American Realty Investors, Inc. Reports Earnings for Quarter Ended September 30, 2024

November 07 2024 - 4:00PM

Business Wire

American Realty Investors, Inc. (NYSE:ARL) is reporting its

results of operations for the three months ended September 30,

2024. For the three months ended September 30, 2024, we reported

net income attributable to common shares of $17.5 million or $1.08

per diluted share, compared to net income attributable to common

shares of $3.0 million or $0.18 per diluted share for the same

period in 2023.

Financial Highlights

- Total occupancy was 79% at September 30, 2024, which includes

95% at our multifamily properties and 48% at our commercial

properties.

- On July 10, 2024, we replaced the existing loan on Forest Grove

with a $6.6 million loan that bears interest at SOFR plus 1.85% and

matures on August 1, 2031.

- On October 18, 2024, we completed a 45,000 square foot lease at

Stanford Center. This is the first new lease at the property

following our major renovation of the property. The new lease

provides a 14% increase in occupancy to the property and a 20%

increase in rent per square foot over recent expired leases at the

property. The lease is expected to commence in April 2025.

- On October 21, 2024, we obtained a $27.5 million construction

loan to finance the development of a 234 unit multifamily property

in Dallas, Texas ("Mountain Creek") that is expected to be

completed in 2026 for a total cost of approximately $49.8 million.

The construction loan on Mountain Creek bears interest at SOFR plus

3.45% and matures on October 20, 2026.

- On October 31, 2024, we paid $23.4 million to resolve all

claims litigation with David Clapper and related entities related

(collectively, the “Clapper") that had been ongoing since 1999. The

matter originally involved a transaction in 1998 in which we were

to acquire eight multifamily properties from the Clapper. As a

result of the settlement, we accrued a loss on real estate

transactions of $23.4 million during the three and nine months

ended September 30, 2024.

Financial Results

Rental revenues decreased $0.8 million from $11.8 million for

the three months ended September 30, 2023 to $11.1 million for the

three months ended September 30, 2024. The decrease in rental

revenue is primarily due to a decrease in occupancy at our

commercial properties. We expect occupancy to improve in the fourth

quarter due to our recently completed 45,000 square foot lease at

Stanford Center.

Net operating loss was $2.1 million for the three months ended

September 30, 2023 and September 30, 2024. Our decrease in revenue

was offset by a decrease in operating expenses, including a

decrease in general and administrative expenses.

Net income attributable to common shares decreased $20.4 million

from net income of $3.0 million for the three months ended

September 30, 2023 to a net loss of $17.5 million for the three

months ended September 30, 2024. The decrease in net income is

primarily attributed to our accrual of the $23.4 million Clapper

Settlement in 2024.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. The Company’s primary

asset and source of its operating results is its investment in

Transcontinental Realty Investors, Inc. (NYSE:TCI). For more

information, visit the Company’s website at

www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (Dollars in thousands, except per

share amounts) (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues: Rental revenues

$

11,074

$

11,838

$

33,541

$

34,236

Other income

533

688

1,738

2,217

Total revenue

11,607

12,526

35,279

36,453

Expenses: Property operating expenses

6,989

7,443

20,247

20,580

Depreciation and amortization

3,120

3,313

9,429

9,615

General and administrative

1,590

1,579

4,550

8,424

Advisory fee to related party

1,971

2,295

5,910

6,883

Total operating expenses

13,670

14,630

40,136

45,502

Net operating loss

(2,063

)

(2,104

)

(4,857

)

(9,049

)

Interest income

5,506

9,008

16,033

25,201

Interest expense

(2,123

)

(1,954

)

(5,958

)

(7,574

)

Gain on foreign currency transactions

-

-

-

993

Loss on early extinguishment of debt

-

-

-

(1,710

)

Equity in income from unconsolidated joint ventures

423

234

1,407

2,946

(Loss) gain on real estate transactions

(23,400

)

(32

)

(23,400

)

156

Income tax provision

4,641

(1,127

)

3,552

(2,416

)

Net (loss) income

(17,016

)

4,025

(13,223

)

8,547

Net income attributable to noncontrolling interest

(444

)

(1,037

)

(1,319

)

(2,456

)

Net (loss) income attributable to the common shares

$

(17,460

)

$

2,988

$

(14,542

)

$

6,091

Earnings per share Basic and diluted

$

(1.08

)

$

0.18

$

(0.90

)

$

0.38

Weighted average common shares used in computing earnings per share

Basic and diluted

16,152,043

16,152,043

16,152,043

16,152,043

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107129132/en/

American Realty Investors, Inc. Investor Relations

Erik Johnson (469) 522-4200

investor.relations@americanrealtyinvest.com

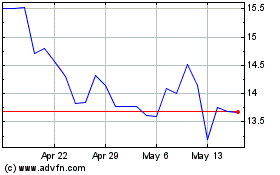

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Nov 2024 to Dec 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Dec 2023 to Dec 2024