0000014693false00000146932024-12-052024-12-050000014693us-gaap:CommonClassAMember2024-12-052024-12-050000014693us-gaap:NonvotingCommonStockMember2024-12-052024-12-050000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2024-12-052024-12-050000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2024-12-052024-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 5, 2024

Brown-Forman Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-00123 | | 61-0143150 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 850 Dixie Highway, | Louisville, | Kentucky | | 40210 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (502) 585-1100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock (voting), $0.15 par value | BFA | New York Stock Exchange |

Class B Common Stock (nonvoting), $0.15 par value | BFB | New York Stock Exchange |

1.200% Notes due 2026 | BF26 | New York Stock Exchange |

2.600% Notes due 2028 | BF28 | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 5, 2024, Brown-Forman Corporation issued a press release reporting its operating results for the second fiscal quarter and six month period ended October 31, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The information pursuant to this Item 2.02 - Results of Operations and Financial Condition, including the information in Exhibit 99.1, is being furnished and shall not be deemed "filed" for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Brown-Forman Corporation Press Release dated December 5, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| BROWN-FORMAN CORPORATION |

| (Registrant) |

| |

| |

| Date: December 5, 2024 | /s/ Michael E. Carr, Jr. |

| Michael E. Carr, Jr. |

| Executive Vice President, General Counsel and Corporate Secretary

|

BROWN-FORMAN REPORTS FIRST HALF FISCAL 2025 RESULTS; REAFFIRMS FULL YEAR GROWTH OUTLOOK

December 5, 2024, LOUISVILLE, KY — Brown-Forman Corporation (NYSE: BFA, BFB) reported financial results for its second quarter and first half of fiscal 2025, ended October 31, 2024. Second quarter reported net sales decreased 1%1 to $1.1 billion (+3% on an organic basis2) compared to the same prior-year period. In the quarter, reported operating income increased 1% to $341 million (+5% on an organic basis) and diluted earnings per share increased 9% to $0.55.

For the first six months of the fiscal year, the company’s reported net sales decreased 5% to $2.0 billion (flat on an organic basis) compared to the same prior-year period. First half reported operating income decreased 7% to $622 million (-3% on an organic basis) and diluted earnings per share decreased 3% to $0.96.

Lawson Whiting, Brown-Forman’s President and Chief Executive Officer shared, “Despite challenging economic conditions, our results for the first half of the fiscal year were in line with our expectations, and we anticipate a return to growth in fiscal 2025. We continue to expect our performance to accelerate through the second half of the year, driven by the strength of our strategy, our portfolio, our geographic breadth, and, of course, our talented people.”

First Half of Fiscal 2025 Highlights

•Net sales declines were largely due to the Finlandia and Sonoma-Cutrer divestitures.

•Net sales declined across all geographic aggregations, but improved sequentially in international markets and the Travel Retail3 channel.

•Gross profit declined 8% (-4% organic) primarily due to the Finlandia and Sonoma-Cutrer divestitures. Gross margin contracted 240 basis points largely related to the timing of input cost fluctuations coupled with high inventory levels, partially offset by favorable price/mix.

•Operating expenses declined by 10% (-4% organic).

•The Brown-Forman Board of Directors increased the quarterly cash dividend for the 41st consecutive year.

First Half of Fiscal 2025 Brand Results

•Net sales for Whiskey3 products declined 1% (flat organic). Growth from Woodford Reserve and Old Forester in the United States was more than offset by declines of the other super-premium Jack Daniel’s expressions, The Glendronach, and Glenglassaugh. Jack Daniel’s Tennessee Whiskey benefited from sequential improvement to a decline of 1% (flat organic). An estimated net increase in distributor inventories positively impacted net sales.

•Net sales for the Tequila3 portfolio declined 17% (-17% organic). el Jimador’s net sales declined 16% (-16% organic) led by lower volumes in the United States and Mexico. Herradura’s net sales decreased 14% (-13% organic) led by lower volumes in Mexico within a challenging economic environment.

•Net sales for the Ready-to-Drink3 (RTD) portfolio declined 6% (+2% organic). Jack Daniel’s RTD/RTP portfolio decreased 8% (+1% organic) led by the impact of the Jack Daniel’s Country Cocktails business model change (JDCC)2. Lapping a strong double-digit comparison, net sales of New Mix declined 1% (+5% organic) driven by the negative effect of foreign exchange that was partially offset by market share gains.

•Rest of Portfolio's3 net sales declined 26% (flat organic) driven by the Finlandia and Sonoma-Cutrer divestitures along with lower volumes of Korbel California Champagnes in the United States. The decline was partially offset by the positive contribution from Diplomático. An estimated net increase in distributor inventories positively impacted net sales.

First Half of Fiscal 2025 Market Results

•In a challenging economic environment, net sales in the United States declined 7% (-3% organic) driven by lower volumes, led by Jack Daniel’s Tennessee Whiskey and Korbel California Champagnes, coupled with the divestiture of Sonoma-Cutrer and the impact of JDCC. The declines were partially offset by growth of Woodford Reserve and Old Forester as these brands continued to outperform the US Whiskey category. An estimated net increase in distributor inventories positively impacted net sales.

•Industry trends remained soft in the Developed International3 markets as net sales declined 5% (-3% organic), though improved sequentially. The decrease was driven by lower volumes from the Jack Daniel’s family of brands, the absence of the Finlandia brand, and declines of Glenglassaugh due to the absence of the high-value cask sales in the same prior-year period. The decline was partially offset by higher volumes of Jack Daniel’s Tennessee Whiskey in Japan due to changes in distributor ordering patterns in the same prior-year period in advance of the transition to owned distribution on April 1, 2024.

•Lapping solid double-digit growth in the prior-year period, net sales in Emerging3 markets declined 3% (+6% organic). The decrease was driven by the Finlandia divestiture, the negative effect of foreign exchange (primarily reflecting the strengthening of the dollar against the Turkish lira), and declines of our Tequila portfolio in Mexico. The decline was partially offset by growth of the Jack Daniel’s family of brands in Brazil and Türkiye.

