Income of $97.4 million and Adjusted Operating

Income of $428.5 million.

- GAAP Operating Income Margin of 8% and Adjusted Operating

Income Margin of 35%.

- GAAP Cash Flow from Operations of $369.4 million and Unlevered

Free Cash Flow of $446.9 million.

Recent Business and Operating Highlights:

- Released the ZoomInfo 2025 Customer Impact Report:

- Sales teams using ZoomInfo reported a 91% improvement to their

connect rates and booked 55% more meetings per month.

- ZoomInfo customers grew their total pipeline by one-third

(32%).

- Customer success managers (CSMs) reported saving more than 10

hours a week using ZoomInfo, and saw a double-digit increase in

renewal rates.

- Closed the quarter with 1,867 customers with $100,000 or

greater in annual contract value, an increase of 58 from the prior

quarter, and an increase of 47 year-over-year.

- As of December 31, 2024, the company’s net revenue retention

rate was 87%.

- During the year ended December 31, 2024, the Company

repurchased 46,801,742 shares of Common Stock accounting for 12% of

total shares outstanding, at an average price of $12.01, for an

aggregate $562.3 million. As of year-end, there remained $137.6

million outstanding under existing share repurchase

authorizations.

- The Board of Directors of ZoomInfo approved an additional

$500.0 million share repurchase authorization in February

2025.

Q4 2024 Financial Highlights

(Unaudited)

($ in millions, except per share

amounts)

GAAP Quarterly Results

Change YoY

Non-GAAP Quarterly

Results

Change YoY

Revenue

$309.1

(2)%

Operating Income

$30.9

(56)%

Adjusted Operating Income

$115.9

(8)%

Operating Income Margin

10%

Adjusted Operating Income Margin

37%

Net Income Per Share (Diluted)

$0.04

Adjusted Net Income Per Share

(Diluted)

$0.26

Cash Flow from Operating Activities

$109.0

(15)%

Unlevered Free Cash Flow

$93.6

(26)%

FY 2024 Financial Highlights

(Unaudited)

($ in millions, except per share

amounts)

GAAP Annual Results

Change YoY

Non-GAAP Annual

Results

Change YoY

Revenue

$1,214.3

(2)%

Operating Income

$97.4

(62)%

Adjusted Operating Income

$428.5

(14)%

Operating Income Margin

8%

Adjusted Operating Income Margin

35%

Net Income Per Share (Diluted)

$0.08

Adjusted Net Income Per Share

(Diluted)

$0.96

Cash Flow from Operating Activities

$369.4

(15)%

Unlevered Free Cash Flow

$446.9

(4)%

The Company uses a variety of operational and financial metrics,

including non-GAAP financial measures, to evaluate its performance

and financial condition. The accompanying financial data includes

additional information regarding these metrics and a reconciliation

of non-GAAP financial information for historical periods to the

most directly comparable GAAP financial measure. The presentation

of non-GAAP financial information should not be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

Business Outlook:

Based on information available as of February 25, 2025, ZoomInfo

is providing guidance for the first quarter and full-year 2025 as

follows:

Q1 2025

FY 2025

Revenue

$294 - $297 million

$1.185 - $1.205 billion

Non-GAAP Adjusted Operating Income

$96 - $99 million

$426 - $436 million

Non-GAAP Adjusted Net Income per share

$0.22 - $0.23

$0.95 - $0.97

Non-GAAP Unlevered Free Cash Flow

Not guided

$420 - $440 million

Weighted Average Shares Outstanding

357 million

362 million

Conference Call and Webcast Information:

ZoomInfo will host a conference call today, February 25, 2025,

to review its results at 4:30 p.m. Eastern Time, 1:30 p.m. Pacific

Time. To participate in the live conference call via telephone,

please register here. Upon registering, a dial-in number and unique

PIN will be provided to join the conference call.

The call will also be webcast live on the Company’s investor

relations website at https://ir.zoominfo.com/, where related

presentation materials will be posted prior to the conference call.

