| As

filed with the Securities and Exchange Commission on May 11, 2023 |

|

Registration

No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form F-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

AGNICO EAGLE MINES LIMITED

(Exact name of Registrant as specified in its

charter)

| Ontario,

Canada |

Not

applicable |

(State

or other jurisdiction of incorporation or

organization) |

(I.R.S.

Employer Identification Number) |

145 King Street East, Suite 400

Toronto, ON, Canada

M5C 2Y7

(416) 947-1212

(Address and telephone number of Registrant’s

principal executive offices)

Davies Ward Phillips & Vineberg LLP

900 Third Avenue

24th Floor

New York, NY U.S.A. 10022

(212) 588-5500

(Name, address and telephone number of agent for

service)

Copies to:

Ammar Al-Joundi

Agnico Eagle Mines Limited

145 King Street East, Suite 400

Toronto, ON, Canada

M5C 2Y7

(416) 947-1212 |

Patricia Olasker

Davies Ward Phillips & Vineberg

LLP

155 Wellington Street West

Toronto, ON, Canada

M5V 3J7

(416) 863-0900 |

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are to be offered pursuant to dividend or interest reinvestment plans, please

check the following box. x

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth

company ¨

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

AGNICO EAGLE MINES LIMITED

COMMON SHARES

DIVIDEND REINVESTMENT AND SHARE PURCHASE PLAN

This prospectus covers 5,000,000 common shares,

without par value (“Common Shares”), of Agnico Eagle Mines Limited (the “Company”, “we” or “us”)

that may be purchased under our dividend reinvestment and share purchase plan (the “Plan”). The Plan provides holders of

our Common Shares with a simple and convenient method of investing cash dividends declared on our Common Shares in additional Common

Shares and, separately, making additional cash purchases of Common Shares.

Under

the Plan, holders of our Common Shares resident in Canada, the United States and elsewhere may opt to have all cash dividends declared

on their Common Shares in the Plan reinvested in additional Common Shares and may make additional cash purchases of Common Shares. Because

all Common Shares issued under the Plan will be issued by the Company, there will be no brokerage commissions or service charges. The

purchase price of the Common Shares acquired through the Plan with reinvested dividends will be 95% of the weighted average purchase

price for a board lot (100 shares) of the Common Shares on the Toronto Stock Exchange (the “TSX”) for a period of 20 trading

days on which at least a board lot was traded immediately preceding a dividend payment date (the “Average Market Price”).

The purchase price of Common Shares purchased with optional cash payments will be 100% of the Average Market Price. As dividends will

be denominated in United States dollars, the Average Market Price will be converted to United States dollars using the indicative daily

exchange rate reported by the Bank of Canada on the dividend payment date. For optional cash payments received in United States dollars,

the Average Market Price will be converted to United States dollars at the indicative daily exchange rate reported by the Bank of Canada

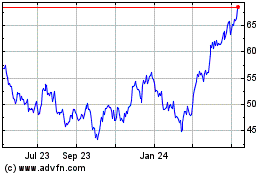

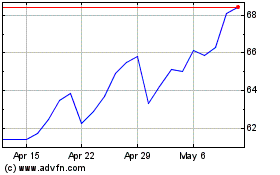

on the dividend payment date. Our Common Shares are listed on both the TSX and the New York Stock Exchange (the “NYSE”) under

the symbol “AEM”. On May 10, 2023, the closing price for our Common Shares on the TSX was C$79.27 and the closing price for

our Common Shares on the NYSE was US$59.24.

We currently pay quarterly dividends on our Common

Shares. The rate at which we pay dividends takes into account all factors that our board of directors considers relevant from the perspective

of the Company, including our available cash flow, financial condition and capital requirements. While we currently expect to pay dividends

on a quarterly basis, any decision to declare dividends is at the discretion of our board.

We cannot estimate anticipated proceeds from

the further sale of Common Shares under the Plan, which will depend on the market price of the Common Shares, the extent of shareholder

participation in the Plan and other factors. We will not pay underwriting commissions in connection with the Plan.

The Plan was initially effective for dividends

declared after June 30, 1999, and was amended on July 27, 2011, July 25, 2012, August 20, 2013 and September 29, 2020.

Investing in our Common Shares involves risks.

See “Risk Factors” and “Forward-Looking Statements” on pages 4 and 5 of this prospectus for

a discussion of certain factors relevant to an investment in our Common Shares.

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION

OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date of this prospectus is May 11, 2023.

TABLE OF CONTENTS

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information

requirements of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”) and, accordingly, we file reports with and

furnish other information to the Securities and Exchange Commission (the “SEC”). Under a multijurisdictional disclosure system

adopted by the United States, such reports and other information may be prepared in accordance with the disclosure requirements of Canada,

which requirements are different from those of the United States. For example, the Company is exempt from the rules under Section 14

of the Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal

shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act.

The SEC maintains an Internet

site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. The Internet address of that site is www.sec.gov. The SEC’s Next-Generation Electronic Data Gathering and Retrieval (“EDGAR”)

system at www.sec.gov contains reports and other information about us and all public documents that we file electronically with the SEC.

Our Internet address is www.agnicoeagle.com. The information contained on our website (or any other website referred to herein)

is not part of this prospectus.

We are also a reporting issuer

in each of the provinces and territories of Canada and are required to file through the Canadian Securities Administrators’ System

for Electronic Document Analysis and Retrieval (“SEDAR”), the Canadian equivalent of the SEC’s EDGAR system, at www.sedar.com,

periodic reports, including audited annual financial statements and unaudited quarterly financial statements, material change reports

and management proxy circulars and related materials for annual and special meetings of our shareholders. In addition, substantially

all of the disclosure materials that we file with the SEC are also available on SEDAR.

We have filed with the SEC

under the U.S. Securities Act of 1933, as amended (the “Securities Act”), a registration statement on Form F-3 relating

to our dividend reinvestment and share purchase plan of which this prospectus is a part. This prospectus does not contain all of the

information set forth in such registration statement, and you should refer to the registration statement and its exhibits to read that

information. For further information about us and our Common Shares, you are encouraged to refer to the registration statement and to

the exhibits filed with it. Statements contained in this prospectus as to the provisions of documents filed as exhibits are not necessarily

complete, and in each instance reference is made to the copy so filed that is included as an exhibit to the registration statement, and

each such statement in this prospectus is qualified in all respects by such reference.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain documents that we file with or furnish to the SEC. This means that we can disclose important

information to you by referring to those documents. The information incorporated by reference is considered to be an important part of

this prospectus, and later information that we file with the SEC will automatically update and supersede that information. References

to this prospectus, unless otherwise stated, include the documents incorporated by reference herein. The following documents, which we

have filed with or furnished to the SEC are specifically incorporated by reference into this prospectus:

All subsequent annual reports

on Form 40-F filed by us pursuant to the Exchange Act prior to the termination of this offering will be incorporated by reference

into this prospectus as of the date of the filing of such annual reports. In addition, we may incorporate by reference into this prospectus

subsequent reports on Form 6-K that we furnish to the SEC prior to the termination of this offering to the extent we expressly provide

therein.

