Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today

announced its financial results for the three months ended December

31, 2024.

“Despite a challenging new home sales environment, we had a

productive first quarter and made progress toward our full year and

Multi-Year Goals,” said Allan P. Merrill, the Company’s Chairman

and Chief Executive Officer. “Net new orders and closings increased

year-over-year, supported by a 20% higher community count. We also

grew our total lot position by about 10% versus the prior year,

primarily through options, positioning us for further community

count growth in the years ahead.”

Looking to the full fiscal year, Mr. Merrill said, “Despite the

affordability challenges of the near-term environment, we remain

confident in our ability to generate a double-digit return on

capital employed this year – even as we position the Company for

substantial growth in the years ahead.”

Speaking to the Company’s three Multi-Year Goals and longer-term

outlook, Mr. Merrill said, “Our community count growth,

deleveraging and Zero Energy Ready goals are all within sight. We

expect to end fiscal year 2025 with approximately 180 active

communities, with control of the land necessary to reach 200 active

communities by the end of fiscal year 2026. Our net debt to net

capitalization ratio should be in the mid-30% range at fiscal

year-end, approaching our target of less than 30% by the end of

fiscal year 2026. Finally, with 98% of our home starts in the first

quarter being built to Zero Energy Ready standards and only four

communities remaining with legacy product, we expect 100% of our

starts will be Zero Energy Ready by December 2025. With our

experienced operating team, growing lot position, healthy balance

sheet, and industry-leading energy efficient homes, we are

well-positioned to drive sustainable value for our shareholders in

the years ahead.”

Beazer Homes Fiscal First Quarter 2025

Highlights and Comparison to Fiscal First Quarter 2024

- Net income from continuing operations was $3.1 million, or

$0.10 per diluted share, compared to net income from continuing

operations of $21.7 million, or $0.70 per diluted share, in fiscal

first quarter 2024

- Adjusted EBITDA was $23.0 million, down 39.4%

- Homebuilding revenue was $460.4 million, up 20.9% on a 22.1%

increase in home closings to 907, partially offset by a 1.0%

decrease in average selling price (ASP) to $507.6 thousand

- Homebuilding gross margin was 15.2%, down 470 basis points

compared to a year ago. Excluding impairments, abandonments and

amortized interest, homebuilding gross margin was 18.2%, down 470

basis points

- SG&A as a percentage of total revenue was 14.0%, down 30

basis points

- Net new orders were 932, up 13.2% on a 17.8% increase in

average community count to 161, partially offset by a 3.8% decrease

in orders per community per month to 1.9

- Active community count at period-end of 163, up 19.9%

- Backlog dollar value was $816.0 million, down 12.5% on a 15.9%

decrease in backlog units to 1,507, partially offset by a 4.0%

increase in ASP of homes in backlog to $541.5 thousand

- Land acquisition and land development spending was $211.3

million, up 6.3% from $198.7 million

- Controlled lots of 28,874, up 9.5% from 26,374

- Unrestricted cash at quarter end was $80.4 million; total

liquidity was $335.4 million

- Total debt to total capitalization ratio remained flat at 46.5%

year-over-year. Net debt to net capitalization ratio was 44.5% at

quarter end compared to 43.7% a year ago

The following provides additional details on the Company's

performance during the fiscal first quarter 2025:

Profitability. Net income from continuing operations was $3.1

million, generating diluted earnings per share of $0.10. First

quarter adjusted EBITDA of $23.0 million was down $15.0 million, or

39.4%, primarily due to lower operating margin, partially offset by

higher revenue on higher closings.

Orders. Net new orders for the first quarter increased to 932,

up 13.2% from 823 in the prior year quarter, primarily driven by a

17.8% increase in average community count to 161 from 137 a year

ago, partially offset by a 3.8% decrease in sales pace to 1.9

orders per community per month, down from 2.0 in the prior year

quarter. The cancellation rate for the quarter was 16.5%, down from

19.0% in the prior year quarter.

Backlog. The dollar value of homes in backlog as of December 31,

2024 was $816.0 million, representing 1,507 homes, compared to

$932.8 million, representing 1,791 homes, at the same time last

year. The ASP of homes in backlog was $541.5 thousand, up 4.0%

versus the prior year quarter. The increase in backlog ASP was

primarily due to changes in product and community mix and price

appreciation in certain communities.

