Buenaventura Announces Third Quarter 2024 Results for Production and Volume Sold per Metal

October 16 2024 - 4:29PM

Business Wire

Compañía de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 3Q24 results for production and volume sold.

Production per Metal

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

2024 Updated Guidance

(1)

Gold ounces produced

El Brocal

6,673

17,329

19.0k - 22.0k

Orcopampa

17,831

54,426

70.0k - 75.0k

Tambomayo

8,015

26,072

28.0k - 32.0k

Julcani

1,428

2,839

3.5k - 4.0k

La Zanja

4,963

8,655

10.0k - 12.0k

Total Direct Operations (2)

38,909

109,321

130.5k - 145.0k

Coimolache

8,368

38,554

41.0k - 46.0k

Total incl. Associated (3)

39,690

118,095

139.6k - 155.0k

Silver ounces produced

El Brocal

516,480

1,701,940

1.8M - 2.0M

Uchucchacua

608,412

1,524,944

2.2M - 2.5M

Yumpag (4)

2,591,227

6,017,839

7.5M - 8.0M

Orcopampa

6,891

22,857

-

Tambomayo

434,054

1,143,490

1.7M - 1.9M

Julcani

261,492

1,090,232

1.5M - 1.7M

La Zanja

8,901

14,904

-

Total Direct Operations (2)

4,427,457

11,516,207

14.7M - 16.1M

Coimolache

38,705

178,341

0.1M - 0.2M

Total incl. Associated (3)

4,243,769

10,931,273

14.0M - 15.4M

Lead metric tons produced

Uchucchacua

3,865

10,812

13.0k - 15.0k

Tambomayo

979

3,093

3.5k - 4.0k

Julcani

108

619

0.9k - 1.0k

Total Direct Operations (2)

4,953

14,523

17.4k - 20.0k

Zinc metric tons produced

El Brocal

0

1,985

1.9k - 2.0k

Uchucchacua

6,153

16,521

19.0k - 22.0k

Tambomayo

1,222

4,034

5.4k - 5.8k

Total Direct Operations (2)

7,374

22,540

26.3k - 29.8k

Copper metric tons produced

El Brocal

16,769

42,334

55.0k - 60.0k

Total Direct Operations (2)

16,769

42,334

55.0k - 60.0k

- 2024 projections are considered to be forward-looking

statements and represent management’s good faith estimates or

expectations of future production results as of October 2024.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja and 100% of El Brocal.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja, 61.43% of El Brocal and 40.094% of Coimolache.

- Considers ore from the pilot stope approved within Yumpag

EIA-sd.

Volume Sold per Metal

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

Gold ounces sold

El Brocal

3,912

10,676

Orcopampa

18,027

54,223

Tambomayo

7,438

24,199

Julcani

1,293

2,527

La Zanja

4,676

8,525

Total Direct Operations (1)

35,345

100,151

Coimolache

8,450

38,526

Total incl. Associated (2)

37,225

111,480

Silver ounces sold

El Brocal

413,407

1,403,306

Uchucchacua

555,012

1,345,729

Yumpag (3)

2,229,149

5,785,760

Orcopampa

10,031

22,174

Tambomayo

402,631

1,035,689

Julcani

248,442

1,052,051

La Zanja

16,450

32,140

Total Direct Operations (1)

3,875,123

10,676,849

Coimolache

38,748

177,393

Total incl. Associated (2)

3,731,208

10,206,718

Lead metric tons sold

El Brocal

0

72

Uchucchacua

3,489

9,752

Yumpag (3)

21

55

Tambomayo

849

2,692

Julcani

96

557

Total Direct Operations (1)

4,455

13,129

Zinc metric tons sold

El Brocal

0

1,592

Uchucchacua

5,026

13,593

Tambomayo

969

3,231

Total Direct Operations (1)

5,995

18,417

Copper metric tons sold

El Brocal

15,571

39,709

Tambomayo

32

95

Julcani

20

79

Total Direct Operations (1)

15,622

39,883

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja and 100% of El Brocal.

- Considers 100% of Buenaventura’s operating units, 100% of La

Zanja, 61.43% of El Brocal and 40.094% of Coimolache.

- Considers ore from the pilot stope approved within Yumpag

EIA-sd.

Average realized prices(1)(2)

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

Year Ended December 31,

2023

Gold (US$/Oz)

2,514

2,323

1,954

Silver (US$/Oz)

29.92

28.14

23.98

Lead (US$/MT)

2,082

2,078

2,093

Zinc (US$/MT)

2,883

2,618

2,315

Copper (US$/MT)

9,391

9,124

8,418

- Considers Buenaventura consolidated figures.

- Realized prices include both provisional sales and final

adjustments for price changes.

Commentary on Operations

Tambomayo:

- Gold, lead and zinc production was in line with expectations.

2024 guidance remains unchanged.

- Silver production was below 3Q24 projections due to delays

related to mine development and in the preparation of high silver

grade ore stopes. 2024 remains unchanged.

Orcopampa:

- 3Q24 gold and silver production was in line with expectations.

2024 guidance remains unchanged.

Coimolache:

- Gold production exceeded 3Q24 projections due to an accelerated

percolation rate at the leach pad. 2024 guidance has therefore been

updated.

- During the 3Q24, Buenaventura filed for a leach pad expansion

construction permit at Coimolache, which is currently pending with

the Ministry of Energy and Mines. Approval is expected by the end

of 1Q25, enabling the Company to begin construction in 2Q25 and to

resume leaching fresh ore in 3Q25.

Julcani:

- Gold and copper production at the Julcani mine is gradually

increasing as the operation transitions to zones richer in these

metals, successfully offsetting lower production from the Achilla

zone which has historically produced lead and silver.

- 2024 guidance has therefore been revised to reflect increased

gold production with lower silver grades.

Uchucchacua:

- Silver and lead production was in line with expectations for

3Q24. 2024 guidance remains unchanged.

- Zinc production exceeded expectations due to higher grades than

was previously projected. 2024 guidance has therefore been

updated.

- Uchucchacua achieved 1,500 TPD average daily throughput in

3Q24, aligned with the Company’s targeted 1,500 TPD by year end

2024.

Yumpag:

- Silver production was in line with expectations for 3Q24. 2024

guidance remains unchanged.

El Brocal:

- Copper production was in line with expectations for 3Q24. 2024

guidance remains unchanged.

- Gold and silver production exceeded expectations for 3Q24 due

to increased volume processed during the quarter. 2024 guidance has

therefore been updated.

- All ore stockpiled in 2Q24 was processed during the 3Q24,

enabling El Brocal to meet its targeted production for the first

nine months of 2024. The average mining rate during 3Q24 was 12,000

tons per day, and the average mining rate for the first nine months

of the year was 11,000 tons per day, aligned with the Company’s

target for full year production to exceed 11,000 tons per day.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

(*) Operations wholly owned by Buenaventura.

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016331347/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer +51 1 419 2540

Gabriel Salas, Head of Investor Relations +51 1 419

2591 gabriel.salas@buenaventura.pe

Contact in New York: Barbara Cano, InspIR Group

+1 646 452 2334 barbara@inspirgroup.com

Website: www.buenaventura.com

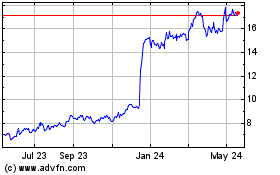

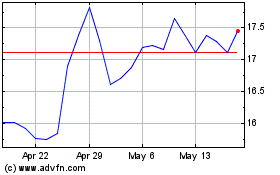

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Feb 2024 to Feb 2025