0001102238false00011022382023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | August 8, 2024 |

American Realty Investors, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Nevada | | 001-15663 | | 75-2847135 |

(State or other jurisdiction of

Incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | |

| 1603 LBJ Freeway, | Suite 800 | Dallas | TX | | 75234 |

| (Address of principal executive offices) | | (Zip Code) |

(469) 522-4200

Registrant’s Telephone Number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 230.425)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Securities Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Securities Act (17 CFR 240.413e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | ARL | NYSE |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 ((17 CFR 230.405 of or Rule 12b-2 of the Securities Act of 1934 (17 CFR 230.405):

☐ Emerging growth company

If an emerging growth company indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition

On August 8, 2024, American Realty Investors, Inc. (“ARL” or the “Company”) announced its operational results for the quarter ended June 30, 2024. A copy of the announcement is attached as Exhibit “99.1.”

The information furnished pursuant to Item 2.02 in this Form 8-K, including Exhibit “99.1” attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934. We undertake no duty or obligation to publicly update or revise the information furnished pursuant to Item 2.02 of this Current Report on Form 8-K.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this Report:

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | Press release dated | August 8, 2024 |

_________________________

* Furnished herewith

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | AMERICAN REALTY INVESTORS, INC. |

| | |

| Dated: August 8, 2024 | By: | /s/ ERIK L. JOHNSON |

| | Erik L. Johnson |

| | President and Chief Executive Officer |

| | | | | | | | |

| NEWS RELEASE | | Contact: |

| | American Realty Investors, Inc. Investor Relations |

| FOR IMMEDIATE RELEASE | | Erik Johnson (469) 522-4200 investor.relations@americanrealtyinvest.com |

American Realty Investors, Inc. reports Earnings for Q2 2024

DALLAS (August 8, 2024) -- American Realty Investors, Inc. (NYSE:ARL) is reporting its results of operations for the three months ended June 30, 2024. For the three months ended June 30, 2024, we reported net income attributable to common shares of $1.2 million or $0.07 per diluted share, compared to net income attributable to common shares of $0.1 million or $0.01 per diluted share for the same period in 2023.

Financial Highlights

•Total occupancy was 78% at June 30, 2024, which includes 93% at our multifamily properties and 48% at our commercial properties.

•On July 10, 2024, we replaced the existing loan on Forest Grove with a $6.6 million loan that bears interest at SOFR plus 1.85% and matures on July 10, 2031.

Financial Results

Rental revenues decreased $0.2 million from $11.4 million for the three months ended June 30, 2023 to $11.2 million for the three months ended June 30, 2024. The decrease in rental revenue is primarily due to an increase of $0.3 million from our multifamily properties offset in part by a decrease of $0.5 million from the commercial properties. The increase in revenue from the multifamily properties is primarily due to the lease-up of Landing on Bayou Cane.

Net operating loss decreased $2.6 million from $3.9 million for the three months ended June 30, 2023 to $1.3 million for the three months ended June 30, 2024. The decrease in net operating loss is primarily due to a decrease in general and administrative expenses associated with our bonds payable, which were repaid in 2023.

Net income attributable to common shares increased $1.0 million from $0.1 million for the three months ended June 30, 2023 to $1.2 million for the three months ended June 30, 2024. The increase in net income is primarily attributed to a decrease in general administrative expenses and loss on extinguishment in debt offset in part by a decrease in interest income.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate investment company, holds a diverse portfolio of equity real estate located across the U.S., including office buildings, apartments, shopping centers, and developed and undeveloped land. The Company invests in real estate through direct ownership, leases and partnerships and invests in mortgage loans on real estate. The Company also holds mortgage receivables. The Company’s primary asset and source of its operating results is its investment in Transcontinental Realty Investors, Inc. (NYSE:TCI). For more information, visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Rental revenues | $ | 11,188 | | | $ | 11,389 | | | $ | 22,467 | | | $ | 22,398 | |

| Other income | 585 | | | 850 | | | 1,205 | | | 1,529 | |

| Total revenue | 11,773 | | | 12,239 | | | 23,672 | | | 23,927 | |

| Expenses: | | | | | | | |

| Property operating expenses | 6,624 | | | 7,031 | | | 13,258 | | | 13,137 | |

| Depreciation and amortization | 3,137 | | | 3,200 | | | 6,309 | | | 6,302 | |

| General and administrative | 1,552 | | | 3,684 | | | 2,960 | | | 6,845 | |

| Advisory fee to related party | 1,737 | | | 2,183 | | | 3,939 | | | 4,588 | |

| Total operating expenses | 13,050 | | | 16,098 | | | 26,466 | | | 30,872 | |

| Net operating loss | (1,277) | | | (3,859) | | | (2,794) | | | (6,945) | |

| Interest income | 4,794 | | | 7,898 | | | 10,527 | | | 16,193 | |

| Interest expense | (1,913) | | | (2,480) | | | (3,835) | | | (5,620) | |

| Gain on foreign currency transactions | — | | | 22 | | | — | | | 993 | |

| Loss on early extinguishment of debt | — | | | (1,710) | | | — | | | (1,710) | |

| Equity in income from unconsolidated joint ventures | 501 | | | 293 | | | 984 | | | 2,712 | |

| Gain on sale or write-down of assets, net | — | | | 188 | | | — | | | 188 | |

| Income tax provision | (614) | | | (49) | | | (1,089) | | | (1,289) | |

| Net income | 1,491 | | | 303 | | | 3,793 | | | 4,522 | |

| Net income attributable to noncontrolling interest | (324) | | | (178) | | | (875) | | | (1,419) | |

| | | | | | | |

| | | | | | | |

| Net income attributable to common shares | $ | 1,167 | | | $ | 125 | | | $ | 2,918 | | | $ | 3,103 | |

| Earnings per share | | | | | | | |

| Basic and diluted | $ | 0.07 | | | $ | 0.01 | | | $ | 0.18 | | | $ | 0.19 | |

| Weighted average common shares used in computing earnings per share | | | | | | | |

| Basic and diluted | 16,152,043 | | | 16,152,043 | | | 16,152,043 | | | 16,152,043 | |

v3.24.2.u1

Cover

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

American Realty Investors, Inc.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-15663

|

| Entity Tax Identification Number |

75-2847135

|

| Entity Address, Address Line One |

1603 LBJ Freeway,

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75234

|

| City Area Code |

469

|

| Local Phone Number |

522-4200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ARL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001102238

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

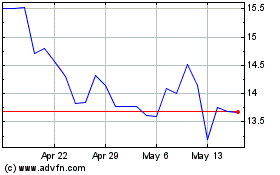

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Oct 2024 to Nov 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Nov 2023 to Nov 2024