•The Travel Retail channel’s net sales declined 5% (-3% organic) led by lower volumes of the other super-premium Jack Daniel’s expressions and Woodford Reserve, as well as the Finlandia divestiture. The declines were partially offset by growth of Jack Daniel’s Tennessee Whiskey and Diplomático.

First Half of Fiscal 2025 Other P&L Items

•Gross profit decreased 8% (-4% organic) largely due to the Finlandia and Sonoma-Cutrer divestitures. Gross margin contracted 240 basis points to 59.2% largely driven by the timing of input cost fluctuations coupled with high inventory levels, the negative effect of foreign exchange, and the impact of the transition services agreements (TSAs) related to the divestitures of Finlandia and Sonoma-Cutrer, partially offset by favorable price/mix and the impact of JDCC.

•Advertising expense decreased 7% (-4% organic) related to the phasing of spend which was more heavily weighted in the prior year period for super-premium Jack Daniel’s expressions and to support the launch of the Jack Daniel’s & Coca-Cola RTD in the United States, along with the impact of recently divested brands.

•Selling, general, and administrative (SG&A) expenses decreased 4% (-3% organic) driven by lower compensation and benefit related expenses, tightened control of discretionary spend, and the absence of transaction-related expenses for the divestiture of Finlandia.

•The company’s operating income decreased 7% (-3% organic) with an operating margin decrease of 60 basis points to 30.4%. The decrease in operating margin was largely driven by the timing of input cost fluctuations coupled with high inventory levels, the impact of the TSAs for the divestitures of Finlandia and Sonoma-Cutrer, and the negative effect of foreign exchange. The decrease was partially offset by favorable price/mix, advertising and SG&A expense leverage, the Franchise tax refund2, and the gain on sale of the Alabama cooperage2.

•Diluted earnings per share decreased $0.03 driven primarily by the decrease in operating income partially offset by a lower effective tax rate.

First Half of Fiscal 2025 Financial Stewardship

On November 22, 2024, the Brown-Forman Board of Directors approved a 4% increase in the quarterly cash dividend to $0.2265 per share on its Class A and Class B common stock. The dividend is payable on January 2, 2025, to stockholders of record on December 6, 2024. Brown-Forman, a member of the

prestigious S&P 500 Dividend Aristocrats Index, has paid regular quarterly cash dividends for 81 consecutive years and has increased the regular dividend for 41 consecutive years.

Fiscal 2025 Outlook

We anticipate a return to growth for organic net sales and organic operating income in fiscal 2025 driven by gains in international markets and the benefit of normalizing inventory trends. This outlook is tempered by our belief that global macroeconomic and geopolitical uncertainties will continue to create a challenging operating environment. Accordingly, we reiterate the following expectations for fiscal 2025:

•Organic net sales growth in the 2% to 4% range.

•Organic operating income growth in the 2% to 4% range.

•An effective tax rate to be in the range of approximately 21% to 23%.

The estimated capital expenditure range has been updated to $180 to $190 million from $195 to $205 million.

Conference Call Details

Brown-Forman will host a conference call to discuss these results at 10:00 a.m. (ET) today. A live audio broadcast of the conference call, and the accompanying presentation slides, will be available via

Brown-Forman’s website, brown-forman.com, through a link to “Investors/Events & Presentations.” A digital audio recording of the conference call and the presentation slides will also be posted on the website and will be available for at least 30 days following the conference call.

Brown-Forman Corporation has been building exceptional spirits brands for more than 150 years, responsibly upholding our founding promise of “Nothing Better in the Market.” Our portfolio of premium brands includes the Jack Daniel’s Family of Brands, Woodford Reserve, Herradura, el Jimador, Korbel, New Mix, Old Forester, The Glendronach, Glenglassaugh, Benriach, Diplomático Rum, Chambord, Gin Mare, Fords Gin, Slane, and Coopers’ Craft. With a team of approximately 5,700 employees worldwide, we proudly share our passion for premium beverages in more than 170 countries. Discover more about us at brown-forman.com and stay connected through LinkedIn, Instagram, and X.

Important Information on Forward-Looking Statements:

This press release contains statements, estimates, and projections that are “forward-looking statements” as defined under U.S. federal securities laws. Words such as “aim,” “ambition,” “anticipate,” “aspire,” “believe,” “can,” “continue,” “could,” “envision,” “estimate,” “expect,” “expectation,” “intend,” “may,” “might,” “plan,” “potential,” “project,” “pursue,” “see,” “seek,” “should,” “will,” “would,” and similar words indicate forward-looking statements, which speak only as of the date we make them. Except as required by law, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. By their nature, forward-looking statements involve risks, uncertainties, and other factors (many beyond our control) that could cause our actual results to differ materially from our historical experience or from our current expectations or projections. These risks and uncertainties include, but are not limited to:

•Our substantial dependence upon the continued growth of the Jack Daniel's family of brands

•Substantial competition from new entrants, consolidations by competitors and retailers, and other competitive activities, such as pricing actions (including price reductions, promotions, discounting, couponing, or free goods), marketing, category expansion, product introductions, or entry or expansion in our geographic markets or distribution networks

•Route-to-consumer changes that affect the timing of our sales, temporarily disrupt the marketing or sale of our products, or result in higher fixed costs

•Disruption of our distribution network or inventory fluctuations in our products by distributors, wholesalers, or retailers

•Changes in consumer preferences, consumption, or purchase patterns – particularly away from larger producers in favor of small distilleries or local producers, or away from brown spirits, our premium products, or spirits generally, and our ability to anticipate or react to them; further legalization of marijuana; bar, restaurant, travel, or other on-premise declines; shifts in demographic or health and wellness trends; or unfavorable consumer reaction to new products, line extensions, package changes, product reformulations, or other product innovation

