Revenue of $270 Million, up 3% Year-Over-Year,

up 6% in Constant Currency GAAP Operating Margin of 7.5% and Record

Non-GAAP Operating Margin of 28.4% GAAP Net Income Per Share of

$0.10 and Record Non-GAAP Net Income Per Share of $0.44 New $100

Million Expansion of Stock Repurchase Program

Box, Inc. (NYSE:BOX), the leading Intelligent Content Cloud,

today announced preliminary financial results for the second

quarter of fiscal year 2025, which ended July 31, 2024.

“As we enter the era of Intelligent Content Management, Box is

delivering a singular platform that can power the lifecycle of

content with intelligence built right in,” said Aaron Levie,

co-founder and CEO of Box. “With Box AI and strategic technology

acquisitions like Alphamoon, the Box Intelligent Content Cloud can

now support more use-cases across the enterprise than traditional

ECM, dramatically expanding our market opportunity.”

“We delivered a strong second quarter, with accelerated billings

growth as well as record gross margin, operating margin, and EPS,”

said Dylan Smith, co-founder and CFO of Box. “These strong results

demonstrate both our proven business model and the success of the

investments we’re making to build the leading Intelligent Content

Management platform.”

Fiscal Second Quarter Financial Highlights

- Revenue for the second quarter of fiscal 2025 was $270.0

million, a 3% increase from revenue for the second quarter of

fiscal 2024 of $261.4 million, or 6% growth on a constant currency

basis.

- Remaining performance obligations (“RPO”) as of July 31, 2024

were $1.272 billion, a 12% increase from RPO as of July 31, 2023 of

$1.138 billion, or 14% growth on a constant currency basis.

- Billings for the second quarter of fiscal 2025 were $256.4

million, a 10% increase from billings for the second quarter of

fiscal 2024 of $232.5 million, or 9% growth on a constant currency

basis.

- GAAP gross profit for the second quarter of fiscal 2025 was a

record $214.5 million, or 79.4% of revenue. This compares to a GAAP

gross profit of $194.4 million, or 74.4% of revenue, in the second

quarter of fiscal 2024.

- Non-GAAP gross profit for the second quarter of fiscal 2025 was

a record $220.2 million, or 81.6% of revenue. This compares to a

non-GAAP gross profit of $201.1 million, or 76.9% of revenue, in

the second quarter of fiscal 2024.

- GAAP operating income in the second quarter of fiscal 2025 was

$20.3 million, or 7.5% of revenue. This compares to a GAAP

operating income of $9.9 million, or 3.8% of revenue, in the second

quarter of fiscal 2024.

- Non-GAAP operating income in the second quarter of fiscal 2025

was a record $76.7 million, or 28.4% of revenue. This compares to a

non-GAAP operating income of $64.7 million, or 24.8% of revenue, in

the second quarter of fiscal 2024.

- GAAP diluted net income per share attributable to common

stockholders in the second quarter of fiscal 2025 was $0.10 on

146.5 million weighted-average shares outstanding. This compares to

GAAP diluted net income per share attributable to common

stockholders of $0.04 in the second quarter of fiscal 2024 on 150.0

million weighted-average shares outstanding. GAAP diluted net

income per share attributable to common stockholders in the second

quarter of fiscal 2025 includes a negative impact of $0.05

year-over-year from unfavorable foreign exchange rates.

- Non-GAAP diluted net income per share attributable to common

stockholders in the second quarter of fiscal 2025 was a record

$0.44. This compares to non-GAAP diluted net income per share

attributable to common stockholders of $0.36 in the second quarter

of fiscal 2024. Non-GAAP diluted net income per share attributable

to common stockholders in the second quarter of fiscal 2025

includes a negative impact of $0.05 year-over-year from unfavorable

foreign exchange rates.

- Net cash provided by operating activities in the second quarter

of fiscal 2025 was $36.3 million, an 11% increase from net cash

provided by operating activities of $32.7 million in the second

quarter of fiscal 2024.

- Non-GAAP free cash flow in the second quarter of fiscal 2025

was $32.7 million, a 59% increase from non-GAAP free cash flow of

$20.6 million in the second quarter of fiscal 2024.

Growth on a constant currency basis and impact from foreign

exchange is determined by comparing current period reported results

with the current results calculated using the equivalent rates in

the prior period.

For more information on the non-GAAP financial measures and key

metrics discussed in this press release, please see the section

titled, “About Non-GAAP Financial Measures and Other Key Metrics,”

and the reconciliations of non-GAAP financial measures and certain

key metrics to their nearest comparable GAAP financial measures at

the end of this press release.

