- Total revenues of $1.1 billion established a new high for a

third quarter.

- Systemwide comparable sales1 grew 32.1% year-over-year, with

positive average check and guest volume contributing to the

result.

- Digital channel sales (from Mobile App, Delivery and Self-order

Kiosks) rose 16% versus the prior year period and represented 58%

of systemwide sales in third quarter.

- Loyalty Program implemented in three markets, grew to 12.9

million registered members2.

- Consolidated Adjusted EBITDA1 was $125.0 million, with an 11.0%

margin.

- Net Income was $35.2 million in the quarter, or $0.17 per

share.

Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the

“Company”), Latin America and the Caribbean’s largest restaurant

chain and the world’s largest independent McDonald’s franchisee,

today reported unaudited results for the three and nine months

ended September 30, 2024.

Third Quarter 2024 Highlights

- Consolidated revenues totaled $1.1 billion, rising in US

dollars despite weaker local currencies.

- Systemwide comparable sales1 rose 32.1% versus the third

quarter of 2023, including the impact of high inflation in

Argentina over the last 12 months.

- Consolidated Adjusted EBITDA1 reached $125.0 million, with an

11.0% margin.

- Net Income was $35.2 million, with a 3.1% margin.

- Net Debt to Adjusted EBITDA leverage ratio ended the third

quarter at 1.2x, unchanged from the end of the previous

quarter.

- The Company opened 19 Experience of the Future (EOTF)

restaurants in the quarter, all of them free-standing, including 11

in Brazil.

- Digital channel sales grew 16%, including strong performances

in Mobile App and Delivery as well as the continued growth of the

Loyalty Program.

1 For definitions, please refer to page 15

of this document.

2 As of September 30, 2024.

Message from Marcelo Rabach, Chief Executive Officer

Third quarter 2024 results demonstrate the resilience of Arcos

Dorados’ business model. Sales and profitability were strong, as US

dollar revenue set a new high for a third quarter and Adjusted

EBITDA was the second highest for a third quarter. Notably,

comparable guest counts rose for the 14th consecutive quarter, with

broad-based traffic increases in the region. This helped drive

systemwide comp sales growth in all three divisions, despite more

challenging economic and consumer environments.

Our strategy, built around Digital, Delivery and Drive-thru,

remained an unmatched structural competitive advantage across all

markets. In line with McDonald’s global growth strategy, we expect

our restaurant opening pipeline to unlock even more shareholder

value, as we capture the significant expansion opportunity over the

next several years. Our balance sheet is as strong as ever, which

allows us to continue ramping up on the Fourth “D” of our strategy:

Development. With that in mind, moving forward, we will begin

referring to our Four D’s Strategy.

For the year-to-date through September, we opened 56 Experience

of the Future restaurants, including 32 openings in Brazil. And,

since the fourth quarter began, we either opened or broke ground on

all the restaurants we plan to open this year.

I believe there are so many reasons to be excited about the

future for Arcos Dorados and its shareholders, including: operating

the world’s most beloved QSR Brand, executing the successful Four

D’s Strategy, the largest market share in the region’s quick

service restaurant (QSR) industry, by far, and a strong balance

sheet to support future growth. In addition, we operate the

region’s most modernized restaurant portfolio with the highest

number of free-standing locations that we believe will continue to

be a structural competitive advantage for the foreseeable

future.

Finally, we believe we are operating in the world’s best ZIP

code. Latin America has one of the globe’s most underpenetrated QSR

industries. While it is true we have political and economic cycles,

we are the least impacted emerging market when it comes to the

serious geopolitical issues in other parts of the world. And, the

consumer class continues to grow in Latin America’s biggest

markets, which will generate growing demand for the world’s most

popular QSR Brand.

It will be our job to capitalize on these opportunities in the

years to come.

