Annual recurring revenue (ARR) ended at $257.3

million, growing 22.5% year over year (1)

Full year service revenue of $243.0 million,

growing 20.8% year over year

Record Q4 GAAP service gross margin of 81.2%;

record non-GAAP service gross margin of 81.7%

Full year free cash flow (FCF) of $48.6 million

with FCF margin of 9.5%(2)

Arlo Technologies, Inc. (NYSE: ARLO), a leading smart home

security platform company, today reported financial results for the

fourth quarter and full year ended December 31, 2024.

“Arlo’s strategy is delivering outstanding results, expanding

our subscriber base and producing strong ARR and profitability

growth in 2024, with ARR and service revenue growth both exceeding

20% and a 390-basis point increase in non-GAAP service gross

margin. Arlo achieved 37% growth in free cash flow, reaching a free

cash flow margin of almost 10% for the full year,” said Matthew

McRae, Chief Executive Officer of Arlo Technologies. “Our

innovation is paying dividends as the launch of AI-driven Arlo

Secure 5.0 generated more premium subscriber additions than any

other platform launch in our history. With our new strategic

partnerships, we will further differentiate Arlo in the smart

security space and position our business to accelerate our ARR

growth trajectory and achieve our long-range targets.”

Q4 2024 Summary

- Ended the quarter with ARR(1) of $257.3 million, growing 22.5%

year over year.

- Service revenue of $64.1 million, an increase of 14.7% year

over year; accounted for 53% of total revenues.

- GAAP service gross margin of 81.2% and record non-GAAP service

gross margin of 81.7%, each up 730 basis points year over

year.

- GAAP gross margin of 36.9% up 190 basis points year over year;

non-GAAP gross margin of 37.5% up 170 basis points year over

year.

- Cumulative paid accounts increased to 4.6 million, growing

63.5% year over year.

- Ended with cash and cash equivalents and short-term investments

balance of $151.5 million, up $15.0 million year over year.

FY2024 Summary

- Service revenue of $243.0 million, growing 20.8% year over

year.

- GAAP service gross margin of 77.5%, up 380 basis points year

over year; non-GAAP service gross margin of 78.1%, up 390 basis

points year over year.

- GAAP gross margin of 36.7%, up 260 basis points year over year;

non-GAAP gross margin of 37.6% up 260 basis points year over

year.

- GAAP operating loss of $34.9 million; non-GAAP operating income

of $37.9 million, an increase of 52% year over year.

- Free cash flow of $48.6 million, up 37% year over year with FCF

margin of 9.5%, up 230 basis points year over year.

Business Highlights

- Executed share buyback program repurchasing $4.4 million of

shares at an average price of $11.67;

- Announced a strategic partnership agreement with Origin AI to

become the exclusive global provider of advanced security solutions

that incorporate wireless sensing technology;

- Announced a strategic partnership with RapidSOS that ensures a

quicker and more informed response during emergencies;

- Expanded our partnership with Samsung to bring new home

security features to the SmartThings community.

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

and per share data)

Revenue

$

121,572

$

137,667

$

135,093

$

510,886

$

491,176

GAAP Gross Margin

36.9

%

35.2

%

35.0

%

36.7

%

34.1

%

Non-GAAP Gross Margin (3)

37.5

%

36.0

%

35.8

%

37.6

%

35.0

%

GAAP Net Income (Loss) per Share - Basic

and Diluted

$

(0.05

)

$

(0.04

)

$

0.01

$

(0.31

)

$

(0.24

)

Non-GAAP Net Income per Share - Basic and

Diluted (3)

$

0.10

$

0.11

$

0.11

$

0.40

$

0.28

_________________________

(1)

ARR represents and is defined as the

annualized paid service revenue we expect to recognize from

subscription contracts, as calculated by taking the average paid

service revenue multiplied by the number of subscription accounts

at the end of the reporting period.

(2)

FCF is calculated as net cash provided by

operating activities less capital expenditures. FCF margin is the

FCF divided by revenue.

(3)

Reconciliation of financial measures

computed on a GAAP basis to the most directly comparable financial

measures computed on a non-GAAP basis is provided at the end of

this press release.

