Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced results for the second quarter (2Q23) and six-month

period ended June 30, 2023 (6M23). All figures have been prepared

in accordance with IFRS (International Financial Reporting

Standards) on a non-GAAP basis and are stated in U.S. dollars

(US$). Buenaventura has provided accumulated six-month results to

reflect the provisional pricing effect on the first six months of

2023.

Second Quarter and Six-Month 2023 Highlights:

- 2Q23 EBITDA from direct operations was US$ 17.1 million,

compared to US$ -12.9 million reported in 2Q22. 6M23 EBITDA from

direct operations reached US$ 68.7 million, compared to US$ 74.0

million reported in 6M22. 2022 EBITDA does not include US$ 300

million resulting from the sale of Buenaventura's stake in

Yanacocha.

- 2Q23 net loss reached US$ 5.4 million, compared to a US$ 44.6

million net loss for the same period in 2022. 6M23 net income was

US$ 67.5 million, compared to US$ 570.1 million net income for the

6M22. The 6M22 result includes a US$ 480 million net income from

discontinued operations, primarily due to the reclassification of

Buenaventura's interest in Yanacocha.

- The Company recorded a US$ 9.8 million provisional price

adjustment for the accumulated first six months of 2023. This is

comprised of US$ -13.7 million in fair value of accounts

receivables and US$ +3.9 million in adjustments to prior period

liquidations. This compares to a US$ 35.1 million loss for the

accumulated first six months of 2022.

- Buenaventura's 6M23 consolidated copper production increased

23% YoY. Zinc production decreased by 68% YoY, lead decreased by

60% YoY, silver decreased by 28% YoY, and gold decreased by 11%

YoY.

- El Brocal's underground mine production increased to 9,300 tpd

during 2Q23, compared to 8,150 tpd in 2Q22. The El Brocal ramp-up

remains on target to reach 10,000 tpd by year-end 2023.

- Buenaventura's cash position reached US$ 202.4 million and net

debt decreased to US$ 520.9 million with an average maturity of 2.9

years by quarter’s end, June 30, 2023.

- 2Q23 capital expenditures were US$ 49.7 million, compared to

US$ 36.1 million for the same period in 2022. 6M23 capital

expenditures reached US$ 85.9 million, compared to US$ 56.0 million

in 6M22, and includes US$ 24.0 million related to the San Gabriel

Project and US$ 19.2 million related to the Yumpag Project.

- Buenaventura looks forward to permitting approval of

Uchucchacua, Yumpag, El Brocal and Coimolache. The company

continues to work with the Peruvian environmental authority

(SENACE) on its final review. We expect permits for Uchucchacua and

Yumpag to be approved during 3Q23.

- Cerro Verde paid a total dividend of US$ 250 million on April

28, 2023. Buenaventura received US$ 49.0 million relative to its

stake in Cerro Verde. Cerro Verde will pay a second dividend on

August 3, 2023, from which Buenaventura will receive an additional

US$ 49.0 million.

Financial Highlights (in millions of US$, except EPS

figures):

2Q23

2Q22

Var

6M23

6M22

Var

Total Revenues

173.3

150.1

15%

358.8

383.0

-6%

Operating Income

-22.0

-64.2

-66%

-9.5

-32.0

N.A.

EBITDA Direct Operations (1)

17.1

-12.9

N.A.

68.7

74.0

-7%

EBITDA Including Affiliates (1)

87.4

57.8

51%

265.7

291.5

-9%

Net Income (2)

-6.7

-36.3

-81%

57.7

568.2

-90%

EPS (3)

-0.03

-0.14

-81%

0.23

2.24

-90%

(1)

Does not include US$ 300 million from the

sale of Buenaventura’s stake in Yanacocha.

(2)

Net Income attributable to owners of the

parent

(3)

As of June 30, 2023, Buenaventura had a

weighted average number of shares outstanding of 253,986,867.

For a full version of Compañía de Minas Buenaventura Second

Quarter 2023 Earnings Release, please visit:

https://www.buenaventura.com/en/inversionistas/reportes-trimestrales/2023

CONFERENCE CALL

INFORMATION:

Compañia de Minas Buenaventura will host a conference call on

Thursday, July 27, 2023, to discuss these results at 11:00 a.m.

Eastern Time / 10:00 a.m. Peru Time

To participate in the conference call, please dial:

Toll-Free US: 1-844-481-2914

Toll International: 1-412-317-0697

Passcode: Ask to be joined into the

Compañía de Minas Buenaventura’s call.

Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=Bsgl7GLh

If you would prefer to receive a call rather than dial in,

please register via the following link. Please use this option

10-15 minutes prior to the conference call start time:

Call Me Link:

https://hd.choruscall.com/?callme=true&passcode=&info=company-email&r=true&b=16

Passcode: 8818009

Participants who do not wish to be interrupted to have their

information gathered may have Chorus Call dial out to them by

clicking on the above link, filling in the information, and

pressing the green phone button at the bottom. The phone number

provided will be automatically called and connected to the

conference without any interruption to the participant. (Please

note: Participants will be joined directly to the conference and

will hear hold music until the call begins. No confirmation message

will be played when joined.)

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2022 Form 20-F, please

contact the investor relations contacts on page 1 of this report or

download the PDF format file from the Company’s web site at

www.buenaventura.com.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release and related conference call contain, in

addition to historical information, forward-looking statements

including statements related to the Company’s ability to manage its

business and liquidity during and after the COVID-19 pandemic, the

impact of the COVID-19 pandemic on the Company’s results of

operations, including net revenues, earnings and cash flows, the

Company’s ability to reduce costs and capital spending in response

to the COVID-19 pandemic if needed, the Company’s balance sheet,

liquidity and inventory position throughout and following the

COVID-19 pandemic, the Company’s prospects for financial

performance, growth and achievement of its long-term growth

algorithm following the COVID-19 pandemic, future dividends and

share repurchases.

This press release may also contain forward-looking information

(as defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning the Company’s, Cerro Verde’s costs and expenses, results

of exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to the

Company’s, Cerro Verde’s future financial performance. Actual

results could differ materially from those projected in the

forward-looking statements as a result of a variety of factors

discussed elsewhere in this Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726901525/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer (511) 419 2540 Gabriel Salas, Head of Investor Relations

(511) 419 2591 / gabriel.salas@buenaventura.pe

Contact in NY: Barbara Cano (646) 452-2334 /

barbara@inspirgroup.com

Company Website: http://www.buenaventura.com

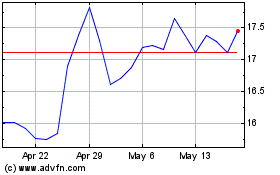

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2023 to Dec 2024