Consolidated Results

Figure 1. AD Holdings Inc Consolidated: Key Financial Results(In

millions of U.S. dollars, except as noted)

3Q23(a)

Currency Translation(b) ConstantCurrencyGrowth(c)

3Q24(a+b+c) % As Reported % Constant Currency

Total Restaurants (Units)

2,339

2,410

Sales by Company-operated Restaurants

1,075.3

(416.5)

424.6

1,083.4

0.8%

39.5%

Revenues from franchised restaurants

49.8

(14.1)

14.6

50.2

0.9%

29.3%

Total Revenues

1,125.1

(430.7)

439.2

1,133.7

0.8%

39.0%

Systemwide Comparable Sales

32.1%

Adjusted EBITDA

129.1

(33.7)

29.6

125.0

-3.2%

22.9%

Adjusted EBITDA Margin

11.5%

11.0%

-0.5 p.p. Net income (loss) attributable to AD

59.7

2.8

(27.3)

35.2

-41.0%

-45.7%

Net income attributable to AD Margin

5.3%

3.1%

-2.2 p.p. No. of shares outstanding (thousands)

210,655

210,663

EPS (US$/Share)

0.28

0.17

Arcos Dorados’ total revenues of $1.1 billion, a new high for a

third quarter, despite the challenging macroeconomic and consumer

environments in the region. Systemwide comparable sales rose 32.1%

with positive contributions from both average check and guest

volumes. The Company’s systemwide comparable sales grew 1.6x

blended inflation for the period, excluding Argentina.

The Three-D’s strategy (Digital, Delivery and Drive-thru), which

has been a key component of the Company’s success in recent years,

continues to be a structural competitive advantage across all

markets, leading to continued market share gains throughout the

Company’s footprint. According to the Company’s proprietary

research, McDonald’s brand gained five points of value share across

its operating footprint in the third quarter compared with the

prior year period.

Sales from Arcos Dorados’ Digital platform rose 16% versus the

prior year and generated 58% of systemwide sales. Guests are

increasingly choosing the seamless experience offered by the Mobile

App’s functionalities, self-order kiosks in restaurants and

McDelivery. Sales growth was strong both inside restaurants as well

as in the Company’s off-premise channels. The latter (Delivery and

Drive-thru) generated 43% of systemwide sales in the third quarter,

combined.

As of September 30, 2024, the Company’s customer relationship

management (CRM) platform had approximately 94 million unique

registered users. As of the end of October 2024, the Loyalty

Program reached almost 14 million registered members across three

markets. The Loyalty Program has become a key driver of customer

engagement, including an increase of 25% in identified sales

compared to the same period last year.

Adjusted EBITDA Bridge

($ million)

Third quarter consolidated Adjusted EBITDA reached $125.0

million, with strong local currency growth offset by an unfavorable

exchange rate environment and the ongoing economic adjustment in

Argentina. This result included a $5.6 million positive impact from

a recovery related to social security contributions in Brazil.

Consolidated Adjusted EBITDA margin was 11.0%. Food and Paper

(F&P) costs remained relatively stable when compared to the

previous year. Leverage in General and Administrative expenses

(G&A) and a better result in the Other Operating Income line

were more than offset by higher Payroll expenses and a deleveraging

of Occupancy & Other Operating expenses as a percentage of

revenue, compared with the prior year period.

Notable items in the Adjusted EBITDA reconciliation

Included in Adjusted EBITDA: The

result for the third quarter of 2024 included a $5.6 million

positive impact from a recovery related to social security

contributions in Brazil.

Excluded from Adjusted EBITDA:

There were no notable items excluded from Adjusted EBITDA in either

the third quarter of 2024 or the third quarter of 2023.

Non-operating Results

Arcos Dorados’ non-operating results for the third quarter

included a net interest expense of $8.5 million and a $2.8 million

gain from non-cash foreign exchange and derivative instruments. The

Company recorded an income tax expense of $39.6 million in the

quarter.

Net income attributable to the Company totaled $35.2 million, or

$0.17 per share, in the third quarter of 2024. Total weighted

average shares amounted to 210,663,057 in the third quarter

compared to 210,654,969 in the prior year’s quarter.

Divisional Results

Brazil Division

Figure 2. Brazil Division: Key Financial Results

(In millions of U.S. dollars, except as noted)

3Q23(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q24(a+b+c) % As

Reported % Constant Currency Total Restaurants

(Units)

1,113

1,160

Total Revenues

439.2

(58.7)

50.9

431.5

-1.8%

11.6%

Systemwide Comparable Sales

6.8%

Adjusted EBITDA

77.8

(10.6)

11.7

79.0

1.5%

15.1%

Adjusted EBITDA Margin

17.7%

18.3%

0.6 p.p.