Any statement contained in

a document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent

that a statement contained herein or therein or in any other later filed document that also is incorporated by reference in this prospectus

modifies or supersedes such statement. Any such statement so modified shall not be deemed, except as so modified, to constitute a part

of this prospectus. Any such statement so superseded shall be deemed not to constitute a part of this prospectus.

You may obtain, without charge,

upon written or oral request, a copy of any of the documents incorporated by reference herein, except for the exhibits to such documents

unless delivery of the exhibits is specifically requested. Requests should be directed to our principal executive offices, Attention:

Investor Relations, 145 King Street East, Suite 400, Toronto, Ontario, Canada M5C 2Y7, Telephone Number: 416-947-1212. Additionally,

copies of such documents may be accessed through the “Investor Relations – Financial Information – Investor Centre”

section of our website at www.agnicoeagle.com.

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

IN THE UNITED STATES

We are incorporated under

the laws of the Province of Ontario, Canada. The majority of the Company’s directors and officers and the experts named in this

prospectus are residents of Canada. Also, almost all of the Company’s assets and the assets of these persons are located outside

of the United States. We have appointed an agent for service of process in the United States, but it may be difficult for holders of

Common Shares who reside in the United States to effect service within the United States upon those directors, officers and

experts who are not residents of the United States. As a result, it may be difficult for shareholders to initiate a lawsuit within the

United States against these non-United States residents, or to enforce judgments in the United States against the Company or these persons

that are obtained in a United States court. The Company’s Canadian counsel has advised the Company that a monetary judgment of

a U.S. court predicated solely upon the civil liability provisions of U.S. federal securities laws would likely be enforceable in Canada

if the U.S. court in which the judgment was obtained had a basis for jurisdiction in the matter that was recognized by a Canadian court

for such purposes. The Company cannot provide assurance that this will be the case. It is less certain that an action could be brought

in Canada in the first instance on the basis of liability predicated solely upon such laws.

RISK FACTORS

Before you decide to participate

in the Plan and invest in our Common Shares, you should be aware of the following material risks in making such an investment. You should

consider carefully these risk factors together with all risk factors and information included or incorporated by reference in this prospectus,

including the risk factors set forth in our 2022 Annual Report, before you decide to participate in the Plan and purchase Common Shares.

In addition, you should consult your own financial and legal advisors before making an investment.

Risks Related to Our Common Shares

Holders of Common Shares

are entitled to receive dividends if, as and when declared by our board of directors out of funds legally available for such payments.

Our board of directors may determine at any time to decrease or discontinue the payment of dividends by the Company. The Business

Corporations Act (Ontario) provides that a corporation may not declare or pay a dividend if there are reasonable grounds for believing

that the corporation is, or would be after the payment of the dividend, unable to pay its liabilities as they become due or the realizable

value of its assets would thereby be less than the aggregate of its liabilities and stated capital of all classes of shares of its capital.

Risks Related to the Plan

You will not know the price

of the Common Shares you are purchasing under the Plan at the time you authorize the investment or elect to have your dividends reinvested.

The price of our Common Shares

may fluctuate between the time you decide to purchase Common Shares under the Plan and the time of actual purchase. In addition, during

this time period, you may become aware of additional information that might affect your investment decision, but you may be unable to

revoke your instructions once they are given.

Under the Plan, we reserve

the right to amend, suspend or terminate the Plan at any time. We will send written notice to participants of any material amendment,

suspension or termination. Any amendment of the Plan which materially affects the rights of participants in the Plan will be subject

to the prior approval of the TSX. If the Plan is terminated, the plan agent will remit to participants certificates registered in their

name for whole Common Shares, together with the proceeds from the sale of any fractions of Common Shares. If the Plan is suspended, subsequent

dividends on Commons Shares will be paid in cash and optional cash payments that have not been used to acquire Common Shares as of the

effective date of the suspension will be repaid to the Plan participant.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference herein contain “forward-looking statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995. These statements relate to, among other things, the Company’s plans, objectives, expectations, estimates,

beliefs, strategies and intentions and can generally be identified by the use of words such as “anticipate”, “believe”,

“budget”, “could”, “estimate”, “expect”, “forecast”, “intend”,

“likely”, “may”, “plan”, “project”, “schedule”, “should”, “target”,

“will”, “would” or other variations of these terms or similar words. Forward-looking statements in this prospectus

and the documents incorporated by reference herein include, but are not limited to, the following:

| · | the

Company’s outlook for 2023 and future periods; |

| · | statements

regarding future earnings and the sensitivity of earnings to gold and other metal prices; |

| · | anticipated

levels or trends for prices of gold and by-product metals mined by the Company or for exchange

rates between currencies in which capital is raised, revenue is generated or expenses are

incurred by the Company; |

| · | estimates

of future mineral production and sales; |

| · | estimates

of future costs, including mining costs, total cash costs per ounce, all-in sustaining costs

per ounce, minesite costs per tonne and other costs; |

| · | estimates

of future capital expenditures, exploration expenditures, development expenditures and other

cash needs, and expectations as to the funding thereof; |

| · | statements

regarding the projected exploration, development and exploitation of ore deposits, including

estimates of the timing of such exploration, development and production or decisions with

respect thereto; |

| · | estimates

of mineral reserves and mineral resources and their sensitivities to gold prices and other

factors, mineral grades and mineral recoveries and statements regarding anticipated future

exploration results; |

| · | anticipated

timing of events with respect to the Company’s minesites, mine development projects

and exploration projects; |

| · | estimates

of future costs and other liabilities for environmental remediation; |

| · | statements

regarding anticipated legislation and regulations, including with respect to climate change,

and estimates of the impact thereof on the Company; |

| · | other

anticipated trends with respect to the Company’s capital resources and results of operations; |

| · | statements

regarding the transition to “pillarless” mining at the LaRonde mine to manage

seismicity risks; |

| · | statements

regarding the joint venture with Teck Resources Limited for the San Nicolás copper-zinc

development; and |

| · | statements

regarding the impact of the COVID-19 pandemic and measures taken to reduce the spread of

