Washington, D.C. 20549

New Perspective Fund

®

Investment portfolio

|

December 31, 2012

|

|

unaudited

|

|

|

|

Value

|

|

Common stocks — 93.71%

|

Shares

|

(000)

|

|

|

|

|

|

CONSUMER DISCRETIONARY — 17.12%

|

|

|

|

Amazon.com, Inc.

1

|

3,922,300

|

$ 985,047

|

|

Home Depot, Inc.

|

11,300,000

|

698,905

|

|

Naspers Ltd., Class N

2

|

9,285,100

|

596,594

|

|

Burberry Group PLC

2

|

19,240,991

|

393,951

|

|

Hyundai Mobis Co., Ltd.

2

|

1,274,924

|

345,793

|

|

Time Warner Inc.

|

7,100,000

|

339,593

|

|

Honda Motor Co., Ltd.

2

|

8,757,300

|

322,780

|

|

Toyota Motor Corp.

2

|

6,749,900

|

315,062

|

|

priceline.com Inc.

1

|

501,000

|

311,221

|

|

adidas AG

2

|

3,485,478

|

310,619

|

|

Nikon Corp.

2

|

9,143,000

|

269,934

|

|

Swatch Group Ltd, non-registered shares

2

|

460,768

|

237,127

|

|

Swatch Group Ltd

2

|

245,770

|

21,464

|

|

Las Vegas Sands Corp.

|

5,561,000

|

256,696

|

|

Industria de Diseño Textil, SA

2

|

1,824,000

|

255,538

|

|

Starbucks Corp.

|

4,550,000

|

243,971

|

|

DIRECTV

1

|

3,745,000

|

187,849

|

|

Tiffany & Co.

|

2,330,900

|

133,654

|

|

H & M Hennes & Mauritz AB, Class B

2

|

3,796,000

|

131,909

|

|

Ford Motor Co.

|

10,000,000

|

129,500

|

|

CBS Corp., Class B

|

3,380,000

|

128,609

|

|

Kia Motors Corp.

2

|

2,256,900

|

120,092

|

|

LVMH Moët Hennessey-Louis Vuitton SA

2

|

548,000

|

102,118

|

|

Expedia, Inc.

|

1,500,000

|

92,175

|

|

Suzuki Motor Corp.

2

|

3,360,000

|

87,836

|

|

Walt Disney Co.

|

1,700,000

|

84,643

|

|

Arcos Dorados Holdings Inc., Class A

|

6,136,000

|

73,387

|

|

General Motors Co.

1

|

2,500,000

|

72,075

|

|

BorgWarner Inc.

1

|

950,000

|

68,039

|

|

Harman International Industries, Inc.

|

1,510,000

|

67,406

|

|

Bayerische Motoren Werke AG

2

|

687,300

|

66,285

|

|

Christian Dior SA

2

|

305,000

|

52,730

|

|

Wynn Macau, Ltd.

1,2

|

15,044,800

|

41,463

|

|

Sands China Ltd.

2

|

2,062,000

|

9,237

|

|

|

|

7,553,302

|

|

|

|

|

|

HEALTH CARE — 15.14%

|

|

|

|

Novo Nordisk A/S, Class B

2

|

12,797,600

|

2,090,102

|

|

Baxter International Inc.

|

7,150,000

|

476,619

|

|

Bayer AG

2

|

4,610,860

|

437,859

|

|

Merck & Co., Inc.

|

10,427,573

|

426,905

|

|

Novartis AG

2

|

5,743,000

|

363,598

|

|

Regeneron Pharmaceuticals, Inc.

1

|

1,929,000

|

329,994

|

|

Gilead Sciences, Inc.

1

|

4,353,000

|

319,728

|

|

Celgene Corp.

1

|

4,000,533

|

314,922

|

|

UCB SA

2

|

4,672,104

|

$ 268,782

|

|

Roche Holding AG

2

|

990,000

|

201,688

|

|

Edwards Lifesciences Corp.

1

|

2,180,000

|

196,570

|

|

Intuitive Surgical, Inc.