First Quarter 2025 Business Outlook (4)

A reconciliation of our business outlook on a GAAP and non-GAAP

basis is provided in the following table:

Three Months Ended March 30,

2025

Revenue

Net Income (Loss)

per Diluted Share

(In millions, except per share

data)

GAAP

$114 - $124

$(0.06) - $0.00

Estimated adjustment for stock-based

compensation and other expense

—

$0.15

Non-GAAP

$114 - $124

$0.09 - $0.15

_________________________

(4)

Business outlook does not include

estimates for any currently unknown income and expense items which,

by their nature, could arise late in a quarter, including:

litigation reserves, net; impairment charges; discrete tax benefits

or detriments relating to tax windfalls or shortfalls from equity

awards; and any additional impacts relating to the implementation

of U.S. tax reform. New material income and expense items such as

these could have a significant effect on our guidance and future

results.

Investor Conference Call / Webcast Details

Arlo will review the fourth quarter and full-year 2024 results

and discuss management’s expectations for the first quarter and

full-year 2025 today, Thursday, February 27, 2025 at 5:00 p.m. ET

(2:00 p.m. PT). To view the accompanying presentation, a live

webcast of the conference call will be available on Arlo’s Investor

Relations website at https://investor.arlo.com. The toll-free

dial-in number for the live audio call is (833) 470-1428. The

international dial-in number for the live audio call is (404)

975-4839. The conference ID for the call is 631583. A replay of the

call will be available via the web at

https://investor.arlo.com.

About Arlo Technologies, Inc.

Arlo is an award-winning, industry leader that is transforming

the ways in which people can protect everything that matters to

them with advanced home, business, and personal security solutions.

Arlo’s deep expertise in AI- and CV-powered analytics, cloud

services, user experience and product design, and innovative

wireless and RF connectivity enables the delivery of a seamless,

smart security experience for Arlo users that is easy to set up and

interact with every day. Arlo’s cloud-based platform provides users

with visibility, insight and a powerful means to help protect and

connect in real-time with the people and things that matter most,

from any location with a Wi-Fi or a cellular connection. To date,

Arlo has launched several categories of award-winning connected

devices, software and services. These include wire-free, smart

Wi-Fi and LTE-enabled security cameras, video doorbells,

floodlights, security system, and Arlo's subscription services:

Arlo Secure and Arlo Safe.

With a mission to bring users peace of mind, Arlo is as

passionate about protecting user privacy as it is about

safeguarding homes and families. Arlo is committed to implementing

industry standards for data protection designed to keep users’

personal information private and in their control. Arlo does not

monetize personal data, provides enhanced controls for user data,

supports privacy legislation, keeps user data safely secure, and

puts security at the forefront of company culture.

© 2025 Arlo Technologies, Inc., Arlo and the Arlo logo are

trademarks and/or registered trademarks of Arlo Technologies, Inc.

and/or certain of its affiliates in the United States and/or other

countries. Other brand and product names are for identification

purposes only and may be trademarks or registered trademarks of

their respective holder(s). The information contained herein is

subject to change without notice. Arlo shall not be liable for

technical or editorial errors or omissions contained herein. All

rights reserved.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995 for Arlo Technologies, Inc.:

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. The words “anticipate,” “expect,” “believe,” “will,” “may,”

“should,” “estimate,” “project,” “outlook,” “forecast” or other

similar words are used to identify such forward-looking statements.

