UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-41563

Brookfield Asset Management Ltd.

(Translation of registrant's name into English)

Brookfield Place, Suite 100, 181 Bay Street, P.O. Box 762 Toronto, Ontario, Canada M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Brookfield Asset Management Ltd. |

| | | (Registrant) |

| | | |

| | | |

| Date: June 13, 2024 | | /s/ Hadley Peer Marshall |

| | | Hadley Peer Marshall |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Brookfield Opens Fundraising for Catalytic Transition Fund with Anchor Commitment from ALTÉRRA Targeted to Raise up to $5 billion to Scale Up Climate Finance in Emerging Markets

First dedicated fund introduced for transition investing in emerging markets

$1 billion committed by UAE-backed ALTÉRRA

CTF first close expected by the end of 2024

BROOKFIELD, NEWS, June 13, 2024 (GLOBE NEWSWIRE) -- Brookfield Asset Management (NYSE: BAM, TSX: BAM) (“Brookfield”) and Alterra Management Limited announced today the launch of the Catalytic Transition Fund (“CTF” or “the Fund”) focused on directing capital into clean energy and transition assets in emerging economies.

With the urgent need to cut emissions and accelerate the climate transition, the Brookfield-managed CTF will harness a $1 billion commitment by ALTÉRRA funds (“ALTÉRRA”) to catalyze up to $5 billion in total capital for deployment into emerging markets. Since announcing the launch of CTF in December 2023, Brookfield has been focused on developing the investment strategy, identifying an advanced pipeline of potential investments and pre-marketing to potential investment partners.

Launched at COP28 in Dubai, ALTÉRRA is the world’s largest private investment vehicle for climate finance. It responds to the call for more ambitious funding models for the climate transition, particularly in developing countries, and to the urgent need to accelerate and scale climate action. At this critical juncture for driving climate action, ALTÉRRA is committed to deploying $30 billion in climate investments with the goal to catalyze $250 billion with partners by 2030.

Emerging and developing economies outside of China receive less than 15% of global clean energy investment, despite representing nearly one third of global emissions and often yielding greater emissions reductions per dollar invested than in developed countries. To align with the goals of the Paris Agreement, clean energy investment in these markets will need to increase six times over current levels to reach $1.6 trillion per year by the early 2030s.

CTF represents a unique private capital approach to crowd in capital for clean energy and transition assets in emerging markets. Managed by Brookfield and driven by the catalytic capital of ALTÉRRA, it will accelerate decarbonization investments while generating attractive risk-adjusted returns in traditionally underserved emerging markets. ALTÉRRA is offering a capped return on its CTF commitment, improving the risk-adjusted returns for investors in the Fund and unlocking compelling investment opportunities for private investors. By acting as a catalyst, ALTÉRRA aims to significantly expand private finance and fuel ambitious new climate strategies in both developing and developed markets.

The strategic partnership between Brookfield and ALTÉRRA benefits from Brookfield’s global leadership and strong track record as the world’s largest transition investor among private fund managers. The first fund in the Brookfield Global Transition Fund series (BGTF I) raised a record $15 billion in 2022. In February 2024, the second fund in the series (BGTF II) announced a first close of $10 billion and is on track to be larger than its predecessor.

For CTF, the capital raised will be deployed in target emerging markets, including in South and Central America, South and Southeast Asia, the Middle East, and Eastern Europe. At least 10% of the Fund’s total capital will be contributed by Brookfield ensuring that its interests align with investment partners. A first close for CTF is expected by the end of 2024.

Mark Carney, Chair and Head of Transition Investing at Brookfield Asset Management, said:

“The Catalytic Transition Fund is a private market solution to the global challenge of delivering transition investment to emerging markets. Brookfield is already a leading transition investor in these regions and has first-hand knowledge of the incredible opportunity and impact that is available in these chronically underfunded markets. Having this dedicated capital for emerging markets will complement our existing Brookfield Global Transition Fund strategy and further accelerate the growth of clean energy and transition investments in the future.”

