0001899287FALSEfalse000189928700018992872024-09-192024-09-190001899287us-gaap:CommonStockMember2024-09-192024-09-190001899287ampx:RedeemableWarrantsMember2024-09-192024-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2024

_________________________

Amprius Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

_________________________

| | | | | | | | |

| Delaware | 001-41314 | 98-1591811 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

1180 Page Ave Fremont, California | 94538 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (800) 425-8803

N/A

(Former Name or Former Address, if Changed Since Last Report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, par value $0.0001 per share | | AMPX | | The New York Stock Exchange |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 | | AMPX.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On September 19, 2024, Amprius Technologies, Inc. (the “Company”) received a notice from the New York Stock Exchange (“NYSE”) that it is not in compliance with the continued listing criteria under Section 802.01C of the NYSE Listed Company Manual (the “Listing Rule”), because the average closing price of the Company's common stock was less than $1.00 over a consecutive 30 trading-day period.

Under the Listing Rule, the Company has six months from its receipt of the non-compliance notice to cure the deficiency and regain compliance by having a closing price of at least $1.00 per share on the last trading day of any calendar month during the six-month cure period and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month or the last trading day of the cure period.

During the six-month cure period, the Company's common stock will continue to be listed and traded on the NYSE, subject to the Company's continued compliance with the NYSE's other applicable listing rules.

On September 20, 2024, the Company announced, through a press release, its receipt of the non-compliance notice and its intention to regain compliance. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AMPRIUS TECHNOLOGIES, INC. |

| | |

| Date: September 20, 2024 | By: | /s/ Sandra Wallach |

| | Name: Sandra Wallach |

| | Title: Chief Financial Officer |

Amprius Technologies Receives Continued Listing Standard Notice from NYSE

FREMONT, Calif. – September 20, 2024 – Amprius Technologies, Inc. ("Amprius" or the "Company") (NYSE: AMPX), a leader in next-generation lithium-ion batteries with its Silicon Anode Platform, received a notice (the “Notice”) from the New York Stock Exchange (“NYSE”) on September 19, 2024 that it is not in compliance with the continued listing criteria under Section 802.01C of the NYSE Listed Company Manual (the “Listing Rule”), because the average closing price of the Company's common stock was less than $1.00 over a consecutive 30 trading-day period. The Notice is a notice of deficiency, not delisting, and does not currently affect the listing or trading of the Company’s common stock on the NYSE.

Under the Listing Rule, the Company has six months from its receipt of the non-compliance notice to cure the deficiency and regain compliance by having a closing price of at least $1.00 per share on the last trading day of any calendar month during the six-month cure period and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month or the last trading day of the cure period.

The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards. The NYSE notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards.

Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission (“SEC”).

About Amprius Technologies, Inc.

Amprius Technologies, Inc. is a leading manufacturer of high-energy and high-power lithium-ion batteries, producing the industry’s highest-known energy density cells. The company’s commercially available SiMaxx™ batteries deliver up to 450 Wh/kg and 1,150 Wh/L, with third-party validation of 500Wh/kg and 1,300 Wh/L. Amprius expanded its product portfolio to include the SiCore™ platform in 2024, significantly enhancing its ability to serve additional customer applications. The company’s corporate headquarters is in Fremont, California, where it maintains an R&D lab and a MWh scale manufacturing facility for the fabrication of silicon anodes and cells. To serve customer demand, Amprius entered into several agreements to secure over 500MW/h of contract manufacturing available today and entered into a lease agreement for a gigawatt-hour-scale facility in Brighton, Colorado.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Amprius’ ability to maintain the listing of its common stock on the NYSE, the expected impacts of the Notice and any potential plans to regain compliance with the continued listing standards of the NYSE. These forward-looking statements are subject to a number of risks and uncertainties, including Amprius’ liquidity position; risks related to the rollout of Amprius’ business and the timing of expected business milestones; Amprius’ ability to commercially produce high performing batteries; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius' batteries; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius files from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

Contacts:

Investors

Tom Colton, Greg Bradbury

Gateway Group, Inc.

949-574-3860

IR@amprius.com

Media

Zach Kadletz, Brenlyn Motlagh

Gateway Group, Inc.

949-574-3860

Amprius@gateway-grp.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ampx_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

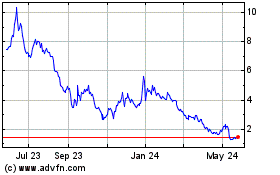

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

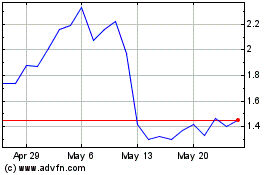

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From Dec 2023 to Dec 2024