Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

October 16 2024 - 3:06PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

CBL & Associates Properties, Inc.

(Name of Issuer)

Common

Stock, $0.001 par value per share

(Title of Class of Securities)

124830878

(CUSIP Number)

Canyon Partners, LLC

2728 North Harwood Street, 2nd Floor

Dallas, Texas 75201

(214) 253-6000

Attention: Jonathan M. Kaplan

with a copy to:

Robert

W. Downes

Sullivan & Cromwell LLP

125 Broad Street

New

York, NY 10004

(212) 558-4312

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

October 10, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box. ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Canyon Capital Advisors LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

|

7 |

|

SOLE VOTING POWER

8,466,294 |

| |

8 |

|

SHARED VOTING POWER

-0- |

| |

9 |

|

SOLE DISPOSITIVE POWER

8,466,294 |

| |

10 |

|

SHARED DISPOSITIVE POWER

-0- |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

8,466,294 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11) 27.5% |

| 14 |

|

TYPE OF REPORTING PERSON

IA |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Mitchell R. Julis |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

8,466,294 |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

8,466,294 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

8,466,294 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11) 27.5% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Joshua S. Friedman |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

8,466,294 |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

8,466,294 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

8,466,294 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11) 27.5% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

| Item 1. |

|

SECURITY AND ISSUER |

|

|

|

|

This Amendment No. 4 (this “Amendment No. 4”) supplements the information set forth in the Schedule 13D filed by

Canyon Capital Advisors LLC (“CCA”), Mr. Mitchell R. Julis, Mr. Joshua S. Friedman and Mr. Jonathan M. Heller (collectively, the “Reporting Persons”) with the United States Securities

and Exchange Commission (the “SEC”) on November 9, 2021, as amended by Amendment No. 1 thereto filed on February 7, 2022, by Amendment No. 2 thereto filed on March 2, 2022 and by Amendment No. 3 thereto

filed on August 10, 2022 (the “Schedule 13D”) relating to the shares of common stock, $0.001 par value per share (the “Common Stock”), of CBL & Associates Properties, Inc., a Delaware corporation (the

“Issuer”). This Amendment No. 4 is being filed to reflect an

increase in the Reporting Persons’ beneficial ownership of more than 1% of the outstanding Common Stock, as a result of a reduction in the outstanding shares of Common Stock. The Reporting Persons’ beneficial ownership percentage has been

calculated based on 30,749,272 shares of Common Stock outstanding as of October 10, 2024, as reported in the Issuer’s Current Report on Form 8-K filed with the SEC on October 10, 2024.

The Issuer’s principal executive offices are located at 2030 Hamilton Place Blvd.,

Suite 500, Chattanooga, TN 37421. All capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D.

The information set forth in response to each separate Item below shall be deemed to be a response to all Items where such information is relevant.

The Schedule 13D is hereby supplementally amended as follows: |

|

|

|

| Item 5. |

|

INTEREST IN SECURITIES OF THE ISSUER |

|

|

| (a) |

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock.

The percentage reported in this Schedule 13D is calculated based upon 30,749,272 shares

of Common Stock outstanding as of October 10, 2024 as reported in the Issuer’s Current Report on Form 8-K filed with the SEC on October 10, 2024. |

|

|

| (b) |

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock. |

|

|

| (c) |

|

There have been no transactions in the shares of Common Stock during the sixty days prior to the date of this Amendment No. 4 by any of the Reporting Persons. |

|

|

| (d) |

|

No person other than the Reporting Persons and the Accounts is known to have the right to participate in the receipt of dividends from, or proceeds from the sale of, the shares of Common Stock held by the Accounts. |

|

|

| (e) |

|

Not applicable. |

|

|

| Item 7. |

|

MATERIAL TO BE FILED AS EXHIBITS |

|

|

|

|

Exhibit 99.1: Joint Filing Agreement as required by Rule 13d-1(k)(1) under the Act

(incorporated by reference to Exhibit 99.1 to Schedule 13D filed by the Reporting Persons with the SEC on November 9, 2021).

Exhibit 99.2: Commitment Letter, by and among the Issuer, the Operating Partnership, CCA and other commitment parties thereto, dated as of

April 26, 2021 (incorporated by reference to Exhibit 99.2 to Schedule 13D filed by the Reporting Persons with the SEC on November 9, 2021).

Exhibit 99.3: Registration Rights Agreement, by and among the Issuer and the other parties thereto and any additional parties identified on the

signature pages of any joinder agreement executed and delivered pursuant thereto, dated as of November 1, 2021 (incorporated by reference to Exhibit 10.5 to Form 8-K filed by the Issuer with the SEC on

November 2, 2021). Exhibit 99.4: Exchangeable Notes Indenture, by and

among the New Notes Issuer, the guarantors thereto, the Issuer, Wilmington Savings Fund Society, FSB, as trustee and collateral agent, dated as of November 1, 2021 (incorporated by reference to Exhibit 10.3 to Form 8-K filed by the Issuer with the SEC on November 2, 2021).

Exhibit 99.5: Director Resignation Agreement, between Canyon Partners LLC and Jeffrey Kivitz, dated as of August 9, 2022 (incorporated by reference

to Exhibit 99.5 to Amendment No.3 to Schedule 13D filed by the Reporting Persons with the SEC on August 10, 2022). |

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth

in this statement is true, complete and correct.

Date: October 16, 2024

|

| CANYON CAPITAL ADVISORS LLC |

|

| /s/ Doug Anderson |

| Name: Doug Anderson |

| Title: Chief Compliance Officer |

|

| /s/ Mitchell R. Julis |

| MITCHELL R. JULIS |

|

| /s/ Joshua S. Friedman |

| JOSHUA S. FRIEDMAN |

|

| |

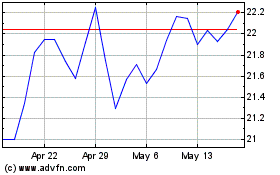

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Oct 2024 to Nov 2024

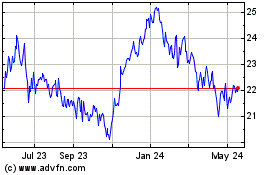

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Nov 2023 to Nov 2024