abrdn Income Credit Strategies Fund (ACP) and First Trust High Income Long/short Fund (FSD) Announce Closing of Reorganization

July 22 2024 - 7:55AM

Business Wire

abrdn Income Credit Strategies Fund (NYSE: ACP) (“ACP” or the

“Acquiring Fund”) and First Trust High Income Long/Short Fund

(NYSE: FSD) (“FSD” or the “Acquired Fund”) announce today the

completed reorganization of the Acquired Fund with the Acquiring

Fund after close of regular business on July 19, 2024.

In the reorganization, common shareholders of FSD received an

amount of ACP common shares with a net asset value equal to the

aggregate net asset value of their holdings of FSD common shares,

as determined at the close of regular business on July 19,

2024.

Relevant details pertaining to the reorganization are as

follows:

Acquiring

Fund

Website for

additional

information

Acquired Fund

Acquiring

Fund NAV

per Share

($)

7/19/24

Conversion

Ratio

ACP

abrdnacp.com

FSD

6.6326

1.893482

There are no proposed changes to the current investment

objective, strategies, structure, or policies of the Acquiring Fund

as a result of the reorganization.

abrdn welcomes the FSD shareholders to the abrdn Fund family. As

a leading global asset manager, abrdn is dedicated to creating

long-term value for our clients. As of March 31, 2024, abrdn

manages over $472.8 billion in assets on behalf of institutional

and retail clients worldwide and believes that our global footprint

ensures that we are always close to our clients and the challenges

they face. For more information on the abrdn range of open-end and

closed-end mutual funds please visit abrdn.com/us.

Important Information

In the United States, abrdn is the marketing name for the

following affiliated, registered investment advisers: abrdn Inc.,

abrdn Investments Limited., abrdn Asia Limited, and abrdn ETFs

Advisors LLC.

First Trust Advisors LP. (“FTA”) is a federally registered

investment advisor and serves as the investment advisor of the

Fund. FTA and its affiliate First Trust Portfolios L.P. (“FTP”), a

FINRA registered broker-dealer, are privately-held companies that

provide a variety of investment services. FTA has collective assets

under management or supervision of approximately $228 billion as of

June 30, 2024, through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds, and separate managed

accounts.

FTA is the supervisor of the First Trust unit investment trusts,

while FTP is the sponsor. FTP is also a distributor of mutual fund

shares and exchange-traded fund creation units. FTA and FTP are

based in Wheaton, Illinois.

The information in this press release is for informational

purposes only and shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities or the solicitation of any vote or approval in

any jurisdiction pursuant to or in connection with the proposed

transaction or otherwise, nor shall there be any sale, issuance or

transfer of securities in any jurisdiction in contravention of

applicable law. No offer of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Closed-end funds are traded on the secondary market through one

of the stock exchanges. The Acquiring Fund’s investment return and

principal value will fluctuate so that an investor’s shares may be

worth more or less than the original cost. Shares of closed-end

funds may trade above (a premium) or below (a discount) the net

asset value (NAV) of the fund’s portfolio. There is no assurance

that the Acquiring Fund will achieve its investment objective. Past

performance does not guarantee future results.

abrdnacp.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722134619/en/

abrdn U.S. Closed-End Funds Investor Relations 1-800-522-5465

Investor.Relations@abrdn.com

First Trust Advisors L.P. 1-800-988-5891

info@ftportfolios.com

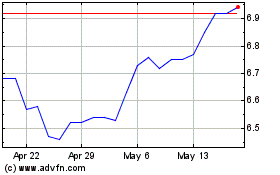

abrdn Income Credit Stra... (NYSE:ACP)

Historical Stock Chart

From Jan 2025 to Feb 2025

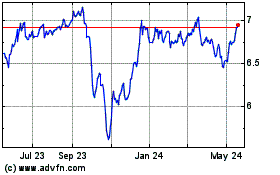

abrdn Income Credit Stra... (NYSE:ACP)

Historical Stock Chart

From Feb 2024 to Feb 2025