Following the conference call, an archived webcast of the call will

be available for one year on ZoomInfo’s Investor Relations

website.

Upcoming Events:

ZoomInfo executives expect to participate in the following

investor events:

- Wolfe Research Software Conference, Feb. 27, 2025

- Raymond James 46th Annual Institutional Investors Conference,

Mar. 5, 2025

- Morgan Stanley Technology, Media & Telecom Conference, Mar.

6, 2025

- DA Davidson, 2nd Annual Best of Breed Bison Conference Mar. 7,

2025

- Stifel Technology Conference, Mar. 11, 2025

For more information on specific events, presentation times, and

webcast details (if available), visit the “News & Events”

section on the company’s investor relations website at

https://ir.zoominfo.com. Conferences with presentations that are

webcast, will be webcast live, and the replay will be available for

a limited time.

Non-GAAP Financial Measures and Other Metrics:

To supplement our consolidated financial statements presented in

accordance with GAAP, this press release contains non-GAAP

financial measures, including Adjusted Operating Income, Adjusted

Operating Income Margin, Adjusted Net Income, Adjusted Net Income

Per Share, and Unlevered Free Cash Flow. We believe these non-GAAP

measures are useful to investors in evaluating our operating

performance because they eliminate certain items that affect

period-over-period comparability and provide consistency with past

financial performance and additional information about our

underlying results and trends by excluding certain items that may

not be indicative of our business, results of operations, or

outlook.

Non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for the comparable GAAP measures, but

rather as supplemental information to our business results. This

information should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

There are limitations to these non-GAAP financial measures because

they are not prepared in accordance with GAAP and may not be

comparable to similarly titled measures of other companies due to

potential differences in methods of calculation and items or events

being adjusted. In addition, other companies may use different

measures to evaluate their performance, all of which could reduce

the usefulness of our non-GAAP financial measures as tools for

comparison. A reconciliation is provided at the end of this press

release for each historical non-GAAP financial measure to the most

directly comparable financial measure stated in accordance with

GAAP. We do not provide a quantitative reconciliation of the

forward-looking non-GAAP financial measures included in this press

release to the most directly comparable GAAP measures due to the

high variability and difficulty to predict certain items excluded

from these non-GAAP financial measures; in particular, the effects

of stock-based compensation expense, taxes and amounts under the

exchange tax receivable agreement, deferred tax assets and deferred

tax liabilities, and restructuring and transaction expenses. We

expect the variability of these excluded items may have a

significant, and potentially unpredictable, impact on our future

GAAP financial results.

We define Adjusted Operating Income as income (loss) from

operations adjusted for, as applicable, (i) the impact of fair

value adjustments to acquired unearned revenue, (ii) amortization

of acquired technology and other acquired intangibles, (iii)

equity-based compensation expense, (iv) restructuring and

transaction-related expenses, (v) integration costs and

acquisition-related expenses, and (vi) legal settlement. We define

Adjusted Operating Income Margin as Adjusted Operating Income

divided by the sum of revenue and the impact of fair value

adjustments to acquired unearned revenue.

We define Adjusted Net Income as net income (loss) adjusted for,

as applicable, (i) the impact of fair value adjustments to acquired

unearned revenue, (ii) loss on debt modification and

extinguishment, (iii) amortization of acquired technology and other

acquired intangibles, (iv) equity-based compensation expense, (v)

restructuring and transaction-related expenses, (vi) integration

costs and acquisition-related expenses, (vii) legal settlement,

(viii) TRA liability remeasurement (benefit) expense, (ix) other

(income) loss, net and (x) tax impacts of adjustments to net income

(loss). We define Adjusted Net Income (Loss) Per Share as Adjusted

Net Income (Loss) divided by diluted weighted average shares

outstanding used for adjusted net income (loss) per share.

We define Unlevered Free Cash Flow as net cash provided by (used

in) operating activities less (i) purchases of property and

equipment and other assets, plus (ii) cash interest expense, (iii)

cash payments related to restructuring and transaction-related

expenses, (iv) cash payments related to integration costs and

acquisition-related compensation, and (v) legal settlement

payments. Unlevered Free Cash Flow does not represent residual cash

flow available for discretionary expenditures since, among other

things, we have mandatory debt service requirements.