Homebuilding Revenue. First quarter homebuilding revenue was

$460.4 million, up 20.9% year-over-year. The increase in

homebuilding revenue was driven by a 22.1% increase in home

closings to 907 homes, partially offset by a 1.0% decrease in ASP

to $507.6 thousand. The increase in closings was primarily due to

higher volume of spec homes that sold and closed within the current

fiscal quarter and improved construction cycle times.

Homebuilding Gross Margin. Homebuilding gross margin was 15.2%,

down 470 basis points compared to a year ago. Excluding

impairments, abandonments and amortized interest, homebuilding

gross margin was 18.2% for the first quarter, down from 22.9% in

the prior year quarter primarily due to an increase in price

concessions and closing cost incentives, an increased share of spec

home closings which generally have lower margins than "to be built"

homes, and changes in product and community mix.

SG&A Expenses. Selling, general and administrative expenses

as a percentage of total revenue was 14.0% for the quarter, down 30

basis points year-over-year due to total revenue growth outpacing

SG&A expense growth.

Land Position. For the current fiscal quarter, land acquisition

and land development spending was $211.3 million, up 6.3%

year-over-year. Controlled lots increased 9.5% to 28,874, compared

to 26,374 from the prior year quarter. Excluding land held for

future development and land held for sale lots, active lots

controlled were 28,178, up 9.6% year-over-year. As of December 31,

2024, the Company controlled 58.9% of its total active lots through

option agreements compared to 53.1% as of December 31, 2023.

Liquidity. At the close of the first quarter, the Company had

$335.4 million of available liquidity, including $80.4 million of

unrestricted cash and $255.0 million of remaining capacity under

the unsecured revolving credit facility, compared to total

available liquidity of $404.2 million a year ago.

Senior Unsecured Revolving Credit Facility. During January 2025,

the Company increased the available borrowing capacity under the

senior unsecured revolving credit facility from $300.0 million to

$365.0 million.

Commitment to Sustainability

The Company remains dedicated to continually enhancing the

energy efficiency of its homes in support of its industry-first

pledge that, by the end of calendar 2025, every new home the

Company starts will be Zero Energy Ready, which means it will meet

the requirements of the U.S. Department of Energy's (DOE) Zero

Energy Ready Home program.

In November, the Company introduced Charity Home Insurance

Agency, which provides consumers with the opportunity to purchase

homeowner’s insurance coverage based on their home specifications

and personal needs. Charity Home Insurance Agency is dedicated to

distributing 100% of profits to the Beazer Charity Foundation, the

Company’s philanthropic arm, which supports nonprofits working in

our communities.

Summary results for the three months ended December 31, 2024 are

as follows:

Three Months Ended December

31,

2024

2023

Change*

New home orders, net of cancellations

932

823

13.2

%

Cancellation rates

16.5

%

19.0

%

(250

) bps

Orders per community per month

1.9

2.0

(3.8

)%

Average active community count

161

137

17.8

%

Active community count at quarter-end

163

136

19.9

%

Land acquisition and land development

spending (in millions)

$

211.3

$

198.7

6.3

%

Total home closings

907

743

22.1

%

ASP from closings (in thousands)

$

507.6

$

512.7

(1.0

)%

Homebuilding revenue (in millions)

$

460.4

$

380.9

20.9

%

Homebuilding gross margin

15.2

%

19.9

%

(470

) bps

Homebuilding gross margin, excluding

impairments and abandonments (I&A)

15.2

%

19.9

%

(470

) bps

Homebuilding gross margin, excluding

I&A and interest amortized to cost of sales

18.2

%

22.9

%

(470

) bps

SG&A expenses as a percent of total

revenue

14.0

%

14.3

%

(30

) bps

Income from continuing operations before

income taxes (in millions)

$

3.2

$

22.9

(86.2

)%

Expense from income taxes (in

millions)

$

—

$

1.2

(97.0

)%

Income from continuing operations, net of

tax (in millions)

$

3.1

$

21.7

(85.6

)%

Basic income per share from continuing

operations

$

0.10

$

0.71

(85.9

)%

Diluted income per share from continuing

operations

$

0.10

$

0.70

(85.7

)%

Net income (in millions)

$

3.1

$

21.7

(85.6

)%

Adjusted EBITDA (in millions)

$

23.0

$

38.0

(39.4

)%

LTM Adjusted EBITDA (in millions)

$

228.4

$

262.9

(13.1

)%

Total debt to total capitalization

ratio

46.5

%

46.5

%

0

bps

Net debt to net capitalization ratio

44.5

%

43.7

%

80

bps

* Change and totals are calculated using

unrounded numbers.

