The Indoor Lab Awarded Aeva a Multi-year

Production Program Agreement with Planned Deployments at Major U.S.

Airports, Mass Transit and Other Large Venues

Strong Traction in Passenger Vehicle Programs,

Including Selection by a Major European OEM for its Automated

Vehicle Validation Program, and Advancing on Track with a Global

Top 10 OEM’s Vehicle Program RFQ

Our Partners Torc Robotics and Daimler Truck

using Aeva 4D as the Exclusive Long-Range LiDAR Successfully

Validated Fully Driverless Operations at Highway Speeds

Aeva® (NYSE: AEVA), a leader in next-generation sensing and

perception systems, today announced its third quarter 2024

results.

Key Company Highlights

- Major industrial production win for security applications with

The Indoor Lab to deploy Aeva 4D LiDAR at multiple planned

locations, starting with John F. Kennedy International Airport in

New York and San Francisco International Airport, and followed by

yet to be disclosed airports, mass transit and other large venues

across the U.S.

- A major European passenger vehicle OEM selected Aeva to

leverage 4D LiDAR’s unique velocity data to validate its

next-generation vehicle automation systems

- Continued to advance towards the finalization of the RFQ for a

global top 10 passenger OEM’s vehicle program and ongoing progress

on other passenger RFQs and engagements

- Torc Robotics using Aeva 4D LiDAR as the exclusive long and

ultra-long range LiDAR successfully validated fully driverless

operations at highway speeds up to 65 miles per hour, a key

milestone towards commercialization for Daimler Truck’s autonomous

truck production program by 2027

- Pulled forward first shipments of Aeva Atlas, our

production-intent product, by approximately two quarters in order

to meet growing demand from recent production wins for automotive

and industrial applications; implementing plans to scale production

for next year

“Aeva continues to convert the growing interest in our unique 4D

LiDAR technology to new wins while also achieving critical

milestones for our existing production programs,” said Soroush

Salehian, Co-Founder and CEO at Aeva. “With more industries looking

to adopt FMCW technology, we made the strategic decision and

executed on pulling forward first shipments of Atlas to the third

quarter to meet more of our strong demand. We believe this further

places Aeva on the path to leading the market and expanding our

commercial momentum with additional wins in automotive, industrial

and beyond.”

Third Quarter 2024 Financial Highlights

- Cash, Cash Equivalents and Marketable Securities

- Cash, cash equivalents and marketable securities of $134.8

million and available facility of $125.0 million as of September

30, 2024

- Revenue

- Revenue of $2.3 million in Q3 2024, compared to revenue of $0.8

million in Q3 2023

- GAAP and Non-GAAP Operating Loss*

- GAAP operating loss of $37.9 million in Q3 2024, compared to

GAAP operating loss of $35.5 million in Q3 2023

- Non-GAAP operating loss of $31.4 million in Q3 2024, compared

to non-GAAP operating loss of $30.3 million in Q3 2023

- GAAP and Non-GAAP Net Loss per Share*

- GAAP net loss per share of $0.70 in Q3 2024, compared to GAAP

net loss per share of $0.75 in Q3 2023

- Non-GAAP net loss per share of $0.55 in Q3 2024, compared to

non-GAAP net loss per share of $0.63 in Q3 2023

- Shares Outstanding

- Weighted average shares outstanding of 53.7 million in Q3

2024

*Tables reconciling GAAP to non-GAAP measures are provided at

the end of this release.

Conference Call Details

Aeva will host a conference call and live webcast to discuss

results at 2:00 p.m. PT / 5:00 p.m. ET today, November 6, 2024. The

live webcast and replay can be accessed at investors.aeva.com.

About Aeva Technologies, Inc. (NYSE: AEVA)

Aeva’s mission is to bring the next wave of perception to a

broad range of applications from automated driving to industrial

robotics, consumer electronics, consumer health, security and

beyond. Aeva is transforming autonomy with its groundbreaking

sensing and perception technology that integrates all key LiDAR

components onto a silicon photonics chip in a compact module. Aeva

4D LiDAR sensors uniquely detect instant velocity in addition to 3D

position, allowing autonomous devices like vehicles and robots to

make more intelligent and safe decisions. For more information,

visit www.aeva.com, or connect with us on X or LinkedIn.

Aeva, the Aeva logo, Aeva 4D LiDAR, Aeva Atlas, Aeries, Aeva

Ultra Resolution, Aeva CoreVision, and Aeva X1 are

trademarks/registered trademarks of Aeva, Inc. All rights reserved.