Net revenue retention is a metric that we calculate based on

customers of ZoomInfo at the beginning of the twelve-month period,

and is calculated as: (a) the total ACV for those customers at the

end of the twelve-month period, divided by (b) the total ACV for

those customers at the beginning of the twelve-month period.

Cautionary Statement Regarding Forward-Looking

Information:

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Actual results may differ materially from those expressed or

implied by these statements. You can generally identify our

forward-looking statements by the words “anticipate”, “believe”,

“can”, “continue”, “could”, “estimate”, “expect”, “forecast”,

“goal”, “intend”, “may”, “might”, “objective”, “outlook”, “plan”,

“potential”, “predict”, “projection”, “seek”, “should”, “target”,

“trend”, “will”, “would” or the negative version of these words or

other comparable words. Any statements in this press release

regarding future revenue, earnings, margins, financial performance,

expenses, estimates, cash flow, growth in free cash flow, results

of changes in operational procedures, liquidity, or results of

operations (including, but not limited to, the guidance provided

under “Business Outlook”), and any other statements that are not

historical facts are forward-looking statements. We have based our

forward-looking statements on beliefs and assumptions based on

information available to us at the time the statements are made. We

caution you that assumptions, beliefs, expectations, intentions and

projections about future events may, and often do, vary materially

from actual results. Therefore, we cannot assure you that actual

results will not differ materially from those expressed or implied

by our forward-looking statements.

Factors that could cause actual results to differ from those

expressed or implied by our forward-looking statements include,

among other things: future economic, competitive, and regulatory

conditions, potential future uses of cash, the successful

integration of acquired businesses, and future decisions made by us

and our competitors. All of these factors are difficult or

impossible to predict accurately and many of them are beyond our

control. For a further list and description of these and other

important risks and uncertainties that may affect our future

operations, see Part I, Item 1A - Risk Factors in our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission, which we may update in Part II, Item 1A - Risk Factors

in Quarterly Reports on Form 10-Q we have filed or will file

hereafter. Our forward-looking statements do not reflect the

potential impact of any future acquisitions, mergers, dispositions,

joint ventures, investments, or other strategic transactions we may

make. Each forward-looking statement contained in this presentation

speaks only as of the date of this press release, and we undertake

no obligation to update or revise any forward-looking statements

whether as a result of new information, future developments or

otherwise, except as required by law.

About ZoomInfo:

ZoomInfo (NASDAQ: ZI) is the Go-To-Market Intelligence platform

that empowers businesses to grow faster with AI-ready insights,

trusted data, and advanced automation. Its solutions provide more

than 35,000 companies worldwide with a complete view of their

customers, making every seller their best seller. ZoomInfo is a

recognized leader in data privacy, with industry-leading GDPR and

CCPA compliance and numerous data security and privacy

certifications. For more information about how ZoomInfo can help

businesses with go-to-market intelligence that accelerates revenue

growth, please visit www.zoominfo.com.

Website Disclosure:

ZoomInfo intends to use its website as a distribution channel of

material company information. Financial and other important

information regarding the Company is routinely posted on and

accessible through the Company’s website at

https://ir.zoominfo.com/. Accordingly, you should monitor the

investor relations portion of our website at

https://ir.zoominfo.com/ in addition to following our press

releases, SEC filings, and public conference calls and webcasts. In

addition, you may automatically receive email alerts and other

information about ZoomInfo when you enroll your email address by

visiting the “Email Alerts” section of our investor relations page

at https://ir.zoominfo.com/.

ZoomInfo Technologies

Inc.