Brazil’s revenues totaled $431.5 million, strongly impacted by

the material depreciation of the Brazilian real versus the prior

year. Systemwide comparable sales rose 6.8% year-over-year, or 1.6x

inflation in the period, on top of double-digit growth in the prior

year quarter.

Digital sales generated almost 70% of the division’s systemwide

sales in the period. Delivery sales rose 14% in US dollars versus

the prior year and represented 22% of systemwide sales. At the end

of October, the Loyalty program reached almost 13 million users.

The program is proving highly effective in attracting new

customers, recovering previously lost customers, and significantly

boosting frequency. "Meu Méqui" continues to evolve in the country,

strengthening customer engagement and reinforcing the Company’s

commitment to deliver personalized experiences.

Based on Company research, Brazil leads in all its brand

attributes, and achieved an all-time high “Top of Mind” score while

also improving its market-leading score as the “Favorite

Brand.”

These results reflect strong marketing activities during the

quarter. The launch of the “Why I call Méqui, Méqui” campaign

increased guests’ emotional connection with the McDonald’s Brand.

Core product sales benefitted from the “Piscininha de Cheddar” that

leveraged Brazilians’ love for melted cheddar. New flavors in

cones, McFlurry and McShake brought innovation to the Dessert

category in the quarter. The family business also benefitted from

Happy Meal licenses such as “Despicable Me 4”, which featured an

exclusive menu and special activations in restaurants.

As reported Adjusted EBITDA in the division totaled $79.0

million in the quarter, rising 1.5% in US dollars versus the prior

year period, despite the depreciation of the Brazilian currency.

Adjusted EBITDA margin was 18.3%, an expansion of 60 basis points.

Excluding the recovery related to social security contributions,

Brazil’s margin contracted 70 basis points mainly due to higher

F&P costs and Royalty expenses as a percentage of revenue.

North Latin American Division (NOLAD)

Figure 3. NOLAD Division: Key Financial Results

(In millions of U.S. dollars, except as noted)

3Q23(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q24(a+b+c) % As

Reported % Constant Currency Total Restaurants

(Units)

638

649

Total Revenues

295.6

(10.2)

24.3

309.7

4.8%

8.2%

Systemwide Comparable Sales

6.2%

Adjusted EBITDA

32.3

(0.9)

(0.8)

30.7

-5.0%

-2.4%

Adjusted EBITDA Margin

10.9%

9.9%

-1.0 p.p.

As reported revenues in NOLAD totaled $309.7 million, up 4.8%

versus the prior year quarter. Systemwide comparable sales rose

6.2% year-over-year, or 2.3x the division’s blended inflation in

the period, driven by strong guest traffic trends in these

markets.

The Company has been investing in the modernization and

digitalization of its restaurants in the division. As a result,

digital sales continued to grow, and increased 37% versus the prior

year, representing 40% of systemwide sales in the quarter. This

growth reflects significant increases in Delivery and Self-Order

Kiosk sales versus the prior year quarter.

In Costa Rica, the Loyalty Program was launched in May 2024 and

has rapidly gained traction among customers, with over 500,000

members joining within the first five months (representing nearly

10% of the country's population). This swift adoption has played a

crucial role in driving strong identified sales penetration in the

market.

NOLAD’s marketing campaigns focused on menu items designed for

families, with Happy Meal licenses featuring “Yu-Gi-Oh and Hello

Kitty”. Arcos Dorados also developed a collaboration with Korean

pop group BTS to enhance its chicken credentials with Gen Z

customers. The collaboration introduced a variety of Asian-inspired

sauces, special packaging and collectible characters for the iconic

Chicken McNuggets. In Mexico, “Best Burger” has successfully

increased core product sales by highlighting their unique taste and

unmatched quality.

As reported Adjusted EBITDA in the division was $30.7 million in

the quarter, down 5.0% versus the prior year in US dollars, partly

due to the depreciation of local currencies versus the prior year.

Adjusted EBITDA margin declined by 100 basis points in the period,

with lower G&A expenses offset by higher Payroll expenses as

well as an increase in Occupancy & Other Operating expenses as

a percentage of revenue.