Recent Business Highlights

- Delivered wins or expansions with leading organizations across

a variety of industries, including Financial Services (Block,

Moelis & Company and Northwest Bank), Hospitality (Resorts

World Las Vegas), Life Sciences (argenx, CymaBay Therapeutics and

IQVIA), Industrial Goods (H2 Green Steel and Heat and Control),

Media and Entertainment (Fremantle and United Talent Agency),

Public Sector (State of Hawaii and United States Department of

Agriculture), Retail (FANATICS and SKECHERS USA), and

Transportation (East Japan Railway Company and Swissport

International).

- Announced the acquisition of the AI-powered, intelligent

document processing (IDP) technology and team of Alphamoon. This

strategic move significantly expands the functionality of Box’s

Intelligent Content Management platform.

- Announced unlimited end-user Box AI queries for Hubs,

Documents, and Notes for customers on Enterprise Plus plans.

- Unveiled a new set of features in Box AI that includes an

integration with GPT-4o, support for image and spreadsheet files,

and the Box AI for Metadata API.

- Expanded its strategic partnership with Slack to bring secure

AI to enterprise content. Also announced that joint customers now

have access to unlimited Box AI queries directly in Slack.

- Hosted BoxWorks Tokyo 2024 and AI Disrupt in London, attracting

thousands of attendees and customer speakers from leading

organizations.

- Announced that the company's 14th annual BoxWorks will take

place on November 12, 2024 in San Francisco where attendees will

learn about Intelligent Content Management and hear from industry

and customer speakers.

- Recognized as one of PEOPLE’s 100 Companies That Care in 2024

and in Fortune® magazine as #10 on the 100 Best Large Workplaces

for Millennials for 2024 by Great Place to Work®.

- Announced the appointment of Samantha Wessels as President of

Box Europe, the Middle East and Africa. Ms. Wessels brings over 20

years of technology experience to Box, having held leadership roles

at Snyk, Elastic, and NTT.

- Announced the appointment of Tricia Gellman as Chief Marketing

Officer of Box. Ms. Gellman brings over two decades of experience

driving growth for leading technology companies, including

Salesforce and Adobe.

Update on Share Repurchase Plan

In the second quarter, approximately 3.9 million shares were

repurchased for approximately $102 million. As of July 31, 2024,

approximately $25 million of buyback capacity was remaining under

the current share repurchase plan. Box remains committed to

opportunistically returning capital to its shareholders through an

ongoing stock repurchase program, and on August 25, 2024, the Board

of Directors authorized an expansion of its stock repurchase

program by $100 million.

Outlook

As a reminder, approximately one third of Box’s revenue is

generated outside of the U.S., of which approximately 60% is in

Japanese Yen. The following guidance includes the expected impact

of FX headwinds, assuming present foreign currency exchange

rates.

Additionally, as we have become consistently profitable in our

international business, in the fourth quarter of fiscal year 2024

we released the valuation allowance against our deferred tax assets

in the United Kingdom. Accordingly, in fiscal year 2025 we are

recognizing deferred tax expense in the United Kingdom. This

non-cash expense is reflected in our GAAP and non-GAAP diluted net

income per share guidance for the third quarter of fiscal year 2025

and full fiscal year 2025.

Q3 FY25 Guidance

- Revenue is expected to be in the range of $274 million to $276

million, up 5% year-over-year, or 6% growth on a constant currency

basis.

- GAAP operating margin is expected to be approximately 7.5%, and

non-GAAP operating margin is expected to be approximately 28%.

- GAAP net income per share attributable to common stockholders

is expected to be in the range of $0.07 to $0.08. GAAP EPS guidance

includes an expected negative impact of $0.02 from unfavorable

exchange rates and $0.01 from the recognition of deferred tax

expenses in international countries.

- Non-GAAP diluted net income per share attributable to common

stockholders is expected to be in the range of $0.41 to $0.42.

Non-GAAP EPS guidance includes an expected negative impact of $0.02

from unfavorable exchange rates and $0.01 from the recognition of

deferred tax expenses in international countries.

- Weighted-average diluted shares outstanding are expected to be

approximately 148 million.

Full Year FY25 Guidance

- Revenue is expected to be in the range of $1.086 billion to

$1.09 billion, up 5% year-over-year, or 7% growth on a constant

currency basis. Due to the weakening of the U.S. dollar versus the

Yen since we last provided guidance, we now expect FX to be a 170

basis point headwind to full fiscal year 2025 revenue growth, 80

basis points lower than our previous expectations. On a constant

currency basis, our new guidance represents a $2 million increase

from our previous guidance.