Third-party trademarks are the property of their respective

owners.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Forward-looking

statements in this press release include our beliefs regarding our

financial position and operating performance and business

objectives for 2024, along with our expectations with respect to

the production agreements with Daimler Truck and The Indoor Lab as

well as engagement and deployments with other customers and

partners, our future production plans and our ability to access

capital under our preferred equity facility. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including, but

not limited to: (i) the fact that Aeva is an early stage company

with a history of operating losses and may never achieve

profitability, (ii) Aeva’s limited operating history and limited

history of shipping significant product volumes, (iii) the ability

to implement business plans, forecasts, and other expectations and

to identify and realize additional opportunities, (iv) the ability

for Aeva to have its products selected for inclusion in OEM

products, (v) the ability to manufacture at volumes and costs

needed for commercial programs, (vi) no assurance that any of our

customers will ever complete such testing and validation with us or

that we will receive any billings or revenues in connection with

such programs, (vii) the need to conclude definitive deployment

agreements with potential end customers, including those mentioned

in this release, (viii) that any validation orders will result in

larger orders, (ix) that any programs into which our products may

be designed will result in significant end customer sales, (x) that

any of the locations referenced in this press release will result

in significant deployments of our products, (xi) unforeseen project

delays or product issues, such as difficulties or delays in

shipping, manufacturing or installation, (xii) end customer

acceptance of the platform, (xiii) revenue recognition rules, and

(xiv) other material risks and other important factors that could

affect our financial results that are further described in our

filings with the SEC. Please refer to our filings with the SEC,

including our most recent Form 10-K and Form 10-Q. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Aeva assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise. Aeva does not give any

assurance that it will achieve its expectations.

Non-GAAP Information

In addition to our financial results determined in accordance

with U.S. GAAP, we present non-GAAP operating loss and non-GAAP net

loss per share. “Non-GAAP operating loss” is defined as GAAP

operating loss before stock-based compensation and litigation

settlement, net. “Non-GAAP net loss per share” is defined as

non-GAAP net loss divided by weighted average shares outstanding,

basic and diluted. “Non-GAAP net loss” is defined as GAAP net loss

before stock-based compensation, litigation settlement, net and

change in fair value of warrant liability.

We believe that non-GAAP operating loss and non-GAAP net loss

per share, when taken together with the corresponding U.S. GAAP

financial measures, provide meaningful supplemental information

regarding our performance by excluding certain items that may not

be indicative of our core business, results of operations, or

outlook. We consider non-GAAP operating loss and non-GAAP net loss

per share to be important measures because they help illustrate

underlying trends in our business and our historical operating

performance on a more consistent basis.

However, non-GAAP financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool, and should not be considered in isolation or as a

substitute for financial information presented in accordance with

U.S. GAAP. Non-GAAP financial measures have limitations, including

that they exclude certain expenses that are required under GAAP,

which adjustments reflect the exercise of judgment by management.

In addition, other companies, including companies in our industry,

may calculate similarly-titled non-GAAP financial measures or

ratios differently or may use other financial measures or ratios to

evaluate their performance, all of which could reduce the

usefulness of non-GAAP operating loss and non-GAAP net loss per

share as tools for comparison. Reconciliations are provided at the

end of this release to the most directly comparable financial

measures in accordance with U.S. GAAP. Investors are encouraged to

review our U.S. GAAP financial measures and not to rely on any

single financial measure to evaluate our business.

AEVA TECHNOLOGIES,

INC.

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

30,462

$

38,547

Marketable securities

104,355

182,481

Accounts receivable

575

628

Inventories

2,125

2,374

Other current assets

7,752

5,195

Total current assets

145,269

229,225

Operating lease right-of-use assets

4,713

7,289

Property, plant and equipment, net

11,389

12,114

Intangible assets, net

1,950

2,625

Other noncurrent assets

5,815

6,132

TOTAL ASSETS

$

169,136

$

257,385

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

3,010

$

3,602

Accrued liabilities

4,632

2,648

Accrued employee costs

4,456

6,043

Lease liability, current portion

3,385

3,587

Other current liabilities

18,132

2,524

Total current liabilities

33,615

18,404

Lease liability, noncurrent portion

1,306

3,767

Warrant liability

4,955

6,772

TOTAL LIABILITIES

39,876

28,943

STOCKHOLDERS’ EQUITY:

Common stock

6

5

Additional paid-in capital

704,853

688,124

Accumulated other comprehensive income

(loss)

116

(87

)

Accumulated deficit

(575,715

)

(459,600

)

TOTAL STOCKHOLDERS’ EQUITY

129,260

228,442

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

169,136

$

257,385

AEVA TECHNOLOGIES,

INC.

Condensed Consolidated

Statements of Operations

(Unaudited)

(In thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

2,250

$

810

$

6,369

$

2,701

Cost of revenue (1)

2,971

2,525

9,330

7,715

Gross loss

(721

)

(1,715

)

(2,961

)

(5,014

)

Operating expenses:

Research and development expenses (1)

27,116

23,787

78,324

76,306

General and administrative expenses

(1)

8,456

8,474

25,530

24,020

Selling and marketing expenses (1)

1,583

1,520

5,818

5,603

Litigation settlement, net (2)

—

—

11,500

—

Total operating expenses

37,155

33,781

121,172

105,929

Operating loss

(37,876

)

(35,496

)

(124,133

)

(110,943

)

Interest income

1,770

2,219

6,327

6,508

Other income (expense), net

(1,268

)