•Production facility, aging warehouse, or supply chain disruption

•Imprecision in supply/demand forecasting

•Higher costs, lower quality, or unavailability of energy, water, raw materials, product ingredients, or labor

•Risks associated with acquisitions, dispositions, business partnerships, or investments – such as acquisition integration, termination difficulties or costs, or impairment in recorded value

•Impact of health epidemics and pandemics, and the risk of the resulting negative economic impacts and related governmental actions

•Unfavorable global or regional economic conditions and related economic slowdowns or recessions, low consumer confidence, high unemployment, weak credit or capital markets, budget deficits, burdensome government debt, austerity measures, higher interest rates, higher taxes, political instability, higher inflation, deflation, lower returns on pension assets, or lower discount rates for pension obligations

•Product recalls or other product liability claims, product tampering, contamination, or quality issues

•Negative publicity related to our company, products, brands, marketing, executive leadership, employees, Board of Directors, family stockholders, operations, business performance, or prospects

•Failure to attract or retain key executive or employee talent

•Risks associated with being a U.S.-based company with a global business, including commercial, political, and financial risks; local labor policies and conditions; protectionist trade policies, or economic or trade sanctions, including additional retaliatory tariffs on American whiskeys and the effectiveness of our actions to mitigate the negative impact on our margins, sales, and distributors; compliance with local trade practices and other regulations; terrorism, kidnapping, extortion, or other types of violence; and health pandemics

•Failure to comply with anti-corruption laws, trade sanctions and restrictions, or similar laws or regulations

•Fluctuations in foreign currency exchange rates, particularly a stronger U.S. dollar

•Changes in laws, regulatory measures, or governmental policies, especially those affecting production, importation, marketing, labeling, pricing, distribution, sale, or consumption of our beverage alcohol products

•Tax rate changes (including excise, corporate, sales or value-added taxes, property taxes, payroll taxes, import and export duties, and tariffs) or changes in related reserves, changes in tax rules or accounting standards, and the unpredictability and suddenness with which they can occur

•Decline in the social acceptability of beverage alcohol in significant markets

•Significant additional labeling or warning requirements or limitations on availability of our beverage alcohol products

•Counterfeiting and inadequate protection of our intellectual property rights

•Significant legal disputes and proceedings, or government investigations

•Cyber breach or failure or corruption of our key information technology systems or those of our suppliers, customers, or direct and indirect business partners, or failure to comply with personal data protection laws

•Our status as a family “controlled company” under New York Stock Exchange rules, and our dual-class share structure

For further information on these and other risks, please refer to our public filings, including the “Risk Factors” section of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

For the Three Months Ended October 31, 2023 and 2024

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | |

| 2023 | | 2024 | | Change |

| | | | | |

| | | | | |

| | | | | |

| Net sales | $ | 1,107 | | | $ | 1,095 | | | (1%) |

| Cost of sales | 436 | | | 449 | | | 3% |

Gross profit | 671 | | | 646 | | | (4%) |

| Advertising expenses | 140 | | | 126 | | | (9%) |

| Selling, general, and administrative expenses | 192 | | | 187 | | | (3%) |

| | | | | |

| | | | | |

| Other expense (income), net | — | | | (8) | | | |

Operating income | 339 | | | 341 | | | 1% |

| Non-operating postretirement expense | — | | | 1 | | | |

| Interest expense, net | 29 | | | 29 | | | |

| Equity method investment income | — | | | (2) | | | |

Income before income taxes | 310 | | | 313 | | | 1% |

| Income taxes | 68 | | | 55 | | | |

Net income | $ | 242 | | | $ | 258 | | | 7% |

| | | | | |

| Earnings per share: | | | | | |

Basic | $ | 0.50 | | | $ | 0.55 | | | 8% |

Diluted | $ | 0.50 | | | $ | 0.55 | | | 9% |

| | | | | |

| Gross margin | 60.6 | % | | 59.1 | % | | |

| Operating margin | 30.6 | % | | 31.1 | % | | |

| | | | | |

| Effective tax rate | 22.0 | % | | 17.6 | % | | |

| | | | | |

| Cash dividends paid per common share | $ | 0.2055 | | | $ | 0.2178 | | | |

| | | | | |

| Shares (in thousands) used in the | | | | | |

calculation of earnings per share | | | | | |

Basic | 479,200 | | | 472,660 | | | |

Diluted | 480,115 | | | 473,057 | | | |

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

For the Six Months Ended October 31, 2023 and 2024

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | |

| 2023 | | 2024 | | Change |

| | | | | |

| | | | | |

| | | | | |

| Net sales | $ | 2,145 | | | $ | 2,046 | | | (5%) |

| Cost of sales | 823 | | | 835 | | | 1% |

Gross profit | 1,322 | | | 1,211 | | | (8%) |

| Advertising expenses | 271 | | | 252 | | | (7%) |

| Selling, general, and administrative expenses | 392 | | | 375 | | | (4%) |

| | | | | |

| | | | | |

| Other expense (income), net | (7) | | | (38) | | | |

Operating income | 666 | | | 622 | | | (7)% |

| Non-operating postretirement expense | 1 | | | 1 | | | |

| Interest expense, net | 56 | | | 57 | | | |

| Equity method investment income | — | | | (2) | | | |

Income before income taxes | 609 | | | 566 | | | (7)% |

| Income taxes | 136 | | | 113 | | | |

Net income | $ | 473 | | | $ | 453 | | | (4)% |

| | | | | |

| Earnings per share: | | | | | |

Basic | $ | 0.99 | | | $ | 0.96 | | | (3)% |

Diluted | $ | 0.98 | | | $ | 0.96 | | | (3)% |

| | | | | |

| Gross margin | 61.6 | % | | 59.2 | % | | |

| Operating margin | 31.0 | % | | 30.4 | % | | |

| | | | | |

| Effective tax rate | 22.4 | % | | 20.1 | % | | |

| | | | | |

| | | | | |

| Cash dividends paid per common share | $ | 0.4110 | | | $ | 0.4356 | | | |

| | | | | |

| Shares (in thousands) used in the | | | | | |

calculation of earnings per share | | | | | |

Basic | 479,262 | | | 472,647 | | | |

Diluted | 480,234 | | | 472,997 | | | |

Brown-Forman Corporation

Unaudited Condensed Consolidated Balance Sheets

(Dollars in millions)

