0000915840false00009158402025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest reported event): February 6, 2025

BEAZER HOMES USA, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-12822 | | 58-2086934 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2002 Summit Boulevard, 15th Floor

Atlanta, Georgia 30319

(Address of Principal Executive Offices)

(770) 829-3700

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | BZH | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

On February 6, 2025, the Company held its 2025 Annual Meeting of Stockholders. A total of 26,765,665 shares were represented in person or by valid proxy at the annual meeting and the Company’s stockholders took the following actions:

1. Election of Directors. Stockholders elected Lloyd E. Johnson, John J. Kelley III, Allan P. Merrill, Peter M. Orser, Norma A. Provencio, June Sauvaget, Danny R. Shepherd, Alyssa P. Steele and C. Christian Winkle to serve as directors until the 2026 Annual Meeting of Stockholders and until their successors are elected and qualified. The vote totals for each of these individuals were:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Shares For | | Shares Against | | Shares Abstained | | Broker Non-Votes |

| Lloyd E. Johnson | | 23,057,565 | | 148,470 | | 74,446 | | 3,485,184 |

| John J. Kelley III | | 23,198,032 | | 27,967 | | 54,482 | | 3,485,184 |

| Allan P. Merrill | | 22,834,526 | | 391,323 | | 54,632 | | 3,485,184 |

| Peter M. Orser | | 22,560,309 | | 665,407 | | 54,765 | | 3,485,184 |

| Norma A. Provencio | | 22,255,081 | | 970,977 | | 54,423 | | 3,485,184 |

| June Sauvaget | | 23,155,901 | | 50,478 | | 74,102 | | 3,485,184 |

| Danny R. Shepherd | | 22,410,434 | | 796,500 | | 73,547 | | 3,485,184 |

| Alyssa P. Steele | | 23,137,898 | | 69,515 | | 73,068 | | 3,485,184 |

| C. Christian Winkle | | 23,154,039 | | 53,087 | | 73,355 | | 3,485,184 |

2. Ratification of Independent Accountants. Stockholders ratified the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2025. The vote totals were: 26,350,350 shares for, 410,679 shares against and 4,636 share abstentions.

3. Vote on Compensation of Named Executive Officers. Stockholders approved the compensation paid to the Company’s named executive officers for the fiscal year ending September 30, 2024. The vote totals were: 22,276,402 shares for, 969,559 shares against, 34,520 share abstentions and 3,485,184 broker non-votes.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On February 6, 2025, the Company issued a press release announcing that it is accelerating the pace of its share repurchases, and provided an update regarding its net debt to net capitalization ratio expectations.

The information set forth in this Item 7.01 (including Exhibit 99.1) of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | BEAZER HOMES USA, Inc. |

| | | | | | | |

Date: | February 6, 2025 | | | | | By: | | /s/ Michael A. Dunn |

| | | | | | | | Michael A. Dunn

Senior Vice President and General Counsel |

FOR IMMEDIATE RELEASE

Beazer Homes Accelerates Pace of Share Repurchases

Updates Net Debt to Net Capitalization Ratio Expectations

Atlanta, Georgia – February 6, 2025 – Beazer Homes USA, Inc. (NYSE: BZH) today announced that it is accelerating the pace of its share repurchases in light of recent share price dislocation. The Company will continue to repurchase shares pursuant to the Company’s previously authorized share repurchase program, under which approximately $24.8 million remains available.

Since January 30th, after reporting earnings for the first quarter of 2025, the Company has repurchased approximately $4.1 million of its shares at a weighted average price of $21.86. The Company plans to increase the pace of its repurchases in light of current market conditions.

"We believe accelerating the pace of our share repurchases makes a lot of sense. The ability to buy back our shares at a significant discount to book value represents a compelling investment opportunity and we plan to act on it,” said Allan P. Merrill, Chairman and Chief Executive Officer.

Considering the acceleration of its share repurchase program, the Company also announced that debt reduction is expected to moderate in the near term. Specifically, the Company now projects its net debt to net capitalization ratio will be in the low 30% range by the end of fiscal 2026 and will be in the mid-to-high 30% range by the end of fiscal 2025. Notwithstanding this near-term moderation in leverage reduction, the Company remains committed to its long-term goal of reducing its net debt to net capitalization ratio below 30%. Furthermore, the Company reaffirmed its outlook for its two other Multi-Year Goals: reaching 200 active communities by the end of fiscal 2026 and starting 100% of its homes qualified as Zero Energy Ready by the end of calendar 2025.

“From a capital allocation perspective, we believe modestly slowing our deleveraging efforts in order to repurchase a meaningful amount of our stock at a significant discount to book value is fully consistent with our balanced growth strategy, which was specifically designed to give us the flexibility necessary to quickly respond to changing market conditions,” Mr. Merrill stated.

About Beazer Homes

Headquartered in Atlanta, Beazer Homes (NYSE: BZH) is one of the country’s largest homebuilders. Every Beazer home is designed and built to provide Surprising Performance, giving you more quality and more comfort from the moment you move in – saving you money every month. With Beazer's Choice Plans™, you can personalize a number of primary living areas – giving you a choice of how you want to live in the home, at no additional cost. And unlike most national homebuilders, we empower our customers to shop and compare loan options. Our Mortgage Choice program gives you the resources to easily compare multiple loan offers and choose the best lender and loan offer for you, saving you thousands over the life of your loan.

We build our homes in Arizona, California, Delaware, Florida, Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina, Tennessee, Texas, and Virginia. For more information, visit beazer.com, or check out Beazer on Facebook, Instagram and Twitter.

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements represent our expectations or beliefs concerning future events, including our plans to accelerate our share repurchases and moderate our debt reduction goals, and it is possible that the results described in this press release will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among others, the risks, uncertainties and other factors discussed under “Risk Factors” in the our Annual Report on Form 10-K for the fiscal year ended September 30, 2024, which was filed with the SEC on November 13, 2024. Statements in this press release that are “forward-looking” include, without limitation, statements about (i) our plans to accelerate the pace of share repurchases in light of current market conditions, (ii) our belief that buying back shares at a significant discount to book value represents a compelling investment opportunity, (iii) moderating our expectations with respect to our net debt to net capitalization ratios at the end of 2025 and 2026 and (iv) our plans and expectations with respect to capital allocation. Any forward-looking statement, including any statement expressing confidence regarding future outcomes, speaks only as of the date on which such statement is made and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all such factors.

For more information, please contact:

David I. Goldberg

SVP and Chief Financial Officer

Beazer Homes USA, Inc.

770-829-3756

david.goldberg@beazer.com

v3.25.0.1

Cover Page

|

Jan. 30, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

BEAZER HOMES USA, INC.

|

| Entity Central Index Key |

0000915840

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-12822

|

| Entity Tax Identification Number |

58-2086934

|

| Entity Address, Address Line One |

2002 Summit Boulevard

|

| Entity Address, Address Line Two |

15th Floor

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30319

|

| City Area Code |

770

|

| Local Phone Number |

829-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

BZH

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

2002 Summit Boulevard

|

| Entity Address, Address Line Two |

15th Floor

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30319

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

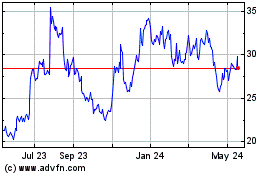

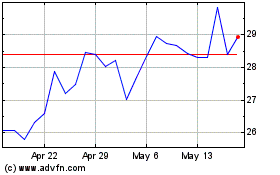

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Feb 2024 to Feb 2025