Mount Logan Capital Inc. (Cboe Canada: MLC)

(“Mount Logan” or the “Company”) today announced it has

successfully completed its previously announced minority investment

in Runway Growth Capital LLC (“Runway”), alongside BC Partners and

its affiliates, which are acquiring the remaining outstanding

ownership in Runway. On closing, Mount Logan issued to former

Runway members an aggregate of 2,693,071 common shares of Mount

Logan at a deemed price of C$2.67, which was determined based on

the 20-day volume-weighted average price prior to and including

January 27, 2025.

With approval of a new investment advisory

agreement, Runway will continue to serve as investment adviser to

its managed funds, including Runway Growth Finance Corp. (Nasdaq:

RWAY) (“Runway Growth Finance”), a business development company,

and to other private funds. Mount Logan looks forward to working

with BC Partners and Runway’s management and investment teams to

capitalize on the opportunities available in the North American

credit markets.

Management Commentary

Ted Goldthorpe, Chief Executive Officer

and Chairman of Mount Logan, stated, "We are thrilled to

officially welcome David and the talented team at Runway to the

Mount Logan family. We are excited about partnering with the Runway

team to scale their specialized capabilities in providing financing

solutions to late-stage growth platforms. Since the announcement,

we have already seen significant benefits of our alignment with the

Runway team. Runway’s expertise enhances our credit capabilities,

and we are confident in our ability to leverage their strong

investment acumen to expand our product suite and further diversify

our private credit fund offerings.”

Advisors

Wildeboer Dellelce LLP acted as Canadian legal

counsel to Mount Logan. Simpson Thacher & Bartlett LLP acted as

legal counsel to BC Partners. Oppenheimer & Co. Inc. acted as

the exclusive financial advisor to Runway Growth Capital LLC.

Wachtell, Lipton, Rosen & Katz acted as legal counsel to Runway

Growth Capital LLC and Eversheds Sutherland (US) LLP acted as legal

counsel to the independent directors of Runway Growth Finance.

About Mount Logan Capital

Inc.

Mount Logan Capital Inc. is an alternative asset

management and insurance solutions company that is focused on

public and private debt securities in the North American market and

the reinsurance of annuity products, primarily through its wholly

owned subsidiaries Mount Logan Management LLC (“ML Management”) and

Ability Insurance Company (“Ability”), respectively. Mount Logan

also actively sources, evaluates, underwrites, manages, monitors

and primarily invests in loans, debt securities, and other

credit-oriented instruments that present attractive risk-adjusted

returns and present low risk of principal impairment through the

credit cycle.

ML Management was organized in 2020 as a

Delaware limited liability company and is registered with the SEC

as an investment adviser under the Investment Advisers Act of 1940,

as amended. The primary business of ML Management is to provide

investment management services to (i) privately offered investment

funds exempt from registration under the Investment Company Act of

1940, as amended (the “1940 Act”) advised by ML Management, (ii) a

non-diversified closed-end management investment company that has

elected to be regulated as a business development company, (iii)

Ability, and (iv) non-diversified closed-end management investment

companies registered under the 1940 Act that operate as interval

funds. ML Management also acts as the collateral manager to

collateralized loan obligations backed by debt obligations and

similar assets.

Ability is a Nebraska domiciled insurer and

reinsurer of long-term care policies and annuity products acquired

by Mount Logan in the fourth quarter of fiscal year 2021. Ability

is also no longer insuring or re-insuring new long-term care

risk.

About Runway Growth Capital

LLCRunway Growth Capital LLC is the investment adviser to

investment funds, including Runway Growth Finance Corp. (Nasdaq:

RWAY), a business development company, and other private funds,

which are lenders of growth capital to companies seeking an

alternative to raising equity. Led by industry veteran David

Spreng, these funds provide senior term loans of a target of $30

million to $150 million to fast-growing companies based in the

United States and Canada. For more information on Runway Growth

Capital LLC and its platform, please visit

www.runwaygrowth.com.

About Runway Growth Finance

Corp.