COVID-19 on the Company’s operations and business. |

Forward-looking statements

are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company as of the date of such

statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and

assumptions of the Company upon which the forward-looking statements herein are based, and which may prove to be incorrect, include,

but are not limited to, the assumptions set out elsewhere herein as well as: that governments, the Company or others do not take other

measures in response to the COVID-19 pandemic or otherwise that, individually or in the aggregate, materially affect the Company’s

ability to operate its business; that cautionary measures taken in connection with the COVID-19 pandemic do not affect productivity;

that measures taken relating to, or other effects of, the COVID-19 pandemic do not affect the Company’s ability to obtain necessary

supplies and deliver them to its mine sites; that there are no significant disruptions affecting the Company’s operations, whether

due to labour disruptions, supply disruptions, damage to equipment, natural or man-made occurrences, pandemics, mining or milling issues,

political changes, title issues, community protests, including by First Nations groups, or otherwise; that permitting, development, expansion

and the ramp up of operations at each of the Company’s mines, mine development projects and exploration projects proceed on a basis

consistent with expectations and that the Company does not change its exploration or development plans relating to such projects; that

the exchange rates between the Canadian dollar, Australian dollar, Euro, Mexican peso and the U.S. dollar will be approximately consistent

with current levels or as set out herein; that prices for gold, silver, zinc and copper will be consistent with the Company’s expectations;

that prices for key mining and construction supplies, including labour costs, remain consistent with the Company’s expectations;

that production meets expectations; that the Company’s current estimates of mineral reserves, mineral resources, mineral grades

and mineral recoveries are accurate; that there are no material delays in the timing for completion of development projects; that seismic

activity at the Company’s operations at LaRonde, Goldex and other properties is as expected by the Company; that the Company’s

current plans to optimize production are successful; and that there are no material variations in the current tax and regulatory environments

that affect the Company.

The forward-looking statements

herein reflect the Company’s views as at the date hereof and involve known and unknown risks, uncertainties and other factors which

could cause the actual results, performance or achievements of the Company or industry results to be materially different from any future

results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the

risk factors set out under “Risk Factors” in the 2022 Annual Report. Given these uncertainties, readers are cautioned not

to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as otherwise required by law,

the Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to

reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement

is based.

CERTAIN MEASURES OF PERFORMANCE

This prospectus discloses

certain financial performance measures, including “total cash costs per ounce”, “all-in sustaining costs per ounce”,

“minesite costs per tonne”, “adjusted net income”, “adjusted net income per share”, “sustaining

capital expenditures”, “development capital expenditures”, “operating margin” and “gross (loss) profit”

that are not standardized measures under International Financial Reporting Standards (“IFRS”). These measures may not be

comparable to similar measures reported by other gold producers. For a reconciliation of these measures to the most directly comparable

financial information presented in the applicable financial statements prepared in accordance with IFRS, see Non-GAAP Financial Performance

Measures in the applicable document.

The total cash costs per

ounce of gold produced (also referred to as total cash costs per ounce) is reported on both a by-product basis (deducting by-product

metal revenues from production costs) and co-product basis (without deducting by-product metal revenues). The total cash costs per ounce

of gold produced is intended to provide information about the cash-generating capabilities of the Company's mining operations. Total

cash costs per ounce of gold produced on a by-product basis is calculated by adjusting production costs as recorded in the consolidated

statements of income (loss) for by-product revenues, inventory production costs, the impact of purchase price allocation in connection

with the merger of equals the Company completed with Kirkland Lake Gold Ltd. (“Kirkland”) on February 8, 2022 (the “Merger”)

to inventory accounting, realized gains and losses on hedges of production costs, operational care and maintenance costs due to COVID-19,

production costs associated with retrospective adjustments from the application of the IAS 16 amendments (which, among other things,

clarified that pre-commercial revenues and production costs could not be recognized in the cost of property, plant and equipment, but

must be recognized in the consolidated statements of income) and other adjustments, which include the costs associated with a 5% in-kind

royalty paid in respect of the Canadian Malartic complex, a 2% in-kind royalty paid in respect of the Detour Lake mine, a 1.5% in-kind

royalty paid in respect of the Macassa mine, as well as smelting, refining and marketing charges and then dividing by the number of ounces

of gold produced. Certain line items such as operational care and maintenance costs due to COVID-19 and realized gains and losses on

hedges of production costs were previously classified as “other adjustments” and have now been disclosed separately to provide

additional detail about these reconciling items, allowing investors to better understand the impacts of such events on the cash operating

costs per ounce and minesite cost per tonne. The total cash costs per ounce of gold produced on a co-product basis is calculated in the

same manner as the total cash costs per ounce of gold produced on a by-product basis, except that no adjustment is made for by-product

metal revenues. Accordingly, the calculation of total cash costs per ounce of gold produced on a co-product basis does not reflect a

reduction in production costs or smelting, refining and marketing charges associated with the production and sale of by-product metals.

Management uses this measure to, and believes it is helpful to investors so they can, understand and monitor the performance of the Company's

mining operations. The Company believes that total cash costs per ounce is useful to help investors understand the costs associated with

gold production and the economics of gold mining. As market prices for gold are quoted on a per ounce basis, using the total cash costs

per ounce of gold produced on a by-product basis measure allows management and investors to assess a mine's cash-generating capabilities

at various gold prices. Management is aware, and investors should note, that these per ounce measures of performance can be affected

by fluctuations in exchange rates and, in the case of total cash costs per ounce of gold produced on a by-product basis, by-product metal

prices. Management compensates for these inherent limitations by using, and investors should also consider, these measures in conjunction

with minesite costs per tonne as well as other data prepared in accordance with IFRS. Management also performs sensitivity analysis in

order to quantify the effects of fluctuating metal prices and exchange rates. Investors should note that total cash costs per ounce are

not reflective of all cash expenditures as they do not include income tax payments, interest costs or dividend payments. This measure

also does not include depreciation or amortization.

The Company’s primary

business is gold production and the focus of its current operations and future development is on maximizing returns from gold production,

with other metal production being incidental to the gold production process. Accordingly, all metals other than gold are considered by-products.

In this prospectus, unless

otherwise indicated, total cash cost per ounce of gold produced is reported on a by-product basis. Total cash costs per ounce of gold

produced is reported on a by-product basis because (i) the majority of the Company’s revenues are from gold (ii) the Company mines

ore, which contains gold, silver, zinc, copper and other metals, (iii) it is not possible to specifically assign all costs to revenues

from the gold, silver, zinc, copper and other metals the Company produce (iv) it is a method used by management and the Board to monitor

operations, and (v) many other gold producers disclose similar measures on a by-product rather than a co-product basis. Investors should

also consider these measures in conjunction with other data prepared in accordance with IFRS.

All-in sustaining costs (“AISC”)

per ounce of gold produced (also referred to as all-in sustaining cost per ounce) on a by-product basis is used to reflect the Company’s

total sustaining expenditures of producing and selling an ounce of gold while maintaining the Company’s current operations. AISC

per ounce is calculated as the aggregate of total cash costs on a by-product basis, sustaining capital expenditures (including capitalized

exploration), general and administrative expenses (including stock options), lease payments related to sustaining assets and reclamation

expenses, and then dividing by the number of ounces of gold produced. These additional costs reflect the additional expenditures that

are required to be made to maintain current production levels. AISC per ounce of gold produced on a co-product basis is calculated in

the same manner as the AISC per ounce of gold produced on a by-product basis, except that the total cash costs on a co-product basis

are used, meaning no adjustment is made for by-product metal revenues. Management is aware, and investors should note, that these per

ounce measures of performance can be affected by fluctuations in foreign exchange rates and, in the case of AISC of gold produced on

a by-product basis, by-product metal prices. Management compensates for this inherent limitations by using these measures in conjunction

with minesite costs per tonne as well as other data prepared in accordance with IFRS. The Company believes AISC per ounce is useful to

help investors understand the costs associated with producing gold, assessing operating performance and the ability to generate free

cashflow and overall value. Investors should note that AISC per ounce is not reflective of all cash expenditures as it does not include

income tax payments, interest costs or dividend payments. This measure also does not include depreciation or amortization. In this prospectus,

unless otherwise indicated, AISC per ounce of gold produced is reported on a by-product basis.