| | | | | | | | | | | |

| April 30,

2024 | | October 31,

2024 |

| Assets: | | | |

| Cash and cash equivalents | $ | 446 | | | $ | 416 | |

| Accounts receivable, net | 769 | | | 954 | |

| Inventories | 2,556 | | | 2,565 | |

| | | |

| Other current assets | 265 | | | 261 | |

Total current assets | 4,036 | | | 4,196 | |

| | | |

| Property, plant, and equipment, net | 1,074 | | | 1,060 | |

| Goodwill | 1,455 | | | 1,468 | |

| Other intangible assets | 990 | | | 1,000 | |

| Equity method investments | 270 | | | 272 | |

| Other assets | 341 | | | 336 | |

Total assets | $ | 8,166 | | | $ | 8,332 | |

| | | |

| Liabilities: | | | |

| Accounts payable and accrued expenses | $ | 793 | | | $ | 695 | |

| | | |

| Accrued income taxes | 38 | | | 46 | |

| Short-term borrowings | 428 | | | 512 | |

| Current portion of long-term debt | 300 | | | 300 | |

| | | |

| | | |

Total current liabilities | 1,559 | | | 1,553 | |

| | | |

| Long-term debt | 2,372 | | | 2,391 | |

| Deferred income taxes | 315 | | | 290 | |

| Accrued postretirement benefits | 160 | | | 159 | |

| Other liabilities | 243 | | | 234 | |

Total liabilities | 4,649 | | | 4,627 | |

| | | |

| Stockholders’ equity | 3,517 | | | 3,705 | |

| | | |

Total liabilities and stockholders’ equity | $ | 8,166 | | | $ | 8,332 | |

| | | |

Brown-Forman Corporation

Unaudited Condensed Consolidated Statements of Cash Flows

For the Six Months Ended October 31, 2023 and 2024

(Dollars in millions)

| | | | | | | | | | | |

| 2023 | | 2024 |

| | | |

| Cash provided by operating activities | $ | 97 | | | $ | 129 | |

| | | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of assets | 13 | | | 51 | |

| | | |

Additions to property, plant, and equipment | (79) | | | (72) | |

Other | 5 | | | — | |

Cash provided by (used for) investing activities | (61) | | | (21) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Net change in other short-term borrowings | 220 | | | 83 | |

| | | |

| | | |

| Payments of withholding taxes related to stock-based awards | (4) | | | (2) | |

Acquisition of treasury stock | (42) | | | — | |

Dividends paid | (197) | | | (206) | |

Other | — | | | (4) | |

| Cash provided by (used for) financing activities | (23) | | | (129) | |

| | | |

| Effect of exchange rate changes | (7) | | | (9) | |

| | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 6 | | | (30) | |

| | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 384 | | | 456 | |

| | | |

Cash, cash equivalents, and restricted cash at end of period | 390 | | | 426 | |

| Less: Restricted cash at end of period | (10) | | | (10) | |

| Less: Cash included in assets held for sale at end of period | (7) | | | — | |

| Cash and cash equivalents at end of period | $ | 373 | | | $ | 416 | |

| | | |

| | | | | | | | | | | | | |

| Schedule A |

| Brown-Forman Corporation |

| Supplemental Statement of Operations Information (Unaudited) |

| | | | | |

| Percentage change versus the prior-year period ended | October 31, 2024 | | |

| 3 Months | | 6 Months | | |

| Reported change in net sales | (1 | %) | | (5 | %) | | |

| Acquisitions and divestitures | 4 | % | | 3 | % | | |

| JDCC* | 1 | % | | 1 | % | | |

| Foreign exchange | — | % | | 1 | % | | |

Organic change in net sales2 | 3 | % | | — | % | | |

| | | | | |

| Reported change in gross profit | (4 | %) | | (8 | %) | | |

| Acquisitions and divestitures | 3 | % | | 3 | % | | |

| JDCC* | — | % | | — | % | | |

| Foreign exchange | 1 | % | | 1 | % | | |

Organic change in gross profit2 | — | % | | (4 | %) | | |

| | | | | |

| Reported change in advertising expenses | (9 | %) | | (7 | %) | | |

| Acquisitions and divestitures | 2 | % | | 2 | % | | |

| | | | | |

| Foreign exchange | — | % | | 1 | % | | |

Organic change in advertising expenses2 | (7 | %) | | (4 | %) | | |

| | | | | |

| Reported change in SG&A | (3 | %) | | (4 | %) | | |

| Acquisitions and divestitures | 2 | % | | 1 | % | | |

| | | | | |

| Foreign exchange | — | % | | — | % | | |

Organic change in SG&A2 | (1 | %) | | (3 | %) | | |

| | | | | |

| Reported change in operating income | 1 | % | | (7 | %) | | |

| Acquisitions and divestitures | 5 | % | | 4 | % | | |

| | | | | |

| Other items* | — | % | | (2 | %) | | |

| Foreign exchange | — | % | | 1 | % | | |

Organic change in operating income2 | 5 | % | | (3 | %) | | |

| | | | | |

*”Other items” include “JDCC” and “Franchise tax refund”. See “Note 2 - Non-GAAP Financial Measures” for details. | | |