Runway Growth Finance is a growing specialty

finance company focused on providing flexible capital solutions to

late- and growth-stage companies seeking an alternative to raising

equity. Runway Growth Finance is a closed-end investment fund that

has elected to be regulated as a business development company under

the Investment Company Act of 1940. Runway Growth Finance is

externally managed by Runway Growth Capital LLC, an established

registered investment advisor that was formed in 2015 and led by

industry veteran David Spreng. For more information, please visit

www.runwaygrowth.com.

About BC Partners & BC Partners

Credit

BC Partners is a leading international

investment firm in private equity, private debt, and real estate

strategies. BC Partners Credit was launched in February 2017, with

a focus on identifying attractive credit opportunities in any

market environment, often in complex market segments. The platform

leverages the broader firm's deep industry and operating resources

to provide flexible financing solutions to middle-market companies

across Business Services, Industrials, Healthcare and other select

sectors. For further information, visit

www.bcpartners.com/credit-strategy.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and information within the meaning of applicable

securities legislation. Forward-looking statements can be

identified by the expressions "seeks", "expects", "believes",

"estimates", "will", "target" and similar expressions. The

forward-looking statements are not historical facts but reflect the

current expectations of the Company regarding future results or

events and are based on information currently available to it.

Certain material factors and assumptions were applied in providing

these forward-looking statements. The forward-looking statements

discussed in this release include, but are not limited to,

statements relating to the Company’s business strategy, model,

approach and future activities; portfolio composition, size and

performance, asset management activities and related income,

capital raising activities, future credit opportunities of the

Company, portfolio realizations, the protection of stakeholder

value, the expansion of the Company’s loan portfolio, including

through its investment in Runway, synergies to be achieved by both

the Company and Runway through the Company’s strategic minority

investment, any future growth and expansion of each of both the

Company and Runway, any change in earnings potential for the

Company as a result of any growth of Runway, the business and

future activities and prospects of Runway and the Company. All

forward-looking statements in this press release are qualified by

these cautionary statements. The Company believes that the

expectations reflected in forward-looking statements are based upon

reasonable assumptions; however, the Company can give no assurance

that the actual results or developments will be realized by certain

specified dates or at all. These forward-looking statements are

subject to a number of risks and uncertainties that could cause

actual results or events to differ materially from current

expectations, including that the expected synergies of the

investment in Runway may not be realized as expected; the risk that

each of the Company and Runway may require a significant investment

of capital and other resources in order to expand and grow their

respective businesses; the Company has a limited operating history

with respect to an asset management oriented business model and the

matters discussed under "Risk Factors" in the most recently filed

annual information form and management discussion and analysis for

the Company. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, a forward-looking

statement speaks only as of the date on which such statement is

made. The Company undertakes no obligation to publicly update any

such statement or to reflect new information or the occurrence of

future events or circumstances except as required by securities

laws. These forward-looking statements are made as of the date of

this press release.

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this release is not, and

under no circumstances is it to be construed as, an offer to sell

or an offer to purchase any securities in the Company or in any

fund or other investment vehicle. This press release is not

intended for U.S. persons. The Company’s shares are not registered

under the U.S. Securities Act of 1933, as amended, and the Company

is not registered under the U.S. Investment Company Act of 1940

(the “1940 Act”). U.S. persons are not permitted to purchase the

Company’s shares absent an applicable exemption from registration

under each of these Acts. In addition, the number of investors in

the United States, or which are U.S. persons or purchasing for the

account or benefit of U.S. persons, will be limited to such number

as is required to comply with an available exemption from the

registration requirements of the 1940 Act.

ContactsMount Logan Capital

Inc.365 Bay Street, Suite 800Toronto, ON M5H

2V1info@mountlogancapital.ca

Nikita KlassenChief Financial

OfficerNikita.Klassen@mountlogancapital.ca

Scott ChanInvestor RelationsScott.Chan@mountlogan.com

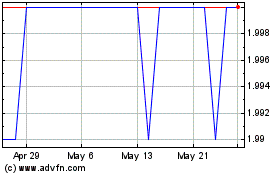

Mount Logan Capital (NEO:MLC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Mount Logan Capital (NEO:MLC)

Historical Stock Chart

From Mar 2024 to Mar 2025