The World Gold Council (“WGC”)

is a non-regulatory market development organization for the gold industry. Although the WGC is not a mining industry regulatory organization,

it has worked closely with its member companies to develop relevant non-GAAP measures. The Company follows the guidance on all-in sustaining

costs released by the WGC in November 2018. Adoption of the all-in sustaining costs per ounce of gold produced measure is voluntary and,

notwithstanding the Company’s adoption of the WGC’s guidance, all-in sustaining costs per ounce of gold produced reported

by the Company may not be comparable to data reported by other gold producers. The Company believes that this measure provides helpful

information about operating performance. However, this non-GAAP measure should be considered together with other data prepared in accordance

with IFRS as it is not necessarily indicative of operating costs or cash flow measures prepared in accordance with IFRS.

Minesite costs per tonne

are calculated by adjusting production costs as recorded in the consolidated statements of income (loss) for inventory production costs,

operational care and maintenance costs due to COVID-19, and other adjustments, and then dividing by tonnage of ore processed (excluding

the tonnage processed prior to the achievement of commercial production). As the total cash costs per ounce of gold produced can be affected

by fluctuations in by-product metal prices and foreign exchange rates, management believes that minesite costs per tonne is useful measure

for investors as it provides additional information regarding the performance of mining operations, eliminating the impact of varying

production levels. Management also uses this measure to determine the economic viability of mining blocks. As each mining block is evaluated

based on the net realizable value of each tonne mined, in order to be economically viable the estimated revenue on a per tonne basis

must be in excess of the minesite costs per tonne. Management is aware, and investors should note, that this per tonne measure of performance

can be affected by fluctuations in processing levels. This inherent limitation may be partially mitigated by using this measure in conjunction

with production costs prepared in accordance with IFRS.

Adjusted net income and adjusted

net income per share are calculated by adjusting the net income as recorded in the consolidated statements of income (loss) for the effects

of certain non-recurring, unusual and other items that the Company believes are not reflective of the Company’s underlying performance

for the reporting period. Adjusted net income is calculated by adjusting net income for foreign currency translation gains or losses,

realized and unrealized gains or losses on derivative financial instruments, impairment loss charges and reversals, environmental remediation,

severance and transaction costs related to acquisitions, purchase price allocations to inventory, income and mining taxes adjustments

as well as other items (which includes changes in estimates of asset retirement obligations at closed sites and gains and losses on the

disposal of assets, self-insurance losses, multi-year donations and integration costs). Adjusted net income per share is calculated by

dividing adjusted net income by the number of shares outstanding on a basic and diluted basis. The Company believes that these generally

accepted industry measures are useful in that they allow for the evaluation of the results of continuing operations and in making comparisons

between periods. Adjusted net income and adjusted net income per share are intended to provide investors with information about the Company’s

continuing income generating capabilities from its core mining business, excluding the above adjustments, which are not reflective of

operational performance. Management uses this measure to, and believes it is helpful to investors so they can, understand and monitor

for the operating performance of the Company in conjunction with other data prepared in accordance with IFRS.

Operating margin is not a

recognized measure under IFRS and this data may not be comparable to data presented by other gold producers. The Company believes that

operating margin is a useful measure that reflects the operating performance of its individual mines associated with the ongoing production

and sale of gold and by-product metals without allocating company-wide overhead (including exploration and corporate development expenses,

amortization of property, plant and mine development, general and administrative expenses, finance costs, gain and losses on derivative

financial instruments, environmental remediation costs, foreign currency translation gains and losses, other expenses and income and

mining tax expenses). This measure is calculated by deducting production costs from revenue from mining operations. In order to reconcile

operating margin to net income as recorded in the consolidated financial statements, the company adds the following items to the operating

margin: Income and mining taxes expense; other expenses (income); care and maintenance expenses; foreign currency translation (gain)

loss; environmental remediation costs; gain (loss) on derivative financial instruments; finance costs; general and administrative expenses;

amortization of property, plant and mine development; exploration and corporate development expenses; and impairment losses (reversals).

Management uses this measure internally for planning purposes and to forecast future operating results. The Company believes that operating

margin is a useful measure that reflects the operating performance of its individual mines associated with the ongoing production and

sale of gold and by-product metals without allocating company-wide overhead (including exploration and corporate development expenses,

amortization of property, plant and mine development, general and administrative expenses, finance costs, gains and losses on derivative

financial instruments, environmental remediation costs, foreign currency translation gains and losses, care and maintenance expenses,

other income and expenses and income and mining tax expenses). This measure is intended to provide investors with additional information

about the Company’s underlying operating results and should be evaluated in conjunction with other data prepared in accordance

with IFRS.

Gross (loss) profit is not

a recognized measure under IFRS and this data may not be comparable to data reported by other gold producers. Gross profit is calculated

by deducting amortization of property plant and mine development from operating margin. The measure represents the amount of revenues

in excess of production costs and amortization of property plant and mine development and is used by management to assess past operational

profitability and performance of the mining operations. Management also uses these measures to, and believes it is useful to investors

so they can monitor the performance of the Company’s mining operations. Management is aware, and investors should note, that the

gross profit measure of performance can be impacted by fluctuations in processing levels, costs of gold produced and metal prices, management

compensates for this inherent limitation by using this measure in conjunction with conjunction with minesite costs per tonne as well

as other data prepared in accordance with IFRS.

Capital expenditures are

classified into sustaining capital expenditures and development capital expenditures. Sustaining capital expenditures are expenditures

incurred during the production phase to sustain and maintain the existing assets so they can achieve constant expected levels of production.

This measure includes expenditures on assets so that they retain their existing productive capacity as well as expenditures that enhance

performance and reliability of the operations. Development capital expenditures are expenditures incurred at new projects and expenditures

at existing operations that are undertaken with the intention to increase net present value through higher production levels or extensions

of mine life above the current plans. Management uses these measures in the capital allocation process and to assess the effectiveness

of its investments, management believes these measures are useful so investors can assess the purpose and effectiveness of the capital

expenditures split between sustaining and development in each reporting period. Management believes that the distinction between sustaining

and development capital expenditures is useful to investors as sustaining capital expenditures are a key component in the calculation

of AISC per ounce. While the Company follows the WGC guidance in its classification of capital expenditures into sustaining or development,

the classification between sustaining and development capital expenditures does not have a standardized definition in accordance with

IFRS and other companies may classify expenditures in a different manner.

