false000088524500008852452024-11-222024-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

November 22, 2024

Date of Report (date of earliest event reported)

THE BUCKLE, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Nebraska | 001-12951 | 47-0366193 |

| (State or other jurisdiction of | (Commission | (I.R.S. Employer |

| incorporation or organization) | File Number) | Identification No.) |

| | | | | | | | | | | | | | | | | |

| 2407 West 24th Street, | | | |

| Kearney, | Nebraska | | 68845-4915 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: (308) 236-8491

__________________________________________________________

(Former name, former address and former fiscal year if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | BKE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02. Results of Operations and Financial Condition

On November 22, 2024, The Buckle, Inc. announced financial results for the fiscal quarter ended November 2, 2024. The full text of the press release is furnished as Exhibit 99.1 to this report.

The information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), as amended, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as set forth by specific reference in such filing.

ITEM 9.01(d). Exhibits

Exhibit 99.1 Press Release Dated November 22, 2024

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| The Buckle, Inc. |

| |

| Date: November 22, 2024 | By: /s/ THOMAS B. HEACOCK |

| | Name: Thomas B. Heacock |

| | Title: Senior Vice President of Finance, |

| | Treasurer and Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| Press Release Dated November 22, 2024 |

| |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

| |

| |

| |

| |

| |

| |

Exhibit 99.1

| | | | | |

| The Buckle, Inc. |

|

2407 W. 24th St. Kearney, NE 68845 |

|

| P.O. Box 1480 Kearney, NE 68848-1480 |

|

phone: 308-236-8491 |

|

fax: 308-236-4493 |

|

For Immediate Release: November 22, 2024 | web: www.buckle.com |

| | | | | |

| Contact: | Thomas B. Heacock, Chief Financial Officer |

| | The Buckle, Inc. |

| | (308) 236-8491 |

THE BUCKLE, INC. REPORTS THIRD QUARTER NET INCOME

KEARNEY, NE -- (BUSINESS WIRE) -- The Buckle, Inc. (NYSE: BKE) announced today that net income for the fiscal quarter ended November 2, 2024 was $44.2 million, or $0.89 per share ($0.88 per share on a diluted basis).

Net sales for the 13-week fiscal quarter ended November 2, 2024 decreased 3.2 percent to $293.6 million from net sales of $303.5 million for the prior year 13-week fiscal quarter ended October 28, 2023. Comparable store net sales for the 13-week fiscal quarter ended November 2, 2024 decreased 0.7 percent from comparable store net sales for the prior year 13-week period ended November 4, 2023. Online sales increased 1.1 percent to $46.6 million for the 13-week fiscal quarter ended November 2, 2024, compared to net sales of $46.1 million for the 13-week fiscal quarter ended October 28, 2023.

Net sales for the 39-week fiscal period ended November 2, 2024 decreased 4.6 percent to $838.5 million from net sales of $878.7 million for the prior year 39-week fiscal period ended October 28, 2023. Comparable store net sales for the 39-week period ended November 2, 2024 decreased 5.4 percent from comparable store net sales for the prior year 39-week period ended November 4, 2023. Online sales decreased 9.2 percent to $128.0 million for the 39-week period ended November 2, 2024, compared to net sales of $141.0 million for the 39-week period ended October 28, 2023.

Due to the 53rd week in fiscal 2023, comparable store net sales for the quarter and year-to-date periods are compared to the 13-week and 39-week periods ended November 4, 2023.

Net income for the third quarter of fiscal 2024 was $44.2 million, or $0.89 per share ($0.88 per share on a diluted basis), compared with net income of $51.8 million, or $1.05 per share ($1.04 per share on a diluted basis) for the third quarter of fiscal 2023.

Net income for the 39-week fiscal period ended November 2, 2024 was $118.3 million, or $2.37 per share ($2.35 per share on a diluted basis), compared with net income of $140.3 million, or $2.83 per share ($2.81 per share on a diluted basis) for the 39-week period ended October 28, 2023.

Management will hold a live audio webcast at 10:00 a.m. EST today to discuss results for the quarter. To register for the live event, please visit https://buckle.zoom.us/webinar/register/WN_ZagNJtIfQImjiUbr7g6zdw. A replay of the event can be accessed through Buckle’s investor relations website within twenty-four hours after the conclusion of the live event (https://corporate.buckle.com/investors/earnings-webcasts).

About Buckle

Buckle is a specialty retailer focused on delivering exceptional service and style through unforgettable experiences. Offering a curated mix of high-quality, on-trend apparel, accessories, and footwear, Buckle is for those living the styled life. Known as a denim destination, each store carries a wide selection of fits, styles, and finishes from leading denim brands, including the Company’s exclusive brand, BKE. Headquartered in Kearney, Nebraska, Buckle currently operates 445 retail stores in 42 states. As of the end of the fiscal quarter, it operated 445 stores in 42 states compared with 443 stores in 42 states at the end of the third quarter of fiscal 2023.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: All forward-looking statements made by the Company involve material risks and uncertainties and are subject to change based on factors which may be beyond the Company’s control. Accordingly, the Company’s future performance and financial results may differ materially from those expressed or implied in any such forward-looking statements. Such factors include, but are not limited to, those described in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake to publicly update or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

Note: News releases and other information on The Buckle, Inc. can be accessed at www.buckle.com.

