Company Highlights

- Q1 2023 net loss available to common stockholders of

$(166.9) million, or $(2.00) per diluted common share compared to

net income of $668.5 million, or $6.83 per diluted common share for

Q1 2022 restated for the adoption of Accounting Standards Update

2018-12 — more commonly known as Long Duration Targeted

Improvements or LDTI.

- Non-GAAP operating income available to common stockholders1

for the first quarter 2023 was $124.3 million, or $1.47 per diluted

common share; Notable items2 negatively impacted results in the

quarter by $9.6 million, or $0.11 per share, after-tax.

- On a trailing twelve-month basis GAAP return on equity of

30.1% and non-GAAP operating return on equity1 of 13.0%

- Total sales4 of $1.4 billion including almost $1 billion of

FIA sales reflecting a sequential quarterly sales increase of

23%

- Private asset deployment ramp continues with approximately

$1.3 billion sourced in the quarter, bringing total portfolio

allocation to 24%

- Ceded $634 million of flow reinsurance to reinsurance

partners creating "fee-like" revenues and growing account value

subject to recurring fees to $10.2 billion

American Equity Investment Life Holding Company (NYSE: AEL), a

leading issuer of fixed index annuities (FIAs), today reported its

first quarter 2023 results. Investment spread increased from the

fourth quarter of 2022, while sales momentum continued in both the

independent agent channel and bank and broker-dealer channel.

American Equity's President and CEO, Anant Bhalla stated: "Our

strong first quarter results across all aspects of our Virtuous

Flywheel reflect the power of AEL 2.0 as it gains momentum. Strong

new money yields enabled by our robust asset sourcing capabilities

and reinsurance structures empowered the front-end of the Flywheel

to sell nearly $1.4 billion of annuities. I am thankful to our

American Equity teammates and our partners in the AEL Network who

have embraced our ways of working to deliver financial dignity to

our retail clients and be the partner of choice to our distribution

partners and advisors."

With regard to the macro-economic outlook, Bhalla continued, “We

opportunistically repurchased $253 million of shares in the first

quarter while maintaining a fortress balance sheet. Our excess

capital position as of March 31, was $650 million. In this current

economic environment, we are extremely vigilant with regards to

prudent balance sheet management and identification of both risks

and opportunities in these turbulent markets. We remain confident

in our ability to return capital to shareholders and selectively

source private assets at very attractive risk-adjusted returns for

all stakeholders."

Non-GAAP operating income available to common stockholders1 for

the first quarter of 2023 was $124.3 million, or $1.47 per diluted

common share, compared to non-GAAP operating income available to

common stockholders1 of $107.1 million, or $1.09 per diluted common

share for the first quarter of 2022, restated for the adoption of

Accounting Standards Update 2018-12 — more commonly known as

Long Duration Targeted Improvements or LDTI. For the first quarter

of 2023, non-GAAP operating income available to common

stockholders1 included notable items2 of $9.6 million, or $0.11 per

share, after taxes. There were no notable items2 affecting results

for the first quarter of 2022.

The year-over-year change in quarterly non-GAAP operating income

available to common stockholders1 excluding the impact of notable

items2 reflects improved investment spread, increased recurring fee

revenue related to reinsurance and a decrease in the change in the

Market Risk Benefit (MRB) liability.

For the first quarter of 2023, net investment income fell by $10

million to $559 million when adjusted to reflect non-GAAP operating

income available to common stockholders1. This $10 million decrease

reflects a decline in average investments primarily due to $3.8

billion of invested assets transferred as a result of an in-force

reinsurance transaction effective October 3, 2022 with 26North Re,

offset in part by improved investment yields resulting from

attractive new money rates, the effect of higher short term rates

on our floating rate portfolio and the increase in portfolio

allocation to privately sourced assets to 24.2%. The contribution

to net investment income from partnerships and other mark-to-market

investments for the first quarter of 2023 was $21 million less than

expected as actual returns were below those used in our investment

projections.