"LTM" indicates amounts for the trailing

12 months.

As of December 31,

2024

2023

Change

Backlog units

1,507

1,791

(15.9

)%

Dollar value of backlog (in millions)

$

816.0

$

932.8

(12.5

)%

ASP in backlog (in thousands)

$

541.5

$

520.8

4.0

%

Land and lots controlled

28,874

26,374

9.5

%

Conference Call

The Company will hold a conference call on January 30, 2025 at

5:00 p.m. ET to discuss these results. Interested parties may

listen to the conference call and view the Company's slide

presentation on the "Investor Relations" page of the Company's

website, www.beazer.com. In addition, the conference call

will be available by telephone at 800-475-0542 (for international

callers, dial 630-395-0227). To be admitted to the call, enter the

pass code "8571348." A replay of the conference call will be

available, until 11:59 PM ET on February 13, 2025 at 866-363-1806

(for international callers, dial 203-369-0194) with pass code

"3740."

About Beazer Homes

Headquartered in Atlanta, Beazer Homes (NYSE: BZH) is one of

the country’s largest homebuilders. Every Beazer home is designed

and built to provide Surprising Performance, giving you more

quality and more comfort from the moment you move in – saving you

money every month. With Beazer's Choice Plans™, you can personalize

your primary living areas – giving you a choice of how you want to

live in the home, at no additional cost. And unlike most national

homebuilders, we empower our customers to shop and compare loan

options. Our Mortgage Choice program gives you the resources to

easily compare multiple loan offers and choose the best lender and

loan offer for you, saving you thousands over the life of your

loan.

We build our homes in Arizona, California, Delaware, Florida,

Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina,

Tennessee, Texas, and Virginia. For more information, visit

beazer.com, or check out Beazer on Facebook, Instagram and

Twitter.

This press release contains forward-looking statements. These

forward-looking statements represent our expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of our control, that could

cause actual results to differ materially from the results

discussed in the forward-looking statements, including, among other

things:

- the cyclical nature of the homebuilding industry and

deterioration in homebuilding industry conditions;

- economic changes nationally and in local markets, including

increases in the number of foreclosures and wage levels, both of

which are outside our control and may impact consumer confidence

and affect the affordability of, and demand for, the homes we

sell;

- elevated mortgage interest rates for prolonged periods, as well

as further increases to, and reduced availability of, mortgage

financing due to, among other factors, additional actions by the

Federal Reserve to address inflation;

- financial institution disruptions, such as the lingering

effects of bank failures that spiked in 2023;

- supply chain challenges negatively impacting our homebuilding

production, including shortages of raw materials and other critical

components such as windows, doors, and appliances;

- our ability to meet or achieve our sustainability related

goals, aspirations, initiatives, and our public statements and

disclosures regarding them;

- inaccurate estimates related to homes to be delivered in the

future (backlog), as they are subject to various cancellation risks

that cannot be fully controlled;

- factors affecting margins, such as adjustments to home pricing,

increased sales incentives and mortgage rate buy down programs in

order to remain competitive;

- decreased revenues;

- decreased land values underlying land option agreements;

- increased land development costs in communities under

development or delays or difficulties in implementing initiatives

to reduce our cycle times and production and overhead cost

structures;

- not being able to pass on cost increases (including cost

increases due to increasing the energy efficiency of our homes)

through pricing increases;

- the availability and cost of land and the risks associated with

the future value of our inventory;