South Latin American Division (SLAD)

Figure 4. SLAD Division: Key Financial Results

(In millions of U.S. dollars, except as noted)

3Q23(a) Currency Translation(b)

ConstantCurrencyGrowth(c) 3Q24(a+b+c) % As

Reported % Constant Currency Total Restaurants

(Units)

588

601

Total Revenues

390.3

(361.8)

364.0

392.5

0.6%

93.3%

Systemwide Comparable Sales

90.4%

Adjusted EBITDA

41.8

(41.5)

35.5

35.7

-14.5%

84.9%

Adjusted EBITDA Margin

10.7%

9.1%

-1.6 p.p.

As reported revenues in SLAD totaled $392.5 million, driven by a

90.4% increase in systemwide comparable sales versus the prior

year, which includes the effect of Argentina and Venezuela’s high

inflation rates. Excluding Argentina, the division’s systemwide

comparable sales grew 1.3x blended inflation.

Results in the third quarter reflect a more challenging consumer

environment, as well as significant macroeconomic and currency

headwinds in Argentina, which further pressured the division’s

margin. Against this backdrop, the Company focused on leveraging

its competitive advantages to strengthen value perception and brand

preference among guests, which contributed to increased value share

across the division, including an additional seven points in Chile

and four points in Argentina.

Digital sales represented 57% of systemwide sales in SLAD in the

quarter, mainly due to the strong performance of the Mobile Order

and Pay functionality on the Mobile App and the continued increase

in sales penetration from Delivery.

In Uruguay, the Loyalty Program is delivering outstanding

results. Launched in April 2024, the program boosted identified

sales penetration in this country and drove important increases in

guest frequency. These results underscore the program’s impact on

guest engagement and potential future sales growth.

The Company continued to strengthen the connection with its key

consumer targets through the Copa America soccer tournament, with

special edition sandwiches and campaigns supporting its sponsorship

of national teams. In Argentina, taking advantage of its unique

passion for soccer, the brand took over Copa America with the

“Grand Leyenda” sandwich featuring soccer super star Angel Di

María. Arcos Dorados also continued strengthening the connection

with families, with activations and campaigns related to top

licenses such as “Despicable Me 4”, “Inside Out 2” and “Yu-Gi-Oh

and Hello Kitty”, significantly improving brand attributes related

to families. The Company also kept its focus on improving the value

for money perception, building compelling entry level meals with a

strong customer response.

As reported Adjusted EBITDA totaled $35.7 million in the third

quarter, which includes the negative impact of the depreciation of

local currencies. Adjusted EBITDA margin contracted 160 basis

points versus the prior year quarter. The division’s Adjusted

EBITDA margin was positively impacted by lower F&P costs as a

percentage of revenue, despite the challenging macroeconomic

environment in Argentina. This was offset by higher Payroll and

Occupancy & Other Operating expenses as a percentage of

revenue.

New Unit Development

Figure 5. Total Restaurants (end of period)* September2024 June2024

March2024 December2023 September2023 Brazil

1,160

1,150

1,141

1,130

1,113

NOLAD

649

649

647

647

638

SLAD

601

596

593

584

588

TOTAL

2,410

2,395

2,381

2,361

2,339

* Considers Company-operated and franchised restaurants at

period-end Figure 6. Footprint as of September 30, 2024 Store Type*

TotalRestaurants Ownership McCafes DessertCenters FS IS MS & FC

CompanyOperated Franchised Brazil

610

91

459

1,160

713

447

124

2,003

NOLAD

408

47

194

649

495

154

19

524

SLAD

257

124

220

601

507

94

205

734

TOTAL

1,275

262

873

2,410

1,715

695

348

3,261

* FS: Free-Standing; IS: In-Store; MS: Mall Store; FC: Food Court.

The Company opened 19 Experience of the Future (EOTF)

restaurants in the third quarter of 2024, all of them freestanding

units, including 11 restaurants in Brazil. For the first nine

months of 2024, the Company opened 56 EOTF restaurants, including

53 freestanding units and 32 units in Brazil.

Arcos Dorados continued modernizing existing restaurants and, as

of the end of September 2024, there were 1,560 EOTF restaurants

making up 65% of the Company’s total footprint.

The restaurant development plan remains on track and the Company

expects to meet its full year guidance of 80 to 90 restaurant

openings in 2024.