H.E Majid Al-Suwaidi, CEO of ALTÉRRA, said:

“While we are making progress in addressing climate change, we need to pick up the pace and scale significantly to meet our collective climate goals. ALTÉRRA wants to challenge the status quo of how we invest in climate solutions, and our investment in the Catalytic Transition Fund reflects our ongoing commitment to go beyond business-as-usual. We are passionate about ensuring capital goes where it is needed and that it drives impact for countries, communities and business. Our catalytic capital will be deployed to supercharge investment in emerging markets – wherever we see great potential for delivering meaningful climate impact and positive economic return.”

About Brookfield Asset Management

Brookfield Asset Management (NYSE: BAM, TSX: BAM) is a leading global alternative asset manager with over $925 billion of assets under management. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We offer a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors.

Brookfield operates one of the world’s largest platforms for renewable power and sustainable solutions. Our renewable power portfolio consists of hydroelectric, wind, utility-scale solar and storage facilities in North America, South America, Europe and Asia, and totals approximately 34,000 megawatts of installed capacity and a development pipeline of approximately 157,000 megawatts. Our portfolio of sustainable solutions assets includes our investments in Westinghouse, a leading global nuclear services business, and a utility and independent power producer with operations in the Caribbean and Latin America, as well as both operating assets and a development pipeline of carbon capture and storage capacity, agricultural renewable natural gas and materials recycling.

As a signatory to the Net Zero Asset Managers initiative, Brookfield is committed to supporting the goal of achieving net-zero greenhouse gas emissions by 2050 or sooner—in line with the Paris Agreement.

For more information, please visit our website at www.brookfield.com.

About ALTÉRRA

ALTÉRRA is the world’s largest private investment vehicle for climate finance. Launched at COP28 with a US$30 billion commitment from the UAE, ALTÉRRA aims to build innovative partnerships to mobilize US$250 billion globally by 2030 to finance the new climate economy and accelerate the climate transition.

ALTERRA's dual-arm structure enhances its impact: the US$25 billion Acceleration Fund directs capital towards projects crucial for accelerating the global transition to a net-zero and climate-resilient economy at scale. The US$5 billion Transformation Fund incentivizes investment flows in high-growth climate opportunities in underserved markets by providing catalytic capital.

Alterra Management Limited is duly licensed and authorised by the ADGM Financial Services Regulatory Authority under the Financial Services Permission No. 200001.

Brookfield

Communications & Media

Simon Maine

Tel: +44 (0)7398 909 278

Email: simon.maine@brookfield.com | Investor Relations:

Jason Fooks

Tel: +1 (866) 989 0311

Email: jason.fooks@brookfield.com |

ALTÉRRA

Simon Hailes

Managing Director Middle East

Edelman Smithfield

M: +971 50 973 1173

Email: simon.hailes@edelmansmithfield.com |

Notice to Readers

This news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations (collectively, “forward-looking statements”). Forward-looking statements include statements that are predictive in nature, depend upon or refer to future results, events or conditions, and include, but are not limited to, statements which reflect management’s current estimates, beliefs and assumptions and which are in turn based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. The estimates, beliefs and assumptions of Brookfield are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Forward-looking statements are typically identified by words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and similar expressions. In particular, the forward-looking statements contained in this news release include statements referring to, among other things, the total capital deployed by CTF and how such capital will be deployed, the expected impact and returns of CTF and the expected first close of CTF .

Although Brookfield believes that such forward-looking statements are based upon reasonable estimates, beliefs and assumptions, certain factors, risks and uncertainties, which are described from time to time in our documents filed with the securities regulators in Canada and the United States, or that are not presently known to Brookfield or that Brookfield currently believes are not material, could cause actual results to differ materially from those contemplated or implied by forward-looking statements.

Readers are urged to consider these risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements, which are based only on information available to us as of the date of this news release. Except as required by law, Brookfield undertakes no obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be as a result of new information, future events or otherwise.

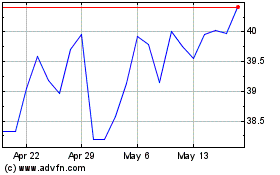

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From May 2024 to Jun 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Jun 2023 to Jun 2024