Box, Inc. Announces Pricing of Offering of $400 Million of Convertible Senior Notes

September 18 2024 - 12:05AM

Business Wire

Box, Inc. (NYSE:BOX), the leading Intelligent Content

Cloud, today announced the pricing of $400 million aggregate

principal amount of 1.50% convertible senior notes due 2029 (the

“notes”) in a private placement to qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”). Box also granted the initial purchasers of

the notes an option to purchase up to an additional $60 million

aggregate principal amount of the notes. The sale of the notes is

expected to close on September 20, 2024, subject to customary

closing conditions.

The notes will be general senior, unsecured obligations of Box.

The notes will bear interest at a rate of 1.50% per year. Interest

will be payable semi-annually in arrears on March 15 and September

15 of each year, beginning on March 15, 2025. The notes will mature

on September 15, 2029, unless earlier converted, repurchased or

redeemed. The initial conversion rate will be 23.0102 shares of

Box’s Class A common stock (“common stock”) per $1,000 principal

amount of notes (equivalent to an initial conversion price of

approximately $43.46 per share of common stock). The initial

conversion price of the notes represents a premium of approximately

30% over the last reported sale price of Box’s common stock on the

New York Stock Exchange on September 17, 2024. The notes will be

convertible into cash up to the aggregate principal amount of the

notes to be converted and cash, shares of Box’s common stock, or a

combination of cash and shares of Box’s common stock, in respect of

the remainder, if any, of Box’s conversion obligation in excess of

the aggregate principal amount of the notes being converted, at

Box’s election.

Box may redeem all or any portion of the notes (subject to a

partial redemption limitation), at its option, on or after

September 20, 2027 and prior to the 31st scheduled trading day

preceding the maturity date, if the last reported sale price of

Box’s common stock has been at least 130% of the conversion price

then in effect for at least 20 trading days (whether or not

consecutive) during any 30 consecutive trading day period

(including the last trading day of such period) ending on and

including the trading day immediately preceding the date on which

Box provides notice of redemption at a redemption price equal to

100% of the principal amount of the notes to be redeemed, plus

accrued and unpaid special interest to, but excluding, the

redemption date.

If a “fundamental change” (as defined in the indenture governing

the notes) occurs at any time prior to the maturity date, holders

of the notes may require Box to repurchase for cash all or any

portion of their notes at a repurchase price equal to 100% of the

principal amount of the notes to be repurchased, plus any accrued

and unpaid special interest. In addition, following certain

corporate events or if Box issues a notice of redemption, Box will,

under certain circumstances, increase the conversion rate for

holders who convert their notes in connection with such corporate

event or during a redemption period.

Box estimates that the net proceeds from the offering will be

approximately $389.2 million (or $447.8 million if the initial

purchasers exercise their option to purchase additional notes in

full), after deducting the initial purchasers’ discounts and

estimated offering expenses payable by Box. Box expects to use

approximately $45.6 million of the net proceeds from the offering

to pay the cost of the capped call transactions described below.

Box also intends to use approximately $191.7 million of the net

proceeds from this offering for the repurchase of $140.0 million

principal amount of its outstanding 0% Convertible Senior Notes due

2026 (the “2026 Notes”). Box intends to use the remainder of the

proceeds from this offering for working capital and other general

corporate purposes, such as the repurchase or repayment of debt,

repurchases of its capital stock and potential acquisitions.

In connection with the pricing of the notes, Box entered into

capped call transactions with certain of the initial purchasers

and/or their respective affiliates and certain other financial

institutions (the “option counterparties”). The capped call

transactions are expected generally to offset potential dilution to

Box’s common stock upon any conversion of notes and/or any cash

payments Box is required to make in excess of the principal amount

of converted notes, as the case may be, with such offset subject to

a cap initially equal to $66.86 (which represents a premium of 100%

over the last reported sale price of Box’s common stock on The New

York Stock Exchange on September 17, 2024), and is subject to

certain adjustments under the terms of the capped call

transactions. If the initial purchasers exercise their option to

purchase additional notes, Box expects to enter into additional

capped call transactions with the option counterparties.