- GAAP operating margin is expected to be approximately 7.0%, and

non-GAAP operating margin is expected to be approximately 27.5%.

For full fiscal year 2025 GAAP and non-GAAP operating margin, we

now expect FX to be a headwind of 130 basis points, 30 basis points

lower than our previous expectations.

- GAAP net income per share attributable to common stockholders

is expected to be in the range of $0.31 to $0.33. FY25 GAAP EPS

guidance includes an expected negative impact of $0.12 from

unfavorable exchange rates and $0.05 from the recognition of

deferred tax expenses in international countries.

- Non-GAAP diluted net income per share attributable to common

stockholders is expected to be in the range of $1.64 to $1.66. FY25

non-GAAP EPS guidance includes an expected negative impact of $0.12

from unfavorable exchange rates and $0.05 from the recognition of

deferred tax expenses in international countries.

- Weighted-average diluted shares outstanding are expected to be

approximately 148 million.

All forward-looking non-GAAP financial measures contained in

this section titled “Outlook” exclude estimates for stock-based

compensation expense, intangible assets amortization, and as

applicable, other special items. Box has provided a reconciliation

of GAAP to non-GAAP net income per share and operating margin

guidance at the end of this press release.

Webcast and Conference Call Information

Box’s management team will host a conference call today

beginning at 2:00 PM (PT) / 5:00 PM (ET) to discuss Box’s financial

results, business highlights and future outlook. A live audio

webcast of this call will be available through Box’s Investor

Relations website at https://www.boxinvestorrelations.com for a

period of 90 days after the date of the call. Prepared remarks will

be available on the Box Investor Relations website after the call

ends.

The conference call can be accessed by registering online at

https://events.q4inc.com/attendee/414637595 at which time

registrants will receive dial-in information as well as a

conference ID. A telephonic replay of the call will be available

approximately two hours after the call and will run for one week.

The replay can be accessed by dialing:

+ 1-800-770-2030 (toll-free), conference ID: 23531 +

1-609-800-9909 (U.S. toll), conference ID: 23531 + 1-647-362-9199

(Canada toll), conference ID: 23531

Box has used, and intends to continue to use, its Investor

Relations website (www.box.com/investors), as well as certain X

accounts (@box, @levie and @boxincir), as a means of disclosing

material non-public information and for complying with its

disclosure obligations under Regulation FD. Information on or that

can be accessed through Box’s Investor Relations website, these X

accounts, or that is contained in any website to which a hyperlink

is provided herein is not part of this press release, and the

inclusion of Box’s Investor Relations website address, these X

accounts, and any hyperlinks are only inactive textual

references.

This press release, the financial tables, as well as other

supplemental information including the reconciliations of non-GAAP

financial measures and certain key metrics to their nearest

comparable GAAP financial measures, are also available on Box’s

Investor Relations website. Box also provides investor information,

including news and commentary about Box’s business and financial

performance, Box’s filings with the Securities and Exchange

Commission, notices of investor events and Box’s press and earnings

releases, on Box’s Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties, and assumptions, including statements