Compared to the first quarter of 2022, the change in the MRB

liability decreased by $26 million to $47 million when adjusted to

reflect non-GAAP operating income available to common

stockholders1. This $26 million decrease reflects a $7 million

benefit from the fourth quarter 2022 in-force reinsurance

transaction which is captured in a $35 million decline in expense

associated with adverse experience and a $10 million positive

change in the amortization of net deferred capital market impacts,

offset in part by a $20 million increase in the interest accrued on

the MRB balance. First quarter 2023 change in MRB liability

adjusted to reflect non-GAAP operating income available to common

stockholders1 was $8 million higher than expected due to $2 million

in adverse experience, $3 million of expense associated with model

true-ups, and $3 million less from the amortization of net deferred

capital market impacts due mostly to a decrease in interest rates

during the quarter.

Compared to the first quarter of 2022, amortization of deferred

policy acquisition and sales inducement cost decreased $3 million

to $115 million reflecting a $5 million reduction from the fourth

quarter 2022 in-force reinsurance transaction. Amortization in the

first quarter of 2023 included $1 million of expense associated

with new sales.

As of March 31, 2023, account value of business ceded subject to

fee income was $10.2 billion, up from $9.6 billion at the end of

2022. Flow reinsurance ceded subject to fee income in the first

quarter of 2023 totaled $634 million of account value. Revenue

associated with recurring fees under reinsurance agreements for the

first quarter of 2023 totaled $22 million compared to $9 million

for the first quarter of 2022 when adjusted to reflect non-GAAP

operating income available to common stockholders1. Growth in ceded

account value and a positive $1 million true-up associated with the

final settlement of the fourth quarter reinsurance transaction

contributed to the increase in revenues.

Other operating costs and expenses for the first quarter of 2023

of $74 million included our single notable item2 in the quarter of

$12 million, pre-tax, to reflect expense associated with the

strategic incentive compensation award made in November of last

year.

The effective tax rate on pre-tax operating income available for

common stockholders1 for the first quarter of 2023 was 24.4%. Tax

expense in the quarter included a $6 million true-up related to

2022 which contributed approximately 300 basis points to the

effective tax rate.

INVESTMENT SPREAD INCREASES AS STRONG ORIGINATION OF PRIVATE

ASSETS CONTINUES

American Equity’s investment spread was 2.67% for the first

quarter of 2023 compared to 2.54% for the fourth quarter of 2022

and 2.51% for the first quarter of 2022. Adjusted investment spread

excluding non-trendable items3 increased to 2.67% in the first

quarter of 2023 from 2.53% in the fourth quarter of 2022.

Average yield on invested assets was 4.48% in the first quarter

of 2023 compared to 4.30% in the fourth quarter of 2022. The

average adjusted yield on invested assets excluding non-trendable

items3 was 4.48% in the first quarter of 2023 compared to 4.29% in

the fourth quarter of 2022. Below expected returns on

mark-to-market assets reduced the portfolio yield by 17 basis

points in the first quarter of 2023 compared to nine basis points

in the fourth quarter of 2022. The benefit to the investment

portfolio from higher short-term rates on floating rate investments

was 7 basis points in the first quarter.

During the quarter, investment asset purchases totaled $2.1

billion and were made at an average rate of 7.19%, including

approximately $1.3 billion of private assets at 7.89%.

The aggregate cost of money for annuity liabilities of 1.81% in

the first quarter of 2023 was up 5 basis points compared to the

fourth quarter of 2022, in line with market costs. The cost of

money in the both quarters reflect a minimal benefit from the

over-hedging of index-linked credits.

FIA SALES INCREASE 23% FROM PRIOR SEQUENTIAL QUARTER

First quarter sales were $1,371 million, of which 70.3%, or $964

million, were in fixed index annuities. Total enterprise FIA sales

increased 23.2% and 9.3% compared to fourth and first quarters of

2022, respectively. Compared to the fourth quarter of 2022, FIA

sales at American Equity Life in the Independent Marketing

Organization (IMO) channel increased 15.5%, while Eagle Life FIA

sales through banks and broker-dealers rose 56.8%.

