AssetMark Launches Morningstar Wealth Investment Strategies for Financial Advisors

September 12 2024 - 10:30AM

AssetMark, a leading provider of wealth management and technology

solutions for financial advisors, announced the addition of

Morningstar Wealth, a division of independent investing insights

firm Morningstar, as a third-party strategist on the AssetMark

Platform.

This launch will enable financial advisors currently working

with AssetMark to access a wide range of model portfolios and

separately managed accounts (“SMAs”) from the Morningstar

Investment Management team which has approximately $316 billion of

assets under management and advisement (“AUMA”) globally.

Today’s addition of the Morningstar Wealth strategies marks a

further step in the firms' strategic collaboration. As announced in

June 2024, AssetMark agreed to acquire approximately $12 billion in

assets from Morningstar Wealth’s Turnkey Asset Management Platform

(TAMP), with the transaction expected to close in late 2024.

“Morningstar has a long history of providing investors with

industry-leading investment products and insights,” said David

McNatt, EVP of Investment Solutions for AssetMark. “Adding these

strategies to AssetMark’s platform is the latest step in our

mission to empower advisors with the necessary resources and tools

to best serve their clients, and another pivotal moment in our

ongoing collaboration with Morningstar.”

Through this launch, AssetMark adds a suite of Morningstar

Wealth strategies to its platform, providing its advisor clients

with several new options to meet a diverse array of investor needs.

The strategy types include:

- Morningstar Equity SMAs – Employing a

valuation-driven approach to investing, seven SMA strategies cover

various market capitalizations, both international and U.S., and

are built for long-term growth.

- Morningstar ETF Models – Diversified core

portfolios focused on growth, income, and risk alignment with

investors' goals, investing primarily in diversified portfolios of

domestic and international ETFs.

- Morningstar Active/Passive Models – Flexible

strategies across different risk tolerances and tax sensitivities,

which balance active and passive investments with the goal of

helping investors achieve their goals.

“Advisors are central to our mission of empowering investor

success, and since announcing our collaboration in June, we have

been looking forward to making our comprehensive and diversified

strategies available to more advisors through the AssetMark

platform,” said Daniel Needham, President of Morningstar Wealth.

“Our strategies draw on the best of Morningstar and are designed to

help investors reach their financial goals.”

About AssetMarkAssetMark operates a wealth

management platform whose mission is to help financial advisors and

their clients. AssetMark, together with its affiliates AssetMark

Trust Company, Voyant, and Adhesion Wealth Advisor Solutions,

serves advisors at every stage of their journey with flexible,

purpose-built solutions that champion client engagement and drive

efficiency. Its ecosystem of solutions equips advisors with

services and capabilities to help deliver better investor outcomes

by enhancing their productivity, profitability, and client

satisfaction.

With a history going back to 1996, AssetMark has over 1,000

employees, and its platform serves over 9,200 financial advisors

and over 261,000 investor households. As of June 30, 2024, the

Company had over $119 billion in platform assets. AssetMark, Inc.

is a Registered Investment Adviser with the U.S. Securities and

Exchange Commission. For more information, please

visit www.assetmark.com. Follow us on LinkedIn.

About Morningstar WealthMorningstar Wealth is a

global organization dedicated to empowering both advisor and

investor success. Our extensive range of offerings includes the

Morningstar International Wealth Platform, model portfolios managed

by the Morningstar Investment Management team ($316 billion in

assets under management and advisement*), Morningstar Office

(portfolio management software), ByAllAccounts (data aggregation

and enrichment), Morningstar Investor (individual investor

platform), and Morningstar.com. *Includes AUMA for advisory

services offered by certain Morningstar subsidiaries that are

authorized in the jurisdictions in which they operate to provide

investment management and advisory services

About Morningstar Inc.Morningstar, Inc. is a

leading provider of independent investment insights in North

America, Europe, Australia, and Asia. The Company offers an

extensive line of products and solutions that serve a wide range of

market participants, including individual and institutional

investors in public and private capital markets, financial advisors

and wealth managers, asset managers, retirement plan providers and

sponsors, and issuers of fixed-income securities. Morningstar

provides data and research insights on a wide range of investment

offerings, including managed investment products, publicly listed

companies, private capital markets, debt securities, and real-time

global market data. Morningstar also offers investment management

services through its investment advisory subsidiaries, with

approximately $316 billion in AUMA as of June 30, 2024. The Company

operates through wholly-owned subsidiaries in 32 countries. For

more information, visit www.morningstar.com/company. Follow

Morningstar on X (formerly known as Twitter) @MorningstarInc.

Media Contacts:

AssetMarkVesselina Davenport

Vesselina.Davenport@AssetMark.com

Morningstar WealthStephanie

Lerdallnewsroom@morningstar.com

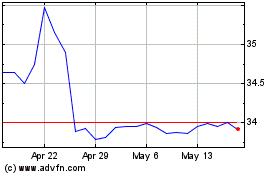

AssetMark Financial (NYSE:AMK)

Historical Stock Chart

From Jan 2025 to Feb 2025

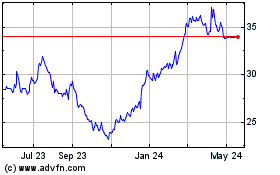

AssetMark Financial (NYSE:AMK)

Historical Stock Chart

From Feb 2024 to Feb 2025