Templeton Emerging Markets Fund Announces Board Initiatives Intended to Reduce Fund Discount

February 26 2025 - 8:00AM

Business Wire

Templeton Emerging Markets Fund [NYSE: EMF] (“EMF” or the

“Fund”) today announced initiatives of the Fund’s Board of Trustees

(“Board”) designed to reduce the Fund’s discount to net asset value

(“NAV”) and benefit shareholders. These initiatives include a

management fee reduction, a managed distribution plan and a share

repurchase program.

Management fee reduction: The Board

approved a five-basis point reduction in the investment management

fee that shareholders pay to the investment manager, Templeton

Asset Management Ltd. The management fee reduction will be

effective March 1, 2025. The prior and new investment management

fee, calculated daily and paid monthly, to Templeton Asset

Management Ltd. based on the average weekly net assets of the Fund

are as follows:

Net Assets

Prior Annual Fee Rate

New Annual Fee Rate

Up to and including $1 billion

1.100%

1.050%

Over $1 billion, up to and including $2

billion

1.050%

1.000%

In excess of $2 billion

1.000%

0.950%

Managed distribution plan: The

Board authorized a managed distribution plan (the “Plan”) pursuant

to which the Fund will make quarterly distributions to shareholders

at the fixed rate of $0.22 per share (this equates to 6.1% and 7.2%

based on the Fund’s January 31, 2025, closing NAV and market price,

respectively). The Plan is intended to provide shareholders with

consistent distributions each quarter and is intended to narrow the

discount between the market price and NAV of the Fund’s common

shares, but there can be no assurance that the Plan will be

successful in doing so. The Fund anticipates the first quarterly

distribution to be paid on or about March 31, 2025. Additional

information about the Plan is provided below.

Share repurchase program: The Board

approved an open-market share repurchase program (the “Share

Repurchase Program”) to authorize the Fund to purchase, from time

to time, up to 10% of the Fund’s common shares in open-market

transactions, at the discretion of management, in order to help

reduce the Fund’s market price discount to NAV. Additional

information about the Share Repurchase Program is provided

below.

Additional information about the Plan: To the extent that

sufficient distributable income is not available on a quarterly

basis, the Fund will distribute long-term capital gains and/or

return of capital in order to maintain its managed distribution

rate. A return of capital may occur, for example, when some or all

of the money that was invested in the Fund is paid back to

shareholders. A return of capital distribution does not necessarily

reflect the Fund’s investment performance and should not be

confused with “yield” or “income.” Even though the Fund may realize

current year capital gains, such gains may be offset, in whole or

in part, by the Fund’s capital loss carryovers from prior

years.

The Board may amend the terms of the Plan or terminate the Plan

at any time without prior notice to the Fund’s shareholders. The

amendment or termination of the Plan could have an adverse effect

on the market price of the Fund’s common shares. The Plan will be

subject to periodic review by the Board, including a yearly review

of the distribution rate to determine if an adjustment should be

made.

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the distribution or from

the terms of the Plan. The amounts and sources of distributions for

tax reporting purposes will depend upon the Fund’s investment

experience during its fiscal year and may be subject to changes

based on tax regulations. The Fund will send a Form 1099-DIV to

shareholders for the calendar year that will describe how to report

the Fund’s distributions for federal income tax purposes.

Additional information about the Share Repurchase Program:

Subject to the 10% limitation, the timing and amount of repurchases

would be in the discretion of the Fund’s portfolio managers. In

exercising its discretion consistent with their portfolio

management responsibilities, the portfolio managers will take into

account various other factors, including, but not limited to, the

level of the discount, the Fund’s performance, portfolio holdings,

dividend history, market conditions, cash on hand, the availability

of other attractive investments, and whether the sale of certain

portfolio securities would be undesirable because of liquidity

concerns or because the sale might subject the Fund to adverse tax

consequences. Any repurchases would be made on a national

securities exchange at the prevailing market price, subject to

exchange requirements, federal securities laws and rules that

restrict repurchases, and the terms of any outstanding leverage or

borrowing of the Fund.

If and when the Fund’s 10% threshold is reached, no further

repurchases could be completed unless authorized by the Board.

Until the 10% threshold is reached, Fund management will have the

flexibility to rapidly commence share repurchases if and when it is

determined to be appropriate in light of prevailing circumstances.

The Share Repurchase Program is intended to benefit shareholders by

enabling the Fund to repurchase shares at a discount to NAV,

thereby increasing the proportionate interest of each remaining

shareholder in the Fund.

For further information on Templeton Emerging Markets Fund,

please visit our web site at

www.franklintempleton.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and $1.58 trillion in assets under management as of

January 31, 2025. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

Category: Fund Announcement

Source: Franklin Templeton Closed End Funds

Source: Franklin Resources, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226200362/en/

Investor Contact: Fund Investor Services: 1-800-342-5236 Media

Contact: Lisa Tibbitts: 1-904-942-4451 or

Lisa.Tibbitts@franklintempleton.com

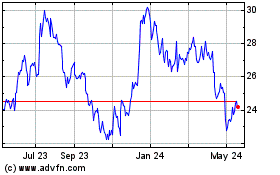

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Mar 2024 to Mar 2025