regarding Box’s expectations regarding its growth and

profitability, the size of its market opportunity, its investments

in go-to-market programs, the demand for its products, the

potential of AI and its impact on Box, the timing of recent and

planned product introductions, enhancements and integrations, the

short- and long-term success, market adoption and retention,

capabilities, and benefits of such product introductions and

enhancements, the success of strategic partnerships and

acquisitions, the impact of macroeconomic conditions on its

business, its ability to grow and scale its business and drive

operating efficiencies, the impact of fluctuations in foreign

currency exchange rates on its future results, its net retention

rate, its ability to achieve revenue targets and billings

expectations, its revenue and billings growth rates, its ability to

expand operating margins, its revenue growth rate plus free cash

flow margin in fiscal year 2025 and beyond, its long-term financial

targets, its ability to maintain profitability on a quarterly or

ongoing basis, its free cash flow, its ability to continue to grow

unrecognized revenue and remaining performance obligations, its

revenue, billings, GAAP and non-GAAP gross margins, GAAP and

non-GAAP net income per share, GAAP and non-GAAP operating margins,

the related components of GAAP and non-GAAP net income per share,

weighted-average outstanding share count expectations for Box’s

fiscal third quarter and full fiscal year 2025 in the section

titled “Outlook” above, equity burn rate, any potential repurchase

of its common stock, whether, when, in what amount and by what

method any such repurchase would be consummated, and the share

price of any such repurchase. There are a significant number of

factors that could cause actual results to differ materially from

statements made in this press release, including: (1) adverse

changes in general economic or market conditions, including those

caused by the Hamas-Israel and Russia-Ukraine conflicts, inflation,

and fluctuations in foreign currency exchange rates; (2) delays or

reductions in information technology spending; (3) factors related

to Box’s highly competitive market, including but not limited to

pricing pressures, industry consolidation, entry of new competitors

and new applications and marketing initiatives by Box’s current or

future competitors; (4) the development of the cloud content

management market; (5) the risk that Box’s customers do not renew

their subscriptions, expand their use of Box’s services, or adopt

new products offered by Box on a timely basis, or at all; (6) Box’s

ability to provide timely and successful enhancements,

integrations, new features and modifications to its platform and

services; (7) actual or perceived security vulnerabilities in Box’s

services or any breaches of Box’s security controls; (8) Box’s

ability to realize the expected benefits of its third-party

partnerships; and (9) Box’s ability to successfully integrate

acquired businesses and achieve the expected benefits from those

acquisitions. In addition, the preliminary financial results set

forth in this release are estimates based on information currently

available to Box. While Box believes these estimates are

meaningful, they could differ from the actual amounts that Box

ultimately reports in its Quarterly Report on Form 10-Q for the

fiscal quarter ended July 31, 2024. Box assumes no obligations and

does not intend to update these estimates prior to filing its Form

10-Q for the fiscal quarter ended July 31, 2024.

Additional information on potential factors that could affect

Box’s financial results is included in the reports on Forms 10-K,

10-Q and 8-K and in other filings Box makes with the Securities and

Exchange Commission from time to time, including the Annual Report

on Form 10-K filed for the fiscal year ended January 31, 2024.

These documents are available on the SEC Filings section of Box’s

Investor Relations website located at www.boxinvestorrelations.com.

Box does not assume any obligation to update the forward-looking

statements contained in this press release to reflect events that

occur or circumstances that exist after the date on which they were

made.

About Non-GAAP Financial Measures and Other Key

Metrics

To supplement Box’s consolidated financial statements, which are

prepared and presented in accordance with GAAP, Box provides

investors with certain non-GAAP financial measures and other key

metrics, including non-GAAP gross profit, non-GAAP gross margin,

non-GAAP operating income, non-GAAP operating margin, non-GAAP net

income attributable to common stockholders, non-GAAP net income per

share attributable to common stockholders, billings, remaining

performance obligations, non-GAAP free cash flow and free cash flow

margin. The presentation of these non-GAAP financial measures and

key metrics is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP. For more information on

these non-GAAP financial measures and key metrics, please see the

reconciliation of these non-GAAP financial measures and certain key

metrics to their nearest comparable GAAP financial measures at the

end of this press release.

Box uses these non-GAAP financial measures and key metrics for

financial and operational decision-making (including for purposes

of determining variable compensation of members of management and

other employees) and as a means to evaluate period-to-period

comparisons. Box’s management believes that these non-GAAP

financial measures and key metrics provide meaningful supplemental

information regarding Box’s performance by excluding certain

expenses that may not be indicative of Box’s recurring core

business operating results. Box believes that both management and

investors benefit from referring to these non-GAAP financial

measures and key metrics in assessing Box’s performance and when

planning, forecasting, and analyzing future periods. These non-GAAP

financial measures and key metrics also facilitate management's

internal comparisons to Box’s historical performance as well as

comparisons to Box’s competitors' operating results. Box believes

these non-GAAP financial measures and key metrics are useful to

investors both because they (1) allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making and (2) are used by Box’s institutional

investors and the analyst community to help them analyze the health

of Box’s business.

A limitation of non-GAAP financial measures and key metrics is

that they do not have uniform definitions. Further, Box’s

definitions will likely differ from the definitions used by other

companies, including peer companies, and therefore comparability

may be limited. Thus, Box’s non-GAAP financial measures and key

metrics should be considered in addition to, and not as a

substitute for, or in isolation from, measures prepared in

accordance with GAAP. Additionally, in the case of stock-based

compensation expense, if Box did not pay a portion of compensation

in the form of stock-based compensation expense, the cash salary

expense included in cost of revenue and operating expenses would be

higher, which would affect Box’s cash position. The accompanying

tables have more details on the reconciliations of non-GAAP

financial measures and certain key metrics to their nearest

comparable GAAP financial measures.