Backed by our new flow reinsurance agreement with 26North Re,

which became effective February 8th, total enterprise multi-year

fixed rate annuity sales were $404 million in the first

quarter.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

The forward-looking statements in this release or that American

Equity uses on its conference call, such as ability, aim,

anticipate, assume, become, believe, building, can, commit,

constructive, confident, continue, could, drive, estimate, expect,

exposure, forward, future, goal, grow, guidance, intend, likely,

look to, maintain, may, might, model, opportunity, outlook, over

time, plan, potential, prepare, project, ramp, remain risk,

scenario, see, should, signal, strategy, tail wind, target, test,

to be, toward, trends, uncertainty, will, would, and their

derivative forms and similar words, as well as any projections of

future results, are based on assumptions and expectations that

involve risks and uncertainties, including the "Risk Factors" the

company describes in its U.S. Securities and Exchange Commission

filings. The Company's future results could differ, and it has no

obligation to correct or update any of these statements.

CONFERENCE CALL

American Equity will hold a conference call to discuss first

quarter 2023 earnings on Tuesday, May 9, at 10:00 a.m. CT.

The conference call will be webcast live on the Internet.

Investors and interested parties who wish to listen to the webcast

may register to access it on our IR website at

https://ir.american-equity.com. An audio replay will also be

available via the same link on our website shortly after the

completion of the call for 30 days.

The call may also be accessed by telephone. Investors and

interested parties may register for the call with the form

available at this link, and

upon submission (and via follow-up email) will receive the dial-in

number and a unique PIN to access the call. Registration is

available now or any time up to and during the time of the call.

Registration is also available by visiting our IR website at

https://ir.american-equity.com.

ABOUT AMERICAN EQUITY

At American Equity Investment Life Holding Company, our

policyholders work with over 40,000 independent agents and advisors

affiliated with independent market organizations (IMOs), banks and

broker-dealers through our wholly-owned operating subsidiaries.

Advisors and agents choose one of our leading annuity products best

suited for their clients' personal needs to create financial

dignity in retirement. To deliver on its promises to policyholders,

American Equity has re-framed its investment focus — building a

stronger emphasis on insurance liability driven asset allocation

and specializing in alternate, private asset management while

partnering with world renowned, public fixed income asset managers.

American Equity is headquartered in West Des Moines, Iowa with

additional offices in Charlotte, NC and New York, NY. For more

information, please visit www.american-equity.com.

1

Use of non-GAAP financial measures is

discussed in this release in the tables that follow the text of the

release.

2

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income (loss) available

to common stockholders for certain matters where more detail may

help investors better understand, evaluate, and forecast results.

Notable items are further discussed in the tables that follow the

text of the release.

3

Non-trendable items are the impact of

investment yield – additional prepayment income and cost of money

effect of over (under) hedging as shown in our March 31, 2023

financial supplement on page 10, “Spread Results”.

4

For the purposes of this document, all

references to sales are on a gross basis. Gross sales is defined as

sales before the use of reinsurance.

American Equity Investment Life Holding

Company

Unaudited (Dollars in

thousands)

Consolidated

Statements of Operations

Three Months Ended

March 31,

2023

2022

Revenues:

Premiums and other considerations

$

4,137

$

10,078

Annuity product charges

62,591

52,355

Net investment income

561,323

567,423

Change in fair value of derivatives

45,890

(477,519

)

Net realized losses on investments

(27,787

)

(13,127

)

Other revenue

16,394

8,817

Total revenues

662,548

148,027

Benefits and expenses:

Insurance policy benefits and change in

future policy benefits

7,208

13,615

Interest sensitive and index product

benefits

57,911

287,917

Market risk benefits (gains) losses

183,694

191,893

Amortization of deferred sales

inducements

46,601

45,085

Change in fair value of embedded

derivatives

404,440

(1,393,649

)

Interest expense on notes and loan

payable

11,018

6,425

Interest expense on subordinated

debentures

1,336

1,317

Amortization of deferred policy

acquisition costs

68,235

72,969

Other operating costs and expenses

74,004

57,795

Total benefits and expenses

854,447

(716,633

)

Income (loss) before income taxes

(191,899

)

864,660

Income tax expense (benefit)

(36,008

)

185,195

Net income (loss)

(155,891

)

679,465

Less: Net income available to

noncontrolling interests

103

—

Net income (loss) available to American

Equity Investment Life Holding Company stockholders

(155,994

)

679,465

Less: Preferred stock dividends

10,919

10,919

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(166,913

)

$

668,546

Earnings (loss) per common share

$

(2.00

)

$

6.90

Earnings (loss) per common share -

assuming dilution

$

(2.00

)