Balance Sheet & Cash Flow Highlights

Figure 7. Consolidated Debt and Financial Ratios(In thousands of

U.S. dollars, except ratios)

September 30,

December 31,

2024

2023

Total Cash & cash equivalents (i)

120,807

246,767

Total Financial Debt (ii)

719,068

728,093

Net Financial Debt (iii)

598,261

481,326

LTM Adjusted EBITDA

485,340

472,304

Total Financial Debt / LTM Adjusted EBITDA ratio

1.5

1.5

Net Financial Debt / LTM Adjusted EBITDA ratio

1.2

1.0

LTM Net income attributable to AD

146,133

181,274

Total Financial Debt / LTM Net income attributable to AD ratio

4.9

4.0

Net Financial Debt / LTM Net income attributable to AD ratio

4.1

2.7

(i) Total cash & cash equivalents includes short-term

investment (ii)Total financial debt includes short-term debt,

long-term debt, accrued interest payable and derivative instruments

(including the asset portion of derivatives amounting to $68.2

million and $46.5 million as a reduction of financial debt as of

September 30, 2024 and December 31, 2023, respectively). (iii) Net

financial debt equals total financial debt less total cash &

cash equivalents.

As of September 30, 2024, total cash and cash equivalents were

$120.8 million and total financial debt (including the net

derivative instrument position) was $719.1 million. Net debt (total

financial debt minus total cash and cash equivalents) was $598.3

million, up from $481.3 million at the end of 2023, due to the

lower cash balance.

The net debt to Adjusted EBITDA leverage ratio ended the quarter

at 1.2x, unchanged from the end of the second quarter 2024.

Net cash generated from operating activities for the nine months

ended September 30, 2024, totaled $159.8 million. Cash used in net

investing activities totaled $192.2 million, including capital

expenditures of $239.2 million, partially compensated by $45.8

million in net proceeds from financial investments. Net cash used

in financing activities was $42.9 million, which included $37.9

million corresponding to the first three installments of the 2024

dividend.

Recent Developments

Moody’s Rating Action

In October 2024, Moody’s upgraded Arcos Dorados’ corporate and

senior debt rating to Ba1 from Ba2, following Brazil’s sovereign

debt rating action. To support the upgrade, Moody’s cited the

Company's solid marketing position in Latin America as the largest

independent McDonald’s franchisee worldwide. The ratings were also

supported by Arcos Dorados’ liquidity condition and geographic

diversification of the Company's solid restaurant base.

Letter of Credit

On October 25, 2024, the Company signed a letter of credit with

Banco Bilbao Vizcaya Argentaria (“BBVA”) of $45 million.

Additionally, on October 28, 2024, Arcos terminated a $45 million

letter of credit with Credit Suisse.

Revolving Credit Facility

On October 31, 2024, Arcos Dorados signed a $25 million

revolving credit facility with Banco Santander Brasil, that matures

on October 31, 2026. Each loan under this agreement will bear

interest annually at TERM SOFR plus a range between 3.20% and

3.60%.

Third Quarter 2024 Earnings Webcast

A webcast to discuss the information contained in this press

release will be held today, November 13, 2024, at 10:00 a.m. ET. In

order to access the webcast, members of the investment community

should follow this link: Arcos Dorados Third Quarter 2024 Earnings

Webcast.

A replay of the webcast will be available later today in the

investor section of the Company’s website:

www.arcosdorados.com/ir.

Definitions

In analyzing business trends, management considers a variety of

performance and financial measures which are considered to be

non-GAAP including: Adjusted EBITDA, Constant Currency basis,

Systemwide sales, and Systemwide comparable sales growth.

Adjusted EBITDA: In addition to financial measures

prepared in accordance with the general accepted accounting

principles (GAAP), this press release and the accompanying tables

use a non-GAAP financial measure titled ‘Adjusted EBITDA’.

Management uses Adjusted EBITDA to facilitate operating performance

comparisons from period to period.

Adjusted EBITDA is defined as the Company’s operating income

plus depreciation and amortization plus/minus the following

losses/gains included within other operating income (expenses),

net, and within general and administrative expenses on the

statement of income: gains from sale or insurance recovery of

property and equipment, write-offs of long-lived assets, and

impairment of long-lived assets.