This prospectus also contains

information as to estimated future total cash costs per ounce, AISC per ounce and minesite costs per tonne. The estimates are based upon

the total cash costs per ounce, AISC per ounce and minesite costs per tonne that the Company expects to incur to mine gold at its mines

and projects and, consistent with the reconciliation of these actual costs referred to above, do not include production costs attributable

to accretion expense and other asset retirement costs, which will vary over time as each project is developed and mined. It is therefore

not practicable to reconcile these forward-looking non-GAAP financial measures to the most comparable IFRS measure.

Payable production (a non-GAAP

non-financial performance measure) is the quantity of mineral produced during a period contained in products that have been or will be

sold by the Company, whether such products are sold during the period or held as inventories at the end of the period.

Pro-forma production costs,

pro-forma total cash costs per ounce of gold produced (on both co-product and by-product basis) and pro-forma sustaining capital expenditures

are non-GAAP measures that are not standardized financial measures under the financial reporting framework used to prepare the Company’s

financial statements. These measures are calculated in the same manner as the similar non-proforma measures described above and incorporate

the pre-merger period for the Detour Lake, Macassa and Fosterville mines from the beginning of the year to the closing of the Merger

on February 8, 2022, which was included as part of the guidance for the year. Management uses these measures to, and believes it is useful

to investors so they can monitor the performance of the company against guidance, as previous guidance provided by the Company was on

a full year basis for all mines. Management is aware and investors should note that given the nature of the adjustments and the fact

that they pertain to a period before the Company controlled Kirkland certain amounts for the pre-Merger period may not be fully comparable

when aggregated, management compensates for this inherent limitation by using this measure in conjunction with the similar non-proforma

measures for the period.

ESTIMATES OF MINERAL RESERVES AND MINERAL

RESOURCES

The mineral reserve and mineral

resource estimates contained in this prospectus have been prepared in accordance with the Canadian Securities Administrators’ National

Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

Effective February 25, 2019,

the SEC’s disclosure requirements and policies for mining properties are more closely aligned with current industry and global

regulatory practices and standards, including NI 43-101. However, Canadian issuers that report in the United States using the multi-jurisdictional

disclosure system of the Exchange Act (the “MJDS”), such as the Company, may still use NI 43-101 rather than the SEC’s

disclosure requirements when using the SEC’s MJDS registration statement and annual report forms. Accordingly, mineral reserve

and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed

by U.S. companies.

Investors are cautioned that

while the SEC now recognizes “measured mineral resources”, “indicated mineral resources” and “inferred

mineral resources”, investors should not assume that any part or all of the mineral deposits in these categories will ever be converted

into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic

and legal feasibility. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated

mineral resources”, or “inferred mineral resources” that the Company reports herein are or will be economically or

legally mineable.

Further, “inferred

mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It

cannot be assumed that any part or all of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian regulations,

estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in limited circumstances.

Investors are cautioned not to assume that any part or all of an inferred mineral resource exists, or is or will ever be economically

or legally mineable.

The mineral reserve and mineral

resource data contained or incorporated by reference herein are estimates, and no assurance can be given that the anticipated tonnages

and grades will be achieved or that the indicated level of recovery will be realized. The Company does not include equivalent gold ounces

for by-product metals contained in mineral reserves in its calculation of contained ounces and mineral reserves are not reported as a

subset of mineral resources.

THE COMPANY

The Company is a senior Canadian

gold mining company that has produced precious metals since its formation in 1972. The Company’s mines are located in Canada, Australia,

Mexico and Finland, with exploration and development activities in these countries as well as the United States. The Company and its

shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. The Company has declared a cash

dividend every year since 1983.

The Company earns a significant

proportion of its revenue and cash flow from the production and sale of gold in both dore bar and concentrate form. The remainder of

revenue and cash flow is generated by the production and sale of by-product metals, primarily silver, zinc and copper.

Our principal executive offices

are located at 145 King Street East, Suite 400, Toronto, Ontario, Canada M5C 2Y7, and our telephone number is (416) 947-1212.

Our Common Shares are listed

on both the TSX and the NYSE under the symbol “AEM”.

USE OF PROCEEDS

We have no basis for estimating

precisely either the number of Common Shares that may be sold under the Plan or the prices at which such shares may be sold. The amount

of the proceeds that we receive will depend upon the Average Market Price of the Common Shares, the extent of shareholder participation

in the Plan and other factors. We intend to use any proceeds from the sale of Common Shares under the Plan for general corporate purposes.

THE DIVIDEND REINVESTMENT AND SHARE PURCHASE

PLAN

WHAT IS THE PURPOSE OF THE PLAN?

The purpose of the Plan is

to provide holders of our Common Shares with a simple and convenient method of investing cash dividends declared on our Common Shares

in additional Common Shares and to make additional optional cash purchases of Common Shares. Shareholders resident in jurisdictions other

than Canada or the United States may participate in the Plan, subject to any restrictions under the laws of their jurisdiction of residence.

We currently pay quarterly

dividends on our Common Shares. The rate at which we pay dividends takes into account all factors that our board of directors considers

relevant from the perspective of our Company, including our available cash flow, financial condition and capital requirements. While

we currently expect to pay dividends on a quarterly basis, the decision to declare dividends is at the discretion of our board.

We have retained Computershare

Trust Company of Canada (“Computershare” or the “Agent”) to act as agent for the participants in the Plan.

WHAT ARE SOME OF THE ADVANTAGES AND DISADVANTAGES

OF THE PLAN?

Before deciding whether to

participate in the Plan, you should consider the following advantages and disadvantages of the Plan, together with the other information

about us and the Plan contained in this prospectus and incorporated by reference to other documents we have filed with or furnished to

the SEC.

Advantages

| · | The

Plan provides participants with the opportunity to automatically invest the cash dividends,

if any, paid on the Common Shares they hold. |

| · | Common

Shares purchased with cash dividends will be acquired at 95% of the weighted average of the

trading prices for a board lot (100 shares) on the TSX for a period of 20 trading days on

which a board lot was traded immediately preceding each dividend payment date (the “Average

Market Price”). As dividends will be denominated in United States dollars, the Average

Market Price will be converted to United States dollars using the indicative daily exchange

rate reported by the Bank of Canada on the dividend payment date. |

| · | The

Plan allows participants to make optional cash purchases of additional Common Shares. |

| · | Dividends

and optional cash purchases can be fully invested in additional Common Shares because the

Plan permits fractional shares to be credited to your account. Dividends on fractional shares

will be reinvested in additional Common Shares. |

| · | Because

all Common Shares sold under the Plan will be issued by us, participants will not pay any

brokerage commissions in connection with their purchase of Common Shares. |

| · | We

will pay all of the administrative costs associated with the Plan. |

Disadvantages

| · | Participants

will not know the actual number of Common Shares they have acquired through the Plan until

after cash dividends and any optional cash payments are invested. |

| · | Because

the purchase price for Common Shares provided under the Plan will be dependent on the Average

Market Price of the Common Shares immediately preceding each dividend payment date, the prices

participants pay for Common Shares, particularly with optional cash payments, may be higher

than the price at which Common Shares could have been purchased in the open market on dividend

payment dates. |

| · | No

interest will be paid by us or by Computershare on dividends or optional cash payments held

by Computershare pending investment. |

| · | Participants

may not sell or otherwise transfer Common Shares acquired under the Plan until such shares

are withdrawn from the Plan. |

| · | Due

to the manner in which dividends are treated under applicable tax laws, participants in the

Plan may be required to make payments to taxing authorities in connection with their annual

tax obligations. |

Shareholders considering

participating in the Plan should carefully consider the matters noted under “Risk Factors” and “Forward-Looking

Statements” prior to enrolling in the Plan.

