AECOM reiterates its capital allocation policy, increases its share repurchase authorization to $1 billion and increases its quarterly dividend by 18%

November 18 2024 - 3:08PM

Business Wire

AECOM (NYSE: ACM), the trusted global infrastructure leader,

today affirmed the priorities of its returns-based capital

allocation policy. Accordingly, the Company announced that its

Board of Directors has approved an increase to its share repurchase

authorization to $1 billion and an increase to its quarterly

dividend by 18% to $0.26 per share.

“The increases to our share repurchase authorization and

quarterly dividend payment reflect our confidence in delivering

strong earnings and cash flow growth, as well as the strength of

our balance sheet,” said Troy Rudd, AECOM’s chief executive

officer. “Through this announcement, we are affirming our

returns-driven capital allocation policy focused on high-returning

investments in accelerating organic growth and margin expansion, as

well as capital returns to shareholders. This includes returning

$2.5 billion to shareholders since 2020, primarily through share

repurchases.”

AECOM’s Returns-Focused Capital

Allocation Policy

AECOM prioritizes its capital allocation based on returns,

including:

- Investments in organic growth

- Share repurchases

- Dividend payments

Consistent with these priorities, the Company has bought back

$2.2 billion of stock since the initiation of its repurchase

program in September 2020, which has reduced its shares outstanding

by 21%. In addition, the Company remains committed to increasing

the per share value of its dividend by double-digits annually, as

reflected in the 20% average annual increase it has delivered over

the last three years.

The increased dividend as declared by the Board will be

reflected in its next dividend payment on January 17, 2025, to

stockholders of record on January 2, 2025.

About AECOM

AECOM (NYSE: ACM) is the global infrastructure leader, committed

to delivering a better world. As a trusted professional services

firm powered by deep technical abilities, we solve our clients’

complex challenges in water, environment, energy, transportation

and buildings. Our teams partner with public- and private-sector

clients to create innovative, sustainable and resilient solutions

throughout the project lifecycle – from advisory, planning, design

and engineering to program and construction management. AECOM is a

Fortune 500 firm that had revenue of $16.1 billion in fiscal year

2024. Learn more at aecom.com.

Forward-Looking Statements

All statements in this communication other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including any statements of the

plans, strategies and objectives for future operations,

profitability, strategic value creation, capital allocation

strategy including stock repurchases, risk profile and investment

strategies, and any statements regarding future economic conditions

or performance, and the expected financial and operational results

of AECOM. Although we believe that the expectations reflected in

our forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Important factors that could cause our

actual results, performance and achievements, or industry results

to differ materially from estimates or projections contained in our

forward-looking statements include, but are not limited to, the

following: our business is cyclical and vulnerable to economic

downturns and client spending reductions; potential government

shutdowns or other funding circumstances that may cause

governmental agencies to modify, curtail or terminate our

contracts; losses under fixed-price contracts; limited control over

operations that run through our joint venture entities; liability

for misconduct by our employees or consultants; failure to comply

with laws or regulations applicable to our business; maintaining

adequate surety and financial capacity; potential high leverage and

inability to service our debt and guarantees; ability to continue

payment of dividends; exposure to political and economic risks in

different countries, including tariffs, geopolitical events, and

conflicts; currency exchange rate and interest fluctuations;

retaining and recruiting key technical and management personnel;

legal claims; inadequate insurance coverage; environmental law

compliance and adequate nuclear indemnification; unexpected

adjustments and cancellations related to our backlog; partners and

third parties who may fail to satisfy their legal obligations;

managing pension costs; AECOM Capital real estate development

projects; cybersecurity issues, IT outages and data privacy; risks

associated with the benefits and costs of the sale of our

Management Services and self-perform at-risk civil infrastructure,

power construction and oil and gas businesses, including the risk

that any purchase adjustments from those transactions could be

unfavorable and result in any future proceeds owed to us as part of

the transactions could be lower than we expect; as well as other

additional risks and factors that could cause actual results to

differ materially from our forward-looking statements set forth in

our reports filed with the Securities and Exchange Commission. Any

forward-looking statements are made as of the date hereof. We do

not intend, and undertake no obligation, to update any

forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118723271/en/

Media Contact: Brendan Ranson-Walsh Senior Vice

President, Global Communications 213.996.2367

Brendan.Ranson-Walsh@aecom.com

Investor Contact: Will Gabrielski Senior Vice President,

Finance, Treasurer 213.593.8208 William.Gabrielski@aecom.com

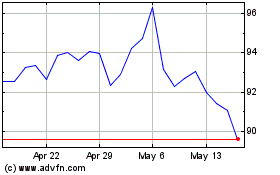

AECOM (NYSE:ACM)

Historical Stock Chart

From Nov 2024 to Dec 2024

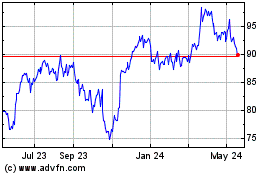

AECOM (NYSE:ACM)

Historical Stock Chart

From Dec 2023 to Dec 2024