Management believes Adjusted EBITDA facilitates

company-to-company operating performance comparisons by backing out

potential differences caused by variations such as capital

structures (affecting net interest expense and other financing

results), taxation (affecting income tax expense) and the age and

book depreciation of facilities and equipment (affecting relative

depreciation expense), which may vary for different companies for

reasons unrelated to operating performance. Figure 8 of this

earnings release includes a reconciliation for Adjusted EBITDA. For

more information, please see Adjusted EBITDA reconciliation in Note

9 – Segment and geographic information – of our financial

statements (6-K Form) filed today with the S.E.C.

Constant Currency basis: refers to amounts calculated

using the same exchange rate over the periods under comparison to

remove the effects of currency fluctuations from this trend

analysis. To better discern underlying business trends, this

release uses non-GAAP financial measures that segregate

year-over-year growth into two categories: (i) currency translation

and (ii) constant currency growth. (i) Currency translation

reflects the impact on growth of the appreciation or depreciation

of the local currencies in which the Company conducts its business

against the US dollar (the currency in which the Company’s

financial statements are prepared). (ii) Constant currency growth

reflects the underlying growth of the business excluding the effect

from currency translation. The Company also calculates variations

as a percentage in constant currency, which are also considered to

be non-GAAP measures, to provide a more meaningful analysis of its

business by identifying the underlying business trends, without

distortion from the effect of foreign currency fluctuations.

Systemwide sales: Systemwide sales represent measures for

both Company-operated and sub-franchised restaurants. While sales

by sub-franchisees are not recorded as revenues by the Company,

management believes the information is important in understanding

its financial performance because these sales are the basis on

which it calculates and records sub-franchised restaurant revenues

and are indicative of the financial health of its sub-franchisee

base.

Systemwide comparable sales growth: this non-GAAP

measure, refers to the change, on a constant currency basis, in

Company-operated and sub-franchised restaurant sales in one period

from a comparable period for restaurants that have been open for

thirteen months or longer (year-over-year basis) including those

temporarily closed. Management believes it is a key performance

indicator used within the retail industry and is indicative of the

success of the Company’s initiatives as well as local economic,

competitive and consumer trends. Sales by sub-franchisees are not

recorded as revenues by the Company.

About Arcos Dorados

Arcos Dorados is the world’s largest independent McDonald’s

franchisee, operating the largest quick service restaurant chain in

Latin America and the Caribbean. It has the exclusive right to own,

operate and grant franchises of McDonald’s restaurants in 20 Latin

American and Caribbean countries and territories with more than

2,400 restaurants, operated by the Company or by its

sub-franchisees, that together employ more than 100 thousand people

(as of 09/30/2024). The Company is also committed to the

development of the communities in which it operates, to providing

young people their first formal job opportunities and to utilize

its Recipe for the Future to achieve a positive environmental

impact. Arcos Dorados is listed for trading on the New York Stock

Exchange (NYSE: ARCO). To learn more about the Company, please

visit the Investors section of our website:

www.arcosdorados.com/ir.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its expectation for revenue generation, its outlook and

guidance for 2024 and the renewal of its Master Franchise Agreement

with McDonald’s. These statements are subject to the general risks

inherent in Arcos Dorados' business. These expectations may or may

not be realized. Some of these expectations may be based upon

assumptions or judgments that prove to be incorrect. In addition,

Arcos Dorados' business and operations involve numerous risks and

uncertainties, many of which are beyond the control of Arcos

Dorados, which could result in Arcos Dorados' expectations not

being realized or otherwise materially affect the financial

condition, results of operations and cash flows of Arcos Dorados.

Additional information relating to the uncertainties affecting

Arcos Dorados' business is contained in its filings with the

Securities and Exchange Commission. The forward-looking statements

are made only as of the date hereof, and Arcos Dorados does not

undertake any obligation to (and expressly disclaims any obligation

to) update any forward-looking statements to reflect events or

circumstances after the date such statements were made, or to

reflect the occurrence of unanticipated events.