WHO IS ELIGIBLE TO PARTICIPATE IN THE PLAN?

The Plan is available to

our shareholders who hold at least one whole Common Share and who reside in Canada or the United States or who reside elsewhere, unless

prohibited by the laws of the country in which they reside. Registered shareholders (which means shareholders who hold Common Shares

in their own name) may enroll directly in the Plan. Beneficial shareholders (which means shareholders who hold their Common Shares through

a broker, investment dealer, financial institution or other nominee) may also be able to participate in the Plan through their nominees

but should contact their broker, investment dealer, financial institution or other nominee to determine the procedure for participation

in the Plan. We cannot require or control an intermediary’s determination as to whether to participate in the Plan or any procedures

adopted by any intermediary with respect to the Plan.

HOW DO I ENROLL IN THE PLAN IF MY COMMON SHARES

ARE REGISTERED IN MY NAME?

If your Common Shares are

registered in your name, you may participate in the Plan immediately by choosing to reinvest the cash dividends, if any, less applicable

Canadian withholding tax, paid on the Common Shares that you hold. See “What are my dividend reinvestment options?”

below for details regarding the different elections you can make under the Plan. You can enroll online through Computershare’s

self-service web portal, Investor Centre, at www.investorcentre.com or by completing a Reinvestment Enrollment—Participant

Declaration Form and returning it to Computershare within the applicable deadlines described below. To obtain an enrollment package,

contact Computershare at 1-800-564-6253 if you are in the United States or Canada or access the Form online at www.investorcentre.com.

Additionally you may access an enrollment form at any time through the “Investor Relations – Stock Information – Dividends”

section of our website at www.agnicoeagle.com.

HOW DO I PARTICIPATE IN THE PLAN IF I AM A

BENEFICIAL SHAREHOLDER?

If you are a beneficial owner

whose Common Shares are held through a broker, investment dealer, financial intermediary or nominee and are therefore registered in a

name other than your own, such as CDS Clearing and Depository Services Inc. (“CDS”) or The Depository Trust Company (“DTC”),

you may participate in the Plan by (i) having those Common Shares transferred into your name directly and then enrolling such Common

Shares in the Plan as a registered holder or (ii) make appropriate arrangements with the broker, investment dealer, financial institution

or other nominee who holds your Common Shares to enroll in the Plan on your behalf. CDS and DTC as a participant will in turn enroll

with the Agent for the applicable dividend record date.

If you are a beneficial owner

of Common Shares and wish to enroll in the Plan through a CDS participant or a DTC participant in respect of your Common Shares registered

through CDS or DTC, appropriate instructions must be received by CDS or DTC, as applicable, from the CDS participant or DTC participant

no later than such deadline as may be established by CDS or DTC from time to time, in order for the instructions to take effect on the

dividend payment date to which that dividend record date relates.

Instructions received by

CDS or DTC after their internal deadline will not take effect until the next following dividend payment date. CDS participants and DTC

participants holding Common Shares on behalf of beneficial owners of Common Shares registered through CDS or DTC must arrange for CDS

or DTC, as applicable, to enroll such Common Shares in the Plan on behalf of such beneficial owners in respect of each dividend payment

date.

If you are a beneficial owner

of Common Shares, you should contact your broker, investment dealer, financial institution or other nominee who holds your Common Shares

to provide instructions regarding your participation in the Plan and to inquire about any applicable deadlines that the nominee may impose

or be subject to and to confirm the fees, if any, the nominee may charge to enroll your Common Shares in the Plan on your behalf or whether

the nominee’s policies might result in any costs otherwise becoming payable by you.

ONCE ENROLLED, HOW DO I REMAIN IN THE PLAN?

Once you have enrolled in

the Plan, you will automatically remain enrolled until you discontinue participation, until we terminate the Plan or if you change your

residence to a country where residents of your new country are not eligible to participate in the Plan (see “May the Plan

be Amended, Suspended or Terminated?”).

CDS or DTC, as applicable,

will provide instructions to Computershare regarding the extent of its participation in the Plan, on behalf of beneficial owners of Common

Shares, in respect of every dividend payment date on which cash dividends otherwise payable to CDS or DTC, as applicable, as shareholder

of record, are to be reinvested under the Plan.

Any Common Shares acquired

outside of the Plan that are not registered in exactly the same name or manner as Common Shares enrolled in the Plan will not be automatically

enrolled in the Plan. If you purchase additional Common Shares outside the Plan and wish to have all Common Shares you own enrolled in

the Plan, you are advised to contact Computershare or the broker, investment dealer, financial institution or other nominee in whose

name your Common Shares are held to ensure that those additional Common Shares also get enrolled.

WHAT ARE MY DIVIDEND REINVESTMENT OPTIONS?

You will not be entitled

to direct reinvestment of less than 100% of all cash dividends on your Common Shares that participate in the Plan, and you will continue

to receive cash dividends, if and when declared, on any of your Common Shares that do not participate in the Plan. You may change your

dividend reinvestment election by contacting Computershare. See ”Who should I contact with questions about the Plan?”

for contact details. In order for any changes in your dividend reinvestment election to take effect for the next dividend payment, if

any, you must notify Computershare in writing at least five business days before the record date for the next dividend.

WHEN WILL MY DIVIDEND REINVESTMENT BEGIN?

The reinvestment of any cash

dividends will begin with the first cash dividend that we pay following your enrollment, but only if Computershare receives a Reinvestment

Enrollment—Participant Declaration Form at least five business days before the record date for that dividend. You can also

enroll online through Computershare’s self-service web portal, Investor Centre, at www.investorcentre.com. If Computershare

receives your Reinvestment Enrollment—Participant Declaration Form, the reinvestment of any cash dividends paid on your Common

Shares, or any changes thereto, will begin with the next dividend, if any, provided that you are still a shareholder on the record date

for the next dividend.

ARE THERE LIMITATIONS ON PARTICIPATION IN THE

PLAN?

You may not transfer the

right to participate in the Plan to another person.