39

1,836

68

Loss before income taxes

$

(37,374

)

$

(33,238

)

$

(115,970

)

$

(104,367

)

Income tax provision

22

—

145

—

Net loss

$

(37,396

)

$

(33,238

)

$

(116,115

)

$

(104,367

)

Net loss per share, basic and diluted

$

(0.70

)

$

(0.75

)

$

(2.18

)

$

(2.36

)

Weighted-average shares used in computing

net loss per share, basic and diluted

53,704,039

44,565,164

53,149,318

44,200,670

(1) Includes stock-based compensation as

follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cost of revenue

$

42

$

161

$

208

$

858

Research and development expenses

4,261

3,094

12,439

12,717

General and administrative expenses

1,983

1,654

3,803

3,989

Selling and marketing expenses

219

240

680

589

Total stock-based compensation expense

$

6,505

$

5,149

$

17,130

$

18,153

(2) Relates to the settlement of

litigation related to the de-SPAC transaction and Aeva's

indemnification obligations related thereto.

AEVA TECHNOLOGIES,

INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(In thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(116,115

)

$

(104,367

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

4,042

3,145

Impairment of inventories

883

170

Change in fair value of warrant

liabilities

(1,817

)

(68

)

Stock-based compensation

17,130

18,153

Amortization of right-of-use assets

2,576

2,278

Amortization of premium and accretion of

discount on available-for-sale securities, net

(2,932

)

(2,102

)

Other

298

—

Changes in operating assets and

liabilities:

Accounts receivable

53

2,118

Inventories

(634

)

89

Other current assets

(2,557

)

(147

)

Other noncurrent assets

317

(204

)

Accounts payable

(563

)

(2,402

)

Accrued liabilities

1,985

(6,291

)

Accrued employee costs

(1,626

)

139

Lease liability

(2,663

)

(2,253

)

Other current liabilities

15,608

250

Net cash used in operating activities

(86,015

)

(91,492

)

Cash flows from investing

activities:

Purchase of property, plant and

equipment

(2,969

)

(3,423

)

Purchase of available-for-sale

securities

(62,848

)

(97,642

)

Proceeds from maturities of

available-for-sale securities

144,108

165,597

Net cash provided by investing

activities

78,291

64,532

Cash flows from financing

activities:

Payments of taxes withheld on net settled

vesting of restricted stock units

(438

)

(62

)

Proceeds from exercise of stock

options

77

152

Net cash (used in) provided by financing

activities

(361

)

90

Net decrease in cash and cash

equivalents

(8,085

)

(26,870

)

Beginning cash and cash

equivalents

38,547

67,420

Ending cash and cash

equivalents

$

30,462

$

40,550

AEVA TECHNOLOGIES,

INC.

Reconciliation of GAAP to

Non-GAAP Operating Results

(Unaudited)

(In thousands, except share

and per share data)

Reconciliation from GAAP to non-GAAP

operating loss

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP operating loss

$

(37,876

)

$

(35,496

)

$

(124,133

)

$

(110,943

)

Stock-based compensation

6,505

5,149

17,130

18,153

Litigation settlement, net

—

—

11,500

—

Non-GAAP operating loss

$

(31,371

)

$

(30,347

)

$

(95,503

)

$

(92,790

)

Reconciliation from GAAP to non-GAAP

net loss

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP net loss

$

(37,396

)

$

(33,238

)

$

(116,115

)

$

(104,367

)

Stock-based compensation

6,505

5,149

17,130

18,153

Litigation settlement, net

—

—

11,500

—

Change in fair value of warrant

liability

1,263

(40

)

(1,817

)

(68

)

Non-GAAP net loss

$

(29,628

)

$

(28,129

)

$

(89,302

)

$

(86,282

)

Reconciliation between GAAP and

non-GAAP net loss per share

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Shares used in computing GAAP net loss per

share:

Basic and diluted

53,704,039

44,565,164

53,149,318

44,200,670

GAAP net loss per share

Basic and diluted

$

(0.70

)

$

(0.75

)

$

(2.18

)

$

(2.36

)

Stock-based compensation

0.13

0.12

0.31

0.41

Litigation settlement, net

—

—

0.22

—

Change in fair value of warrant

liability

0.02

(0.00

)

(0.03

)

—

Non-GAAP net loss per share

Basic and diluted

$

(0.55

)

$

(0.63

)

$

(1.68

)

$

(1.95

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106706154/en/

Investors: Andrew Fung investors@aeva.ai

Media: Michael Oldenburg press@aeva.ai

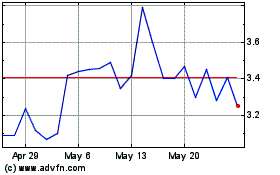

Aeva Technologies (NYSE:AEVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

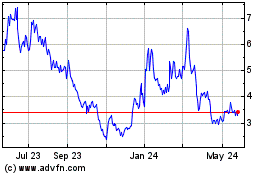

Aeva Technologies (NYSE:AEVA)

Historical Stock Chart

From Nov 2023 to Nov 2024