Third Quarter 2024 Consolidated Results

Figure 8. Third Quarter 2024 Consolidated

Results

(In thousands of U.S. dollars, except per

share data)

For Three-Months ended For Nine-Months ended

September 30, September 30,

2024

2023

2024

2023

REVENUES Sales by Company-operated restaurants

1,083,447

1,075,328

3,175,578

3,016,212

Revenues from franchised restaurants

50,238

49,782

150,364

140,211

Total Revenues

1,133,685

1,125,110

3,325,942

3,156,423

OPERATING COSTS AND EXPENSES Company-operated restaurant expenses:

Food and paper

(381,175)

(376,023)

(1,115,088)

(1,061,634)

Payroll and employee benefits

(207,894)

(200,904)

(603,392)

(580,286)

Occupancy and other operating expenses

(315,571)

(300,456)

(930,182)

(843,176)

Royalty fees

(67,163)

(65,058)

(198,527)

(180,317)

Franchised restaurants - occupancy expenses

(20,720)

(21,424)

(62,995)

(60,053)

General and administrative expenses

(68,070)

(67,806)

(209,682)

(202,924)

Other operating income (expenses), net

6,733

(2,364)

15,519

4,219

Total operating costs and expenses

(1,053,860)

(1,034,035)

(3,104,347)

(2,924,171)

Operating income

79,825

91,075

221,595

232,252

Net interest expense and other financing results

(8,480)

(4,973)

(39,059)

(26,960)

(Loss) gain from derivative instruments

(516)

900

733

(13,220)

Foreign currency exchange results

3,292

1,286

(15,823)

22,231

Other non-operating income (expenses), net

758

(106)

106

(100)

Income before income taxes

74,879

88,182

167,552

214,203

Income tax expense, net

(39,589)

(28,072)

(76,695)

(87,922)

Net income

35,290

60,110

90,857

126,281

Net income attributable to non-controlling interests

(76)

(389)

(502)

(785)

Net income attributable to Arcos Dorados Holdings Inc.

35,214

59,721

90,355

125,496

Net income attributable to Arcos Dorados Holdings Inc. Margin as

% of total revenues

3.1%

5.3%

2.7%

4.0%

Earnings per share information ($ per share): Basic net

income per common share

$

0.17

$

0.28

$

0.43

$

0.60

Weighted-average number of common shares outstanding-Basic

210,663,057

210,654,969

210,659,761

210,625,346

Adjusted EBITDA Reconciliation Net income attributable to

Arcos Dorados Holdings Inc.

35,214

59,721

90,355

125,496

Net income attributable to non-controlling interests

76

389

502

785

Income tax expense, net

39,589

28,072

76,695

87,922

Other non-operating income (expenses), net

(758)

106

(106)

100

Foreign currency exchange results

(3,292)

(1,286)

15,823

(22,231)

(Loss) gain from derivative instruments

516

(900)

(733)

13,220

Net interest expense and other financing results

8,480

4,973

39,059

26,960

Depreciation and amortization

45,411

37,286

133,704

105,806

Operating charges excluded from EBITDA computation

(237)

759

(2,583)

1,622

Adjusted EBITDA

124,999

129,120

352,716

339,680

Adjusted EBITDA Margin as % of total revenues

11.0 %

11.5 %

10.6 %

10.8 %

Third Quarter 2024 Results by Division

Figure 9. Third Quarter 2024 Consolidated Results by

Division

(In thousands of U.S. dollars)

For Three-Months ended as Constant

For Nine-Months ended as Constant September

30, reported Currency September 30,

reported Currency

2024

2023

Incr/(Decr)% Incr/(Decr)%

2024

2023

Incr/(Decr)% Incr/(Decr)% Revenues Brazil

431,473

439,213

-1.8%

11.6%

1,322,400

1,218,610

8.5%

13.6%

NOLAD

309,684

295,641

4.8%

8.2%

922,610

832,497

10.8%

9.7%

SLAD

392,528

390,256

0.6%

93.3%

1,080,932

1,105,316

-2.2%

105.5%

TOTAL

1,133,685

1,125,110

0.8%

39.0%

3,325,942

3,156,423

5.4%

44.8%

Operating Income (loss)

Brazil

61,157

59,374

3.0%

16.8%

186,393

156,376

19.2%

24.9%

NOLAD

17,337

21,779

-20.4%

-18.4%

48,511

54,136

-10.4%

-11.8%

SLAD

24,175

34,187

-29.3%

66.0%

58,336

97,101

-39.9%

28.6%

Corporate and Other

(22,844)

(24,265)

5.9%

-75.8%

(71,645)

(75,361)

