AM Best Affirms Credit Ratings of Agrinational Insurance Company

May 16 2024 - 10:52AM

Business Wire

AM Best has affirmed the Financial Strength Rating of A-

(Excellent) and the Long-Term Issuer Credit Rating of “a-”

(Excellent) of Agrinational Insurance Company (Agrinational)

(headquartered in Colchester, VT). The outlook of these Credit

Ratings (ratings) is stable.

The ratings reflect Agrinational’s balance sheet strength, which

AM Best assesses as strong, as well as its adequate operating

performance, limited business profile and appropriate enterprise

risk management. The company also receives rating enhancement

provided by its ultimate parent, Archer Daniels Midland Company

(ADM) [NYSE: ADM].

Agrinational’s strong balance sheet strength is supported by its

risk-adjusted capitalization at the strongest level, as measured by

Best’s Capital Adequacy Ratio (BCAR), conservative investment

strategy, and appropriate reinsurance structure in place with

highly rated reinsurers. In addition, the company is afforded

financial flexibility and support from ADM. Agrinational’s adequate

operating performance reflects the positive trend in its improved

combined and operating ratios resulting from the benefits of the

company’s strategy in focusing on its core business while exiting

from restrictive and non-core exposures. While the company produced

net loss results in 2023 due to large claims, management expects

operating performance to return to its positive trend in the near

term. Agrinational has a low cost-expense structure and a keen

underwriting focus with an emphasis on risk management controls,

which are well-integrated with those of its parent. Agrinational

provides a variety of coverages with a focus on commercial property

and marine coverages, workers’ compensation, general liability and

a medical expense cost containment program for ADM.

The ratings also reflect rating enhancement provided to

Agrinational by ADM, one of the world’s largest agricultural

processors and food ingredient providers. Agrinational holds a

strategic position within ADM, serving a critical role in meeting

certain global insurance requirements and providing risk management

services to ADM and its subsidiaries. ADM in turn provides implicit

and explicit support to Agrinational.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best's

Credit Ratings. For information on the proper use of Best’s Credit

Ratings, Best’s Performance Assessments, Best’s Preliminary Credit

Assessments and AM Best press releases, please view Guide to Proper

Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240516201279/en/

Chul Lee Senior Financial Analyst +1 908 882

2005 chul.lee@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Fred Eslami Associate Director +1 908 882

1759 fred.eslami@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

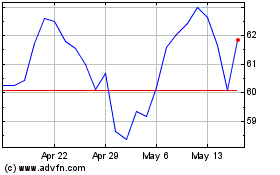

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2024 to Jun 2024

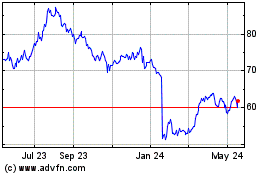

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Jun 2023 to Jun 2024