- our ability to raise debt and/or equity capital, due to factors

such as limitations in the capital markets (including market

volatility), adverse credit market conditions and financial

institution disruptions, and our ability to otherwise meet our

ongoing liquidity needs (which could cause us to fail to meet the

terms of our covenants and other requirements under our various

debt instruments and therefore trigger an acceleration of a

significant portion or all of our outstanding debt obligations),

including the impact of any downgrades of our credit ratings or

reduction in our liquidity levels;

- market perceptions regarding any capital raising initiatives we

may undertake (including future issuances of equity or debt

capital);

- changes in tax laws or otherwise regarding the deductibility of

mortgage interest expenses and real estate taxes, including those

resulting from regulatory guidance and interpretations issued with

respect thereto, such as the IRS's guidance regarding heightened

qualification requirements for federal credits for building

energy-efficient homes;

- increased competition or delays in reacting to changing

consumer preferences in home design;

- natural disasters (such as the recent California wildfires) or

other related events that could result in delays in land

development or home construction, increase our costs or decrease

demand in the impacted areas;

- shortages of or increased costs for labor used in housing

production, including as a result of federal or state legislation,

and the level of quality and craftsmanship provided by such

labor;

- terrorist acts, protests and civil unrest, political

uncertainty, acts of war or other factors over which the Company

has no control;

- potential negative impacts of public health emergencies and

lingering impacts of past pandemics;

- the potential recoverability of our deferred tax assets;

- increases in corporate tax rates;

- potential delays or increased costs in obtaining necessary

permits as a result of changes to, or complying with, laws,

regulations or governmental policies, and possible penalties for

failure to comply with such laws, regulations or governmental

policies, including those related to the environment;

- the results of litigation or government proceedings and

fulfillment of any related obligations;

- the impact of construction defect and home warranty

claims;

- the cost and availability of insurance and surety bonds, as

well as the sufficiency of these instruments to cover potential

losses incurred;

- the impact of information technology failures, cybersecurity

issues or data security breaches, including cybersecurity incidents

deploying evolving artificial intelligence tools and incidents

impacting third-party service providers that we depend on to

conduct our business;

- the impact of governmental regulations on homebuilding in key

markets, such as regulations limiting the availability of water and

electricity (including availability of electrical equipment such as

transformers and meters); and

- the success of our sustainability initiatives, including our

ability to meet our goal that by the end of 2025 every home we

start will be Zero Energy Ready, as well as the success of any

other related partnerships or pilot programs we may enter into in

order to increase the energy efficiency of our homes and prepare

for a Zero Energy Ready future.

Any forward-looking statement, including any statement

expressing confidence regarding future outcomes, speaks only as of

the date on which such statement is made and, except as required by

law, we undertake no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events. New factors emerge from time to time, and it

is not possible to predict all such factors.

-Tables Follow-

BEAZER HOMES USA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

December 31,

in thousands (except per share data)

2024

2023

Total revenue

$

468,953

$

386,818

Home construction and land sales

expenses

396,875

309,088

Gross profit

72,078

77,730

Commissions

16,113

13,246

General and administrative expenses

49,772

41,986

Depreciation and amortization

4,055

2,233

Operating income

2,138

20,265

Loss on extinguishment of debt, net

—

(13

)

Other income, net

1,028

2,657

Income from continuing operations before

income taxes

3,166

22,909

Expense from income taxes

36

1,181

Income from continuing operations

3,130

21,728

Income (loss) from discontinued

operations, net of tax

—

—

Net income

$

3,130

$

21,728

Weighted-average number of shares:

Basic

30,426

30,595

Diluted

30,800

30,982

Basic income per share:

Continuing operations

$

0.10

$

0.71

Discontinued operations

—

—

Total

$

0.10

$

0.71

Diluted income per share:

Continuing operations

$

0.10

$

0.70

Discontinued operations

—

—

Total

$

0.10

$

0.70

Three Months Ended

December 31,

Capitalized Interest in

Inventory

2024

2023

Capitalized interest in inventory,

beginning of period

$

124,182

$

112,580

Interest incurred

20,161

18,206

Capitalized interest amortized to home

construction and land sales expenses

(13,910

)

(11,190

)

Capitalized interest in inventory, end of

period

$

130,433

$

119,596

BEAZER HOMES USA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

in thousands (except share and per share

data)

