American Equity Announces $200 Million Accelerated Share Repurchase Agreement

March 20 2023 - 5:45AM

Business Wire

American Equity Investment Life Holding Company (“American

Equity”) (NYSE: AEL), a leading issuer of fixed index annuities

(FIAs), today announced that it has entered into an accelerated

share repurchase agreement (“ASR”) with JP Morgan to repurchase

$200 million of American Equity common stock. The accelerated share

repurchase reflects the Company’s continued progress on its growth

strategy, the strength of its balance sheet, and the opportunity to

deliver additional value to shareholders by repurchasing

undervalued equity as part of its balanced approach to capital

allocation.

The ASR was entered pursuant to American Equity’s previously

announced share repurchase program. After completion of the ASR,

approximately $276 million will remain available under American

Equity’s share repurchase program. The $200 million announced today

equates to approximately 6 million shares at the closing price on

March 17, 2023 and represents approximately 7% of American Equity’s

fully diluted outstanding common stock, as of that date. Since

December 31, 2022, American Equity has repurchased approximately

2.437 million shares in the open market at a weighted average price

of $38.22.

Under the terms of the ASR, American Equity will make a payment

of $200 million to JP Morgan and will receive an initial delivery

of 80% of the estimated total repurchase, approximately 4.831

million shares of its common stock based on the March 17, 2023

closing price. The final number of shares to be repurchased will be

based on the volume-weighted average price of American Equity’s

common stock during the term of the ASR, less a discount and

subject to adjustments pursuant to the terms of the ASR. The final

settlement of the ASR is expected to occur in the company’s fiscal

2023 third quarter ending on September 30, 2023.

ABOUT AMERICAN EQUITY

At American Equity Investment Life Holding Company (NYSE: AEL),

we think of ourselves as The Financial Dignity CompanyTM. Our

policyholders work with independent agents, banks and

broker-dealers through our wholly-owned operating subsidiaries, to

choose one of our leading annuity products best suited for their

personal needs to create financial dignity in retirement. To

deliver on its promises to policyholders, American Equity has

re-framed its investments focus – building a stronger emphasis on

insurance liability driven asset allocation and specializing in

alternate, private asset management. American Equity is

headquartered in West Des Moines, Iowa with satellite offices in

Charlotte, NC and New York, NY. For more information, please visit

www.american-equity.com.

FORWARD-LOOKING STATEMENTS

The forward-looking statements in this release, such as

additional, expect, opportunity, strategy, will, and their

derivative forms and similar words, as well as any projections of

future results, are based on assumptions and expectations that

involve risks and uncertainties, including the "Risk Factors" the

company describes in its U.S. Securities and Exchange Commission

filings. The Company's future results could differ, and it has no

obligation to correct or update any of these statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230320005218/en/

Investors: Steven D. Schwartz, Vice President, Investor

Relations (515) 273-3763, sschwartz@american-equity.com Media:

Jared Levy/Jamie Tully FGS Global AEL@FGSGlobal.com

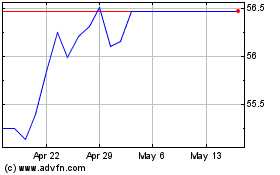

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Feb 2025 to Mar 2025

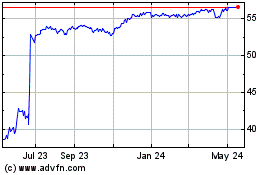

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Mar 2025