Condensed Consolidated Balance

Sheets

(in millions, except share data;

unaudited)

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

139.9

$

447.1

Short-term investments

—

82.2

Restricted cash, current

—

0.2

Accounts receivable, net

246.1

272.0

Prepaid expenses and other current

assets

58.6

59.6

Income tax receivable

6.4

3.2

Total current assets

$

451.0

$

864.3

Restricted cash, non-current

9.1

8.9

Property and equipment, net

112.6

65.1

Operating lease right-of-use assets,

net

90.9

80.7

Intangible assets, net

275.8

334.6

Goodwill

1,692.7

1,692.7

Deferred tax assets

3,717.6

3,707.1

Deferred costs and other assets, net of

current portion

117.9

114.9

Total assets

$

6,467.6

$

6,868.3

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

16.6

$

34.4

Accrued expenses and other current

liabilities

123.0

113.8

Unearned revenue, current portion

473.8

439.6

Income taxes payable

0.6

2.0

Current portion of tax receivable

agreements liability

22.3

31.4

Current portion of operating lease

liabilities

9.9

11.2

Current portion of long-term debt

5.9

6.0

Total current liabilities

$

652.1

$

638.4

Unearned revenue, net of current

portion

4.1

2.3

Tax receivable agreements liability, net

of current portion

2,740.2

2,786.6

Operating lease liabilities, net of

current portion

151.2

89.9

Long-term debt, net of current portion

1,221.8

1,226.4

Deferred tax liabilities

2.4

1.9

Other long-term liabilities

2.3

3.5

Total liabilities

$

4,774.1

$

4,749.0

Stockholders' Equity:

Common Stock, par value $0.01

$

3.4

$

3.8

Additional paid-in capital

1,362.9

1,804.9

Accumulated other comprehensive income

14.8

27.3

Retained earnings

312.4

283.3

Total stockholders' equity

$

1,693.5

$

2,119.3

Total liabilities and stockholders'

equity

$

6,467.6

$

6,868.3

ZoomInfo Technologies

Inc.

Consolidated Statements of

Operations

(in millions, except per share

amounts; unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Revenue

$

309.1

$

316.4

$

1,214.3

$

1,239.5

Cost of revenue:

Cost of service (1)

$

43.7

$

35.0

$

151.6

$

139.4

Amortization of acquired technology

9.5

9.6

38.2

39.1

Gross profit

$

255.9

$

271.8

$

1,024.5

$

1,061.0

Operating expenses:

Sales and marketing (1)

$

114.9

$

98.4

$

414.1

$

408.5

Research and development (1)

56.4

48.3

196.1

191.5

General and administrative (1)

48.3

49.2

295.3

179.6

Amortization of other acquired

intangibles

5.4

5.4

21.6

21.9

Total operating expenses

$

225.0

$

201.3

$

927.1

$

801.5

Income from operations

$

30.9

$

70.5

$

97.4

$

259.5

Interest expense, net

$

9.8

$

11.4

$

39.3

$

45.2

Loss on debt modification and

extinguishment

—

2.1

0.7

4.3

Other loss (income), net

29.6

(149.7

)

26.1

(178.8

)

Income (Loss) before income taxes

$

(8.5

)

$

206.7

$

31.3

$

388.8

Provision (Benefit) for income taxes

(23.1

)

212.2

2.2

281.5

Net income (loss)

$

14.6

$

(5.5

)

$

29.1

$

107.3

Net income (loss) per share of common

stock:

Basic

$

0.04

$

(0.01

)

$

0.08

$

0.27

Diluted

0.04

(0.01

)

0.08

0.27

_______________________________________

(1)

Amounts include equity-based compensation

expense, as follows:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2024

2023

2024

2023

Cost of service

$

2.6

$

3.9

$

10.5

$

15.7

Sales and marketing

12.2

16.7

50.3

71.3

Research and development

11.0

11.1

40.5

45.1

General and administrative

8.0

9.0

36.7

35.5

Total equity-based compensation

expense

$

33.8

$

40.7

$

138.0

$

167.6

ZoomInfo Technologies

Inc.

