Conagra Sales Fall Short of Targets --update

June 27 2019 - 10:26AM

Dow Jones News

By Micah Maidenberg

Conagra Brands Inc. joined the list of food makers disclosing

disappointing results, as its Hunt's tomato, Chef Boyardee and

Marie Callender's frozen-food businesses hurt sales in the latest

quarter.

Conagra's struggles come on the heels of a General Mills Inc.

report Wednesday that showed sales of cereal and yogurt were flat

and its snacks business declined.

The results from Chicago-based Conagra and General Mills provide

fresh evidence that packaged-food makers still face a host of

challenges in fixing their businesses, as consumers seek out new

brands as well as food they think is healthier and fresher. Last

month Kellogg Co. reported weak sales of cereal and grappled with a

recall of protein bars. Kraft Heinz Co., meanwhile, is attempting

to restart growth under a new chief executive.

Conagra said Thursday that sales excluding currency fluctuations

and the effects of acquisitions declined 0.7% in its quarter that

ended May 26. Overall sales totaled $2.61 billion, weaker than the

$2.66 billion analysts polled by FactSet predicted.

Shares of the maker of Healthy Choice frozen dinners and Peter

Pan peanut butter fell 9% in morning trading.

The company reported $757 million in sales in its Pinnacle

business in the latest quarter, but said consumers purchased less

of those products overall. Conagra said sales were in line with its

expectations as it pursues a "value-over-volume" strategy at

Pinnacle. Its brands include Birds Eye frozen foods and Hungry Man

dinners.

Conagra bought Pinnacle last October to further tie the company

to the freezer section of grocery stores, where consumers have been

seeking out convenient meals. The company has previously said it

would stop shipments of some Pinnacle products that had fallen out

of favor with consumers.

In the grocery and snacks business, comparable sales fell 2.5%.

Conagra reported gains from its snacking brands, but those were

offset by weaker demand for Hunt's products and Chef Boyardee

brands.

A recall of P.F. Chang's-branded products also weighed on

results, Conagra said.

Profit rose to $126.5 million, or 26 cents a share, up from

$69.6 million, or 18 cents a share, a year earlier. After

adjustments for restructuring costs, impairments and certain other

expenses, profit for the quarter of 36 cents a share fell short of

analysts' targets.

For its 2020 fiscal year, Conagra said it anticipates 1% to 1.5%

organic sales growth, a measure that strips out the effects of

mergers and currency fluctuations.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

June 27, 2019 11:11 ET (15:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

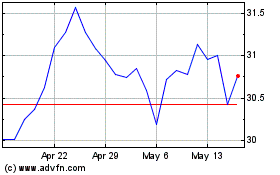

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jul 2023 to Jul 2024