See "Note 2 - Non-GAAP Financial Measures" for details on our use of Non-GAAP financial measures, how these measures are calculated, and the reasons why we believe this information is useful to readers. Note: Totals may differ due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Schedule B | | | | | | |

| Brown-Forman Corporation | | | | | | |

| Supplemental Statement of Operations Information (Unaudited) | | | | | | |

Six Months Ended October 31, 2024 | | | | | | |

| | | | | | | | | | | | |

| Supplemental Information3 | | | | | | | | |

| Volumes (9-Liter Cases) | | Net Sales % Change vs. Prior-Year Period |

Product Category / Brand Family / Brand3 | Depletions

(Millions)* | % Change vs. Prior-Year Period | Shipments (Millions)* | % Change vs. Prior-Year Period | | Reported | Acquisitions and Divestitures | JDCC | Foreign Exchange | | | Organic2 |

| Whiskey | 10.4 | (4 | %) | 10.6 | (1 | %) | | (1 | %) | — | % | — | % | 1 | % | | | — | % |

| JDTW | 6.9 | (4 | %) | 7.1 | (1 | %) | | (1 | %) | — | % | — | % | — | % | | | — | % |

| JDTH | 1.0 | (3 | %) | 1.0 | — | % | | — | % | — | % | — | % | 1 | % | | | 2 | % |

| Gentleman Jack | 0.4 | (7 | %) | 0.4 | (2 | %) | | 1 | % | — | % | — | % | — | % | | | 1 | % |

| JDTA | 0.5 | 4 | % | 0.5 | 3 | % | | (2 | %) | — | % | — | % | 3 | % | | | 1 | % |

| JDTF | 0.3 | (8 | %) | 0.3 | (4 | %) | | (3 | %) | — | % | — | % | 1 | % | | | (2 | %) |

| Woodford Reserve | 0.8 | 1 | % | 0.9 | 7 | % | | 8 | % | — | % | — | % | — | % | | | 8 | % |

| Old Forester | 0.2 | 1 | % | 0.2 | (3 | %) | | 11 | % | — | % | — | % | — | % | | | 11 | % |

| Rest of Whiskey | 0.2 | (23 | %) | 0.2 | (25 | %) | | (22 | %) | — | % | — | % | — | % | | | (22 | %) |

| Ready-to-Drink | 10.3 | (4 | %) | 10.3 | (1 | %) | | (6 | %) | — | % | 6 | % | 2 | % | | | 2 | % |

| JD RTD/RTP | 5.3 | (8 | %) | 5.3 | (5 | %) | | (8 | %) | — | % | 8 | % | 1 | % | | | 1 | % |

| New Mix | 4.9 | 3 | % | 4.9 | 3 | % | | (1 | %) | — | % | — | % | 6 | % | | | 5 | % |

| Tequila | 1.0 | (15 | %) | 1.0 | (18 | %) | | (17 | %) | — | % | — | % | 1 | % | | | (17 | %) |

| el Jimador | 0.7 | (14 | %) | 0.7 | (19 | %) | | (16 | %) | — | % | — | % | — | % | | | (16 | %) |

| Herradura | 0.3 | (13 | %) | 0.3 | (10 | %) | | (14 | %) | — | % | — | % | 1 | % | | | (13 | %) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Rest of Portfolio | 1.0 | (11 | %) | 1.2 | (4 | %) | | (26 | %) | 27 | % | — | % | (1 | %) | | | — | % |

| Non-branded and bulk | NA | NA | NA | NA | | 39 | % | 2 | % | — | % | — | % | | | 41 | % |

| Total Portfolio | 22.6 | (5 | %) | 23.1 | (2 | %) | | (5 | %) | 3 | % | 1 | % | 1 | % | | | — | % |

| | | | | | | | | | | | |

| Other Brands and Aggregations | | | | | | | | | | | |

| Jack Daniel's Family | 14.6 | (6 | %) | 14.8 | (3 | %) | | (2 | %) | — | % | 1 | % | 1 | % | | | (1 | %) |

| American Whiskey | 10.3 | (4 | %) | 10.5 | (1 | %) | | — | % | — | % | — | % | 1 | % | | | 1 | % |

| Diplomático | 0.1 | (10 | %) | 0.1 | 77 | % | | 95 | % | — | % | — | % | (6 | %) | | | 90 | % |

| Gin Mare | 0.1 | 17 | % | 0.1 | 15 | % | | 15 | % | — | % | — | % | (2 | %) | | | 13 | % |

See "Note 2 - Non-GAAP Financial Measures" for details on our use of Non-GAAP financial measures, how these measures are calculated, and the reasons why we believe this information is useful to readers. *Volumes are adjusted to (i) remove increases or decreases related to acquired and divested brands for periods not comparable year over year and (ii) reflect the Jack Daniel’s Country Cocktails business model change (JDCC) during fiscal 2024 and 2025. For additional information concerning acquisitions and divestitures impacting depletions and shipments and the change in the JDCC business model, see the applicable defined terms in “Note 2 – Non-GAAP Financial Measures.

Note: Totals may differ due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | |

| Schedule C | | | | | | |

| Brown-Forman Corporation | | | |

| Supplemental Statement of Operations Information (Unaudited) | | | |

Six Months Ended October 31, 2024 | | | |

| | | | | | | |

| Net Sales % Change vs. Prior-Year Period |

Geographic Area3 | Reported | Acquisitions and Divestitures | JDCC | Foreign Exchange | | | Organic2 |

| United States | (7 | %) | 2 | % | 2 | % | — | % | | | (3 | %) |

| Developed International | (5 | %) | 2 | % | — | % | — | % | | | (3 | %) |

| Germany | (2 | %) | — | % | — | % | (1 | %) | | | (2 | %) |

| Australia | (5 | %) | — | % | — | % | — | % | | | (4 | %) |

| United Kingdom | (8 | %) | — | % | — | % | (3 | %) | | | (11 | %) |

| France | (2 | %) | — | % | — | % | (1 | %) | | | (3 | %) |

| Canada | (2 | %) | 4 | % | — | % | 1 | % | | | 3 | % |

| Spain | (12 | %) | 1 | % | — | % | — | % | | | (11 | %) |

| Rest of Developed International | (7 | %) | 8 | % | — | % | — | % | | | 1 | % |