However, the absence of these words does not mean that the

statements are not forward-looking. The forward-looking statements

represent our expectations or beliefs concerning future events

based on information available at the time such statements were

made and include statements regarding our potential future

business, operating performance and financial condition, including

descriptions of our expected revenue and profitability (and related

timing), GAAP and non-GAAP gross margins, operating margins, tax

rates, expenses, cash outlook, free cash flow and free cash flow

margins; strategic objectives and initiatives; the recurring

revenue business model; expectations regarding market expansion and

future growth, including with respect to our long-range plan

targets; optimism for strategic partner investments due to the

expansion our retail partnership lineup; the expected benefits of

Arlo Secure 5.0; and others. These statements are based on

management's current expectations and are subject to certain risks

and uncertainties, including the following: future demand for our

products may be lower than anticipated, including due to inflation,

fluctuating consumer confidence, banking failures and rising

interest rates; we may be unsuccessful in developing and expanding

our sales and marketing capabilities; we may not be able to

increase sales of our paid subscription services; consumers may

choose not to adopt our new product offerings or adopt competing

products; product performance may be adversely affected by real

world operating conditions; we may be unsuccessful or experience

delays in manufacturing and distributing our new and existing

products; and we may fail to manage costs and cost saving

initiatives, the cost of developing new products and manufacturing

and distribution of our existing offerings. Further, certain

forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecast in such forward-looking statements. Further information

on potential risk factors that could affect our business are

detailed in our periodic filings with the Securities and Exchange

Commission, including, but not limited to, those risks and

uncertainties listed in the section entitled “Risk Factors” in the

most recently filed Annual Report and Quarterly Report filed with

the Securities and Exchange Commission (the “SEC”) and subsequent

filings with the SEC. Given these circumstances, you should not

place undue reliance on these forward-looking statements. We

undertake no obligation to release publicly any revisions to any

forward-looking statements contained herein to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

Non-GAAP Financial Information:

To supplement our unaudited financial data prepared on a basis

consistent with U.S. Generally Accepted Accounting Principles

(“GAAP”), we disclose certain non-GAAP financial measures that

exclude certain charges, including non-GAAP gross profit, non-GAAP

gross margin, non-GAAP research and development, non-GAAP sales and

marketing, non-GAAP general and administrative, non-GAAP total

operating expenses, non-GAAP operating income (loss), non-GAAP

operating margin, adjusted EBITDA, adjusted EBITDA margin, non-GAAP

provision for income taxes, non-GAAP net income (loss) and non-GAAP

net income (loss) per diluted share. These supplemental measures

exclude adjustments for stock-based compensation expense,

restructuring charges, write-off of deferred financing costs,

separation expenses, amortization of development of software cost,

depreciation expenses, litigation reserves, net, and the related

tax effects. In addition, we use free cash flow as non-GAAP measure

when assessing the sources of liquidity, capital resources, and

quality of earnings. We believe that free cash flow (usage) is

helpful in understanding our capital requirements and provides an

additional means to reflect the cash flow trends in our business.

These non-GAAP measures are not in accordance with, or an

alternative for GAAP, and may be different from similarly-titled

non-GAAP measures used by other companies. We believe that these

non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with our results of operations as

determined in accordance with GAAP and that these measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP measures. The presentation of this

additional information is not meant to be considered in isolation

or as a substitute for the most directly comparable GAAP measures.

We compensate for the limitations of non-GAAP financial measures by

relying upon GAAP results to gain a complete picture of our

performance.

In calculating non-GAAP financial measures, we exclude certain

items to facilitate a review of the comparability of our operating

performance on a period-to-period basis because such items are not,

in our view, related to our ongoing operational performance. We use

non-GAAP measures to evaluate the operating performance of our

business, for comparison with forecasts and strategic plans, and

for benchmarking performance externally against competitors. In

addition, management’s incentive compensation is determined using

certain non-GAAP measures. Since we find these measures to be

useful, we believe that investors benefit from seeing results

“through the eyes” of management in addition to seeing GAAP

results. We believe that these non-GAAP measures, when read in

conjunction with our GAAP measures, provide useful information to

investors by offering:

- the ability to make more meaningful period-to-period

comparisons of our on-going operating results;

- the ability to better identify trends in our underlying

business and perform related trend analyses;

- a better understanding of how management plans and measures our

underlying business; and

- an easier way to compare our operating results against analyst

financial models and operating results of competitors that

supplement their GAAP results with non-GAAP financial

measures.

The following are explanations of the adjustments that we

incorporate into non-GAAP measures, as well as the reasons for

excluding them in the reconciliations of these non-GAAP financial

measures:

Stock-based compensation expense consists of non-cash charges

for the estimated fair value of stock options, performance-based

stock options, restricted stock units (RSU), performance-based

restricted stock units, shares under the employee stock purchase

plan granted to employees and employees' annual bonus in RSU form.