1

|

387,000

|

189,773

|

|

Bristol-Myers Squibb Co.

|

5,348,400

|

174,304

|

|

Sonic Healthcare Ltd.

2

|

11,432,400

|

159,642

|

|

AstraZeneca PLC

2

|

2,965,000

|

140,171

|

|

Hospira, Inc.

1

|

4,040,000

|

126,210

|

|

Mindray Medical International Ltd., Class A (ADR)

|

3,415,000

|

111,670

|

|

Sonova Holding AG

2

|

916,723

|

101,561

|

|

Pfizer Inc

|

4,000,000

|

100,320

|

|

Allergan, Inc.

|

800,000

|

73,384

|

|

Cochlear Ltd.

2

|

635,000

|

52,533

|

|

Fresenius Medical Care AG & Co. KGaA

2

|

350,000

|

24,182

|

|

|

|

6,680,517

|

|

|

|

|

|

CONSUMER STAPLES — 12.14%

|

|

|

|

Nestlé SA

2

|

8,724,700

|

568,625

|

|

Shoprite Holdings Ltd.

2

|

22,607,926

|

549,473

|

|

British American Tobacco PLC

2

|

10,364,500

|

525,169

|

|

Pernod Ricard SA

2

|

4,038,600

|

474,886

|

|

Anheuser-Busch InBev NV

2

|

4,989,050

|

435,986

|

|

Unilever NV, depository receipts

2

|

10,245,000

|

386,582

|

|

SABMiller PLC

2

|

7,989,008

|

376,027

|

|

PepsiCo, Inc.

|

4,005,000

|

274,062

|

|

Costco Wholesale Corp.

|

2,700,000

|

266,679

|

|

Philip Morris International Inc.

|

3,152,500

|

263,675

|

|

Coca-Cola Co.

|

5,800,000

|

210,250

|

|

Procter & Gamble Co.

|

2,900,000

|

196,881

|

|

Associated British Foods PLC

2

|

5,015,000

|

127,652

|

|

Coca-Cola Amatil Ltd.

2

|

7,704,261

|

108,317

|

|

Mead Johnson Nutrition Co.

|

1,485,000

|

97,847

|

|

Wal-Mart de México, SAB de CV, Series V

|

29,667,984

|

97,154

|

|

Wesfarmers Ltd.

2

|

2,100,000

|

81,035

|

|

Colgate-Palmolive Co.

|

715,000

|

74,746

|

|

Avon Products, Inc.

|

4,000,000

|

57,440

|

|

AMOREPACIFIC Corp.

2

|

45,200

|

51,387

|

|

Japan Tobacco Inc.

2

|

1,680,000

|

47,362

|

|

Coca-Cola Hellenic Bottling Co. SA

2

|

1,800,000

|

42,584

|

|

Grupo Modelo, SAB de CV, Series C

|

4,505,000

|

40,435

|

|

|

|

5,354,254

|

|

|

|

|

|

INFORMATION TECHNOLOGY — 11.31%

|

|

|

|

Google Inc., Class A

1

|

1,012,700

|

718,379

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

2

|

159,268,994

|

533,059

|

|

Taiwan Semiconductor Manufacturing Co. Ltd. (ADR)

|

7,000,000

|

120,120

|

|

Oracle Corp.

|

14,811,100

|

493,506

|

|

ASML Holding NV

2

|

4,798,982

|

310,684

|

|

ASML Holding NV (New York registered)

|

2,564,870

|

165,203

|

|

Texas Instruments Inc.

|

14,880,062

|

460,389

|

|

Arm Holdings PLC

2

|

22,567,544

|

288,569

|

|

Samsung Electronics Co. Ltd.

2

|

156,100

|

223,414

|

|

Infineon Technologies AG

2

|

22,775,000

|

184,814

|

|

Avago Technologies Ltd.

|

5,435,000

|

172,072

|

|

salesforce.com, inc.

1

|

985,000

|

165,578

|

|

International Business Machines Corp.

|

850,000

|

162,818

|

|

Amphenol Corp.

|

2,100,000

|

135,870

|

|

MasterCard Inc., Class A

|

225,000

|

110,538

|

|

Microsoft Corp.

|

4,100,000

|

$ 109,593

|

|

Nintendo Co., Ltd.