| Emerging | (3 | %) | 6 | % | — | % | 4 | % | | | 6 | % |

| Mexico | (11 | %) | — | % | — | % | 6 | % | | | (5 | %) |

| Poland | (15 | %) | 20 | % | — | % | (8 | %) | | | (3 | %) |

| Brazil | 31 | % | — | % | — | % | 6 | % | | | 37 | % |

| Rest of Emerging | (3 | %) | 8 | % | — | % | 4 | % | | | 9 | % |

| Travel Retail | (5 | %) | 2 | % | — | % | — | % | | | (3 | %) |

| Non-branded and bulk | 39 | % | 2 | % | — | % | — | % | | | 41 | % |

| Total | (5 | %) | 3 | % | 1 | % | 1 | % | | | — | % |

See "Note 2 - Non-GAAP Financial Measures" for details on our use of Non-GAAP financial measures, how these measures are calculated, and the reasons why we believe this information is useful to readers. Note: Totals may differ due to rounding.

| | | | | | |

| Schedule D | |

| Brown-Forman Corporation | |

| Supplemental Information (Unaudited) — Estimated Net Change in Distributor Inventories |

| | |

Six Months Ended October 31, 2024 | |

| Estimated Net Change in Distributor Inventories3 vs. Prior-Year Period |

Geographic Area3 - Net Sales | |

| United States | | 3% |

| Developed International | | 4% |

| Emerging | | 2% |

| Travel Retail | | (1%) |

| Non-branded and bulk | | —% |

| | |

Product category / brand family / brand3 | | |

| Whiskey | | 3% |

| JDTW | | 3% |

| JDTH | | 4% |

| Gentleman Jack | | 5% |

| JDTA | | —% |

| JDTF | | 6% |

| Woodford Reserve | | 5% |

| Old Forester | | 1% |

| Rest of Whiskey | | —% |

| Ready-to-Drink | | 3% |

| JD RTD/RTP | | 5% |

| New Mix | | —% |

| Tequila | | (1%) |

| el Jimador | | (6%) |

| Herradura | | 3% |

| | |

| | |

| Rest of Portfolio | | 5% |

| Non-branded and bulk | | —% |

| | |

| Statement of Operations Line Items | | |

| Net Sales | | 3% |

| Cost of Sales | | 3% |

| Gross Profit | | 3% |

| Operating Income | | 6% |

| | |

See "Note 3 - Definitions - Estimated Net Change in Distributor Inventories."

A positive difference is interpreted as a net increase in distributors’ inventories; whereas, a negative difference is interpreted as a net decrease in distributors’ inventories.

Note 1 - All related commentary and percentage growth rates are on a reported basis and compared to the same prior-year periods, unless otherwise noted.

Note 2 - Non-GAAP Financial Measures

Use of Non-GAAP Financial Information. We report our financial results in accordance with U.S. generally accepted accounting principles (GAAP). Additionally, we use some financial measures in this press release that are not measures of financial performance under GAAP. These non-GAAP measures, defined below, should be viewed as supplements to (not substitutes for) our results of operations and other measures reported under GAAP. Other companies may define or calculate these non-GAAP measures differently. Reconciliations of these non-GAAP measures to the most closely comparable GAAP measures are presented on Schedules A, B, and C of this press release.

“Organic change” in measures of statements of operations. We present changes in certain measures, or line items, of the statements of operations that are adjusted to an “organic” basis. We use “organic change” for the following measures: (a) organic net sales; (b) organic cost of sales; (c) organic gross profit; (d) organic advertising expenses; (e) organic selling, general, and administrative (SG&A) expenses; (f) organic other expense (income), net; (g) organic operating expenses*and (h) organic operating income. To calculate these measures, we adjust, as applicable, for (1) acquisitions and divestitures, (2) other items, and (3) foreign exchange. We explain these adjustments below.

•“Acquisitions and divestitures.” This adjustment removes (a) the gain or loss recognized on sale of divested brands and certain assets, (b) any non-recurring effects related to our acquisitions and divestitures (e.g., transaction, transition, and integration costs), (c) the effects of operating activity related to acquired and divested brands for periods not comparable year over year (non-comparable periods), and (d) fair value changes to contingent consideration liabilities. Excluding non-comparable periods allows us to include the effects of acquired and divested brands only to the extent that results are comparable year over year.

During fiscal 2023, we acquired Gin Mare Brand, S.L.U. and Mareliquid Vantguard, S.L.U., which owned the Gin Mare brand (Gin Mare). This adjustment removes the fair value adjustments to Gin Mare’s earn-out contingent consideration liability that is payable in cash no earlier than July 2024 and no later than July 2027.

During fiscal 2024, we sold our Finlandia vodka business, which resulted in a pre-tax gain of $92 million, and entered into a related transition services agreement (TSA) for this business. This adjustment removes the (a) transaction costs related to the divestiture, (b) operating activity for the non-comparable period, which is activity in the first and second quarters of fiscal 2024, and (c) net sales, cost of sales, and operating expenses* recognized pursuant to the TSA related to distribution services in certain markets.

During fiscal 2024, we sold the Sonoma-Cutrer wine business in exchange for an ownership percentage of 21.4% in The Duckhorn Portfolio Inc. (Duckhorn) along with $50 million cash and entered into a related TSA for this business. This transaction resulted in a pre-tax gain of $175 million. This adjustment removes the (a) transaction costs related to the divestiture, (b) operating activity for the non-comparable period, which is activity in the first and second quarters of fiscal 2024, and (c) net sales, cost of sales, and operating expenses*recognized pursuant to the TSA related to distribution services in certain markets.