We believe that the exclusion of these charges provides for more

accurate comparisons of our operating results to peer companies due

to the varying available valuation methodologies, subjective

assumptions and the variety of award types. In addition, we believe

it is useful to investors to understand the specific impact

stock-based compensation expense has on our operating results.

Other non-GAAP items are the result of either unique or

unplanned events, including, when applicable: restructuring

charges, impairment charges, write-off of deferred financing costs,

separation expenses, amortization of software development cost,

depreciation expenses, and litigation reserves, net. It is

difficult to predict the occurrence or estimate the amount or

timing of these items in advance. Although these events are

reflected in our GAAP financial statements, these unique

transactions may limit the comparability of our on-going operations

with prior and future periods. The amounts result from events that

often arise from unforeseen circumstances, which often occur

outside of the ordinary course of continuing operations. Therefore,

the amounts do not accurately reflect the underlying performance of

our continuing business operations for the period in which they are

incurred.

Source: Arlo-F

***Financial Tables

ARLO TECHNOLOGIES, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

As of December 31,

2024

2023

(In thousands, except share and

per share data)

ASSETS

Current assets:

Cash and cash equivalents

$

82,032

$

56,522

Short-term investments

69,419

79,974

Accounts receivable, net

57,332

65,360

Inventories

40,633

38,408

Prepaid expenses and other current

assets

13,190

10,271

Total current assets

262,606

250,535

Property and equipment, net

4,765

4,761

Operating lease right-of-use assets,

net

15,698

11,450

Goodwill

11,038

11,038

Restricted cash

—

4,131

Other non-current assets

4,293

3,623

Total assets

$

298,400

$

285,538

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

63,784

$

55,201

Deferred revenue

27,248

18,041

Accrued liabilities

85,730

88,209

Total current liabilities

176,762

161,451

Non-current operating lease

liabilities

18,357

17,021

Other non-current liabilities

2,372

3,790

Total liabilities

197,491

182,262

Commitments and contingencies

Stockholders’ Equity:

Preferred stock: $0.001 par value;

50,000,000 shares authorized; none issued or outstanding

—

—

Common stock: $0.001 par value;

500,000,000 shares authorized; shares issued and outstanding:

100,885,158 at December 31, 2024 and 95,380,281 at December 31,

2023

101

95

Additional paid-in capital

498,739

470,322

Accumulated other comprehensive income

34

320

Accumulated deficit

(397,965

)

(367,461

)

Total stockholders’ equity

100,909

103,276

Total liabilities and stockholders’

equity

$

298,400

$

285,538

ARLO TECHNOLOGIES, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

and per share data)

Revenue:

Products

$

57,425

$

75,784

$

79,168

$

267,888

$

289,938

Services

64,147

61,883

55,925

242,998

201,238

Total revenue

121,572

137,667

135,093

510,886

491,176

Cost of revenue:

Products

64,689

74,820

73,143

268,769

270,663

Services

12,029

14,431

14,601

54,613

52,950

Total cost of revenue

76,718

89,251

87,744

323,382

323,613

Gross profit

44,854

48,416

47,349

187,504

167,563

Gross margin

36.9

%

35.2

%

35.0

%

36.7

%

34.1

%

Operating expenses:

Research and development

15,267

17,562

16,450

73,183

68,647

Sales and marketing

20,823

17,832

18,004

73,723

66,141

General and administrative

14,304

17,052

13,282

72,134

56,371

Others

488

1,423

71

3,356

1,307

Total operating expenses

50,882

53,869

47,807

222,396

192,466

Loss from operations

(6,028

)

(5,453

)

(458

)

(34,892

)

(24,903

)

Operating margin

(5.0

)%

(4.0

)%

(0.3

)%

(6.8

)%

(5.1

)%

Interest income, net

1,303

1,400

1,199

5,584

3,935

Other income (expense), net

(4

)

(57

)

84

(104

)

107

Income (loss) before income taxes

(4,729

)