Consolidated Statements of

Cash Flows

(in millions; unaudited)

Twelve Months Ended December

31,

2024

2023

Operating activities:

Net income

$

29.1

$

107.3

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

85.7

80.6

Amortization of debt discounts and

issuance costs

2.2

2.4

Amortization of deferred commissions

costs

67.6

75.3

Asset impairments and lease abandonment

charges

57.4

5.2

Gain on lease modification

(1.7

)

—

Loss on debt modification and

extinguishment

0.7

4.3

Equity-based compensation expense

138.0

167.6

Deferred income taxes

(5.9

)

276.7

Tax receivable agreement remeasurement

38.5

(160.7

)

Provision for bad debt expense

42.8

33.8

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable, net

(16.9

)

(82.8

)

Prepaid expenses and other current

assets

(4.4

)

(8.0

)

Deferred costs and other assets, net of

current portion

(35.5

)

(78.2

)

Income tax receivable

(3.2

)

2.4

Accounts payable

(17.7

)

(1.8

)

Accrued expenses and other liabilities

(43.4

)

(11.2

)

Unearned revenue

36.1

22.0

Net cash provided by operating

activities

$

369.4

$

434.9

Investing activities:

Purchases of short-term investments

$

—

$

(145.0

)

Maturities of short-term investments

82.2

194.5

Proceeds from sales of short-term

investments

—

1.4

Purchases of property and equipment and

other assets

(64.9

)

(26.5

)

Right of use asset initial direct

costs

(3.4

)

—

Cash paid for acquisitions, net of cash

acquired

(0.5

)

—

Net cash provided by investing

activities

$

13.4

$

24.4

Financing activities:

Payments of deferred consideration

$

(0.7

)

$

(0.4

)

Payments of debt issuance and modification

costs

(2.1

)

(3.8

)

Repayment of debt

(5.9

)

(6.0

)

Proceeds from exercise of stock

options

—

0.4

Taxes paid related to net share settlement

of equity awards

(22.8

)

(24.5

)

Proceeds from issuance of common stock

under the ESPP

4.2

7.2

Tax receivable agreement payments

(94.0

)

—

Repurchase of common stock

(565.6

)

(400.1

)

Tax distributions

(3.1

)

—

Net cash used in financing activities

$

(690.0

)

$

(427.2

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

$

(307.2

)

$

32.1

Cash, cash equivalents, and restricted

cash at beginning of year

456.2

424.1

Cash, cash equivalents, and restricted

cash at end of year

$

149.0

$

456.2

Cash, cash equivalents, and restricted

cash at end of period:

Cash and cash equivalents

$

139.9

$

447.1

Restricted cash, current

—

0.2

Restricted cash, non-current

9.1

8.9

Total cash, cash equivalents, and

restricted cash

$

149.0

$

456.2

Supplemental disclosures of cash flow

information:

Interest paid in cash

$

44.0

$

48.5

Cash paid for taxes

13.8

12.2

Supplemental disclosures of non-cash

investing and financing activities:

Equity-based compensation included in

capitalized software

$

5.6

$

5.4

Property and equipment included in

accounts payable and accrued expenses and other current

liabilities

5.0

1.8

ZoomInfo Technologies

Inc.

Reconciliation of GAAP Cash

Flow From Operations to Non-GAAP Unlevered Free Cash Flow

(in millions; unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net cash provided by operating

activities (GAAP)

$

109.0

$

128.8

$

369.4

$

434.9

Purchases of property and equipment and

other assets

(23.4

)

(8.9

)

(64.9

)

(26.5

)

Interest paid in cash

4.4

5.5

44.0

48.5

Restructuring and transaction-related

expenses paid in cash

3.5

0.6

67.0

6.1

Integration costs and acquisition-related

compensation paid in cash

—

—

1.3

0.5

Litigation settlement payments (1)

0.1

—

30.1

—

Unlevered Free Cash Flow

(Non-GAAP)

$

93.6

$

126.0

$

446.9

$

463.5

_______________________________________

(1)

Represents payments associated with

certain legal settlements. For the year ended December 31, 2024,

these payments primarily related to the settlement of class actions

in Illinois and California class action and similar, unfiled claims

in the states of Indiana and Nevada (the “Class Actions”).

ZoomInfo Technologies

Inc.

