Buenaventura Announces Closing of Transaction to Divest Its Chaupiloma Royalty Company to Franco-Nevada for $210 Million

August 13 2024 - 4:17PM

Business Wire

Proceeds will strengthen balance sheet,

enhancing shareholder returns

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced that it has closed a transaction to sell to a subsidiary

of Franco-Nevada Corporation 100% of Chaupiloma Dos de Cajamarca

(“Chaupiloma”), Buenaventura’s subsidiary that owns 1.8% net

smelter return royalty on all minerals (the “Royalty”) covering

Newmont Corporation’s Yanacocha mine and adjacent mineral

properties located in Peru.

Under the terms of the definitive agreement, consideration for

the Royalty consists of $210 million paid to Buenaventura in cash

upon closing, as well as a contingent payment of $15 million in

Franco-Nevada common shares, payable upon achievement of certain

conditions as described below.

"Today's announcement represents another critical step forward,

aligned with our strategic objective of reinforcing Buenaventura’s

financial strength to return to leverage levels reflecting our

Company’s true operational performance, aligned with our commitment

to our shareholders and bond holders,” said Leandro Garcia, CEO of

Buenaventura. “This transaction enables Buenaventura to strengthen

its financial position, with sale proceeds also directed towards

driving further growth, led by progress on our San Gabriel project.

Buenaventura’s San Gabriel project achieved 57% overall progress

towards completion by second quarter’s end, meeting our planned

targets. We remain on track to reach our goal of producing our

first gold bar by the second half of 2025.”

Transaction Overview:

- $210 million in cash paid to Buenaventura and its affiliate on

closing, whereby a wholly-owned subsidiary of Franco-Nevada

acquired their Peruvian subsidiary Chaupiloma Dos De Cajamarca,

which holds the Royalty.

- A contingent payment of 118,534 common shares of Franco-Nevada,

representing $15 million as at signing, will be payable to

Buenaventura and its affiliate upon the Conga project, a project of

Minera Yanacocha which is primarily owned by Newmont Mining

Corporation, achieving commercial production for a full year prior

to the twentieth anniversary of closing.

- Buenaventura and its affiliate are entitled to receive a

variable price equivalent to payments received by Chaupiloma for

the Conga Royalty and two additional royalties.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru: Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache.

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2023 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site. (*) Operations wholly owned by

Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813819889/en/

Contacts in Lima: Daniel Dominguez, Chief Financial Officer

(511) 419 2540 Gabriel Salas, Head of Investor Relations (511) 419

2591 / Gabriel.salas@buenaventura.pe Company Website:

https://www.buenaventura.com/en/inversionistas Contacts in NY:

Barbara Cano (646) 452 2334 barbara@inspirgroup.com

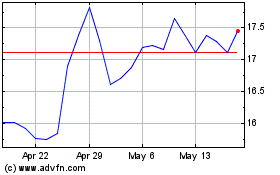

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2023 to Dec 2024