(4,110

)

825

(29,412

)

(20,861

)

Provision for income taxes

132

329

133

1,092

1,175

Net income (loss)

$

(4,861

)

$

(4,439

)

$

692

$

(30,504

)

$

(22,036

)

Net income (loss) per share:

Basic

$

(0.05

)

$

(0.04

)

$

0.01

$

(0.31

)

$

(0.24

)

Diluted

$

(0.05

)

$

(0.04

)

$

0.01

$

(0.31

)

$

(0.24

)

Weighted average shares used to compute

net income (loss) per share:

Basic

100,687

99,731

94,819

98,630

92,754

Diluted

100,687

99,731

101,938

98,630

92,754

ARLO TECHNOLOGIES, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Year Ended December 31,

2024

2023

(In thousands)

Cash flows from operating activities:

Net loss

$

(30,504

)

$

(22,036

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Stock-based compensation expense

68,657

47,948

Depreciation and amortization

3,200

4,661

Allowance for credit losses and non-cash

changes to reserves

2,085

279

Deferred income taxes

(13

)

112

Discount accretion on investments and

other

(3,259

)

(2,005

)

Changes in assets and liabilities:

Accounts receivable, net

8,228

690

Inventories

(4,510

)

7,777

Prepaid expenses and other assets

(3,577

)

(1,498

)

Accounts payable

8,289

3,723

Deferred revenue

9,437

6,610

Accrued and other liabilities

(6,727

)

(7,959

)

Net cash provided by operating

activities

51,306

38,302

Cash flows from investing activities:

Purchases of property and equipment

(2,688

)

(2,847

)

Purchases of short-term investments

(205,068

)

(149,870

)

Proceeds from maturities of short-term

investments

218,596

102,031

Net cash provided by (used in) investing

activities

10,840

(50,686

)

Cash flows from financing activities:

Proceeds related to employee benefit

plans

8,365

8,493

Repurchase of common stock

(4,421

)

—

Restricted stock unit withholdings

(44,711

)

(23,635

)

Net cash used in financing activities

(40,767

)

(15,142

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

21,379

(27,526

)

Cash, cash equivalents and restricted

cash, at beginning of period

60,653

88,179

Cash, cash equivalents and restricted

cash, at end of period

$

82,032

$

60,653

Non-cash investing activities:

Purchases of property and equipment

included in accounts payable and accrued liabilities

$

708

$

189

Supplemental cash flow information:

Cash paid for income taxes, net

$

1,156

$

1,196

ARLO TECHNOLOGIES, INC.

RECONCILIATIONS OF GAAP MEASURES

TO NON-GAAP MEASURES

UNAUDITED STATEMENT OF OPERATIONS

DATA:

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

data)

GAAP gross profit:

Products

$

(7,264

)

$

964

$

6,025

$

(881

)

$

19,275

Services

52,118

47,452

41,324

188,385

148,288

Total GAAP gross profit

44,854

48,416

47,349

187,504

167,563

GAAP gross margin:

Products

(12.6

)%

1.3

%

7.6

%

(0.3

)%

6.6

%

Services

81.2

%

76.7

%

73.9

%

77.5

%

73.7

%

Total GAAP gross margin

36.9

%

35.2

%

35.0

%

36.7

%

34.1

%

Stock-based compensation expense -

Products

426

666

692

3,333

3,175

Stock-based compensation expense -

Services

(19

)

289

145

692

358

Amortization of software development cost

- Services

290

152

151

744

605

Non-GAAP gross profit:

Products

(6,838

)

1,630

6,717

2,452

22,450

Services

52,389

47,893

41,620

189,821

149,251

Total Non-GAAP gross profit

$

45,551

$

49,523

$

48,337

$

192,273

$

171,701

Non-GAAP gross margin:

Products

(11.9

)%

2.2

%

8.5

%

0.9

%

7.7

%

Services

81.7

%

77.4

%

74.4

%

78.1

%

74.2

%

Total Non-GAAP gross margin

37.5

%

36.0

%

35.8

%

37.6

%

35.0

%

GAAP research and development

$

15,267

$

17,562

$

16,450

$

73,183

$

68,647

Stock-based compensation expense

(2,883

)