2

|

987,000

|

105,313

|

|

TDK Corp.

2

|

2,774,000

|

100,874

|

|

Yahoo! Inc.

1

|

4,200,000

|

83,580

|

|

Xilinx, Inc.

|

2,000,000

|

71,800

|

|

KLA-Tencor Corp.

|

1,377,697

|

65,799

|

|

SAP AG

2

|

599,000

|

47,984

|

|

TE Connectivity Ltd.

|

1,153,125

|

42,804

|

|

Jabil Circuit, Inc.

|

1,613,044

|

31,116

|

|

EMC Corp.

1

|

1,175,000

|

29,728

|

|

FLIR Systems, Inc.

|

1,050,000

|

23,426

|

|

Corning Inc.

|

1,420,000

|

17,920

|

|

Apple Inc.

|

25,000

|

13,326

|

|

|

|

4,988,276

|

|

|

|

|

|

FINANCIALS — 10.80%

|

|

|

|

ACE Ltd.

|

6,354,000

|

507,049

|

|

Citigroup Inc.

|

12,455,000

|

492,720

|

|

American Express Co.

|

7,500,000

|

431,100

|

|

CME Group Inc., Class A

|

7,877,900

|

399,488

|

|

AIA Group Ltd.

2

|

90,437,800

|

360,435

|

|

Prudential PLC

2

|

24,986,141

|

348,639

|

|

JPMorgan Chase & Co.

|

6,620,000

|

291,081

|

|

HSBC Holdings PLC

2

|

27,233,796

|

288,047

|

|

Moody’s Corp.

|

4,840,100

|

243,554

|

|

ICICI Bank Ltd. (ADR)

|

4,583,700

|

199,895

|

|

ICICI Bank Ltd.

2

|

848,188

|

17,866

|

|

AXA SA

2

|

10,851,207

|

196,276

|

|

Goldman Sachs Group, Inc.

|

1,440,000

|

183,686

|

|

Allianz SE

2

|

1,193,000

|

165,274

|

|

Morgan Stanley

|

7,500,000

|

143,400

|

|

Bank of Nova Scotia

|

2,380,000

|

137,484

|

|

Weyerhaeuser Co.

1

|

3,500,000

|

97,370

|

|

Bank of China Ltd., Class H

2

|

180,875,000

|

81,882

|

|

ING Groep NV, depository receipts

1,2

|

8,060,000

|

77,075

|

|

DNB ASA

2

|

5,094,318

|

64,937

|

|

BNP Paribas SA

2

|

666,000

|

37,541

|

|

|

|

4,764,799

|

|

|

|

|

|

INDUSTRIALS — 10.12%

|

|

|

|

United Technologies Corp.

|

4,970,000

|

407,590

|

|

Schneider Electric SA

2

|

5,064,298

|

377,713

|

|

General Electric Co.

|

14,300,000

|

300,157

|

|

Delta Air Lines, Inc.

1

|

25,000,000

|

296,750

|

|

KONE Oyj, Class B

2

|

3,356,500

|

248,541

|

|

United Continental Holdings, Inc.

1

|

10,500,000

|

245,490

|

|

Intertek Group PLC

2

|

4,259,428

|

214,956

|

|

Aggreko PLC

2

|

7,165,750

|

205,502

|

|

Siemens AG

2

|

1,547,100

|

168,154

|

|

Boeing Co.

|

2,150,000

|

162,024

|

|

Ryanair Holdings PLC (ADR)

1

|

4,422,499

|

151,603

|

|

Vallourec SA

2

|

2,813,000

|

146,800

|

|

Canadian Pacific Railway Ltd.

|

1,300,000

|

131,869

|

|

Union Pacific Corp.

|

995,000

|

125,091

|

|

Experian PLC

2

|

7,350,000

|

118,756

|

|

Deere & Co.

|

1,300,000

|

112,346

|

|

FANUC CORP.

