Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 27 2024 - 9:38AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC

20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

| For

the month of: December, 2024 |

Commission

File Number: 002-09048 |

THE BANK OF NOVA SCOTIA

(Name

of registrant)

40

Temperance Street, Toronto, Ontario, M5H 0B4

Attention:

Secretary's Department (Tel.: (416) 866-3672)

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F Form

40-F X

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

THE BANK OF NOVA SCOTIA |

| |

|

|

| Date: December 27, 2024 |

By: |

/s/

Meigan

Terry

|

| |

|

Name: Meigan Terry |

| |

|

Title: SVP, Global Communications |

EXHIBIT

INDEX

Exhibit 99.1

Scotiabank Completes Additional Investment in

KeyCorp

TORONTO, Dec. 27, 2024 /CNW/ - Scotiabank announced

today that following regulatory approval from the Board of Governors of the Federal Reserve System, it has completed its acquisition of

an additional approximately 10% pro-forma ownership stake in KeyCorp through newly issued common shares at US$17.17 per share, for a cash

consideration of approximately US$2.0 billion.

Scotiabank announced on August 12, 2024, that it had

entered into an agreement to acquire an approximately 14.9% pro-forma ownership stake in KeyCorp for total consideration of approximately

US$2.8 billion. Scotiabank previously closed the initial investment of approximately 4.9% on August 30, 2024, and has now completed both

stages of the investment.

"Our investment in KeyCorp represents a cost-effective,

low-risk approach to deploying capital into the U.S. while boosting returns for our shareholders," said Scott Thomson, President

and Chief Executive Officer of Scotiabank. "We are pleased to have closed this transaction, which is consistent with our commitment

to allocate capital from developing markets to developed markets in North America."

The impact to Common Equity Tier 1 ratio from both

stages of the transaction is expected to be approximately -55 basis points. Scotiabank's approximately 14.9% ownership interest will be

classified as an Investment in Associate for accounting purposes.

About Scotiabank

Scotiabank's vision is to be our clients' most trusted financial partner and deliver sustainable, profitable growth. Guided by our

purpose: "for every future," we help our clients, their families and their communities achieve success through a broad range

of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment

banking, and capital markets. With assets of approximately $1.4 trillion (as at October 31, 2024), Scotiabank is one of

the largest banks in North America by assets, and trades on the Toronto Stock Exchange (TSX: BNS) and New York Stock Exchange

(NYSE: BNS). For more information, please visit www.scotiabank.com and follow us on X @Scotiabank.

SOURCE Scotiabank

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/27/c1567.html

%CIK: 0000009631

For further information: For investor inquiries only: John McCartney,

Investor Relations, Scotiabank, john.mccartney@scotiabank.com; For media inquiries only: Carina Ruas, Global Communications, Scotiabank,

carina.ruas@scotiabank.com

CO: Scotiabank

CNW 10:20e 27-DEC-24

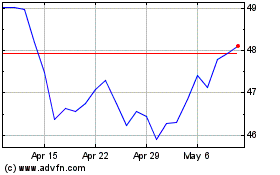

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Nov 2024 to Dec 2024

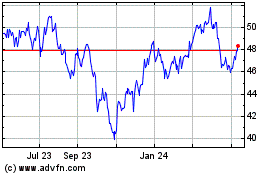

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Dec 2023 to Dec 2024