Box has been advised that, in connection with establishing their

initial hedges of the capped call transactions, the option

counterparties or their respective affiliates may enter into

various derivative transactions with respect to Box’s common stock

and/or purchase shares of Box’s common stock concurrently with or

shortly after the pricing of the notes. This activity could

increase (or reduce the size of any decrease in) the market price

of Box’s common stock or the notes at that time.

In addition, Box has been advised that the option counterparties

or their respective affiliates may modify their hedge positions by

entering into or unwinding various derivatives with respect to

Box’s common stock and/or purchasing or selling Box’s common stock

or other securities of Box in secondary market transactions

following the pricing of the notes and prior to the maturity of the

notes and are likely to do so in connection with any early

conversion, repurchase or redemption of the notes to the extent Box

unwinds a corresponding portion of the capped call transactions, or

if Box otherwise unwinds all or a portion of the capped call

transactions, and on each exercise date for the capped call

transactions. This activity could also cause or prevent an increase

or a decrease in the market price of Box’s common stock or the

notes, which could affect a noteholder’s ability to convert the

notes, and, to the extent the activity occurs during any

observation period related to a conversion of notes, affect the

amount and value of the consideration that a noteholder will

receive upon conversion of its notes.

Box also expects in connection with the repurchase of a portion

of its 2026 Notes, those holders of the 2026 Notes that sell their

2026 Notes to Box may enter into or unwind various derivatives with

respect to Box’s common stock and/or purchase shares of Box’s

common stock concurrently with or shortly after the pricing of the

notes. In particular, Box expects that many holders of the 2026

Notes employ a convertible arbitrage strategy with respect to the

2026 Notes and have a short position with respect to Box’s common

stock that they would close, through purchases of Box’s common

stock, in connection with Box’s repurchase of the 2026 Notes. This

activity could increase (or reduce the size of any decrease in) the

market price of Box’s common stock, which may also affect the

trading price of the notes at that time, and could have resulted in

a higher effective conversion price for the notes.

In connection with the issuance of its 2026 Notes, Box entered

into capped call transactions (the “existing capped call

transactions”) with certain financial institutions (the “existing

capped call counterparties”). In connection with the repurchase of

the 2026 Notes, Box entered into agreements with certain of the

existing capped call counterparties to unwind a portion of the

existing capped call transactions corresponding to the principal

amount of the 2026 Notes repurchased (the “unwind transactions”).

In connection with the unwind transactions, Box has been advised

that the counterparties to the unwind transactions or their

respective affiliates expect to sell shares of Box’s common stock

and/or unwind various derivatives with respect to Box’s common

stock to unwind their hedge in connection with those transactions.

Such activity could decrease, or reduce the size of any increase

in, the market price of Box’s common stock. Box expects to receive

approximately $30.3 million in connection with the unwind

transactions, which it intends to use for general corporate

purposes.

The offer and sale of the notes, and any shares of Box’s common

stock potentially issuable upon conversion of the notes, have not

been, and will not be, registered under the Securities Act or any

state securities laws and, unless so registered, may not be offered

or sold in the United States absent registration or an applicable

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and other

applicable securities laws.

This press release is neither an offer to sell nor a

solicitation of an offer to buy any securities, nor shall it

constitute an offer, solicitation or sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917785505/en/

Investors: Cynthia Hiponia/Elaine Gaudioso ir@box.com

Media: Kait Conetta press@box.com

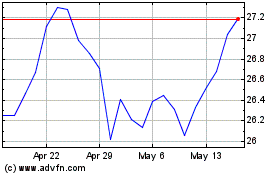

Box (NYSE:BOX)

Historical Stock Chart

From Oct 2024 to Nov 2024

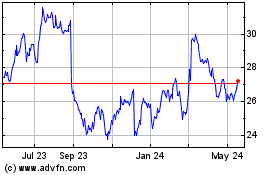

Box (NYSE:BOX)

Historical Stock Chart

From Nov 2023 to Nov 2024