Financial Tables to Follow

THE BUCKLE, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands Except Per Share Amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| | November 2,

2024 | | October 28,

2023 | | November 2,

2024 | | October 28,

2023 |

| | | | | | | |

| SALES, Net of returns and allowances | $ | 293,618 | | | $ | 303,457 | | | $ | 838,490 | | | $ | 878,719 | |

| | | | | | | |

COST OF SALES (Including buying, distribution, and occupancy costs) | 153,547 | | | 156,242 | | | 445,188 | | | 459,835 | |

| | | | | | | |

| Gross profit | 140,071 | | | 147,215 | | | 393,302 | | | 418,884 | |

| | | | | | | |

| OPERATING EXPENSES: | | | | | | | |

| Selling | 71,986 | | | 70,242 | | | 206,454 | | | 205,081 | |

| General and administrative | 13,602 | | | 12,908 | | | 41,709 | | | 39,247 | |

| | 85,588 | | | 83,150 | | | 248,163 | | | 244,328 | |

| | | | | | | |

| INCOME FROM OPERATIONS | 54,483 | | | 64,065 | | | 145,139 | | | 174,556 | |

| | | | | | | |

| OTHER INCOME, Net | 4,023 | | | 4,490 | | | 11,510 | | | 11,322 | |

| | | | | | | |

| INCOME BEFORE INCOME TAXES | 58,506 | | | 68,555 | | | 156,649 | | | 185,878 | |

| | | | | | | |

| INCOME TAX EXPENSE | 14,334 | | | 16,793 | | | 38,379 | | | 45,540 | |

| | | | | | | |

| NET INCOME | $ | 44,172 | | | $ | 51,762 | | | $ | 118,270 | | | $ | 140,338 | |

| | | | | | | |

| | | | | | | |

| EARNINGS PER SHARE: | | | | | | | |

| Basic | $ | 0.89 | | | $ | 1.05 | | | $ | 2.37 | | | $ | 2.83 | |

| | | | | | | |

| Diluted | $ | 0.88 | | | $ | 1.04 | | | $ | 2.35 | | | $ | 2.81 | |

| | | | | | | |

| Basic weighted average shares | 49,854 | | | 49,513 | | | 49,854 | | | 49,513 | |

| Diluted weighted average shares | 50,297 | | | 49,937 | | | 50,230 | | | 49,891 | |

THE BUCKLE, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands Except Share and Per Share Amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | |

| ASSETS | November 2,

2024 | | February 3,

2024 (1) | | October 28,

2023 |

| | | | | |

| CURRENT ASSETS: | | | | | |

| Cash and cash equivalents | $ | 301,958 | | | $ | 268,213 | | | $ | 311,657 | |

| Short-term investments | 23,482 | | | 22,210 | | | 23,446 | |

| Receivables | 7,901 | | | 8,697 | | | 10,341 | |

| Inventory | 149,351 | | | 126,290 | | | 152,289 | |

| Prepaid expenses and other assets | 22,236 | | | 18,846 | | | 11,206 | |

| Total current assets | 504,928 | | | 444,256 | | | 508,939 | |

| | | | | |

| PROPERTY AND EQUIPMENT | 508,273 | | | 489,037 | | | 483,435 | |

| Less accumulated depreciation and amortization | (365,241) | | | (360,200) | | | (359,367) | |

| 143,032 | | | 128,837 | | | 124,068 | |

| | | | | |

| OPERATING LEASE RIGHT-OF-USE ASSETS | 287,687 | | | 280,813 | | | 253,418 | |

| LONG-TERM INVESTMENTS | 27,261 | | | 24,993 | | | 22,508 | |

| OTHER ASSETS | 13,362 | | | 10,911 | | | 12,274 | |

| | | | | |

| Total assets | $ | 976,270 | | | $ | 889,810 | | | $ | 921,207 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| | | | | |

| CURRENT LIABILITIES: | | | | | |

| Accounts payable | $ | 67,701 | | | $ | 45,958 | | | $ | 63,320 | |

| Accrued employee compensation | 27,095 | | | 49,827 | | | 34,784 | |

| Accrued store operating expenses | 25,921 | | | 19,067 | | | 26,335 | |

| Gift certificates redeemable | 12,571 | | | 16,667 | | | 12,305 | |

| Current portion of operating lease liabilities | 76,963 | | | 85,265 | | | 78,884 | |

| Income taxes payable | 2,519 | | | 4,672 | | | 536 | |

| Total current liabilities | 212,770 | | | 221,456 | | | 216,164 | |

| | | | | |

| DEFERRED COMPENSATION | 27,261 | | | 24,993 | | | 22,508 | |

| NON-CURRENT OPERATING LEASE LIABILITIES | 247,850 | | | 230,141 | | | 208,517 | |

| Total liabilities | 487,881 | | | 476,590 | | | 447,189 | |

| | | | | |

| COMMITMENTS | | | | | |

| | | | | |

| STOCKHOLDERS’ EQUITY: | | | | | |

| Common stock, authorized 100,000,000 shares of $.01 par value; issued and outstanding; 50,773,796 shares at November 2, 2024, 50,445,186 shares at February 3, 2024, and 50,445,386 shares at October 28, 2023 | 508 | | | 504 | | | 504 | |

| Additional paid-in capital | 202,895 | | | 192,686 | | | 189,297 | |

| Retained earnings | 284,986 | | | 220,030 | | | 284,217 | |

| Total stockholders’ equity | 488,389 | | | 413,220 | | | 474,018 | |

| | | | | |

| Total liabilities and stockholders’ equity | $ | 976,270 | | | $ | 889,810 | | | $ | 921,207 | |

| | | | | |

| (1) Derived from audited financial statements. | | | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

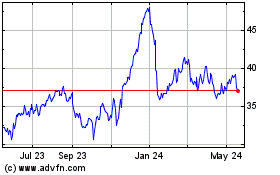

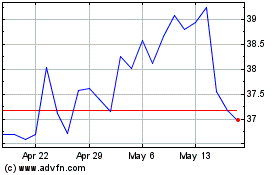

Buckle (NYSE:BKE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Buckle (NYSE:BKE)

Historical Stock Chart

From Nov 2023 to Nov 2024