2

|

538,800

|

100,197

|

|

Honeywell International Inc.

|

1,500,000

|

95,205

|

|

Precision Castparts Corp.

|

500,000

|

94,710

|

|

Geberit AG

2

|

423,000

|

$ 93,643

|

|

Lockheed Martin Corp.

|

1,000,000

|

92,290

|

|

Michael Page International PLC

2

|

14,279,900

|

92,229

|

|

Parker-Hannifin Corp.

|

1,000,000

|

85,060

|

|

W.W. Grainger, Inc.

|

400,500

|

81,049

|

|

Komatsu Ltd.

2

|

2,876,500

|

73,608

|

|

Atlas Copco AB, Class B

2

|

2,981,500

|

73,148

|

|

European Aeronautic Defence and Space Co. EADS NV

2

|

1,770,000

|

69,372

|

|

Marubeni Corp.

2

|

6,000,000

|

42,997

|

|

Cummins Inc.

|

320,000

|

34,672

|

|

Eaton Corp. PLC

|

427,300

|

23,160

|

|

|

|

4,464,682

|

|

|

|

|

|

MATERIALS — 7.11%

|

|

|

|

Newmont Mining Corp.

|

10,398,000

|

482,883

|

|

Barrick Gold Corp.

|

11,000,000

|

385,110

|

|

Linde AG

2

|

1,999,100

|

348,622

|

|

FMC Corp.

|

3,180,000

|

186,094

|

|

Alcoa Inc.

|

17,900,000

|

155,372

|

|

Holcim Ltd

2

|

2,082,111

|

153,354

|

|

Glencore International PLC

2

|

26,005,000

|

151,549

|

|

Syngenta AG

2

|

370,000

|

149,252

|

|

BASF SE

2

|

1,522,000

|

143,055

|

|

First Quantum Minerals Ltd.

|

5,413,000

|

119,231

|

|

Dow Chemical Co.

|

3,580,000

|

115,705

|

|

Potash Corp. of Saskatchewan Inc.

|

2,745,000

|

111,694

|

|

Gold Fields Ltd.

2

|

8,500,000

|

105,494

|

|

Akzo Nobel NV

2

|

1,325,000

|

87,433

|

|

Monsanto Co.

|

850,000

|

80,452

|

|

Impala Platinum Holdings Ltd.

2

|

3,865,000

|

78,040

|

|

Praxair, Inc.

|

700,000

|

76,615

|

|

Rio Tinto PLC

2

|

1,100,000

|

64,100

|

|

BHP Billiton Ltd.

2

|

1,600,000

|

62,485

|

|

L’Air Liquide SA, bonus shares

2

|

346,499

|

43,421

|

|

United States Steel Corp.

|

1,500,000

|

35,805

|

|

|

|

3,135,766

|

|

|

|

|

|

ENERGY — 5.31%

|

|

|

|

Oil Search Ltd.

2

|

31,941,554

|

234,734

|

|

TOTAL SA

2

|

4,410,000

|

228,251

|

|

Petróleo Brasileiro SA – Petrobras, ordinary nominative (ADR)

|

9,780,000

|

190,417

|

|

Petróleo Brasileiro SA – Petrobras, preferred nominative (ADR)

|

983,150

|

18,975

|

|

Canadian Natural Resources, Ltd.

|

7,145,000

|

205,723

|

|

Royal Dutch Shell PLC, Class B

2

|

2,585,998

|

91,524

|

|

Royal Dutch Shell PLC, Class A (ADR)

|

1,000,000

|

68,950

|

|

Royal Dutch Shell PLC, Class B (ADR)

|

200,000

|

14,178

|

|

FMC Technologies, Inc.

1

|

3,715,000

|

159,113

|

|

Enbridge Inc.

|

3,600,000

|

155,697

|

|

INPEX CORP.