Non-GAAP gross profit and non-GAAP gross margin. Box defines

non-GAAP gross profit as GAAP gross profit excluding expenses

related to stock-based compensation (“SBC”) included in cost of

revenue, intangible assets amortization, and as applicable, other

special items. Non-GAAP gross margin is defined as non-GAAP gross

profit divided by revenue. Although SBC is an important aspect of

the compensation of Box’s employees and executives, determining the

fair value of certain of the stock-based instruments Box utilizes

estimation and the expense recorded may bear little resemblance to

the actual value realized upon the vesting or future exercise of

the related stock-based awards. Management believes it is useful to

exclude SBC in order to better understand the long-term performance

of Box’s core business and to facilitate comparison of Box’s

results to those of peer companies. Management also views

amortization of acquired intangible assets, such as the

amortization of the cost associated with an acquired company’s

developed technology and trade names, as items arising from

pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are continually

evaluated for impairment, amortization of the cost of purchased

intangibles is a static expense that is not typically affected by

operations during any particular period. Box also excludes expenses

associated with a non-recurring workforce reorganization from

non-GAAP gross profit as they are considered by management to be

special items outside of Box’s core operating results.

Non-GAAP operating income and non-GAAP operating margin. Box

defines non-GAAP operating income as operating income excluding

expenses related to SBC, intangible assets amortization, and as

applicable, other special items. Non-GAAP operating margin is

defined as non-GAAP operating income divided by revenue. Box

excludes the following expenses as they are considered by

management to be special items outside of Box’s core operating

results: (1) fees related to shareholder activism (2) expenses

related to certain litigation, (3) expenses associated with a

non-recurring workforce reorganization, consisting primarily of

severance and other personnel-related costs, and (4) expenses

related to acquisitions.

Non-GAAP net income attributable to common stockholders and

non-GAAP net income per share attributable to common stockholders.

Box defines non-GAAP net income attributable to common stockholders

as GAAP net income attributable to common stockholders excluding

expenses related to SBC, intangible assets amortization,

amortization of debt issuance costs, the income tax benefit from

the release of a valuation allowance on deferred tax assets,

undistributed earnings attributable to preferred stockholders, and

as applicable, other special items as described in the preceding

paragraph. Box defines non-GAAP net income per share attributable

to common stockholders as non-GAAP net income attributable to

common stockholders divided by the weighted-average outstanding

shares.

Billings. Billings reflect, in any particular period, (1) sales

to new customers, plus (2) subscription renewals and (3) expansion

within existing customers, and represent amounts invoiced for all

products and professional services. Box calculates billings for a

period by adding changes in deferred revenue and contract assets in

that period to revenue. Box believes that billings help investors

better understand sales activity for a particular period, which is

not necessarily reflected in revenue as a result of the fact that

Box recognizes subscription revenue ratably over the subscription

term. Box considers billings a significant performance measure. Box

monitors billings to manage the business, make planning decisions,

evaluate performance and allocate resources. Box believes that

billings offers valuable supplemental information regarding the

performance of the business and helps investors better understand

the sales volumes and performance of the business. Although Box

considers billings to be a significant performance measure, Box

does not consider it to be a non-GAAP financial measure because it

is calculated using exclusively revenue, deferred revenue, and

contract assets, all of which are financial measures calculated in

accordance with GAAP.

Remaining performance obligations. Remaining performance

obligations (“RPO”) represent, at a point in time, contracted

revenue that has not yet been recognized. RPO consists of deferred

revenue and backlog. Backlog is defined as non-cancellable

contracts deemed certain to be invoiced and recognized as revenue

in future periods. Future invoicing is determined to be certain

when we have an executed non-cancellable contract or a significant

penalty that is due upon cancellation. While Box believes RPO is a

leading indicator of revenue as it represents sales activity not

yet recognized in revenue, it is not necessarily indicative of

future revenue growth as it is influenced by several factors,

including seasonality, contract renewal timing, average contract

terms and foreign currency exchange rates. Box monitors RPO to

manage the business and evaluate performance. Box considers RPO to

be a significant performance measure. Box does not consider RPO to

be a non-GAAP financial measure because it is calculated in

accordance with GAAP, specifically under ASC Topic 606.

Non-GAAP free cash flow and free cash flow margin. Box defines

non-GAAP free cash flow as cash flows from operating activities

less purchases of property and equipment, principal payments of

finance lease liabilities, capitalized internal-use software costs,

and other items that did not or are not expected to require cash

settlement and that management considers to be outside of Box’s

core business. Free cash flow margin is calculated as non-GAAP free

cash flow divided by revenue. Box specifically identifies adjusting

items in the reconciliation of GAAP to non-GAAP financial measures.