(3,584

)

(2,631

)

(16,149

)

(12,700

)

Non-GAAP research and development

$

12,384

$

13,978

$

13,819

$

57,034

$

55,947

Percentage of revenue

10.2

%

10.2

%

10.2

%

11.2

%

11.4

%

GAAP sales and marketing

$

20,823

$

17,832

$

18,004

$

73,723

$

66,141

Stock-based compensation expense

(2,437

)

(1,594

)

(1,283

)

(8,447

)

(5,899

)

Non-GAAP sales and marketing

$

18,386

$

16,238

$

16,721

$

65,276

$

60,242

Percentage of revenue

15.1

%

11.8

%

12.4

%

12.8

%

12.3

%

GAAP general and administrative

$

14,304

$

17,052

$

13,282

$

72,134

$

56,371

Stock-based compensation expense

(8,771

)

(8,556

)

(5,346

)

(40,036

)

(25,816

)

Non-GAAP general and administrative

$

5,533

$

8,496

$

7,936

$

32,098

$

30,555

Percentage of revenue

4.6

%

6.2

%

5.9

%

6.3

%

6.2

%

ARLO TECHNOLOGIES, INC.

RECONCILIATIONS OF GAAP MEASURES

TO NON-GAAP MEASURES (CONTINUED)

UNAUDITED STATEMENT OF OPERATIONS DATA

(CONTINUED):

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

data)

GAAP total operating expenses

$

50,882

$

53,869

$

47,807

$

222,396

$

192,466

Stock-based compensation expense

(14,091

)

(13,734

)

(9,260

)

(64,632

)

(44,415

)

Others

(488

)

(1,423

)

(71

)

(3,356

)

(1,307

)

Non-GAAP total operating expenses

$

36,303

$

38,712

$

38,476

$

154,408

$

146,744

GAAP operating loss

$

(6,028

)

$

(5,453

)

$

(458

)

$

(34,892

)

$

(24,903

)

GAAP operating margin

(5.0

)%

(4.0

)%

(0.3

)%

(6.8

)%

(5.1

)%

Stock-based compensation expense

14,498

14,689

10,097

68,657

47,948

Others

778

1,575

222

4,100

1,912

Non-GAAP operating income

$

9,248

$

10,811

$

9,861

$

37,865

$

24,957

Non-GAAP operating margin

7.6

%

7.9

%

7.3

%

7.4

%

5.1

%

Depreciation

517

558

702

2,458

4,056

Adjusted EBITDA

$

9,765

$

11,369

$

10,563

$

40,323

$

29,013

Adjusted EBITDA margin

8.0

%

8.3

%

7.8

%

7.9

%

5.9

%

GAAP provision for income taxes

$

132

$

329

$

133

$

1,092

$

1,175

GAAP income tax rate

(2.8

)%

(8.0

)%

16.1

%

(3.7

)%

(5.6

)%

Non-GAAP provision for income taxes

$

132

$

329

$

133

$

1,092

$

1,175

Non-GAAP income tax rate

1.3

%

2.7

%

1.2

%

2.5

%

4.1

%

ARLO TECHNOLOGIES, INC.

RECONCILIATIONS OF GAAP MEASURES

TO NON-GAAP MEASURES (CONTINUED)

UNAUDITED STATEMENT OF OPERATIONS DATA

(CONTINUED):

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

and per share data)

GAAP net loss

$

(4,861

)

$

(4,439

)

$

692

$

(30,504

)

$

(22,036

)

Stock-based compensation expense

14,498

14,689

10,097

68,657

47,948

Others

778

1,575

222

4,100

1,912

Non-GAAP net income

$

10,415

$

11,825

$

11,011

$

42,253

$

27,824

GAAP net loss per share - basic

$

(0.05

)

$

(0.04

)

$

0.01

$

(0.31

)

$

(0.24

)

