GDP, Inflation, and Rates to Remain Stable in 2025, Investors to Focus on Quality Across Asset Classes

January 16 2025 - 10:02AM

Business Wire

Franklin Templeton Institute’s Global

Investment Management Survey reveals optimistic outlook for the

economy, equities, fixed income and alternative investments in

2025

Investors are gearing up for a promising 2025, citing stable

inflation, rates, and low unemployment according to the latest

Global Investment Management Survey by the Franklin Templeton

Institute.

Conducted in November, the results capture insights from more

than 200 of Franklin Templeton’s senior investment professionals

worldwide, covering public and private equity, public and private

debt, real estate, digital assets, hedge funds and secondary

private market investments.

“One year ago, this survey showed lingering fears of a global

recession but growing optimism that a recession should and could be

avoided,” said Stephen Dover, Chief Market Strategist and Head of

the Franklin Templeton Institute. “Fast forward to today, our

robust economy aligns with our original predictions and we are

optimistic for the year ahead.”

The complete survey results can be found here.

Additional Insights from the Survey’s Four Focus Areas

The Economy Should Remain

Robust

- We predict US real gross domestic product (GDP) forecast of

2.5%, which is higher than the 2.2% expectation of the

International Monetary Fund (IMF) and 2.1% Bloomberg consensus;

Europe real GDP forecast of 0.5%, which is lower than the 1.2%

expectations from the IMF and the Bloomberg consensus; and China

real GDP of 3.5%, which is lower than the 4.5% expectations from

the IMF and Bloomberg consensus.

- Inflation, as measured by US Core Personal Consumption

Expenditures (PCE), is expected to stabilize and finish 2025 around

2.75%, which is in line with the current reading of 2.8% and higher

than the estimates from the Fed of 2.2% and Bloomberg consensus of

2.3%.

- We believe the unemployment rate in the US will end the year

around 4.25%, in line with the current Bloomberg consensus

expectation of 4.3%.

Equities: Will End the Year

Positive

- The S&P 500 is anticipated to end the year higher, within

the range of 6400–6800

- We predict 7.5% earnings growth in the U.S., which is

significantly lower than the market’s expectation of 14.7%. U.S.

earnings growth will be driven by strong real GDP growth of

2.5%.

- We favor small-cap stocks and believe both value and growth

stocks will generate positive returns due to free cash flow yield,

high return on invested capital, and high return on equity.

- Outside of the U.S., investors have a bullish outlook on India

and Japan.

- Favored sectors include financials, technology, industrials,

and energy/energy services.

Fixed Income: Shorter Duration Will

Benefit

- US investment-grade spreads are expected to end 2025 at 95

basis points (bps) up from the current level of 78 bps but below

the 10-year average of 122 bps.

- US high-yield spreads are expected to end 2025 at 300 bps up

from a current level of 266 bps, but below the 10-year average

spread of roughly 419 bps.

- High-yield default rates are expected to increase from 1.1% to

around 2.5%, still much lower than the historical average of

3.4%.

- Municipal bonds continue to be a high-quality, diversifying

investment option, with expected total returns of about 3.75% in

2025.

Alternatives: New Opportunities

Arise

- Secondary investments offer good value due to their structural

advantages for individuals and institutions.

- A significant amount of debt will mature soon, presenting an

attractive opportunity for private credit managers with

capital.

- The most attractive opportunity is within real estate debt as

banks hesitate to lend, allowing managers to negotiate favorable

terms.

- Real estate valuations dropped to more realistic levels,

creating opportunities across select sectors, namely multi-family

housing, industrial warehouse, life sciences, medical offices and

neighborhood retail.

“Confidence continues to grow across asset classes. As we enter

2025 from a position of strength, we expect global economic growth

to be stable and stronger than anticipated,” added Dover.

“Investors who strategically position themselves to capitalize on

these economic conditions in 2025 will unlock favorable

outcomes.”

There is no assurance that any estimate, forecast or

projection will be realized.

About the survey

The survey provides a comprehensive summation of the views of

more than 200 of Franklin Templeton’s investment professionals who

focus on both public and private markets across asset classes. The

specific forecasts within the survey reflect the average of the

group; each investment team operates independently and has its own

views.

First conducted in January 2024, the survey is a starting point

for Franklin Templeton clients, including financial advisors and

institutional investors, to understand the firm’s views on the

economy, equities, fixed income and alternatives. For an overview

of the January survey, click here.

The Franklin Templeton Institute, launched in January 2021, is

an innovative hub for research and knowledge sharing that unlocks

the firm’s competitive advantage as a source of global market

insights.

The views expressed are those of the investment manager and the

comments, opinions and analyses are rendered as of the publication

date and may change without notice. The underlying assumptions and

these views are subject to change based on market and other

conditions and may differ from other portfolio managers or of the

firm as a whole. The information provided in this material is not

intended as a complete analysis of every material fact regarding

any country, region or market. There is no assurance that any

prediction, projection or forecast on the economy, stock market,

bond market or the economic trends of the markets will be realized.

The value of investments and the income from them can go down as

well as up and you may not get back the full amount that you

invested. Past performance is not necessarily indicative nor a

guarantee of future performance. All investments involve risks,

including possible loss of principal.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,400 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and approximately $1.6 trillion in assets under

management as of January 31, 2024. For more information, please

visit franklintempleton.com and follow us on LinkedIn, Twitter and

Facebook.

Copyright © 2025. Franklin Templeton. All rights reserved.

TN24-10

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116371850/en/

Franklin Templeton Corporate Communications: Laura McNamara, +1

(978) 505-0524, laura.mcnamara@franklintempleton.com

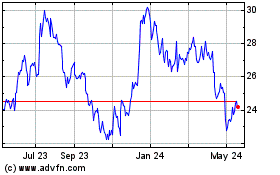

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Jan 2024 to Jan 2025