Box considers non-GAAP free cash flow to be a profitability and

liquidity measure that provides useful information to management

and investors about the amount of cash generated by the business

that can possibly be used for investing in Box's business and

strengthening its balance sheet, but it is not intended to

represent the residual cash flow available for discretionary

expenditures. The presentation of non-GAAP free cash flow is also

not meant to be considered in isolation or as an alternative to

cash flows from operating activities as a measure of liquidity.

About Box

Box (NYSE:BOX) is the Intelligent Content Cloud, a single

platform that enables organizations to fuel collaboration, manage

the entire content lifecycle, secure critical content, and

transform business workflows with enterprise AI. Founded in 2005,

Box simplifies work for leading global organizations, including

AstraZeneca, JLL, Morgan Stanley, and Nationwide. Box is

headquartered in Redwood City, CA, with offices across the United

States, Europe, and Asia. Visit box.com to learn more. And visit

box.org to learn more about how Box empowers nonprofits to fulfill

their missions.

BOX, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Thousands)

(Unaudited)

July 31,

January 31,

2024

2024

ASSETS

Current assets:

Cash and cash equivalents

$

406,620

$

383,742

Short-term investments

75,605

96,948

Accounts receivable, net

177,487

281,487

Deferred commissions

43,516

45,817

Other current assets

30,431

34,186

Total current assets

733,659

842,180

Operating lease right-of-use assets,

net

88,453

99,354

Goodwill

76,773

76,750

Deferred commissions, non-current

58,464

63,541

Deferred tax assets

73,411

75,665

Other long-term assets

89,978

83,673

Total assets

$

1,120,738

$

1,241,163

LIABILITIES, CONVERTIBLE PREFERRED

STOCK AND STOCKHOLDERS’ DEFICIT

Current liabilities:

Accounts payable, accrued expenses and

other current liabilities

$

44,076

$

52,737

Accrued compensation and benefits

33,189

36,872

Operating lease liabilities

25,662

26,812

Deferred revenue

483,987

562,859

Total current liabilities

586,914

679,280

Debt, net, non-current

371,824

370,822

Operating lease liabilities,

non-current

82,173

94,165

Other liabilities, non-current

26,081

35,863

Total liabilities

1,066,992

1,180,130

Series A convertible preferred stock

493,145

492,095

Stockholders’ deficit:

Common stock

14

14

Additional paid-in capital

740,292

785,374

Accumulated other comprehensive loss

(10,659

)

(9,686

)

Accumulated deficit

(1,169,046

)

(1,206,764

)

Total stockholders’ deficit

(439,399

)

(431,062

)

Total liabilities, convertible preferred

stock and stockholders’ deficit

$

1,120,738

$

1,241,163

BOX, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In Thousands, Except Per

Share Data)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

Revenue

$

270,039

$

261,428

$

534,697

$

513,326

Cost of revenue (1)

55,513

67,013

113,765

128,664

Gross profit

214,526

194,415

420,932

384,662

Operating expenses:

Research and development (1)

65,445

63,316

128,118

125,834

Sales and marketing (1)

95,235

88,605

187,908

174,815

General and administrative (1)

33,566

32,619

66,619

65,803

Total operating expenses

194,246

184,540

382,645

366,452

Income from operations

20,280

9,875

38,287

18,210

Interest and other income, net

4,699

3,293

8,557

5,611

Income before provision for income

taxes

24,979

13,168

46,844

23,821

Provision for income taxes

4,483

2,377

9,126

4,680

Net income

$

20,496

$

10,791

$

37,718

$

19,141

Accretion and dividend on series A

convertible preferred stock

(4,310

)

(4,307

)

(8,550

)

(8,531

)

Undistributed earnings attributable to

preferred stockholders

(1,845

)

(740

)

(3,313

)

(1,209

)

Net income attributable to common

stockholders

$

14,341

$

5,744

$

25,855

$

9,401

Net income per share attributable to

common stockholders

Basic

$

0.10

$

0.04

$

0.18

$

0.07

Diluted

$

0.10

$

0.04

$

0.18

$

0.06

Weighted-average shares used to compute

net income per share attributable to common stockholders

Basic

144,070

144,248

144,678

144,490

Diluted

146,525

150,007

147,634

150,218

(1) Includes stock-based compensation

expense as follows:

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

Cost of revenue

$

4,731

$

5,230

$

9,352

$

9,715

Research and development

19,676

18,722

37,495

35,724

Sales and marketing

19,173

17,546

36,956

32,864

General and administrative

11,531

11,848

22,470

22,320

Total stock-based compensation

$

55,111

$

53,346

$

106,273

$

100,623

BOX, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

20,496

$

10,791

$

37,718

$

19,141

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

5,296

11,577

9,984

24,483

Stock-based compensation expense

55,111

53,346

106,273

100,623

Amortization of deferred commissions

13,178

13,621

26,538

27,369

Other

1,585

1,385

2,402

1,705

Changes in operating assets and

liabilities:

Accounts receivable, net

(32,264

)

(33,496

)

103,301

96,309

Deferred commissions

(11,438

)

(9,206

)

(19,288

)

(17,319

)

Operating lease right-of-use assets,

net

4,814

4,764

13,350

15,850

Other assets

1,071

712

(595

)

(1,227

)

Accounts payable, accrued expenses and

other liabilities

1,787

14,608

(14,399

)

(6,136

)

Operating lease liabilities

(6,389

)

(11,121

)

(15,326

)

(24,186

)

Deferred revenue

(16,949

)

(24,305

)

(82,456

)

(79,006

)

Net cash provided by operating

activities

36,298

32,676

167,502

157,606

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of short-term investments

(8,966

)

(30,307

)

(56,455

)

(65,745

)

Maturities of short-term investments

51,000

17,000

75,896

50,000

Sales of short-term investments

—

—

3,567

—

Purchases of property and equipment

(398

)

952

(1,674

)

(2,000

)

Proceeds from sales of property and

equipment

3,295

622

5,991

1,253

Capitalized internal-use software

costs

(6,113

)

(4,544

)

(11,677

)

(8,377

)

Other

—

—

—

(190

)

Net cash provided by (used in) investing

activities

38,818

(16,277

)

15,648

(25,059

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Repurchases of common stock

(106,552

)

(62,535

)

(138,686

)

(104,906

)

Payments of dividends to preferred

stockholders

(3,750

)

(3,750

)

(7,500

)

(7,443

)

Proceeds from exercise of stock

options

5,716

35

15,353

795

Proceeds from issuances of common stock

under employee stock purchase plan

—

—

15,677

16,045

Employee payroll taxes paid for net

settlement of stock awards

(16,474

)

(21,450

)

(37,783

)

(42,026

)

Principal payments of finance lease

liabilities

—

(9,071

)

(2,141

)

(18,952

)

Other

(347

)

(2,365

)

(2,022

)

(3,570

)

Net cash used in financing activities

(121,407

)

(99,136

)

(157,102

)

(160,057

)

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

3,622

(2,785

)

(2,589

)

(4,836

)

Net (decrease) increase in cash, cash

equivalents, and restricted cash

(42,669

)

(85,522

)

23,459

(32,346

)

Cash, cash equivalents, and restricted

cash, beginning of period

450,385

482,216

384,257

429,040

Cash, cash equivalents, and restricted

cash, end of period

$

407,716

$

396,694

$

407,716

$

396,694

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP DATA

(In Thousands, Except Per

Share Data and Percentages)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

GAAP gross profit

$

214,526

$

194,415

$

420,932

$

384,662

Stock-based compensation

4,731

5,230

9,352

9,715

Acquired intangible assets

amortization

981

1,452

2,133

2,904

Non-GAAP gross profit

$

220,238

$

201,097

$

432,417

$

397,281

GAAP gross margin

79.4

%

74.4

%

78.7

%

74.9

%

Stock-based compensation

1.8

2.0

1.8

1.9

Acquired intangible assets

amortization

0.4

0.5

0.4

0.6

Non-GAAP gross margin

81.6

%

76.9

%

80.9

%

77.4

%

GAAP operating income

$

20,280

$

9,875

$

38,287

$

18,210

Stock-based compensation

55,111

53,346

106,273

100,623

Acquired intangible assets

amortization

981

1,452

2,133

2,904

Acquisition-related expenses

293

14

293

14

Expenses related to litigation

25

27

104

319

Non-GAAP operating income

$

76,690

$

64,714

$

147,090

$

122,070

GAAP operating margin

7.5

%

3.8

%

7.2

%

3.5

%

Stock-based compensation

20.4

20.4

19.9

19.6

Acquired intangible assets

amortization

0.4

0.6

0.4

0.6

Acquisition-related expenses

0.1

—

—

—

Expenses related to litigation

—

—

—

0.1

Non-GAAP operating margin

28.4

%

24.8

%

27.5

%

23.8

%

GAAP net income attributable to common

stockholders

$

14,341

$

5,744

$

25,855

$

9,401

Stock-based compensation

55,111

53,346

106,273

100,623

Acquired intangible assets

amortization

981

1,452

2,133

2,904

Acquisition-related expenses

293

14

293

14

Expenses related to litigation

25

27

104

319

Amortization of debt issuance costs

477

474

953

948

Undistributed earnings attributable to

preferred stockholders

(6,486

)