During the second quarter of fiscal 2024, we recognized a gain of $7 million on the sale of certain fixed assets. During the first quarter of fiscal 2025, we recognized a gain of $12 million on the sale of the Alabama cooperage. This adjustment removes the gains from our other expense (income), net and operating income.

We believe that these adjustments allow for us to better understand our organic results on a comparable basis.

•“Other items.” Other items include the additional items outlined below.

“Jack Daniel’s Country Cocktails business model change (JDCC).” In fiscal 2021, we entered into a partnership with the Pabst Brewing Company for the supply, sales, and distribution of Jack Daniel's Country Cocktails in the United States while Brown-Forman continued to produce certain products. During fiscal 2024, this production fully transitioned to Pabst Brewing Company for the Jack Daniel’s Country Cocktails products. This adjustment removes the non-comparable operating activity related to the sales of Brown-Forman-produced Jack Daniel’s Country Cocktails products for the first and second quarters of fiscal 2024 and fiscal 2025.

*Operating expenses include advertising expenses, SG&A expenses, and other expenses (income), net.

14

“Franchise tax refund.” During the first quarter of fiscal 2025, we recognized a $13 million franchise tax refund due to a change in franchise tax calculation methodology for the state of Tennessee. This modification lowered our annual franchise tax obligation and was retroactively applied to franchise taxes paid during fiscal 2020 through fiscal 2023. This adjustment removes the franchise tax refund from our other expense (income), net and operating income.

•“Foreign exchange.” We calculate the percentage change in certain line items of the statements of operations in accordance with GAAP and adjust to exclude the cost or benefit of currency fluctuations. Adjusting for foreign exchange allows us to understand our business on a constant-dollar basis, as fluctuations in exchange rates can distort the organic trend both positively and negatively. (In this press release, “dollar” means the U.S. dollar unless stated otherwise.) To eliminate the effect of foreign exchange fluctuations when comparing across periods, we translate current-year results at prior-year rates and remove transactional and hedging foreign exchange gains and losses from current- and prior-year periods.

We use the non-GAAP measure “organic change,” along with other metrics, to: (a) understand our performance from period to period on a consistent basis; (b) compare our performance to that of our competitors; (c) calculate components of management incentive compensation; (d) plan and forecast; and (e) communicate our financial performance to the Board of Directors, stockholders, and investment community. We have consistently applied the adjustments within our reconciliations in arriving at each non-GAAP measure. We believe these non-GAAP measures are useful to readers and investors because they enhance the understanding of our historical financial performance and comparability between periods. When we provide guidance for organic change in certain measures of the statements of operations we do not provide guidance for the corresponding GAAP change, as the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, such as foreign exchange, which could have a significant impact to our GAAP income statement measures.

In addition to the non-GAAP financial measures presented, we believe that our results are affected by changes in distributor inventories, particularly in our largest market, the United States, where the spirits industry is subject to regulations that essentially mandate a so-called “three-tier system,” with a value chain that includes suppliers, distributors, and retailers. Accordingly, we also provide information concerning estimated fluctuations in distributor inventories. We believe such information is useful in understanding our performance and trends as it provides relevant information regarding customers’ demand for our products. See Schedule D of this press release.

Note 3 - Definitions

From time to time, to explain our results of operations or to highlight trends and uncertainties affecting our business, we aggregate markets according to stage of economic development as defined by the International Monetary Fund (IMF), and we aggregate brands by beverage alcohol category. Below, we define the geographic and brand aggregations used in this release.

Geographic Aggregations.

In Schedule C and Schedule D, we provide supplemental information for our top markets ranked by percentage of net sales. In addition to markets listed by country name, we include the following aggregations:

•“Developed International” markets are “advanced economies” as defined by the IMF, excluding the United States. Our top developed international markets were Germany, Australia, the United Kingdom, France, Canada, and Spain. This aggregation represents our net sales of branded products to these markets.

•“Spain” includes Spain and certain other surrounding territories.

•“Emerging” markets are “emerging and developing economies” as defined by the IMF. Our top emerging markets were Mexico, Poland, and Brazil. This aggregation represents our net sales of branded products to these markets.

•“Brazil” includes Brazil, Uruguay, Paraguay, and certain other surrounding territories.

•“Travel Retail” represents our net sales of branded products to global duty-free customers, other travel retail customers, and the U.S. military, regardless of customer location.

•“Non-branded and bulk” includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey, regardless of customer location.

Brand Aggregations.

In Schedule B and Schedule D, we provide supplemental information for our top brands ranked by percentage of net sales. In addition to brands listed by name, we include the following aggregations outlined below.

Beginning in fiscal 2025, we aggregated the “Wine” and “Vodka” product categories with “Rest of Portfolio,” due to the divestitures of Sonoma-Cutrer and Finlandia. Please refer to the new definition of "Rest of Portfolio” for more information. The fiscal 2024 "Rest of Portfolio" amounts have been adjusted accordingly for comparison purposes.

“Whiskey” includes all whiskey spirits and whiskey-based flavored liqueurs. The brands included in this category are the Jack Daniel’s family of brands (excluding the “Ready-to-Drink” products defined below), the Woodford Reserve family of brands (Woodford Reserve), the Old Forester family of brands (Old Forester), The Glendronach, Glenglassaugh, Benriach, Slane Irish Whiskey, and Coopers’ Craft.

•“American whiskey” includes the Jack Daniel’s family of brands (excluding the “Ready-to-Drink” products defined below), Woodford Reserve, Old Forester, and Coopers’ Craft.

•“Super-premium American whiskey” includes Woodford Reserve, Gentleman Jack, and other super-premium Jack Daniel's expressions.

•“Ready-to-Drink” includes all ready-to-drink (RTD) and ready-to-pour (RTP) products. The brands included in this category are Jack Daniel’s RTD and RTP products (JD RTD/RTP), New Mix, and other RTD/RTP products.