December 31, 2024

September 30, 2024

ASSETS

Cash and cash equivalents

$

80,379

$

203,907

Restricted cash

39,088

38,703

Accounts receivable (net of allowance of

$284 and $284, respectively)

70,721

65,423

Owned inventory

2,164,074

2,040,640

Deferred tax assets, net

131,096

128,525

Property and equipment, net

39,792

38,628

Operating lease right-of-use assets

18,097

18,356

Goodwill

11,376

11,376

Other assets

45,905

45,969

Total assets

$

2,600,528

$

2,591,527

LIABILITIES AND STOCKHOLDERS’

EQUITY

Trade accounts payable

$

151,717

$

164,389

Operating lease liabilities

19,570

19,778

Other liabilities

123,903

149,900

Total debt (net of debt issuance costs of

$7,885 and $8,310, respectively)

1,071,290

1,025,349

Total liabilities

1,366,480

1,359,416

Stockholders’ equity:

Preferred stock (par value $0.01 per

share, 5,000,000 shares authorized, no shares issued)

—

—

Common stock (par value $0.001 per share,

63,000,000 shares authorized, 31,201,705 issued and outstanding and

31,047,510 issued and outstanding, respectively)

31

31

Paid-in capital

852,702

853,895

Retained earnings

381,315

378,185

Total stockholders’ equity

1,234,048

1,232,111

Total liabilities and stockholders’

equity

$

2,600,528

$

2,591,527

Inventory Breakdown

Homes under construction

$

815,757

$

754,705

Land under development

1,085,063

1,023,188

Land held for future development

19,879

19,879

Land held for sale

16,880

19,086

Capitalized interest

130,433

124,182

Model homes

96,062

99,600

Total owned inventory

$

2,164,074

$

2,040,640

BEAZER HOMES USA, INC.

SUPPLEMENTAL OPERATING AND FINANCIAL DATA – CONTINUING

OPERATIONS

Three Months Ended December

31,

SELECTED OPERATING DATA

2024

2023

Closings:

West region

581

454

East region

201

136

Southeast region

125

153

Total closings

907

743

New orders, net of

cancellations:

West region

589

533

East region

227

172

Southeast region

116

118

Total new orders, net

932

823

As of December 31,

Backlog units:

2024

2023

West region

973

1,112

East region

341

359

Southeast region

193

320

Total backlog units

1,507

1,791

Aggregate dollar value of homes in backlog

(in millions)

$

816.0

$

932.8

ASP in backlog (in thousands)

$

541.5

$

520.8

in thousands

Three Months Ended December

31,

SUPPLEMENTAL FINANCIAL DATA

2024

2023

Homebuilding revenue:

West region

$

291,863

$

234,409

East region

108,564

71,753

Southeast region

59,995

74,757

Total homebuilding revenue

$

460,422

$

380,919

Revenue:

Homebuilding

$

460,422

$

380,919

Land sales and other

8,531

5,899

Total revenue

$

468,953

$

386,818

Gross profit:

Homebuilding

$

69,975

$

75,943

Land sales and other

2,103

1,787

Total gross profit

$

72,078

$

77,730

Reconciliation of homebuilding gross profit and homebuilding

gross margin (GAAP measures) to homebuilding gross profit and the

related gross margin excluding impairments and abandonments and

interest amortized to cost of sales (non-GAAP measures) is provided

for each period discussed below. Management believes that this

information assists investors in comparing the operating

characteristics of homebuilding activities by eliminating many of

the differences in companies' respective level of impairments and

level of debt. These non-GAAP financial measures may not be

comparable to other similarly titled measures of other companies

and should not be considered in isolation or as a substitute for,

or superior to, financial measures prepared in accordance with

GAAP.

Three Months Ended December

31,

in thousands

2024

2023

Homebuilding gross profit/margin

(GAAP)

$

69,975

15.2

%

$

75,943

19.9

%

Inventory impairments and abandonments

(I&A)

—

—

Homebuilding gross profit/margin excluding

I&A (Non-GAAP)

69,975

15.2

%

75,943

19.9

%

Interest amortized to cost of sales

13,910

11,190

Homebuilding gross profit/margin excluding

I&A and interest amortized to cost of sales (Non-GAAP)

$

83,885

18.2

%

$

87,133

22.9

%

Reconciliation of net income (GAAP measure) to Adjusted EBITDA

(Non-GAAP measure) is provided for each period discussed below.