Reconciliation of GAAP Income

from Operations to Non-GAAP Adjusted Operating Income

(in millions; unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Income from operations (GAAP)

$

30.9

$

70.5

97.4

$

259.5

Impact of fair value adjustments to

acquired unearned revenue (1)

—

—

—

0.2

Amortization of acquired technology

9.5

9.6

38.2

39.1

Amortization of other acquired

intangibles

5.4

5.4

21.6

21.9

Equity-based compensation expense

33.8

40.7

138.0

167.6

Restructuring and transaction-related

expenses (2)

34.6

0.4

101.6

10.3

Litigation settlement (3)

1.7

—

31.7

—

Adjusted Operating Income

(Non-GAAP)

$

115.9

$

126.5

$

428.5

$

498.6

Revenue (GAAP)

$

309.1

$

316.4

$

1,214.3

$

1,239.5

Impact of fair value adjustments to

acquired unearned revenue

—

—

—

0.2

Revenue for adjusted operating margin

calculation (Non-GAAP)

$

309.1

$

316.4

$

1,214.3

$

1,239.7

Operating Income Margin (GAAP)

10

%

22

%

8

%

21

%

Adjusted Operating Income Margin

(Non-GAAP)

37

%

40

%

35

%

40

%

_______________________________________

(1)

Represents the impact of fair value

adjustments to acquired unearned revenue relating to services

billed by an acquired company prior to our acquisition of that

company. These adjustments represent the difference between the

revenue recognized based on management’s estimate of fair value of

acquired unearned revenue and the receipts billed prior to the

acquisition less revenue recognized prior to the acquisition.

(2)

Represents costs directly associated with

acquisition or disposal activities, including employee severance

and termination benefits, contract termination fees and penalties,

and other exit or disposal costs. For the year ended December 31,

2024, this expense is primarily related to lease impairment and

abandonment charges as well as lease restructuring activities. For

the year ended December 31, 2023, this expense is primarily related

to costs associated with a June 2023 reduction in force, and

impairment charges related to the Ra’anana office and other

offices.

(3)

Represents charges associated with certain

legal settlements. For the year ended December 31, 2024, these

charges are primarily related to costs incurred due to the Class

Actions.

ZoomInfo Technologies

Inc.

Reconciliation of GAAP Net

Income to Non-GAAP Adjusted Net Income

(in millions, except per share

amounts; unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net income (loss) (GAAP)

$

14.6

$

(5.5

)

$

29.1

$

107.3

Impact of fair value adjustments to

acquired unearned revenue (1)

—

—

—

0.2

Loss on debt modification and

extinguishment

—

2.1

0.7

4.3

Amortization of acquired technology

9.5

9.6

38.2

39.1

Amortization of other acquired

intangibles

5.4

5.4

21.6

21.9

Equity-based compensation expense

33.8

40.7

138.0

167.6

Restructuring and transaction-related

expenses (2)

34.6

0.4

101.6

10.3

Litigation settlement (3)

1.7

—

31.7

—

TRA liability remeasurement (benefit)

expense

28.6

(146.8

)

38.5

(160.7

)

Other income

—

—

(2.4

)

—

Tax impacts of adjustments to net income

(loss) (4)

(34.6

)

196.2

(33.2

)

223.1

Adjusted Net Income (Non-GAAP)

$

93.6

$

102.1

$

363.8

$

413.1

Diluted Net Income (Loss) Per Share

(GAAP)

$

0.04

$

(0.01

)

$

0.08

$

0.27

Impact of fair value adjustments to

acquired unearned revenue per diluted share

—

—

—

—

Loss on debt modification and

extinguishment per diluted share

—

0.01

—

0.01

Amortization of acquired technology per

diluted share

0.03

0.02

0.10

0.10

Amortization of other acquired intangibles

per diluted share

0.02

0.01

0.06

0.05

Equity-based compensation expense per

diluted share

0.09

0.10

0.37

0.41

Restructuring and transaction-related

expenses per diluted share

0.10

—

0.27

0.03

Litigation settlement per diluted

share

—

—

0.08

—

TRA liability remeasurement (benefit)

expense per diluted share

0.08

(0.36

)

