Avista requests recovery of costs for providing service in Oregon

November 01 2024 - 3:05PM

Today, Avista (NYSE: AVA) filed a request with the Public Utility

Commission of Oregon (PUC) to increase natural gas base rates

effective September 1, 2025.

The proposal is designed to increase overall

natural gas base revenue by approximately $7.8 million, or 6.6% on

a billed basis, and is based on a proposed rate of return of 7.67%

with a common equity ratio of 50% and a 10.4% return on equity.

“Our customers remain our primary focus as we

make decisions about how and where to invest across the company,”

Avista CEO Dennis Vermillion said. “We strive to keep

energy affordable while making important and necessary investments

in our infrastructure. We’ve made these investments on behalf of

our customers because it’s the right thing to do. We want our

customers to have energy available when they need it.”

“Our costs to deliver energy continue to outpace

our revenue. Avista is not unique in this regard; utilities across

the nation work to replace infrastructure and meet increasing

compliance obligations while the fixed costs of operating and

maintaining systems are increasing.”

“Once we make investments in our system, we must

recover the costs. It’s important for the health of the company and

an essential part of providing safe and reliable energy to better

align the rates customers pay with Avista’s costs to serve through

these general rate requests. We understand that it’s challenging

and often frustrating when we file rate cases and that many people

are struggling.”

“We are pleased that the Commission recently

approved requests by the Company that reduce customer rates

beginning in November, resulting from our annual purchased gas cost

adjustments. That decrease was approximately $15.1 million, or

11.5%,” Vermillion said. “Our My Energy Discount program has also

helped many Oregon customers with their natural gas bills.”

Infrastructure InvestmentsThe

capital investments driving our need for rate relief include

upgrades and maintenance of natural gas pipe and distribution

equipment as well as other information technology improvements.

Major capital investments included in today's filing are:

- The

continuation of a major project to replace portions of natural gas

distribution pipe. The project is replacing hundreds of miles of

natural gas pipeline that was installed prior to 1987.

- Replacement of

natural gas infrastructure that has reached the end of its useful

life or needs to be replaced due to other regional infrastructure

or compliance requirements.

- Implementation

and upgrades of technology systems that make it easier for

customers to do business with Avista and that enable employees to

perform their jobs and serve customers in a safe, reliable and

efficient manner.

Customer BillsIf approved by

the PUC, a residential customer using an average of 47 therms per

month would see a $4.37 per month increase, or 6.8 percent, for a

revised monthly bill of $68.67 (inclusive of a proposed $1.75 per

month increase in the basic charge).

The actual percentage and dollar increase will

vary by customer class and will depend on how much energy a

customer uses. The requested natural gas rate billing changes by

rate schedule are as follows:

|

|

Residential Schedule 410/411 |

6.7% |

| |

General Service Schedule

420 |

7.2% |

| |

Large General Service Schedule

424 |

3.1% |

| |

Interruptible Service Schedule

440 |

2.4% |

| |

Seasonal Service Schedule

444 |

2.5% |

| |

Transportation Service

Schedule 456 |

7.0% |

| |

Overall |

6.6% |

More About RatesOn average,

about 40% of an Oregon residential Avista customer’s bill is the

combined cost of purchasing natural gas on the wholesale market and

transporting it through Avista’s system for delivery to customers.

These costs fluctuate up and down based on market prices and are

not marked up by Avista. The remaining 60% is related to the

ownership and operating costs of Avista's delivery system to

provide safe, reliable, and affordable service to all customers

while meeting mandatory state and federal requirements.

Avista serves approximately 106,000 customers in

Oregon. The PUC has up to 10 months to review Avista's request.

Customer ResourcesMore Oregon

customers than ever before now qualify for our monthly bill

discount program. Discounts are based on household size and annual

income and last for two years. With higher income limits than other

programs, more people are eligible. Plus, participants can still

receive other energy assistance and services from local community

action agencies. Applying is quick and easy with no paperwork

required. Visit www.myavista.com/myenergydiscountOR to learn more.

Avista also provides support to customer assistance funds such as

Project Share. And since 2017, we have partnered with the Energy

Trust of Oregon to provide energy efficiency programs, including

rebates and incentives, which help customers manage their energy

use. To learn more, visit www.myavista.com/assistance.

About Avista Corp.Avista Corp.

is an energy company involved in the production, transmission and

distribution of energy as well as other energy-related businesses.

Avista Utilities is the operating division that provides electric

service to 418,000 customers and natural gas to 382,000 customers.

Its service territory covers 30,000 square miles in eastern

Washington, northern Idaho and parts of southern and eastern

Oregon, with a population of 1.7 million. Alaska Energy and

Resources Company is an Avista subsidiary that provides retail

electric service to 18,000 customers in the city and borough of

Juneau, Alaska, through its subsidiary Alaska Electric Light and

Power Company. Avista stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

www.avistacorp.com.

This news release contains forward-looking

statements regarding the company’s current expectations.

Forward-looking statements are all statements other than historical

facts. Such statements speak only as of the date of the news

release and are subject to a variety of risks and uncertainties,

many of which are beyond the company’s control, which could cause

actual results to differ materially from the expectations. These

risks and uncertainties include, in addition to those discussed

herein, all of the factors discussed in the company’s Annual Report

on Form 10-K for the year ended Dec. 31, 2023 and the

Quarterly Report on Form 10-Q for the quarter ended June 30,

2024.

SOURCE: Avista Corporation

To unsubscribe from Avista’s news release distribution, send a

reply message to dalila.sheehan@avistacorp.com

Contact: Media: Lena Funston (509)

495-8090, lena.funston@avistacorp.comInvestors: Stacey Wenz (509)

495-2046, stacey.wenz@avistacorp.comAvista 24/7 Media Access (509)

495-4174

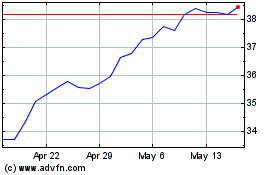

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

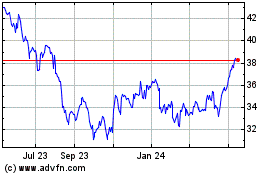

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024