Subject to applicable law

and regulatory policy, we reserve the right to determine, from time to time, a minimum number of Common Shares that a participant must

hold in order to be eligible to participate in, or continue to participate in, the Plan. Without limitation, we further reserve the right

to refuse participation in the Plan to, or terminate the participation of, any person who, in our sole opinion, is participating in the

Plan primarily with a view to arbitrage trading, whose participation in the Plan is part of a scheme to avoid applicable legal requirements

or engage in unlawful behavior or who has been artificially accumulating our securities, for the purpose of taking undue advantage of

the Plan to our detriment. We may also deny the right to participate in the Plan to any person or terminate the participation of any

participant in the Plan if we deem it advisable under any laws or regulations. See “How can I make additional cash purchases

of Common Shares?” for information concerning the minimum amount per investment and the maximum annual investment that may

be made through additional cash purchases under the Plan.

WHEN DOES COMPUTERSHARE REINVEST DIVIDENDS

AND PURCHASE COMMON SHARES?

Dividend Reinvestment

The reinvestment of dividends

to purchase Common Shares will occur on each date that we pay a dividend.

Optional Additional Cash Investments

Common Shares will be purchased

with optional cash payments on each dividend payment date provided that such cash payments are received by Computershare at least five

business days, but not more than 30 calendar days, prior to the applicable dividend payment date. Optional cash payments received by

Computershare on or after this date or more than 30 days prior to a dividend payment date will be remitted to you. Payments in currencies

other than Canadian or U.S. dollars will not be accepted.

HOW DOES COMPUTERSHARE PURCHASE THE COMMON

SHARES?

Dividend Reinvestment

Computershare will use reinvested

cash dividend payments to purchase Common Shares under the Plan for your account directly from us. Your account will then be credited

with the number of Common Shares, including fractional shares, equal to (i) the total amount of cash dividends to be reinvested

on your behalf, less any applicable withholding tax, divided by (ii) the price per Common Share calculated pursuant to the method

described below under “At what price will Common Shares be purchased under the Plan?”

The total amount to be reinvested

in Common Shares on your behalf will depend on the amount of the cash dividend, if any, paid on the number of Common Shares you hold

and have designated for reinvestment under the Plan.

Dividends to be reinvested

in Common Shares pursuant to the Plan will be denominated in U.S. dollars for all participants in the Plan.

Optional Cash Investments

On each dividend payment

date, Computershare will use your optional cash payment, if any, to purchase Common Shares under the Plan for your account directly from

us. Your account will then be credited with the number of Common Shares, including fractional shares, equal to (i) the amount of

your optional cash payment divided by (ii) the price per Common Share calculated pursuant to the method described below under “At

what price will Common Shares be purchased under the Plan”.

WILL MY OPTIONAL CASH PAYMENTS BE USED TO PURCHASE

SHARES IF WE DO NOT PAY A DIVIDEND?

Computershare will use optional

cash payments to purchase Common Shares only on a dividend payment date. If our board of directors has not declared a dividend, and therefore

no dividends will be reinvested pursuant to the Plan, Computershare will not purchase additional Common Shares using optional cash payments

received and will remit the funds to participants by check to each participant’s address of record.

HOW CAN I MAKE ADDITIONAL CASH PURCHASES OF

COMMON SHARES?

Optional Cash Investments

The Proceeds of Crime

(Money Laundering) and Terrorist Financing Act (Canada) and the regulations made thereunder (collectively, the “Act”)

require that the Agent collect and record specific information and take other compliance measures on new or existing Plan participants

who elect to make an optional cash investment under the Plan. In order to acquire Common Shares for additional optional cash investment,

all Plan participants must have passed the requisite requirements under the Act, which are contained in each of the Reinvestment Enrollment

– Participant Declaration Form and the Optional Cash Purchase (OCP) – Participant Declaration Form available online

at www.investorcentre.com. Optional cash payments may be made when enrolling in the Plan by enclosing a check in the minimum amount of

US$500 or the equivalent in Canadian dollars made payable to Computershare or, where applicable, to your broker, investment dealer, financial

institution or other nominee, with a completed Reinvestment Enrollment – Participant Declaration Form or Optional Cash Purchase

(OCP)-Participant Declaration Form. Thereafter, participants may make the optional cash payments by check by using the Combined Pre-Authorized

Debit (PAD) Agreement/Optional Cash Purchase Voucher sent to participants with their respective statements or by enrolling for the pre-authorized

debit (PAD) service using the Agent’s web portal at www.investorcentre.com. Your total optional cash investment in any one

calendar year may not exceed US$20,000 or the Canadian dollar equivalent. Optional cash purchases by all participants in any fiscal year

may not exceed two (2%) percent of our Common Shares outstanding at the beginning of the fiscal year. If necessary, available Common

Shares will be allocated by Computershare on a pro rata basis to avoid exceeding this limit. Interest will not be paid on amounts

held pending investment, and you may cancel an optional cash payment by notifying Computershare in writing at least ten business days

before the applicable dividend payment date.

There is no obligation to

make any optional cash payments under the Plan or to invest the same amount of cash with each optional cash payment.

Checks

Checks for optional cash

investments by registered shareholders should be made payable to “Computershare Trust Company of Canada”. Please include

a completed Optional Cash Purchase (OCP)-Participant Declaration Form or an Optional Cash Purchase — Contribution Voucher

form, which is attached to each statement that you receive. Beneficial owners seeking to make optional cash investments should obtain

instructions for doing so from the nominee holding their shares.

Pre-Authorized Debit

Participants with a bank

account held with a Canadian financial institution and which have already been coded compliant with the Act, are eligible to participate

in the pre-authorized debit (“PAD”) service for the operational cash purchase option of the Plan. Eligible participants may

participate in a one-time and/or recurring PAD by submitting a PAD request through the Computershare’s web portal at www.investorcentre.com.

Computershare must receive the PAD request no later than 10 business days prior to the dividend payment date for which you wish to apply

such debit, otherwise such debit will be applied on the next dividend payment date.

If you authorize a one-time

debit, your bank account will be debited within five to ten business days from the time your request is received. Your monies will be

applied to purchase Common Shares on the next available dividend payment date after the funds have been withdrawn from your account.

Interest will not be paid on amounts held pending investment. If you authorize a quarterly recurring automatic debit, then your account

will be debited on the 6th of March, June, September and December. If the 6th is not a business day, then the debit shall occur on the

next business day.

To modify or cancel a recurring

PAD service, you must notify Computershare in writing or online through the Computershare’s web portal at www.investorcentre.com.

It may take up to 10 business days from the date Computershare receives your instructions for the modification or cancellation to take

effect.

AT WHAT PRICE WILL COMMON SHARES BE PURCHASED

UNDER THE PLAN?

The purchase price of the

Common Shares acquired with cash dividends will be equal to 95% of the Average Market Price. The purchase price of Common Shares acquired

with optional cash investments will be 100% of the Average Market Price. As dividends will be denominated in United States dollars, the

Average Market Price will be converted to United States dollars using the indicative daily exchange rate reported by the Bank of Canada

on the dividend payment date. For optional cash payments received in United States dollars, the Average Market Price will be converted

to United States dollars at the indicative daily exchange rate reported by the Bank of Canada on the dividend payment date.