0.10

(0.40

)

Other income per diluted share

—

—

(0.01

)

—

Tax impacts of adjustments to net income

(loss) per diluted share

(0.10

)

0.49

(0.09

)

0.54

Adjusted Net Income Per Share

(Non-GAAP)

$

0.26

$

0.26

$

0.96

$

1.01

Shares for Adjusted Net Income Per

Share(5)

358

400

377

411

_______________________________________

(1)

Represents the impact of fair value

adjustments to acquired unearned revenue relating to services

billed by an acquired company prior to our acquisition of that

company. These adjustments represent the difference between the

revenue recognized based on management’s estimate of fair value of

acquired unearned revenue and the receipts billed prior to the

acquisition less revenue recognized prior to the acquisition.

(2)

Represents costs directly associated with

acquisition or disposal activities, including employee severance

and termination benefits, contract termination fees and penalties,

and other exit or disposal costs.For the year ended December 31,

2024, this expense is primarily related to lease impairment and

abandonment charges as well as lease restructuring activities. For

the year ended December 31, 2023, this expense is primarily related

to costs associated with a June 2023 reduction in force, and

impairment charges related to the Ra’anana office and other

offices.

(3)

Represents charges associated with certain

legal settlements. For the year ended December 31, 2024, these

charges are primarily related to costs incurred due to the Class

Actions.

(4)

Represents tax expense associated with Net

income (loss) (GAAP) excluded from Adjusted Net Income (Non-GAAP).

The Company calculates the tax impacts of adjustments to net income

(loss) by taking the total gross value of the adjustments and

multiplying it by the Company’s U.S. federal and state statutory

tax rate. We then recalculate the tax impact of book-tax

differences related to equity compensation, the tax receivable

agreements, restructuring and transaction-related expenses, and

items that are deemed to be unrelated to current year operating

income or are one-time in nature, such as provision to return

true-ups. For the three and twelve months ended December 31, 2024,

these primarily relate to adjusting out $31.9 million and $30.1

million of tax benefit from the effects of changes in state tax law

and apportionment, recognizing $18.5 million and $63.6 million of

tax benefit related to the amortization of costs associated with

corporate structure simplification, and adjusting out $4.5 million

and $17.5 million of tax expense from non-deductible stock-based

compensation, respectively. For the three and twelve months ended

December 31, 2023, these primarily relate to adjusting out $139.7

million and $138.4 million of tax expense from the effects of

changes in state tax law and apportionment, recognizing $12.7

million and $60.0 million of tax benefit related to the

amortization of costs associated with corporate structure

simplification, and adjusting out $7.8 million and $23.4 million of

tax expense from non-deductible stock-based compensation. We

believe the exclusion of these adjustments provides investors with

useful information about the Company’s underlying results and

trends, allowing them to better understand and compare net income

(loss) related to ongoing operations and the related current and

deferred income tax expense.

(5)

Diluted earnings per share is computed by

giving effect to all potential weighted average Common Stock, and

any securities that are convertible into Common Stock, including

options and restricted stock units. The dilutive effect of

outstanding awards and convertible securities is reflected in

diluted earnings per share by application of the treasury stock

method, excluding deemed repurchases assuming proceeds from

unrecognized compensation as required by GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225694335/en/

Investor Contact: Jeremiah Sisitsky VP of Investor

Relations IR@zoominfo.com

Media Contact: Meghan Barr VP, Communications (203)

216-1878 pr@zoominfo.com

ZoomInfo Technologies (NASDAQ:ZI)

Historical Stock Chart

From Jan 2025 to Feb 2025

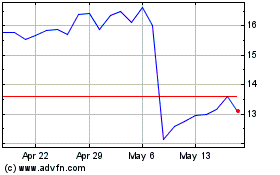

ZoomInfo Technologies (NASDAQ:ZI)

Historical Stock Chart

From Feb 2024 to Feb 2025