AM Best Affirms Credit Ratings of Ameriprise Financial, Inc. and Its Subsidiaries

November 14 2024 - 1:44PM

Business Wire

AM Best has affirmed the Financial Strength Rating (FSR)

of A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term

ICRs) of “aa-” (Superior) of RiverSource Life Insurance Company

(Minneapolis, MN) and its wholly owned subsidiary, RiverSource Life

Insurance Co. of New York (Albany, NY). These companies represent

the key life/health (L/H) insurance subsidiaries of Ameriprise

Financial, Inc. (Ameriprise) (headquartered in Minneapolis, MN)

[NYSE: AMP] and are collectively known as Ameriprise Financial

Group. Concurrently, AM Best has affirmed the FSR of A (Excellent)

and the Long-Term ICR of “a+” (Excellent) of Ameriprise Captive

Insurance Company (ACIC) (Burlington, VT), a property/casualty

(P/C) subsidiary of Ameriprise. In addition, AM Best has affirmed

the Long-Term ICR of “a-” (Excellent) and the existing Long-Term

Issue Credit Ratings (Long-Term IRs) of Ameriprise. The outlook of

all these Credit Ratings (ratings) is stable. (Please see below for

a detailed listing of the Long-Term IRs.)

The ratings reflect Ameriprise Financial Group’s balance sheet

strength, which AM Best assesses as very strong, as well as its

strong operating performance, favorable business profile and

appropriate enterprise risk management (ERM).

The balance sheet metrics for the RiverSource L/H grouped

companies remain supportive of the very strong balance sheet

strength assessment. On an enterprise level, the L/H group has

taken various steps to de-risk the balance sheet from interest rate

volatility, and this has been accomplished through reinsurance and

the reduction of interest sensitive products. AM Best views the

capabilities of Ameriprise’s mature risk management program

supportive of this strategy. The L/H group’s operating metrics

include continued positive operating net income, growth in

premiums, and a return on equity well above industry averages

(45%). Distribution capabilities are robust throughout the L/H

group’s adviser channel, leaning on an innovative delivery process

and achieving operating efficiencies through its investments in

technology. Ameriprise’s life and annuity business is complemented

by the enterprise’s larger asset management businesses in the

United States (U.S.) and internationally. As a L/H group, the

RiverSource companies not only are diversified geographically

across the U. S., but also offer investment services in addition to

life and annuity products.

The ratings also reflect ACIC’s balance sheet strength, which AM

Best assesses as very strong, as well as its strong operating

performance, limited business profile and appropriate ERM. ACIC

benefits from rating enhancement due to its strategic importance as

a single-parent captive insurance provider.

AM Best assesses ACIC’s business profile as limited due to its

narrow market focus as a single-parent captive serving just one

customer (its parent) for a limited amount of exposure. ACIC

provides various coverages to Ameriprise in the form of errors and

omissions policies, a workers’ compensation deductible

reimbursement policy, fidelity bonds and property terrorism

(nuclear, biological, chemical or radiological). The captive has

generated strong operating performance as demonstrated by its

five-year average pre-tax return on revenue and equity ratios,

which compare favorably with the averages for AM Best’s commercial

casualty composite. Additionally, ACIC benefits from a very low

expense ratio.

The following Long-Term IRs have been affirmed with stable

outlooks:

Ameriprise Financial, Inc. — — “a-” (Excellent) on $500 million

3.00% senior unsecured notes, due 2025 — “a-” (Excellent) on $500

million 2.875% senior unsecured notes, due 2026 — “a-” (Excellent)

on $600 million 5.7% senior unsecured notes, due 2028 — “a-”

(Excellent) on $500 million 4.50% senior unsecured notes, due 2032

— “a-” (Excellent) on $750 million 5.15% senior unsecured notes,

due 2033

The following indicative Long-Term IRs have been affirmed with

stable outlooks under the current shelf registration:

Ameriprise Financial, Inc.— — “a-” (Excellent) on senior

unsecured debt — “bbb+” (Good) on subordinated debt — “bbb” (Good)

on preferred stock

AM Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit

www.ambest.com/captive.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114876074/en/

Omar Mostafa Senior Financial Analyst +1 908

882 1684 omar.mostafa@ambest.com Fred Eslami

Associate Director-P/C +1 908 882 1759

fred.eslami@ambest.com Christopher Sharkey Associate

Director, Public Relations +1 908 882 2310

christopher.sharkey@ambest.com Al Slavin Senior Public

Relations Specialist +1 908 882 2318

al.slavin@ambest.com

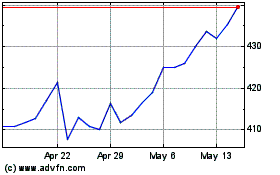

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

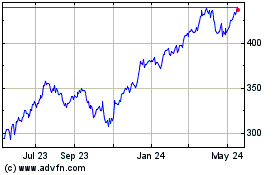

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Nov 2023 to Nov 2024