AZZ incorporated Acquires West Virginia and Virginia Galvanizing Facilities

August 03 2009 - 3:00AM

PR Newswire (US)

Acquisition will facilitate expansion of our strategic geographic

area and increases our total network of plants to 22 galvanizing

facilities in 13 states FORT WORTH, Texas, Aug. 3

/PRNewswire-FirstCall/ -- AZZ incorporated (NYSE:AZZ), a

manufacturer of electrical products and a provider of galvanizing

services, today announced the acquisition of substantially all of

the assets related to Pilot Galvanizing in Poca, West Virginia, and

Bristol Galvanizing in Bristol, Virginia. The acquisition is a part

of the stated AZZ strategy to continue the geographic expansion of

our served market that should provide a basis for continued growth

of the Galvanizing Services Segment of the Company. AZZ has

effectively doubled our network of plants in the last 3 years and

continues to seek out additional expansion opportunities. "Not only

does this acquisition represent two more operations for our network

of plants, but opens up another strategic geographic area that has

the potential for additional growth and expansion. Their rich

heritage of providing a superior level of service and support to

their customers complements our existing facilities. Certainly, the

pride and integrity with which it has been operated is consistent

with the philosophy and methodology that AZZ employs in our current

operations. We anticipate that it will be accretive in the first

year of operation, and should add in the range of $6 to $8 million

in annualized revenues. We appreciate the opportunity to continue

the proud tradition of customer service that has been sustained by

the current ownership. The senior operating management team has

agreed to join AZZ and will report to our regional offices in

Cincinnati, Ohio effective August 1, 2009," stated David H. Dingus,

president and chief executive officer of AZZ incorporated. Pilot

Galvanizing was originally founded in 1987 in Poca, West Virginia

and expanded into the Virginia market with the opening of the

Bristol facility in 2001. AZZ incorporated is a specialty

electrical equipment manufacturer serving the global markets of

power generation, transmission and distribution and industrial, as

well as, a leading provider of hot dip galvanizing services to the

steel fabrication market nationwide. Except for the statements of

historical fact, this release may contain forward-looking

statements that involve risks and uncertainties some of which are

detailed from time to time in documents filed by the Company with

the SEC. Those risks and uncertainties include, but are not limited

to: changes in customer demand and response to products and

services offered by the company, including demand by the electrical

power generation markets, electrical transmission and distribution

markets, the industrial markets, and the hot dip galvanizing

markets; prices and raw material costs, including zinc and natural

gas which are used in the hot dip galvanizing process; changes in

the economic conditions of the various markets the Company serves,

foreign and domestic, customer requested delays of shipments,

acquisition opportunities, currency exchange rates, adequacy of

financing, and availability of experienced management employees to

implement the Company's growth strategy. The Company can give no

assurance that such forward-looking statements will prove to be

correct. We undertake no obligation to affirm, publicly update or

revise any forward-looking statements, whether as a result of

information, future events or otherwise. DATASOURCE: AZZ

incorporated CONTACT: Dana Perry, Senior Vice President, Finance

and CFO of AZZ incorporated, +1-817-810-0095; or Joe Dorame, Joe

Diaz or Robert Blum, all of Lytham Partners, +1-602-889-9700

Copyright

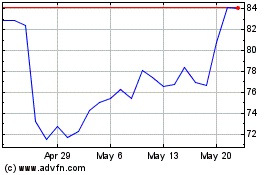

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

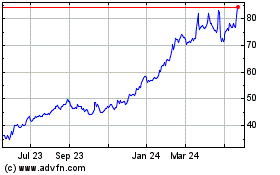

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024