Stock-based compensation expense

0.15

0.13

0.10

0.66

0.52

Others

—

0.02

—

0.05

—

Non-GAAP net income per share -

diluted

$

0.10

$

0.11

$

0.11

$

0.40

$

0.28

Shares used in computing GAAP net loss -

basic

100,687

99,731

94,819

98,630

92,754

Shares used in computing non-GAAP net

income - diluted

107,125

107,294

101,938

106,695

100,217

Free cash flow:

Net cash provided by operating

activities

$

6,671

$

18,366

$

7,935

$

51,306

$

38,302

Less: Purchases of property and

equipment

(1,076

)

(961

)

(399

)

(2,688

)

(2,847

)

Free cash flow (1)

$

5,595

$

17,405

$

7,536

$

48,618

$

35,455

Free cash flow margin (1)

4.6

%

12.6

%

5.6

%

9.5

%

7.2

%

_________________________

(1)

Free cash flow is calculated as net cash

provided by operating activities less capital expenditures. Free

cash flow margin is the free cash flow divided by revenue.

ARLO TECHNOLOGIES, INC.

UNAUDITED SUPPLEMENTAL FINANCIAL

INFORMATION

As of and for the three months

ended

December 31,

2024

September 29,

2024

June 30,

2024

March 31,

2024

December 31,

2023

(In thousands, except headcount

and per share data)

Cash, cash equivalents and short-term

investments

$

151,451

$

146,574

$

144,005

$

142,863

$

136,496

Accounts receivable, net

$

57,332

$

68,567

$

61,746

$

56,496

$

65,360

Days sales outstanding

44

45

44

41

44

Inventories

$

40,633

$

51,975

$

45,227

$

44,676

$

38,408

Inventory turns

6.4

5.8

5.8

5.7

7.6

Weeks of channel inventory:

U.S. retail channel

7.7

14.2

14.8

12.9

11.1

U.S. distribution channel

9.4

7.1

12.5

11.4

20.5

APAC distribution channel

8.5

7.5

3.9

6.4

3.9

Deferred revenue (current and

non-current)

$

27,551

$

24,827

$

23,695

$

21,540

$

18,114

Cumulative registered accounts (1)

10,823

10,383

9,987

9,173

8,652

Cumulative paid accounts (2)

4,599

4,235

3,980

3,235

2,813

Annual recurring revenue (ARR) (3)

$

257,332

$

241,572

$

234,981

$

226,968

$

210,078

Headcount

360

355

362

373

363

Non-GAAP diluted shares

107,125

107,294

106,127

103,803

101,938

_________________________

(1)

We define our registered accounts at the

end of a particular period as the number of unique registered

accounts on the Arlo platform as of the end of such period. The

number of registered accounts does not necessarily reflect the

number of end-users on the Arlo platform as one registered account

may be used by multiple end-users to monitor the devices attached

to that household.

(2)

Paid accounts are defined as any account

worldwide where a subscription to a paid service is being collected

(either by us or by our customers or channel partners, including

Verisure).

(3)

ARR represents and is defined as the

annualized paid service revenue we expect to recognize from

subscription contracts, as calculated by taking the average paid

service revenue multiplied by the number of subscription accounts

at the end of the reporting period.

REVENUE BY GEOGRAPHY

Three Months Ended

Twelve Months Ended

December 31,

2024

September 29,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(In thousands, except percentage

data)

Americas

$

70,309

57.8%

$

73,303

53.2%

$

86,702

64.2%

$

266,075

52.1%

$

301,418

61.4%

EMEA

44,841

36.9%

57,773

42.0%

42,433

31.4%

220,821

43.2%

164,750

33.5%

APAC

6,422

5.3%

6,591

4.8%

5,958

4.4%

23,990

4.7%

25,008

5.1%

Total

$

121,572

100.0%

$

137,667

100.0%

$

135,093

100.0%

$

510,886

100.0%

$

491,176

100.0%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227209277/en/

Arlo Investor Relations Tahmin Clarke investors@arlo.com

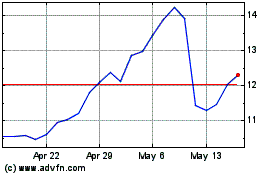

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Feb 2024 to Feb 2025