•“Jack Daniel’s RTD/RTP” products include all RTD line extensions of Jack Daniel’s, such as Jack Daniel’s & Cola, Jack Daniel’s & Coca-Cola RTD, Jack Daniel’s Country Cocktails, Jack Daniel’s Double Jack, and other malt- and spirit-based Jack Daniel’s RTDs, along with Jack Daniel’s Winter Jack RTP.

•“Jack Daniel’s & Coca-Cola RTD” includes all Jack Daniel’s & Coca-Cola RTD products and Jack Daniel’s bulk whiskey shipments for the production of these products.

•“Tequila” includes el Jimador, the Herradura family of brands (Herradura), and other tequilas.

•“Rest of Portfolio” includes Sonoma-Cutrer (which was divested on April 30, 2024), Korbel California Champagnes, Diplomático, Gin Mare, Chambord, Finlandia Vodka (which was divested on November 1, 2023), Fords Gin, Korbel Brandy, and other agency brands.

•“Non-branded and bulk” includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey and wine.

•“Jack Daniel’s family of brands” includes Jack Daniel’s Tennessee Whiskey (JDTW), JD RTD/RTP, Jack Daniel’s Tennessee Honey (JDTH), Gentleman Jack, Jack Daniel’s Tennessee Apple (JDTA), Jack Daniel’s Tennessee Fire (JDTF), Jack Daniel’s Single Barrel Collection (JDSB), Jack Daniel’s Bonded Tennessee Whiskey, Jack Daniel’s Sinatra Select, Jack Daniel’s Tennessee Rye Whiskey (JDTR), Jack Daniel’s Triple Mash Blended Straight Whiskey, Jack Daniel’s Bottled-in-Bond, Jack Daniel’s American Single Malt, Jack Daniel’s 12 Year Old, Jack Daniel’s 10 Year Old, and other Jack Daniel’s expressions.

Other Metrics.

•“Shipments.” We generally record revenues when we ship or deliver our products to our customers. In this release, unless otherwise specified, we refer to shipments when discussing volume.

•“Depletions.” This metric is commonly used in the beverage alcohol industry to describe volume. Depending on the context, depletions usually means either (a) where Brown-Forman is the distributor, shipments directly to retail or wholesale customers or (b) where Brown-Forman is not the distributor, shipments from distributor customers to retailers and wholesalers. We believe that depletions measure volume in a way that more closely reflects consumer demand than our shipments to distributor customers do.

•“Consumer takeaway.” When discussing trends in the market, we refer to consumer takeaway, a term commonly used in the beverage alcohol industry that refers to the purchase of product by consumers from retail outlets, including products purchased through e-commerce channels, as measured by volume or retail sales value. This information is provided by outside parties, such as Nielsen and the National Alcohol Beverage Control Association (NABCA). Our estimates of market share or changes in market share are derived from consumer takeaway data using the retail sales value metric. We believe consumer takeaway is a leading indicator of consumer demand trends.

•“Estimated net change in distributor inventories.” We generally recognize revenue when our products are shipped or delivered to customers. In the United States and certain other markets, our customers are distributors that sell downstream to retailers and consumers. We believe that our distributors’ downstream sales more closely reflect actual consumer demand than do our shipments to distributors. Our shipments increase distributors’ inventories, while distributors’ depletions (as described above) reduce their inventories. Therefore, it is possible that our shipments do not coincide with distributors’ downstream depletions and merely reflect changes in distributors’ inventories. Because changes in distributors’ inventories could affect our trends, we believe it is useful for investors to understand those changes in the context of our operating results.

We perform the following calculation to determine the “estimated net change in distributor inventories”:

•For both the current-year period and the comparable prior-year period, we calculate a “depletion-based” amount by (a) dividing the organic dollar amount (e.g. organic net sales) by the corresponding shipment volumes to arrive at a shipment per case amount, and (b) multiplying the resulting shipment per case amount by the corresponding depletion volumes. We subtract the year-over-year percentage change of the “depletion-based” amount from the year-over-year percentage change of the organic amount to calculate the “estimated net change in distributor inventories.”

•A positive difference is interpreted as a net increase in distributors’ inventories, which implies that organic trends could decrease as distributors reduce inventories; whereas, a negative difference is interpreted as a net decrease in distributors’ inventories, which implies that organic trends could increase as distributors rebuild inventories.

v3.24.3

Document and Entity Information

|

Dec. 05, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 05, 2024

|

| Entity Registrant Name |

Brown-Forman Corporation

|

| Entity Central Index Key |

0000014693

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-00123

|

| Entity Tax Identification Number |

61-0143150

|

| Entity Address, Address Line One |

850 Dixie Highway,

|

| Entity Address, City or Town |

Louisville,

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

40210

|

| City Area Code |

(502)

|

| Local Phone Number |

585-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock (voting), $0.15 par value

|

| Trading Symbol |

BFA

|

| Security Exchange Name |

NYSE

|

| Nonvoting Common Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Common Stock (nonvoting), $0.15 par value

|

| Trading Symbol |

BFB

|

| Security Exchange Name |

NYSE

|

| One Point Two Percent Notes Due in Fiscal Two Thousand Twenty Seven [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.200% Notes due 2026

|

| Trading Symbol |

BF26

|

| Security Exchange Name |

NYSE

|

| Two Point Six Percent Notes Due in Fiscal Two Thousand Twenty Nine [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.600% Notes due 2028

|

| Trading Symbol |

BF28

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_NonvotingCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_LongtermDebtTypeAxis=bfb_OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_LongtermDebtTypeAxis=bfb_TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

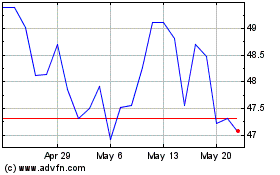

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Dec 2024 to Jan 2025

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jan 2024 to Jan 2025