2

|

28,903

|

154,251

|

|

EOG Resources, Inc.

|

1,000,000

|

120,790

|

|

Occidental Petroleum Corp.

|

1,470,000

|

112,617

|

|

Technip SA

2

|

950,000

|

109,373

|

|

ConocoPhillips

|

1,800,000

|

104,382

|

|

Noble Energy, Inc.

|

800,000

|

81,392

|

|

Transocean Ltd.

|

1,420,000

|

63,403

|

|

Schlumberger Ltd.

|

850,000

|

58,896

|

|

Baker Hughes Inc.

|

1,150,000

|

46,966

|

|

Imperial Oil Ltd.

|

963,500

|

41,390

|

|

Chevron Corp.

|

371,100

|

40,131

|

|

Cenovus Energy Inc.

|

1,166,840

|

$ 39,051

|

|

|

|

2,340,204

|

|

|

|

|

|

TELECOMMUNICATION SERVICES — 0.66%

|

|

|

|

SOFTBANK CORP.

2

|

3,951,700

|

144,600

|

|

América Móvil, SAB de CV, Series L (ADR)

|

4,595,800

|

106,347

|

|

América Móvil, SAB de CV, Series L

|

17,175,000

|

19,797

|

|

Koninklijke KPN NV

2

|

4,000,000

|

19,781

|

|

|

|

290,525

|

|

|

|

|

|

UTILITIES — 0.54%

|

|

|

|

GDF SUEZ

2

|

6,948,347

|

143,163

|

|

CLP Holdings Ltd.

2

|

11,260,000

|

94,553

|

|

|

|

237,716

|

|

|

|

|

|

MISCELLANEOUS — 3.46%

|

|

|

|

Other common stocks in initial period of acquisition

|

|

1,528,132

|

|

|

|

|

|

|

|

|

|

Total common stocks (cost: $27,580,239,000)

|

|

41,338,173

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible securities — 0.02%

|

|

|

|

|

|

|

|

MISCELLANEOUS — 0.02%

|

|

|

|

Other convertible securities in initial period of acquisition

|

6,638

|

|

|

|

|

|

|

|

|

|

Total convertible securities (cost: $5,605,000)

|

|

6,638

|

|

|

|

|

|

|

|

|

|

|

Principal amount

|

|

|

Short-term securities — 6.41%

|

(000)

|

|

|

|

|

|

|

Freddie Mac 0.10%–0.19% due 1/7–8/13/2013

|

$742,579

|

742,417

|

|

U.S. Treasury Bills 0.12%–0.157% due 1/31–5/2/2013

|

603,900

|

603,831

|

|

Federal Home Loan Bank 0.12%–0.22% due 2/1–7/1/2013

|

419,750

|

419,652

|

|

Fannie Mae 0.14%–0.175% due 1/2–3/27/2013

|

394,100

|

394,078

|

|

Federal Farm Credit Banks 0.15%–0.20% due 3/11–8/8/2013

|

224,700

|

224,601

|

|

National Australia Funding (Delaware) Inc. 0.185%–0.20% due 2/5–2/6/2013

3

|

84,500

|

84,489

|

|

Bank of Nova Scotia 0.175% due 1/25–2/4/2013

|

80,000

|

79,988

|

|

Victory Receivables Corp. 0.19% due 1/3/2013

3

|

50,000

|

49,999

|

|

Gotham Funding Corp. 0.20% due 1/7/2013

3

|

27,200

|

27,199

|

|

Toronto-Dominion Holdings USA Inc. 0.19%–0.20% due 2/4–2/19/2013

3

|

75,800

|

75,780

|

|

International Bank for Reconstruction and Development 0.13%–0.14% due 1/14–3/14/2013

|

54,500

|

54,498

|

|

Sumitomo Mitsui Banking Corp. 0.19% due 1/28/2013

3

|

47,200

|

47,192

|

|

Commonwealth Bank of Australia 0.17% due 1/2/2013

3

|

25,000

|

25,000

|

|

|

|

|

|

Total short-term securities (cost: $2,828,273,000)

|

|

2,828,724

|

|

|

|

|

|

Total investment securities (cost: $30,414,117,000)

|

|

44,173,535

|

|

Other assets less liabilities

|

|

(61,446)

|

|

|

|

|

|

|

|

|

|

Net assets

|

|

$44,112,089

|

As permitted by U.S. Securities and Exchange Commission regulations,

“Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly

disclosed.

1

Security did not produce income during the last 12 months.