WHAT ARE THE FEES ASSOCIATED WITH PARTICIPATION

IN THE PLAN?

Participants in the Plan

will not be charged any brokerage commission or other fees in connection with the purchase of Common Shares under the Plan, and we will

pay all costs of administering the Plan. Participants will be responsible for any brokerage commission or other fees incurred in connection

with any requested sales of their Common Shares held in the Plan upon their termination of participation in the Plan. See “How

do I terminate my participation in the Plan?” You should obtain a copy of such charges from Computershare before requesting

the sale of any of your Common Shares held in the Plan.

If you are a beneficial owner

of Common Shares, you should contact your broker, investment dealer, financial institution or other nominee who holds your Common Shares

to confirm the fees, if any, the nominee may charge to enroll your Common Shares in the Plan on your behalf or whether the nominee’s

policies might result in any costs otherwise becoming payable by you.

WHAT HAPPENS IF I OWN FRACTIONAL COMMON SHARES

UNDER THE PLAN?

Computershare will credit

your account with fractions of Common Shares, computed to six decimal places, and with dividends in respect of such fractional shares

to allow full investment of eligible funds.

WHO IS THE PLAN ADMINISTRATOR?

Computershare, as agent for

Plan participants, will administer the Plan. Its responsibilities include:

| · | receiving

eligible funds; |

| · | purchasing

and holding the Common Shares accumulated under the Plan; |

| · | reporting

regularly to the participants; and |

| · | other

duties specified by the Plan. |

Common Shares purchased under

the Plan will be registered in the name of each participant and will be held by Computershare in the accounts of participants. We will

pay certain administrative fees and expenses of Computershare as may, from time to time, be agreed upon by Computershare and us.

WHAT KIND OF REPORTS WILL I RECEIVE AS A PLAN

PARTICIPANT?

Computershare will maintain

a separate account for each participant in the Plan, which will be credited with the number of Common Shares purchased for the participant

on each dividend payment date. You will receive from Computershare a detailed statement of your account following each dividend payment.

This statement will set out the record date, the dividend payment date, the amount of cash dividend paid on your Common Shares, the amount

of any applicable withholding tax, the number of Common Shares purchased through the Plan with respect to such dividend, the purchase

price per Common Share, any optional cash payments you made and the updated total number of Common Shares being held by Computershare

for your account.

If you are not a registered

shareholder and participate in the Plan through arrangements made for you by your broker, investment dealer, financial institution or

other nominee, you may or may not be provided with reports with respect to your participation in the Plan. You should contact your nominee

regarding obtaining information on your account with the Plan.

HOW DO I SELL COMMON SHARES THAT I PURCHASED

THROUGH THE PLAN?

You may not sell, transfer,

pledge or otherwise dispose of any Common Shares held in the Plan. If you are a registered holder of Common Shares and you wish to sell

or otherwise transfer or dispose of any of your Common Shares held in the Plan, you must withdraw the shares from the Plan by completing

the withdrawal portion of the voucher located on the reverse of your statement of account and delivering it to Computershare. Computershare

will issue, in your name, a share certificate representing the Common Shares you wish to sell. Any dividends declared and paid on Common

Shares withdrawn from the Plan will be paid only in cash. Beneficial owners should contact their nominees for instructions on how to

sell their Common Shares.

HOW DO I TERMINATE MY PARTICIPATION IN THE

PLAN?

If you are a registered holder

of Common Shares, you may terminate your participation in the Plan at any time by following the instructions at Computershare’s

Investor Centre web portal, at www.investorcentre.com or by completing the termination portion of the voucher located on the reverse

of your statement of account and delivering it to Computershare. Beneficial owners must make arrangements to terminate their participation

in the Plan through their nominees.

Computershare must receive

your notice of termination at least five business days before the record date for the applicable dividend. If Computershare receives

your termination request after this date, the termination and settlement of your account will not occur until after the dividend payment

date. When a registered holder terminates participation in the Plan, a certificate for the number of whole Common Shares credited to

its account under the Plan will be issued, and a cash payment will be made for any fraction of a Common Share based upon, in the case

of a payment in Canadian dollars, the prevailing market price at the time of the trade on the TSX, and, in the case of a payment in United

States dollars, the prevailing market price at the time of the trade on the NYSE. Thereafter, cash dividends on any Common Shares that

a registered holder continues to hold will be paid to it and will not be reinvested.

Your participation in the

Plan will terminate upon receipt by Computershare of written notice of your death. A certificate for the number of whole Common Shares

credited to your account will be issued in your name or the name of your estate and forwarded, together with a cash payment for any fractional

share based upon, in the case of a payment in Canadian dollars, the prevailing market price at the time of the trade on the TSX, and,

in the case of a payment in United States dollars, the prevailing market price at the time of the trade on the NYSE, to your personal

representative.

Upon terminating participation

in the Plan, you may request that all Common Shares held for your account be sold by completing the termination portion of the voucher

located on the reverse of your statement of account, and delivering it to the Agent. Your shares will be sold through a registered dealer

or stockbroker designated by Computershare as soon as practicable following receipt by Computershare of your instructions to sell your

Common Shares. Such instructions may be delivered to the Agent via the Agent’s web portal at www.investorcentre.com. The proceeds

of the sale, less brokerage commissions, transfer taxes (if any) and withholding taxes (if any) will be paid to you. Your Common Shares

may be commingled with the Common Shares to be sold for other participants in the Plan, in which case the proceeds to each participant

will be based upon the average sale price of all the commingled Common Shares. Computershare will purchase fractional shares at a price

determined in the same manner as in the case of whole Common Shares sold for you and remit the proceeds to you.

All payments of cash under

the Plan will be made in either Canadian or U.S. dollars. Unless a participant requests otherwise in writing, Computershare will make

payments in Canadian dollars where the participant has a Canadian mailing address and in U.S. dollars where the participant has a non-Canadian

mailing address, in each case as such address in shown on its records.

WILL I RECEIVE SHARE CERTIFICATES FOR PLAN

COMMON SHARES?

Generally, all Common Shares

purchased pursuant to the Plan will be held in book-entry form and will be credited to your individual Plan account held by Computershare.

For participants in the Plan holding Common Shares through CDS or DTC participants, such shares will be registered in the name of CDS

(or its nominee) or DTC (or its nominee) as applicable, and held for the benefit of the participants of those depositaries.

A participant may, at any

time upon written request to the Agent, have share certificates issued and registered in the participant’s name for any number

of whole Common Shares owned by such participant under the Plan without terminating participation in the Plan. Otherwise, share certificates

will not be issued to participants for Common Shares in accounts under the Plan. No certificate for a fraction of a Common Share will

be issued.

Accounts under the Plan are

maintained in the names in which the Common Shares of the participants were registered at the time they enrolled in the Plan. Consequently,

certificates for Common Shares will be registered in exactly the same manner when issued.

WILL I BE ABLE TO VOTE PLAN COMMON SHARES?

Plan participants who are