4.9%

-94.6%

TOTAL

79,825

91,075

-12.4%

11.1%

221,595

232,252

-4.6%

-4.7%

Adjusted EBITDA Brazil

79,007

77,848

1.5%

15.1%

240,621

206,450

16.6%

22.1%

NOLAD

30,683

32,308

-5.0%

-2.4%

85,446

84,218

1.5%

0.3%

SLAD

35,705

41,780

-14.5%

84.9%

91,017

119,370

-23.8%

60.4%

Corporate and Other

(20,396)

(22,816)

10.6%

-73.8%

(64,368)

(70,358)

8.5%

-95.1%

TOTAL

124,999

129,120

-3.2%

22.9%

352,716

339,680

3.8%

15.0%

Figure 10. Average Exchange Rate per Quarter* Brazil Mexico

Argentina

3Q24

5.55

18.95

941.31

3Q23

4.88

17.07

312.54

* Local $ per 1 US$

Summarized Consolidated Balance Sheet

Figure 11. Summarized Consolidated Balance Sheets

(In thousands of U.S. dollars)

September 30, December 31,

2024

2023

ASSETS

Current assets Cash and cash equivalents

115,908

196,661

Short-term investments

4,899

50,106

Accounts and notes receivable, net

135,059

147,980

Other current assets (1)

250,123

210,531

Derivative instruments

266

—

Total current assets

506,255

605,278

Non-current assets Property and equipment, net

1,161,066

1,119,885

Net intangible assets and goodwill

67,942

70,026

Deferred income taxes

103,964

98,163

Derivative instruments

67,914

46,486

Equity method investments

16,457

18,111

Leases right of use asset

963,296

954,564

Other non-current assets (2)

74,223

106,725

Total non-current assets

2,454,862

2,413,960

Total assets

2,961,117

3,019,238

LIABILITIES AND EQUITY

Current liabilities Accounts payable

328,168

374,986

Taxes payable (3)

152,866

163,143

Accrued payroll and other liabilities

142,591

142,487

Royalties payable to McDonald’s Corporation

16,886

21,292

Provision for contingencies

1,239

1,447

Interest payable

19,069

7,447

Financial debt (4)

46,621

37,361

Operating lease liabilities

96,031

93,507

Total current liabilities

803,471

841,670

Non-current liabilities Accrued payroll and other

liabilities

21,913

27,513

Provision for contingencies

34,912

49,172

Financial debt (5)

721,558

729,771

Deferred income taxes

6,082

1,166

Operating lease liabilities

859,707

853,107

Total non-current liabilities

1,644,172

1,660,729

Total liabilities

2,447,643

2,502,399

Equity Class A shares of common stock

389,967

389,907

Class B shares of common stock

132,915

132,915

Additional paid-in capital

8,659

8,719

Retained earnings

605,986

566,188

Accumulated other comprehensive loss

(605,957)

(563,081)

Common stock in treasury

(19,367)

(19,367)

Total Arcos Dorados Holdings Inc shareholders’ equity

512,203

515,281

Non-controlling interest in subsidiaries

1,271

1,558

Total equity

513,474

516,839

Total liabilities and equity

2,961,117

3,019,238

(1) Includes "Other receivables", "Inventories" and "Prepaid

expenses and other current assets". (2) Includes "Miscellaneous"

and "Collateral deposits". (3) Includes "Income taxes payable" and

"Other taxes payable". (4) Includes "Short-term debt”, “Current

portion of long-term debt" and "Derivative instruments”. (5)

Includes "Long-term debt, excluding current portion" and

"Derivative instruments".

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113097566/en/

Investor Relations Contact Dan Schleiniger VP of Investor

Relations Arcos Dorados daniel.schleiniger@mcd.com.uy

Media Contact David Grinberg VP of Corporate Communications

Arcos Dorados david.grinberg@mcd.com.uy Follow us on: LinkedIn

Instagram X YouTube

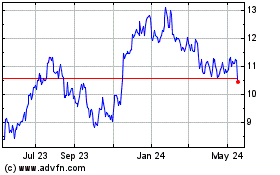

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

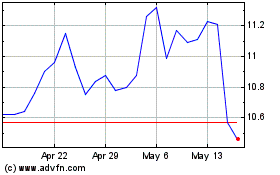

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Dec 2023 to Dec 2024