0000066756FALSE00000667562025-01-242025-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) - January 24, 2025

ALLETE, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Minnesota | 1-3548 | 41-0418150 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer |

| incorporation or organization) | | Identification No.) |

30 West Superior Street

Duluth, Minnesota 55802-2093

(Address of principal executive offices, including zip code)

(218) 279-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, without par value | ALE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 5 - CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On January 24, 2025, ALLETE, Inc. (the “Company”) announced the planned retirement of Steven W. Morris, Senior Vice President and Chief Financial Officer. Mr. Morris, age 63, became Vice President and Chief Accounting Officer in 2016. He served as Controller from 2014 until 2021. In 2022, Mr. Morris assumed his current position, in which he also serves as the Company’s principal financial officer and principal accounting officer. As part of an orderly transition, Mr. Morris will remain at the Company through his retirement date of July 18, 2025.

Readers are cautioned that forward-looking statements should be read in conjunction with disclosures under the heading: “Forward-Looking Statements” located on page 2 of this Current Report on Form 8-K.

1

ALLETE Form 8-K dated January 24, 2025

Forward-Looking Statements

Statements in this report that are not statements of historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there can be no assurance that the expected results will be achieved. Any statements that express, or involve discussions as to, future expectations, risks, beliefs, plans, objectives, assumptions, events, uncertainties, financial performance, or growth strategies (often, but not always, through the use of words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “likely,” “will continue,” “could,” “may,” “potential,” “target,” “outlook” or words of similar meaning) are not statements of historical facts and may be forward-looking.

In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause our actual results to differ materially from those indicated in forward-looking statements made by or on behalf of ALLETE in this Current Report on Form 8-K (Form 8-K), in presentations, on our website, in response to questions or otherwise. These statements are qualified in their entirety by reference to, and are accompanied by, the following important factors, in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements that could cause our actual results to differ materially from those indicated in the forward-looking statements:

•our ability to successfully implement our strategic objectives;

•global and domestic economic conditions affecting us or our customers;

•changes in and compliance with laws and regulations or changes in tax rates or policies;

•changes in rates of inflation or availability of key materials and suppliers;

•the outcome of legal and administrative proceedings (whether civil or criminal) and settlements;

•weather conditions, natural disasters and pandemic diseases;

•our ability to access capital markets, bank financing and other financing sources;

•changes in interest rates and the performance of the financial markets;

•project delays or changes in project costs;

•changes in operating expenses and capital expenditures and our ability to raise revenues from our customers;

•the impacts of commodity prices on ALLETE and our customers;

•our ability to attract and retain qualified, skilled and experienced personnel;

•effects of emerging technology;

•war, acts of terrorism and cybersecurity attacks;

•our ability to manage expansion and integrate acquisitions;

•population growth rates and demographic patterns;

•wholesale power market conditions;

•federal and state regulatory and legislative actions that impact regulated utility economics, including our allowed rates of return, capital structure, ability to secure financing, industry and rate structure, acquisition and disposal of assets and facilities, operation and construction of plant facilities and utility infrastructure, recovery of purchased power, capital investments and other expenses, including present or prospective environmental matters;

•effects of competition, including competition for retail and wholesale customers;

•effects of restructuring initiatives in the electric industry;

•the impacts on our businesses of climate change and future regulation to restrict the emissions of GHG;

•effects of increased deployment of distributed low-carbon electricity generation resources;

•the impacts of laws and regulations related to renewable and distributed generation;

•pricing, availability and transportation of fuel and other commodities and the ability to recover the costs of such commodities;

•our current and potential industrial and municipal customers’ ability to execute announced expansion plans;

•real estate market conditions where our legacy Florida real estate investment is located may deteriorate;

•the success of efforts to realize value from, invest in, and develop new opportunities;

•the risk that Alloy Parent or ALLETE may be unable to obtain governmental and regulatory approvals required for the Merger, or that required governmental and regulatory approvals or agreements with other parties interested therein may delay the Merger, may subject the Merger to or impose adverse conditions or costs, or may cause the parties to abandon the Merger;

•the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or could otherwise cause the failure of the Merger to be consummated on the timeline anticipated; and

•the announcement and pendency of the Merger, during which ALLETE is subject to certain operating restrictions, could have an adverse effect on ALLETE’s businesses, results of operations, financial condition or cash flows.

2

ALLETE Form 8-K dated January 24, 2025

Forward-Looking Statements (Continued)

Additional disclosures regarding factors that could cause our results or performance to differ from those anticipated by this report are discussed in Part I, Item 1A. Risk Factors of ALLETE’s Annual Report on Form 10-K for the year ended December 31, 2023, and Part II, Item 1A. Risk Factors of ALLETE’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which that statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of these factors, nor can it assess the impact of each of these factors on the businesses of ALLETE or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Readers are urged to carefully review and consider the various disclosures made by ALLETE in this Form 8-K and in other reports filed with the SEC that attempt to identify the risks and uncertainties that may affect ALLETE’s business.

3

ALLETE Form 8-K dated January 24, 2025

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| ALLETE, Inc. |

| | |

| | |

| | |

| | |

| | |

| January 24, 2025 | | /s/ Julie L. Padilla |

| | Julie L. Padilla |

| | Vice President, Chief Legal Officer and Corporate Secretary |

4

ALLETE Form 8-K dated January 24, 2025

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

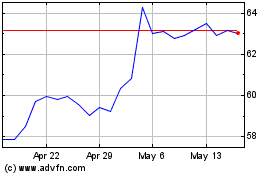

Allete (NYSE:ALE)

Historical Stock Chart

From Dec 2024 to Jan 2025

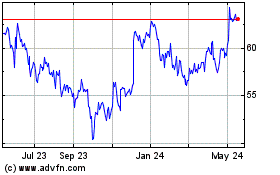

Allete (NYSE:ALE)

Historical Stock Chart

From Jan 2024 to Jan 2025