Management believes that Adjusted EBITDA assists investors in

understanding and comparing core operating results and underlying

business trends by eliminating many of the differences in

companies' respective capitalization, tax position, level of

impairments, and other non-recurring items. This non-GAAP financial

measure may not be comparable to other similarly titled measures of

other companies and should not be considered in isolation or as a

substitute for, or superior to, financial measures prepared in

accordance with GAAP.

Three Months Ended December

31,

LTM Ended December

31,(a)

in thousands

2024

2023

2024

2023

Net income (GAAP)

$

3,130

$

21,728

$

121,577

$

156,008

Expense from income taxes

36

1,181

17,765

20,984

Interest amortized to home construction

and land sales expenses and capitalized interest impaired

13,910

11,190

70,953

65,904

EBIT (Non-GAAP)

17,076

34,099

210,295

242,896

Depreciation and amortization

4,055

2,233

16,689

11,918

EBITDA (Non-GAAP)

21,131

36,332

226,984

254,814

Stock-based compensation expense

1,913

1,673

7,631

7,368

Loss on extinguishment of debt

—

13

424

44

Inventory impairments and

abandonments(b)

—

—

1,996

451

Gain on sale of investment(c)

—

—

(8,591

)

—

Severance expenses

—

—

—

224

Adjusted EBITDA (Non-GAAP)

$

23,044

$

38,018

$

228,444

$

262,901

(a)

"LTM" indicates amounts for the trailing

12 months.

(b)

In periods during which we impaired

certain of our inventory assets, capitalized interest that is

impaired is included in the line above titled "Interest amortized

to home construction and land sales expenses and capitalized

interest impaired."

(c)

We previously held a minority interest in

a technology company specializing in digital marketing for new home

communities, which was sold during the quarter ended March 31,

2024. In exchange for the previously held investment, we received

cash in escrow along with a minority partnership interest in the

acquiring company, which was recorded within other assets in our

condensed consolidated balance sheets. The resulting gain of

$8.6 million from this transaction was recognized in other

income, net on our condensed consolidated statement of operations.

The Company believes excluding this one-time gain from Adjusted

EBITDA provides a better reflection of the Company's performance as

this item is not representative of our core operations.

Reconciliation of total debt to total capitalization ratio (GAAP

measure) to net debt to net capitalization ratio (non-GAAP measure)

is provided for each period below. Management believes that net

debt to net capitalization ratio is useful in understanding the

leverage employed in our operations and as an indicator of our

ability to obtain financing. This non-GAAP financial measure may

not be comparable to other similarly titled measures of other

companies and should not be considered in isolation or as a

substitute for, or superior to, financial measures prepared in

accordance with GAAP.

in thousands

As of December 31,

2024

As of December 31, 2023

Total debt (GAAP)

$

1,071,290

$

974,644

Stockholders' equity (GAAP)

1,234,048

1,121,011

Total capitalization (GAAP)

$

2,305,338

$

2,095,655

Total debt to total capitalization ratio

(GAAP)

46.5

%

46.5

%

Total debt (GAAP)

$

1,071,290

$

974,644

Less: cash and cash equivalents (GAAP)

80,379

104,226

Net debt (Non-GAAP)

990,911

870,418

Stockholders' equity (GAAP)

1,234,048

1,121,011

Net capitalization (Non-GAAP)

$

2,224,959

$

1,991,429

Net debt to net capitalization ratio

(Non-GAAP)

44.5

%

43.7

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130746401/en/

Beazer Homes USA, Inc.

David I. Goldberg Sr. Vice President & Chief Financial

Officer 770-829-3700 investor.relations@beazer.com

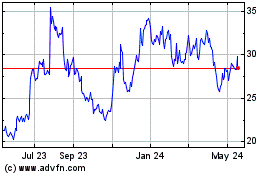

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Dec 2024 to Jan 2025

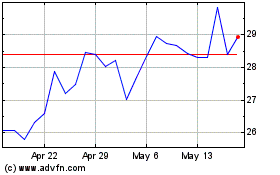

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Jan 2024 to Jan 2025