0001130713false00011307132024-10-212024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

OCTOBER 21, 2024

Date of Report (date of earliest event reported)

Beyond, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-41850 | | 87-0634302 |

| (State or other jurisdiction of | | (Commission File Number) | | (I.R.S. Employer |

| incorporation or organization) | | | | Identification Number) |

799 W. Coliseum Way

Midvale, Utah 84047

(Address of principal executive offices)

(801) 947-3100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | BYON | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Kirkland’s Credit Agreement

On October 21, 2024, the Company entered into a strategic business relationship with Kirkland’s Inc. (“Kirkland’s”).

Pursuant to a secured Term Loan Credit Agreement (“Credit Agreement”), the Company will provide $17 million in debt financing to Kirkland’s and its subsidiaries, including an $8.5 million promissory note and a $8.5 million convertible note (the “Loan”). The Loan will be secured by Kirkland’s’ assets and second in priority behind Bank of America’s existing loan to Kirkland’s (the “ABL Facility”) and will mirror the terms of the ABL Facility. Kirkland’s will use the Loan to pay off an existing loan to Gordan Brothers, to pay transaction fees in connection with the Credit Agreement and related transactions, to increase cash on hand, to finance capital expenditures, and for general corporate purposes. A portion of the $8.5 million convertible note (plus accrued interest) (the “Conversion Amount”) can be converted into Kirkland’s common stock at a conversion price of $1.85 per share in an amount not to exceed 2,609,215 shares at the Company’s election prior to obtaining Kirkland’s stockholder approval of the Subscription Agreement (as defined below) and the full amount of the convertible note will automatically convert upon obtaining Kirkland’s stockholder approval.

The Credit Agreement is subject to customary affirmative covenants and negative covenants as well as financial covenants.

The Company will also invest $8 million in Kirkland’s common stock pursuant to a Subscription Agreement and Investor Rights Agreement (collectively the “Subscription Agreement”), subject to receiving approval of Kirkland’s stockholders. If Kirkland’s issues the full amount of shares contemplated by the Subscription Agreement and the Company converts the full amount of the Conversion Amount, the Company will own up to approximately 40% of Kirkland’s common stock.

In exchange, Kirkland’s will grant the Company the right to designate two persons for appointment to Kirkland’s board as independent directors (Kirkland’s current board consists of six directors, two of whom would resign and be replaced by Company designees), and the Company will have the right to appoint one individual as a non-voting observer to Kirkland’s board.

Pursuant to the terms of the Collaboration Agreement (the “Collaboration Agreement”), the Company and Kirkland’s will engage in collaborative marketing efforts, including the sale of certain Kirkland’s products on the Company’s e-commerce channels. Under the Collaboration Agreement, the Company will receive a quarterly fee of 0.25% on all of Kirkland’s quarterly retail and e-commerce revenue starting in the first fiscal quarter of fiscal 2025 through the term of the Collaboration Agreement. The Company will also receive an incentive fee of 1.5% on Kirkland’s’ incremental growth in e-commerce revenue measured on the increase of year-over-year sales on a trailing twelve-month basis.

Lastly, pursuant to a Trademark License Agreement (the “License Agreement”) the Company will grant Kirkland’s (i) an exclusive license to operate brick-and-mortar “Bed Bath & Beyond” retail stores, ranging from 7,000 to 15,000 square feet, in the “neighborhood-format,” beginning with up to five stores, and (ii) a non-exclusive license to operate “shop-in-shops” under the “Bed Bath & Beyond” marks at the locations and in the size and format mutually agreed upon by the parties. In return the Company will receive a 3% royalty (increasing to 5% upon termination of the Collaboration Agreement) on all in-store net sales, with a minimum fee equal to (i) $200,000 for the first 24 months and (ii) $25,000 per month thereafter.

Revolving Line of Credit

On October 21, 2024, Beyond, Inc. (the “Company” or “Beyond”) entered into a Loan and Security Agreement (the “Loan Agreement”) with BMO Bank N.A. (in such capacity, “BMO”), pursuant to which BMO agrees to lend the Company up to $25 million on a one-year revolving line of credit to aid the Company in securing strategic ventures, including providing financing to current or prospective strategic partners, participating in future growth opportunities, and for other general corporate purposes of the Company. In connection with the Loan Agreement, BMO issued a revolving line of credit promissory note (the “Revolving Note”) and granted a lien on the cash collateral account specified in the Loan Agreement (the “Cash Collateral Account”). The revolving line of credit bears interest on the unpaid principal balance at an annual rate equal to the Secured Overnight Financing Rate, or SOFR Rate, for a one-month interest period plus 1.00%, established by the Federal Reserve Bank of New York. The Company is obligated to pay certain commitment fees on undrawn amounts under the Loan Agreement in amounts specified in the Loan Agreement. The Loan Agreement and Revolving Note terminate on October 21, 2025 and loans thereunder may be borrowed, repaid, and reborrowed up to such date.

The Loan Agreement is subject to limited affirmative covenants and negative covenants, including the requirement that the Company maintain cash in the Cash Collateral Account in an amount that is three percent greater than BMO’s aggregate commitments under the Loan Agreement.

The foregoing descriptions of or references to the Term Loan Credit Agreement, Subscription Agreement, Investor Rights Agreement, License Agreement, Loan Agreement, and Revolving Note are not complete and are qualified in their entirety by reference to the full text of such agreements, documents, exhibits thereto, and schedules thereto, each of which will be filed as exhibits to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The foregoing disclosure in Item 1.01 hereof is incorporated by reference into this Item 2.03.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements regarding future growth opportunities, entry into strategic ventures and partnerships and results therefrom, expectations with respect to performance related to the agreements or relationships. Actual results could differ materially for a variety of known and unknown risks, uncertainties, and other important factors, including those found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the Securities and Exchange Commission (the “SEC”) on February 23, 2024, the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, which was filed with the SEC on July 31, 2024, and in the Company’s subsequent filings with the SEC.

| | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | |

| | BEYOND, INC. |

| | |

| By: | /s/ E. Glen Nickle |

| | E. Glen Nickle |

| | Chief Legal Officer |

| Date: | October 21, 2024 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

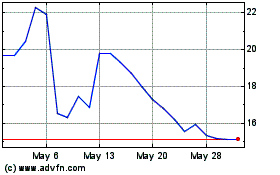

Beyond (NYSE:BYON)

Historical Stock Chart

From Oct 2024 to Nov 2024

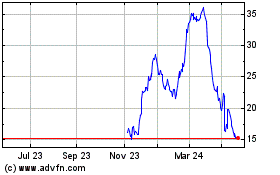

Beyond (NYSE:BYON)

Historical Stock Chart

From Nov 2023 to Nov 2024