$

6.83

Weighted average common shares outstanding

(in thousands):

Earnings (loss) per common share

83,417

96,866

Earnings (loss) per common share -

assuming dilution

83,417

97,953

NON-GAAP FINANCIAL MEASURES

In addition to net income (loss) available to common

stockholders, we have consistently utilized non-GAAP operating

income available to common stockholders and non-GAAP operating

income available to common stockholders per common share - assuming

dilution, non-GAAP financial measures commonly used in the life

insurance industry, as economic measures to evaluate our financial

performance. Non-GAAP operating income available to common

stockholders equals net income (loss) available to common

stockholders adjusted to eliminate the impact of items that

fluctuate from quarter to quarter in a manner unrelated to core

operations, and we believe measures excluding their impact are

useful in analyzing operating trends. The most significant

adjustments to arrive at non-GAAP operating income available to

common stockholders eliminate the impact of fair value accounting

for our fixed index annuity business. These adjustments are not

economic in nature but rather impact the timing of reported

results. We believe the combined presentation and evaluation of

non-GAAP operating income available to common stockholders together

with net income (loss) available to common stockholders provides

information that may enhance an investor’s understanding of our

underlying results and profitability.

Reconciliation

from Net Income (Loss) Available to Common Stockholders to Non-GAAP

Operating Income Available to Common Stockholders

Three Months Ended

March 31,

2023

2022

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(166,913

)

$

668,546

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

24,384

13,725

Change in fair value of derivatives and

embedded derivatives

206,202

(847,207

)

Capital markets impact on the change in

fair value of market risk benefits

136,950

118,913

Net investment income

(2,491

)

—

Other revenue

5,969

—

Income taxes

(79,765

)

153,090

Non-GAAP operating income available to

common stockholders

$

124,336

$

107,067

Impact of excluding notable items (a)

$

9,566

$

—

Per common share - assuming dilution:

Net income (loss) available to American

Equity Investment Life Holding Company common stockholders

$

(2.00

)

$

6.83

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Anti-dilutive impact for losses (b)

0.03

—

Net realized losses on financial assets,

including credit losses

0.29

0.14

Change in fair value of derivatives and

embedded derivatives

2.43

(8.65

)

Capital markets impact on the change in

fair value of market risk benefits

1.62

1.21

Net investment income

(0.03

)

—

Other revenue

0.07

—

Income taxes

(0.94

)

1.56

Non-GAAP operating income available to

common stockholders

$

1.47

$

1.09

Impact of excluding notable items (a)

$

0.11

$

—

Notable

Items

Three Months Ended

March 31,

2023

2022

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

$

9,566

$

—

Total notable items (a)

$

9,566

$

—

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income (loss) available

to common stockholders for certain matters where more detail may

help investors better understand, evaluate, and forecast

results.

For the three months ended March 31, 2023,

non-GAAP operating income available to common stockholders would

increase $9.6 million if we were to exclude the impact of notable

items.

(b)

For periods with a loss, dilutive shares

were not included in the calculation as inclusion of such shares

would have an anti-dilutive effect.

Book Value per

Common Share

Q1 2023

Total stockholders’ equity attributable

to American Equity Investment Life Holding Company

$

2,605,485

Equity available to preferred stockholders

(a)

(700,000

)

Total common stockholders' equity (b)

1,905,485

Accumulated other comprehensive (income)

loss (AOCI)

3,036,429

Total common stockholders’ equity

excluding AOCI (b)

4,941,914

Net impact of fair value accounting for

derivatives and embedded derivatives

(1,735,943

)

Net capital markets impact on the fair

value of market risk benefits

(247,806

)

Total common stockholders’ equity

excluding AOCI and the net impact of fair value accounting for

fixed index annuities (b)

$

2,958,165

Common shares outstanding

77,753,194

Book Value per Common Share:

(c)

Book value per common share

$

24.51

Book value per common share excluding AOCI

(b)

$

63.56

Book value per common share excluding AOCI

and the net impact of fair value accounting for fixed index

annuities (b)

$

38.05

(a)

Equity available to preferred stockholders

is equal to the redemption value of outstanding preferred stock

plus share dividends declared but not yet issued.