2

Valued under fair value procedures adopted by authority

of the board of trustees. The total value of all such securities, including those in “Miscellaneous,” was $20,018,998,000,

which represented 45.38% of the net assets of the fund. This amount includes $19,973,821,000 related to certain securities trading

outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading.

3

Acquired in a transaction exempt from registration

under section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally

to qualified institutional buyers. The total value of all such securities was $309,659,000, which represented .70% of the net assets

of the fund.

Investments in affiliates

A company is considered to be an affiliate of the fund under the

Investment Company Act of 1940 if the fund’s holdings in that company represent 5% or more of the outstanding voting shares.

Further details on such holdings and related transactions during the three months ended December 31, 2012, appear below.

|

|

|

|

|

|

|

Value of

|

|

|

|

|

|

|

Dividend

|

affiliate at

|

|

|

|

|

|

|

income

|

12/31/2012

|

|

|

Beginning shares

|

Additions

|

Reductions

|

Ending shares

|

(000)

|

(000)

|

|

|

|

|

|

|

|

|

|

Michael Page International PLC*

|

16,800,000

|

—

|

2,520,100

|

14,279,900

|

$ —

|

$ —

|

*Unaffiliated issuer at 12/31/2012.

Valuation disclosures

Capital Research and Management Company (“CRMC”), the

fund’s investment adviser, values the fund’s investments at fair value as defined by accounting principles generally

accepted in the United States of America. The net asset value of each share class of the fund is generally determined as of approximately

4:00 p.m. New York time each day the New York Stock Exchange is open.

Security transactions

are recorded by the fund as of the date the trades are executed with brokers. Assets and liabilities, including investment securities,

denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more

pricing vendors on the valuation date.

Methods and inputs — The fund’s investment adviser uses

the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods

and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price

of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business

on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are

taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities purchased

with more than 60 days left to maturity, are generally valued at prices obtained from one or more pricing vendors. Vendors value

such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that

are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However,

these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

|

Fixed-income class

|

Examples of standard inputs

|

|

All

|

Benchmark yields, transactions, bids, offers, quotations from dealers and

|

|

|

trading systems, new issues, spreads and other relationships observed in

|

|

|

the markets among comparable securities; and proprietary pricing models

|

|

|

such as yield measures calculated using factors such as cash flows,

|

|

|

financial or collateral performance and other reference data (collectively

|

|

|

referred to as “standard inputs”)

|

|

Corporate bonds & notes; convertible securities

|

Standard inputs and underlying equity of the issuer

|

|

Bonds & notes of governments & government agencies

|

Standard inputs and interest rate volatilities

|

When the fund’s investment adviser deems it appropriate to

do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in

good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not

available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or

equity securities traded principally among fixed-income dealers, are generally valued in the manner described above for either

equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates fair value. The value

of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to

par when they reach 60 days.

Securities and other assets for which representative market quotations

are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in

good faith under fair value guidelines adopted by authority of the fund’s

board of trustees as further described below.

The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange

Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment

adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to

be assigned to a particular security, such as

the type and cost of the security; contractual or legal restrictions on resale

of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion

or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security;

and changes in overall market conditions.

In

addition, the closing prices of equity securities

that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local

trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments

that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater

market activity occurred.

Processes and structure

—

The

fund’s

board of trustees has delegated authority to the

fund’s

investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint

Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process,

and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions

made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes

in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better

reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the

fair valuation guidelines to the board of trustees with supplemental information to support the changes. The

fund’s

board and audit committee also regularly review reports that describe fair value determinations

and methods.

The

fund’s

investment

adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process,

including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing

decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual

control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies

the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities.

Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant

observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities

trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market

movements following the close of local trading.

Level 3 values are

based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market

participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk

or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because

the inputs used to determine fair value may not always be quoted prices in an active market

.

