AssetMark Completes Acquisition of Key TAMP Business Assets in Strategic Alliance with Morningstar Wealth

December 02 2024 - 10:00AM

AssetMark, Inc., a leading provider of wealth management and

technology solutions for financial advisors, today announced the

close of its acquisition of Morningstar Wealth’s Turnkey Asset

Management Platform (TAMP) assets. This acquisition, a key

milestone in the strategic alliance between AssetMark and

Morningstar Wealth, brings approximately $12 billion in assets to

AssetMark’s platform, broadening its array of investment solutions

for financial advisors and their clients.

“The alliance between Morningstar Wealth and our acquisition of

their TAMP assets marks a significant milestone for our company,

our advisors, and their clients,” said Michael Kim, President and

CEO of AssetMark. “We are thrilled to welcome advisors that

currently utilize Morningstar Wealth to the AssetMark Platform.

These advisors will gain access to our expansive suite of renowned

investment solutions, tailored high-net-worth services,

cutting-edge technology, and exceptional service, empowering them

to scale and grow their businesses more efficiently. Additionally,

this alliance will provide our existing advisors with access to an

enhanced range of model portfolios and separately managed accounts

(SMAs) from the Morningstar Investment Management team.”

Lou Maiuri, Chairman and Group CEO of AssetMark Financial

Holdings, Inc., highlighted the strategic importance of the deal:

'This acquisition is a key step in advancing our long-term

strategy, enhancing both our scale and capabilities to deliver even

greater value to our clients. By aligning with respected industry

leaders like Morningstar Wealth, we are further strengthening our

position as a premier provider of comprehensive wealth management

solutions.'"

The collaboration between AssetMark and Morningstar represents a

powerful combination of two trusted names in financial services,

each dedicated to advancing outcomes for financial advisors. As

part of the collaboration, Morningstar Wealth will continue to

serve as a third-party strategist on the AssetMark platform,

enriching the breadth of investment services available.

"We are proud to advance our strategic alliance with AssetMark.

This milestone paves the way for a smooth transition of accounts

and gives advisors access to an enhanced platform experience,” said

Daniel Needham, President of Morningstar Wealth. “Since launching

on AssetMark, our strategies have been well received by advisors,

demonstrating how each firm's distinct strengths and capabilities

are coming together to empower advisor success.”

This acquisition further strengthens AssetMark’s position and

reaffirms its commitment to innovation, scale, and service

excellence. AssetMark looks forward to deepening its collaboration

with Morningstar Wealth as they work together to expand

opportunities for advisors and deliver enhanced outcomes for

investors.

About AssetMark

AssetMark operates a wealth management platform whose mission is

to help financial advisors and their clients. AssetMark, together

with its affiliates AssetMark Trust Company, Voyant, and Adhesion

Wealth Advisor Solutions, serves advisors at every stage of their

journey with flexible, purpose-built solutions that champion client

engagement and drive efficiency. Its ecosystem of solutions equips

advisors with services and capabilities to help deliver better

investor outcomes by enhancing their productivity, profitability,

and client satisfaction.

With a history going back to 1996, AssetMark has over 1,000

employees, and its platform serves over 9,000 financial advisors

and over 263,000 investor households. As of September 30, 2024, the

Company had over $127 billion in platform assets. AssetMark, Inc.

is a Registered Investment Adviser with the U.S. Securities and

Exchange Commission. For more information, please visit

www.assetmark.com. Follow us on LinkedIn.

About Morningstar Wealth

Morningstar Wealth is a global organization dedicated to

empowering the success of advisors and individual investors alike.

Our extensive range of offerings includes the Morningstar

International Wealth Platform; investment strategies such as Model

Portfolios and SMAs managed by the Morningstar Investment

Management team, with $328 billion in assets under management and

advisement as of September 30, 2024; Morningstar Office (portfolio

management software); ByAllAccounts (data aggregation and

enrichment); Morningstar Investor (an all-in-one investment

platform for individual investors that delivers research, portfolio

tracking, and tools to build and monitor wealth); and

Morningstar.com (a leading resource offering market insights,

investment research, and educational content to help investors make

informed decisions across a range of investment topics and

goals).

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent

investment insights in North America, Europe, Australia, and Asia.

The Company offers an extensive line of products and solutions that

serve a wide range of market participants, including individual and

institutional investors in public and private capital markets,

financial advisors and wealth managers, asset managers, retirement

plan providers and sponsors, and issuers of fixed-income

securities. Morningstar provides data and research insights on a

wide range of investment offerings, including managed investment

products, publicly listed companies, private capital markets, debt

securities, and real-time global market data. Morningstar also

offers investment management services through its investment

advisory subsidiaries, with approximately $328 billion in AUMA as

of Sept. 30, 2024. The Company operates through wholly-owned

subsidiaries in 32 countries. For more information, visit

www.morningstar.com/company. Follow Morningstar on X (formerly

known as Twitter) @MorningstarInc.

Media Contacts:

AssetMarkVesselina.Davenport@assetmark.com

Morningstar Wealthnewsroom@morningstar.com

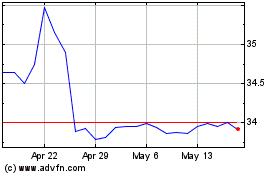

AssetMark Financial (NYSE:AMK)

Historical Stock Chart

From Jan 2025 to Feb 2025

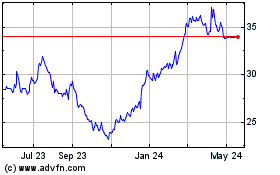

AssetMark Financial (NYSE:AMK)

Historical Stock Chart

From Feb 2024 to Feb 2025