Brookfield Business Partners (NYSE: BBU, BBUC; TSX: BBU.UN, BBUC)

today announced that the Toronto Stock Exchange (“TSX”) has

accepted a notice filed by Brookfield Business Partners L.P. of its

intention to renew its normal course issuer bid for its limited

partnership units (“Units”) and a notice filed by Brookfield

Business Corporation of its intention to renew its normal course

issuer bid for its class A exchangeable subordinate voting shares

(“Exchangeable Shares”). Brookfield Business Partners believes that

the Units or the Exchangeable Shares, respectively, may from time

to time trade in a price range that does not fully reflect their

value and that, in such circumstances, the acquisition of Units or

Exchangeable Shares, as applicable, may represent an attractive use

of available funds.

Brookfield Business Partners is authorized to

purchase up to 3,714,088 Units and 3,647,722 Exchangeable Shares,

representing up to 5% of the issued and outstanding Units and

Exchangeable Shares, respectively. At the close of business on

August 8, 2024, there were 74,281,766 Units and 72,954,447

Exchangeable Shares issued and outstanding. Under Brookfield

Business Partners’ normal course issuer bids, it may purchase up to

10,340 Units and up to 5,184 Exchangeable Shares on the TSX during

any trading day, which represents 25% of the average daily trading

volume of 41,360 Units and 20,738 Exchangeable Shares on the TSX

for the six months ended July 31, 2024.

Purchases under each normal course issuer bid

are authorized to commence on August 19, 2024 and will terminate on

August 18, 2025, or earlier should Brookfield Business Partners

L.P. or Brookfield Business Corporation complete purchases under

each respective normal course issuer bid prior to such date.

Under Brookfield Business Partners L.P.’s normal

course issuer bid that commenced on August 17, 2023 and will expire

on August 16, 2024, Brookfield Business Partners L.P. previously

sought and received approval from the TSX to purchase up to

3,730,658 Units. As of August 8, 2024, Brookfield Business Partners

and its affiliates purchased a total of 647,754 Units under

Brookfield Business Partners L.P.’s previous normal course issuer

bid through the facilities of the TSX, the New York Stock Exchange

and/or alternative trading systems in Canada and the United States

at a weighted average price paid per Unit of US$16.73.

Under Brookfield Business Corporation’s normal

course issuer bid that commenced on August 17, 2023 and will expire

on August 16, 2024, Brookfield Business Corporation previously

sought and received approval from the TSX to repurchase up to

3,647,745 Exchangeable Shares. No Exchangeable Shares were

purchased under Brookfield Business Corporation’s previous normal

course issuer bid.

Purchases of Units and Exchangeable Shares will

be made through the facilities of the TSX, the New York Stock

Exchange and/or alternative trading systems. All Units and

Exchangeable Shares purchased by Brookfield Business Partners L.P.

and Brookfield Business Corporation under the applicable normal

course issuer bids will be cancelled. Purchases will be subject to

compliance with applicable United States federal securities laws,

including Rule 10b-18 under the United States Securities Exchange

Act of 1934, as amended, as well as applicable Canadian securities

laws.

Brookfield Business Partners has entered into

automatic repurchase plans, which have been pre-cleared by the TSX,

to allow for the purchase of Units or Exchangeable Shares, as

applicable, subject to certain trading parameters, at times when

Brookfield Business Partners would ordinarily not be active in the

market due to its own internal trading black-out periods, insider

trading rules or otherwise. Outside of these periods, Units and

Exchangeable Shares will be purchased in accordance with

management’s discretion and in compliance with applicable law. The

actual number of Units and Exchangeable Shares purchased under the

automatic plans, the timing of such purchases and the price at

which Units and Exchangeable Shares are purchased will depend upon

future market conditions.

Brookfield Business Partners is

a global business services and industrials company focused on

owning and operating high-quality businesses that provide essential

products and services and benefit from a strong competitive

position. Investors have flexibility to invest in our company

either through Brookfield Business Partners L.P. (NYSE: BBU; TSX:

BBU.UN), a limited partnership, or Brookfield Business Corporation

(NYSE, TSX: BBUC), a corporation. For more information, please

visit https://bbu.brookfield.com.

Brookfield Business Partners is the flagship

listed vehicle of Brookfield Asset Management’s Private Equity

Group. Brookfield Asset Management is a leading global alternative

asset manager with approximately $1 trillion of assets under

management.

For more information, please

contact:

|

Media:Marie FullerTel: +44 207 408 8375Email:

marie.fuller@brookfield.com |

Investors:Alan FlemingTel: +1 (416) 645-2736Email:

alan.fleming@brookfield.com |

|

|

|

Cautionary Statement Regarding

Forward-Looking Statements and Information

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian and U.S. securities laws,

including the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, include statements regarding the operations, business,

financial condition, expected financial results, performance,

prospects, opportunities, priorities, targets, goals, ongoing

objectives, strategies and outlook of Brookfield Business Partners,

as well as regarding recently completed and proposed acquisitions,

dispositions, and other transactions, and the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and include words such as “expects”,

“anticipates”, “plans”, “believes”, “estimates”, “seeks”,

“intends”, “targets”, “projects”, “forecasts”, “views”,

“potential”, “likely” or negative versions thereof and other

similar expressions, or future or conditional verbs such as “may”,

“will”, “should”, “would” and “could”.

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, investors and other

readers should not place undue reliance on forward-looking

statements and information because they involve known and unknown

risks, uncertainties and other factors, many of which are beyond

our control, which may cause the actual results, performance or

achievements of Brookfield Business Partners to differ materially

from anticipated future results, performance or achievements

expressed or implied by such forward-looking statements and

information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: general

economic conditions and risks relating to the economy, including

unfavorable changes in interest rates, foreign exchange rates,

inflation and volatility in the financial markets; global equity

and capital markets and the availability of equity and debt

financing and refinancing within these markets; strategic actions

including our ability to complete dispositions and achieve the

anticipated benefits therefrom; the ability to complete and

effectively integrate acquisitions into existing operations and the

ability to attain expected benefits; changes in accounting policies

and methods used to report financial condition (including

uncertainties associated with critical accounting assumptions and

estimates); the ability to appropriately manage human capital; the

effect of applying future accounting changes; business competition;

operational and reputational risks; technological change; changes

in government regulation and legislation within the countries in

which we operate; governmental investigations; litigation; changes

in tax laws; ability to collect amounts owed; catastrophic events,

such as earthquakes, hurricanes and pandemics/epidemics;

cybersecurity incidents; the possible impact of international

conflicts, wars and related developments including terrorist acts

and cyber terrorism; and other risks and factors detailed from time

to time in our documents filed with the securities regulators in

Canada and the United States including those set forth in the “Risk

Factors” section in our most recently filed Form 20-F.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive. When

relying on our forward-looking statements and information,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Except as

required by law, we undertake no obligation to publicly update or

revise any forward-looking statements or information, whether

written or oral, that may be as a result of new information, future

events or otherwise.

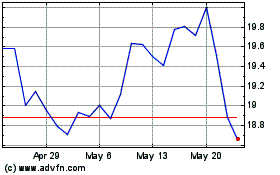

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Oct 2024 to Nov 2024

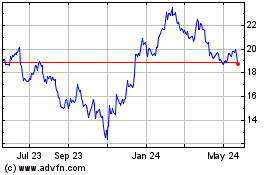

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Nov 2023 to Nov 2024