The following table presents the fund’s valuation levels as of December 31, 2012 (dollars in thousands):

|

|

Investment securities

|

|

Level 1

|

Level 2*

|

Level 3

|

Total

|

Assets:

Assets:

|

|

|

|

|

|

Common stocks:

|

|

|

|

|

|

Consumer discretionary

|

$ 3,872,770

|

$ 3,680,532

|

$ —

|

$ 7,553,302

|

|

Health care

|

2,840,399

|

3,840,118

|

—

|

6,680,517

|

|

Consumer staples

|

1,579,169

|

3,775,085

|

—

|

5,354,254

|

|

Information technology

|

3,193,565

|

1,794,711

|

—

|

4,988,276

|

|

Financials

|

3,126,827

|

1,637,972

|

—

|

4,764,799

|

|

Industrials

|

2,439,066

|

2,025,616

|

—

|

4,464,682

|

|

Materials

|

1,748,961

|

1,386,805

|

—

|

3,135,766

|

|

Energy

|

1,522,071

|

818,133

|

—

|

2,340,204

|

|

Telecommunication services

|

126,144

|

164,381

|

—

|

290,525

|

|

Utilities

|

—

|

237,716

|

—

|

237,716

|

|

Miscellaneous

|

870,203

|

657,929

|

—

|

1,528,132

|

|

Convertible securities

|

—

|

6,638

|

—

|

6,638

|

|

Short-term securities

|

—

|

2,828,724

|

—

|

2,828,724

|

|

Total

|

$21,319,175

|

$22,854,360

|

$ —

|

$44,173,535

|

*Securities with a market value of $19,566,852,000, which represented

44.36% of the net assets of the fund, transferred from Level 1 to Level 2 since the prior fiscal year-end, primarily due to significant

market movements following the close of local trading.

unaudited

|

Federal income tax information

|

(dollars in thousands)

|

|

|

|

|

Gross unrealized appreciation on investment securities

|

$14,924,759

|

|

Gross unrealized depreciation on investment securities

|

(1,186,516)

|

|

Net unrealized appreciation on investment securities

|

13,738,243

|

|

Cost of investment securities for federal income tax purposes

|

30,435,292

|

Key to abbreviation

ADR = American Depositary Receipts

Investments are not FDIC-insured, nor are they deposits of or

guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks,

charges and expenses. This and other important information is contained in the fund prospectus and summary prospectus, which can

be obtained from your financial professional and should be read carefully before investing. You may also call American Funds Service

Company (AFS) at 800/421-4225 or visit the American Funds website at americanfunds.com.

ITEM 2 – Controls and Procedures

The Registrant’s Principal Executive Officer

and Principal Financial Officer have concluded, based on their evaluation of the Registrant’s disclosure controls and procedures

(as such term is defined in Rule 30a-3 under the Investment Company Act of 1940), that such controls and procedures are adequate

and reasonably designed to achieve the purposes described in paragraph (c) of such rule.

There were no changes in the Registrant’s

internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred

during the Registrant’s last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the

Registrant’s internal control over financial reporting.

ITEM 3 – Exhibits

The certifications required by Rule 30a-2 of

the Investment Company Act of 1940 and Section 302 of the Sarbanes-Oxley Act of 2002 are attached as exhibits hereto.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

NEW PERSPECTIVE FUND

|

|

|

|

|

|

By

/s/ Michael J. Thawley

|

|

|

Michael J. Thawley, Executive Vice President

and

Principal Executive Officer

|

|

|

|

|

|

Date: February 28, 2013

|

Pursuant to the requirements of the Securities

Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf

of the Registrant and in the capacities and on the dates indicated.

|

By

/s/ Michael J. Thawley

|

|

Michael J. Thawley, Executive Vice President

and

Principal Executive Officer

|

|

|

|

Date: February 28, 2013

|

|

By

/s/ Brian C. Janssen

|

|

Brian C. Janssen, Treasurer and

Principal Financial Officer

|

|

|

|

Date: February 28, 2013

|

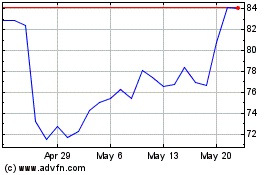

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

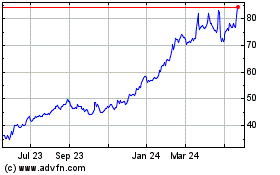

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024