CBL Properties Announces Sale of Monroeville Mall for $34.0 Million

January 31 2025 - 1:00PM

Business Wire

CBL Properties (NYSE:CBL) today announced that it had closed on

the sale of Monroeville Mall and Annex in Monroeville, PA, for

$34.0 million, all cash.

“The sale of Monroeville Mall is a great example of the

resilient value of well-located real estate in a dynamic market,”

commented Stephen D. Lebovitz, CBL’s Chief Executive Officer. “This

transaction allows us to focus efforts on higher productivity

properties, generates significant cash proceeds and further reduces

leverage.”

Approximately $7.1 million of the net proceeds was utilized to

reduce the outstanding principal of the Company’s outparcel and

open-air center loan to $333.0 million, allowing for the release of

a collateral parcel as part of the sale.

About CBL Properties

Headquartered in Chattanooga, TN, CBL Properties owns and

manages a national portfolio of market-dominant properties located

in dynamic and growing communities. CBL’s owned and managed

portfolio is comprised of 89 properties totaling 56.2 million

square feet across 21 states, including 54 high-quality enclosed

malls, outlet centers and lifestyle retail centers as well as more

than 30 open-air centers and other assets. CBL seeks to

continuously strengthen its company and portfolio through active

management, aggressive leasing and profitable reinvestment in its

properties. For more information visit cblproperties.com.

Information included herein contains “forward-looking

statements” within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company’s various filings with the Securities and Exchange

Commission, including without limitation the Company’s Annual

Report on Form 10-K and the “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included therein,

for a discussion of such risks and uncertainties.

CBL_Corp

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131565176/en/

Investor Contact: Katie Reinsmidt, Executive Vice President

& Chief Operating Officer, 423.490.8301,

Katie.Reinsmidt@cblproperties.com Media Contact: Stacey Keating,

Vice President– Corporate Communications, 423.490.8361,

Stacey.Keating@cblproperties.com

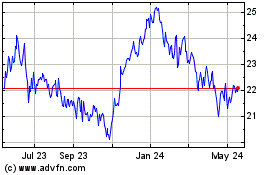

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jan 2025 to Feb 2025

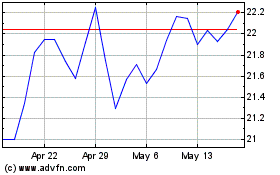

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Feb 2024 to Feb 2025