(6,314

)

(12,466

)

(11,945

)

Non-GAAP net income attributable to common

stockholders

$

64,742

$

54,743

$

123,145

$

102,264

GAAP net income per share attributable to

common stockholders, diluted

$

0.10

$

0.04

$

0.18

$

0.06

Stock-based compensation

0.38

0.35

0.72

0.67

Acquired intangible assets

amortization

0.01

0.01

0.01

0.02

Acquisition-related expenses

—

—

—

—

Expenses related to litigation

—

—

—

—

Amortization of debt issuance costs

—

—

0.01

0.01

Undistributed earnings attributable to

preferred stockholders

(0.05

)

(0.04

)

(0.09

)

(0.08

)

Non-GAAP net income per share attributable

to common stockholders, diluted

$

0.44

$

0.36

$

0.83

$

0.68

Weighted-average shares used to compute

net income per share attributable to common stockholders,

diluted

146,525

150,007

147,634

150,218

GAAP net cash provided by operating

activities

$

36,298

$

32,676

$

167,502

$

157,606

Proceeds from sales of property and

equipment, net of purchases

2,897

1,574

4,317

(747

)

Principal payments of finance lease

liabilities

—

(9,071

)

(2,141

)

(18,952

)

Capitalized internal-use software

costs

(6,460

)

(4,611

)

(13,699

)

(9,091

)

Non-GAAP free cash flow

$

32,735

$

20,568

$

155,979

$

128,816

GAAP net cash provided by (used in)

investing activities

$

38,818

$

(16,277

)

$

15,648

$

(25,059

)

GAAP net cash used in financing

activities

$

(121,407

)

$

(99,136

)

$

(157,102

)

$

(160,057

)

BOX, INC.

RECONCILIATION OF GAAP REVENUE

TO BILLINGS

(In Thousands)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

GAAP revenue

$

270,039

$

261,428

$

534,697

$

513,326

Deferred revenue, end of period

502,104

479,293

502,104

479,293

Less: deferred revenue, beginning of

period

(513,572

)

(507,385

)

(586,871

)

(566,630

)

Contract assets, beginning of period

3,345

2,642

2,452

1,900

Less: contract assets, end of period

(5,481

)

(3,477

)

(5,481

)

(3,477

)

Billings

$

256,435

$

232,501

$

446,901

$

424,412

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP NET INCOME PER SHARE GUIDANCE

(In Thousands, Except Per

Share Data)

(Unaudited)

Three Months Ended

Fiscal Year Ended

October 31, 2024

January 31, 2025

GAAP net income per share attributable to

common stockholders range, diluted

$

0.07

-$

0.08

$

0.31

-$

0.33

Stock-based compensation

0.36

0.36

1.43

1.43

Acquired intangible asset amortization

0.01

0.01

0.03

0.03

Acquisition-related expenses

0.01

0.01

0.01

0.01

Expenses related to litigation

—

—

0.01

0.01

Amortization of debt issuance costs

—

—

0.01

0.01

Undistributed earnings attributable to

preferred stockholders

(0.04

)

(0.04

)

(0.17

)

(0.17

)

Non-GAAP net income per share attributable

to common stockholders range, diluted

$

0.41

-$

0.42

$

1.64

-$

1.66

Weighted-average shares, diluted

148,000

148,500

Note: Figures may not sum due to

rounding.

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP OPERATING MARGIN GUIDANCE

(Unaudited)

Three Months Ended

Fiscal Year Ended

October 31, 2024

January 31, 2025

GAAP operating margin

7.5

%

7.0

%

Stock-based compensation

19.5

19.5

Acquired intangible assets

amortization

0.5

0.5

Other (1)

0.5

0.5

Non-GAAP operating margin

28.0

%

27.5

%

(1) Other includes acquisition-related

expenses and expenses related to litigation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826136608/en/

Investors: Cynthia Hiponia and Elaine Gaudioso +1 650-209-3463

ir@box.com

Media: Denis Roy and Rachel Levine +1 650-543-6926

press@box.com

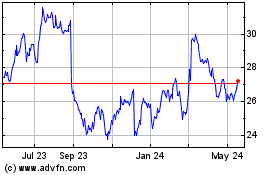

Box (NYSE:BOX)

Historical Stock Chart

From Oct 2024 to Nov 2024

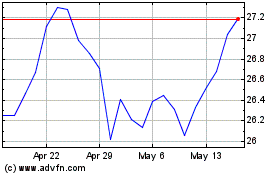

Box (NYSE:BOX)

Historical Stock Chart

From Nov 2023 to Nov 2024