(b)

Total common stockholders' equity, total

common stockholders' equity excluding AOCI and total common

stockholders' equity excluding AOCI and the net impact of fair

value accounting for fixed index annuities, non-GAAP financial

measures, exclude equity available to preferred stockholders. Total

common stockholders’ equity and book value per common share

excluding AOCI, non-GAAP financial measures, are based on common

stockholders’ equity excluding the effect of AOCI. Since AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale securities, we believe these

non-GAAP financial measures provide useful supplemental

information. Total common stockholders' equity and book value per

common share excluding AOCI and the net impact of fair value

accounting for fixed index annuities, non-GAAP financial measures,

are based on common stockholders' equity excluding AOCI and the net

impact of fair value accounting for fixed index annuities. Since

the net impact of fair value accounting for our fixed index annuity

business is not economic in nature but rather impact the timing of

reported results, we believe these non-GAAP financial measures

provide useful supplemental information.

(c)

Book value per common share including and

excluding AOCI and book value per common share excluding AOCI and

the net impact of fair value accounting for fixed index annuities

are calculated as total common stockholders’ equity, total common

stockholders’ equity excluding AOCI and total common stockholders'

equity excluding AOCI and the net impact of fair value accounting

for fixed index annuities divided by the total number of shares of

common stock outstanding.

NON-GAAP FINANCIAL MEASURES

Average Common Stockholders' Equity and

Return on Average Common Stockholders' Equity

Return on average common stockholders' equity measures how

efficiently we generate profits from the resources provided by our

net assets. Return on average common stockholders' equity is

calculated by dividing net income available to common stockholders,

for the trailing twelve months, by average equity available to

common stockholders. Non-GAAP operating return on average common

stockholders' equity excluding average accumulated other

comprehensive income (AOCI) and average net impact of fair value

accounting for fixed index annuities is calculated by dividing

non-GAAP operating income available to common stockholders, for the

trailing twelve months, by average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities. We exclude AOCI because AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale investments. We exclude the net

impact of fair value accounting for fixed index annuities as the

amounts are not economic in nature but rather impact the timing of

reported results.

Twelve Months Ended

March 31, 2023

Average Common Stockholders' Equity

Attributable to American Equity Investment Life Holding Company,

Excluding Average AOCI and Average Net Impact of Fair Value

Accounting for Fixed Index Annuities

Average total stockholders’ equity

$

4,162,215

Average equity available to preferred

stockholders

(700,000

)

Average equity available to common

stockholders

3,462,215

Average AOCI

1,304,970

Average common stockholders' equity

excluding average AOCI

4,767,185

Average net impact of fair value

accounting for derivatives and embedded derivatives

(1,393,594

)

Average net capital markets impact on the

fair value of market risk benefits

(223,214

)

Average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities

$

3,150,377

Net income available to American Equity

Investment Life Holding Company common stockholders

$

1,041,085

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

58,923

Change in fair value of derivatives and

embedded derivatives

(495,796

)

Capital markets impact on the change in

fair value of market risk benefits

(375,580

)

Net investment income

(1,015

)

Other revenue

11,938

Income taxes

168,983

Non-GAAP operating income available to

common stockholders

$

408,538

Impact of excluding notable items (a)

191,456

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company

Net income available to common

stockholders

30.1

%

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company, Excluding Average AOCI and Average Net Impact of Fair

Value Accounting for Fixed Index Annuities

Non-GAAP operating income available to

common stockholders

13.0

%

Notable

Items

Twelve Months Ended

March 31, 2023

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

$

9,566

Impact of actuarial assumption updates

181,890

Total notable items (a)

$

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income (loss) available

to common stockholders for certain matters where more detail may

help investors better understand, evaluate, and forecast

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005633/en/

Steven Schwartz | Head of Investor Relations American Equity

Investment Life Holding Company® 515-273-3763 |

sschwartz@american-equity.com

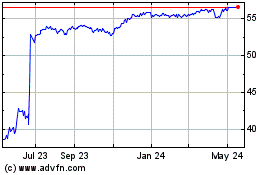

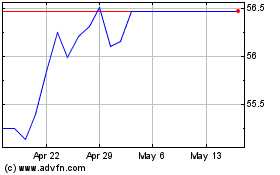

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Feb 2025 to Mar 2025

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Mar 2025